bjdlzx

Analysts Expect Crude Oil and Natural Gas Prices to Rise in the Coming Months

Crude oil and natural gas prices are likely to trade higher than current levels due to concerns over fossil fuel supply as global energy demand rises.

Analysts are expecting a higher natural gas price going forward and over the next 12 months, the commodity price should rise nearly 55% to $9.10 per million British Thermal Units [/MMBtu]. As of this writing, Natural Gas Futures – December 2022 (NGZ2) – the benchmark for the commodity’s price – is trading at $5.883/MMBtu.

Analysts are expecting a higher crude oil price going forward, and over the next 12 months, the price of the raw material should rise nearly 24% to $108.46 per barrel [/bbl]. As of this writing, Crude Oil WTI Futures – December 2022 (CLZ2) – the benchmark for the commodity’s price – is trading at $87.47/bbl.

Investors should take advantage of the expected bright future for natural gas and crude oil prices and increase their exposure to these commodities through Diversified Energy Company PLC (OTCQX:DECPF).

The US oil and gas explorer and producer aims to increase oil-equivalent production and improve its ability to capitalize on rising fossil fuel prices. This should translate into higher sales and margins going forward, which could pave the way for a sharp rise in the share price.

The Role of Diversified Energy Company PLC in the Oil & Gas Industry

Based in Birmingham, Alabama, Diversified Energy Company PLC is an independent owner of producing natural gas and oil wells operated primarily in the Appalachian Basin of the United States and in the US central region.

The company’s activities include the production of hydrocarbons and condensates as well as the transportation and marketing of these assets.

The portfolio includes approximately 64,000 wells producing natural gas, natural gas liquids [NGL] and oil classified as conventional and unconventional, depending on the geological formation of the mineral.

The portfolio also includes 17,000 miles of natural gas pipelines located in Tennessee, Kentucky, Virginia, West Virginia, Ohio and Pennsylvania. The company also operates approximately 500 miles of midstream infrastructure in the central region.

The Growth Strategy of Diversified Energy Company PLC

In terms of long-term strategy, Diversified Energy Company PLC has been acquiring mineral assets in the central region of the United States for a little over a year. The company intends to have additional wells in this area, possibly through further acquisitions following a recent portfolio integration with upstream operations in Oklahoma and Texas, and in East Texas and Northwest Louisiana.

Diversified Energy now also operates in the central region of the US, leveraging its experience as an operator in the Appalachian Basin, one of the key regions of the US for producing oil and natural gas properties that can be exploited at lower operating costs than other mineral districts.

In the central region of the United States, the oil and gas explorer looks for upstream assets that will improve the profitability of the portfolio over the years.

The decision to expand the radius of action in this region bordering the Appalachian Basin is strategically very interesting. This is true not only from a financial point of view, as the purchase of an upstream asset is made if the price is considered affordable, but also from a geographical point of view.

The central region of the United States connects to the US Gulf Coast where there are terminals for shipments to foreign countries and particularly to European regasification plants. As a result, Diversified Energy can leverage a selling price in this region that tends to be above the domestic market average.

The ability to own and operate assets in the central region brings Diversified Energy closer to the infrastructure network that will drive U.S. fossil fuels into lucrative European markets spurred by the conflict in Ukraine, while European gas demand is strong as the countries become energy independent of Russian products.

This growth strategy in the central region should allow Diversified Energy Company PLC to achieve a significant expansion in the company’s overall production [production is 90% gas and 10% oil]. The integration of the portfolio with assets in the US Central Region should position the Diversified Energy operation much better to benefit from the next expected hike in fossil fuel prices, particularly gas, and more important, stronger demand from overseas, especially Europe.

How About the Costs

But operating costs in the central region are higher than in the Appalachian Basin, and that’s a bit of a drag. The situation is different for the company in the Appalachia region, where operating its vertically integrated midstream network is helping to contain operational costs.

However, following the addition of upstream assets in Oklahoma and Texas, acquired in September 2022, total cash costs could now be a little over $9.85 per barrel of oil equivalent produced, up almost 26% year-on-year.

Diversified Energy appears confident that it can recoup these higher operational costs by implementing the Smarter Asset Management program.

This program requires, among other things, the closing of an acquisition if the purchase price is considered low according to specific key criteria. The purchase price was about 1.4 times net cash flow, or 1.4 times adjusted EBITDA, the company indicated for East Texas and Northwest Louisiana assets. While for Oklahoma and Texas assets, the ratio was higher, hovering at 2.5 times.

These purchases are partly financed with cash or lines of credit from banks.

Furthermore, following the acquisition of specialist operators, Diversified Energy Company PLC has strengthened its team dedicated to decommissioning orphaned oil and gas wells, while eliminating the need for expensive third-party services and realizing significant cost savings. Currently, Diversified Energy incurs an average cost of decommissioning orphaned oil and gas wells of $21,052 per rig, a cost savings of 6% compared to last year’s levels.

Production and Financial Condition After Portfolio Integration With Assets in the Central Region

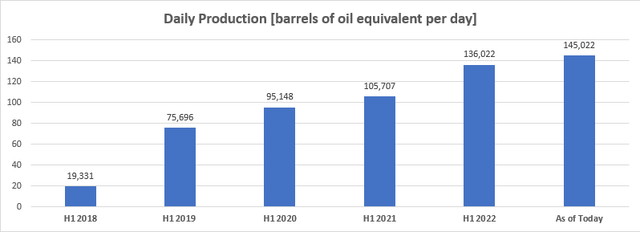

Currently, Diversified Energy can produce about 145,022 barrels of oil equivalent per day [boepd], reflecting a growth of 6.6% over the last H1 2022 reporting period, or a whopping 37% growth since 2021. These large production improvements follow the acquisition of assets in the central US region.

ir.div.energy/us-press-releases

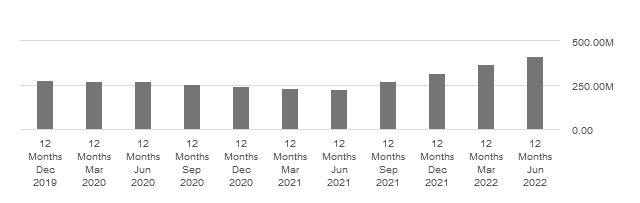

Favorable commodity prices and boepd growth allow Diversified Energy to generate significant cash flow from annual operations, with the chart below showing the sharp increase from $250 million a few quarters ago to more than $450 million currently.

seekingalpha/symbol/DECPF/cash-flow-statement

Robust operating cash flow generation has enabled the company to allocate extra funds to improve the financial condition and pay the quarterly dividend.

The quality of the upstream assets proves crucial to the cash flow generated, but also for attracting investors to securitization practices and thus providing the necessary capital to the company.

The financial condition currently shows approximately $300 million in total liquidity having recently completed a securitization agreement for some upstream Oklahoma mineral properties. This provides Diversified Energy Company PLC with an additional loan contingent on meeting certain carbon reduction targets.

So far this year, the company has completed 4 deals of this type, raising approximately $1.1 billion, on which it has to pay interest at the rate of 5.7% per annum. This financing vehicle will allow the company to access the funds it needs to fund growth and pay down an expensive portion of its debt of around $1.36 billion.

Due to the quality of the assets offered as collateral, the loan now appears to be associated with a better financing cost condition, while the capital market environment is challenging due to sharply rising interest rates.

With respect to the cash flow distribution to the board of shareholders, Diversified Energy Company will pay a quarterly dividend of $0.043 per share on Dec. 28, 2022.

However, it may not be the dividend that would pique interest in Diversified Energy Company PLC given the small amount per share. Rather, the possibility that the stock price will rise in response to an expected increase in income and cash flow as production increases and hydrocarbon market prices improve.

Outlook for Hydrocarbon Prices

For further production expansion, Diversified Energy Company PLC should continue to pursue this as it continues to seek high-margin mineral assets in the central region that are characterized by lower production decline rates than the industry average.

The gas price, but also the oil price, must do the rest. In that regard, the markets should not disappoint bulls’ expectations over the next few months based on the following factors, which should be welcomed by Diversified Energy Company PLC shareholders as well.

Higher Gas Prices Catalysts

The US Energy Information Administration [EIA] forecasts that the natural gas production of the US – the world’s largest fossil fuel supplier – will reach 99.7 billion cubic feet per day [bcfd] by 2023, well above the record production level of 94.6 bcfd in 2021.

However, this unprecedented level of US production does not allay concerns about a steady supply of the commodity for domestic needs and export. Because after storage of 30-40% of the feedstock, US natural gas production should then support consumption, which analysts say will reach 85.08 bcfd in 2023 after hitting a record high of 88.4 bcfd in 2022.

The trend of the expected supply-demand balance of natural gas in 2022/2023 will become routine going forward and not just in the US, as climate change policies put pressure on fossil fuel upstream activities and consumption is fueled by a higher need for energy.

Ongoing urbanization and industrialization, especially in China and other emerging countries, will continue to ensure strong demand for fossil fuels in the future.

Higher Oil Prices Catalysts

Crude oil prices are also subject to upward pressure amid a tight supply scenario as OPEC becomes increasingly reluctant to deliver the number of barrels desired by the US and other western countries. In November, OPEC+ reduced the daily supply of crude oil by 2 million barrels, despite pressure from US President Joe Biden to provide more volumes of the commodity to meet global energy needs.

In addition, the European ban on Russian oil as a sanction for the conflict in Ukraine is expected to take effect in December, adding to concerns about sufficient supplies of this commodity to meet global demand, which, like gas, is gradually increasing.

Stock Valuation: The Share Price is Not High and Has an Upside Potential

Shares of Diversified Energy Company PLC were trading at around $1.47 per unit as of this writing, while the market cap was $1.22 billion, and the 52-week range was $1.24 to $1.74.

From a technical perspective, shares are not trading high as they are below the long-term trend of the 200-day simple moving average of $1.51. Also, the stock price is currently trading in the lower half of the 52-week range.

Given the promising prospects for the company’s business and natural gas and crude oil prices, the stock price could potentially be significantly higher than current levels.

Of course, it’s also possible that the company doesn’t pursue its growth goals in the central region of the United States, or that fossil fuel prices don’t rise as expected. However, this negative scenario currently has a low score in terms of probability of occurrence.

First, because the geopolitical and macroeconomic factors involved are such that commodity prices should rise.

Second, the results of the US midterm elections should not disappoint the US minerals sector. Although the expected Republican tsunami did not materialize from the US midterm elections, Democrats will have fewer seats in the US House of Representatives, while the situation for the US Senate is at stake as both political parties have an equal chance to take control of this branch of the US Congress. As a result, the US Congress is at risk of deadlock on various measures, including the fact that the Greens may want to reduce drilling activities for environmental reasons.

The results of the US midterm elections should not disappoint the US mineral industry, including Diversified Energy Company PLC, which should continue undisturbed to fulfill its dreams in the Appalachian and US Central Region.

Conclusion – The Stock Represents an Opportunity to Gain Exposure to Rising Fossil Fuels at a Reasonable Price

Diversified Energy Company PLC appears to be a good investment in the energy sector as its shares have the potential to trade higher on expected improvements in the company’s production profile and higher prices for gas and oil.

Be the first to comment