dima_zel

The stock market (SPY)(QQQ) is down significantly year-to-date, resulting in numerous attractive opportunities across the high yield universe. Giving us numerous opportunities to deploy capital into quality businesses at very attractive starting yields and valuations. After the latest CPI data came out, it appears that inflation has truly finally peaked and will likely begin to decline in the coming months. This, in turn, should give the Federal Reserve the needed flexibility to slow their pace of interest rate hikes and potentially even halt them in the not-too-distant future. Once this happens, we expect high yield stocks to take off like a rocket.

In this article, we will discuss the details behind our interest rate and inflation outlook and then share some of our top picks in the current environment.

Our Interest Rate And Inflation Outlook

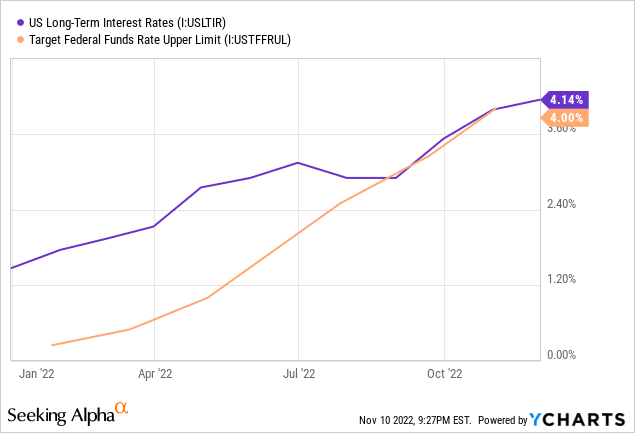

This year U.S. interest rates have surged due to four-decade high inflation that has persisted far beyond when most policy makers – who initially labeled it transitory – thought it would:

1. Recessionary Forces

In the near-term, we expect the current recession to continue to beat down inflation and ultimately prompt the Federal Reserve to pivot from raising interest rates towards lowering them in an effort to support the economy.

Recessions are generally deflationary because a declining demand for goods and services results in surplus inventory and a rising unemployment rate, which in turn puts downward pressure on wages. All of this leads to lower prices.

2. Housing and Supply Chain Issued Resolved

Another major reason why inflation has likely peaked is simply that the supply chain situation is improving significantly, with company after company reporting that supply chain issues have eased and shipping data indicating that the demand for shipping containers is normalizing (for example, read Triton International’s (TRTN) latest earnings report).

On top of that, the housing market is in recession, and in the coming months we expect housing costs to begin declining meaningfully. This will also relieve considerable pressure on the consumer and reduce the CPI substantially.

3. Technological Innovation

Longer term, we believe that technological innovation will be deflationary for two main reasons. First and foremost, it reduces the demand for/increases the efficient distribution of labor, which in turn will have a downward effect on wages. Between increased and improved automation technologies and the increased global connectivity of the workforce (i.e., more people from low-wage regions doing work that was previously done by people in higher wage regions thanks to improved communications technology), the cost of the labor component for producing goods and services will continue to decline.

The other way in which technological innovation is likely going to be increasingly deflationary is that it is completely changing how company’s think about being able to meet demand. Inflation in its purest form is an increase in the money supply. However, when we think about common inflationary metrics, it is effectively prices for goods and services increasing as a result of too much money chasing too few goods and services (i.e., demand outstripping supply). In a company with significantly enhanced – if not complete – automation, companies can scale their productivity rapidly to a point where they can scale the production of goods and services faster than demand can grow, even if the government keeps printing and distributing massive stimulus checks. As a result, the economy could someday reach a point where it will – in most cases at least – always ramp up production rapidly to meet increased demand, making meaningful price increases rare. Elon Musk of Tesla (TSLA) and SpacEx has predicted this himself, stating at his company’s recent AI Day that innovations like Tesla’s Optimus robot will create:

a future of abundance where there is no poverty, where you can have whatever you want, in terms of products and services.

Why do interest rates matter to us as investors? Well, perhaps no one put it better than the Oracle of Omaha – Warren Buffett of Berkshire Hathaway (BRK.A)(BRK.B) – himself:

The most important item over time in valuation is obviously interest rates. Any investment is worth all the cash you’re going to get out between now and judgment day discounted back. If interest rates are destined to be at very low levels … it makes any stream of earnings from investments worth more money.

As a result, in the short-term stocks are taking a pretty heavy beating thus far this year since higher discount rates are being applied to valuation models to account for the current higher interest rate as well as the expectation by some that interest rates are going to move far higher still.

While we do not have a strong view on the short-term direction of interest rates, as we believe short-term predictions are too hard to make with accuracy, we believe for the aforementioned reasons that interest rates will likely not end up much higher than they are today over the longer term.

Our Top Picks

With interest rates likely nearing a peak, we think that now is a great time to be loading up on alternative asset managers, which profit immensely from low interest rates. Blue chips like Blackstone (BX), KKR (KKR), and Brookfield (BAM) are all in Buy range and – for those with a little more risk tolerance – recent IPOs in the space like Patria (PAX) and Blue Owl (OWL) offer even more upside in our view. Furthermore, alternative asset managers are set to profit immensely from the enormous growth runways facing the renewable power and infrastructure spaces as well as from the increased consolidation of the global real estate industry. Private equity and direct lending opportunities also about, especially if interest rates level off.

Another area that we really like in an environment where interest rates level off and even decline – especially one in which economic conditions are expected to be weak – is the triple net lease REIT (VNQ) sector. Blue chips like Realty Income (O) and W.P. Carey (WPC) are still attractively priced, but we like up and coming investment grade companies like Essential Properties Trust (EPRT) and Spirit Realty Capital (SRC).

A third top pick of ours continues to be energy midstream (AMLP). While it has been on a great run this year thanks to high energy prices and inflation, its cash flows are very stable and several leading firms are accelerating distribution growth, which we believe has of yet to be fully priced in to the markets. Businesses that look especially opportunistic to us in this space at the moment include Enterprise Products (EPD), Energy Transfer (ET) (which has grown its distribution by over 70% over the past year, is set to grow it further with a ~10% forward yield, and is paying down debt hand-over-fist), and Plains (PAA)(PAGP) (which is set to grow its distribution – that is already yielding over 7% – at a double digit CAGR through 2028 based on our recent calculations and management guidance). For income investors in particular, it is hard to go wrong with investment grade midstream businesses at current valuations, especially in the current environment.

Investor Takeaway

The market has been beaten down this year and the Federal Reserve continues to guide for further interest rate hikes. As long as it continues this trend, the stock market will likely continue to be pressured, especially as the current economic downturn worsens in the coming months. That said, the recent inflation data (which was better than expected) offers a green shoot which – along with the other aforementioned catalysts that we believe will bring inflation and interest rates down – may just be a very strong bullish signal.

We believe that by taking advantage of the numerous attractive high yielding opportunities in the market today while they are still discounted, investors will set themselves up to thrive long-term. At High Yield Investor, we are tirelessly searching for and strategically buying these opportunities in the triple net lease REIT, alternative asset management, midstream, and many other sectors.

Be the first to comment