Torsten Asmus

This article was co-produced with Dividend Sensei.

Every bear market is different, created by a unique combination of risk factors that scare investors into panic selling even the world’s best companies.

That’s what’s been happening in the UK, where some truly baffling decisions by the government, which have been partially reversed but only increased confusion, have resulted in financial market chaos.

This kind of chaos will bankrupt weak companies but hardly damage blue chips. If you can tell the difference between them, then the UK crisis of 2022 could prove to be a life-changing opportunity for income investors.

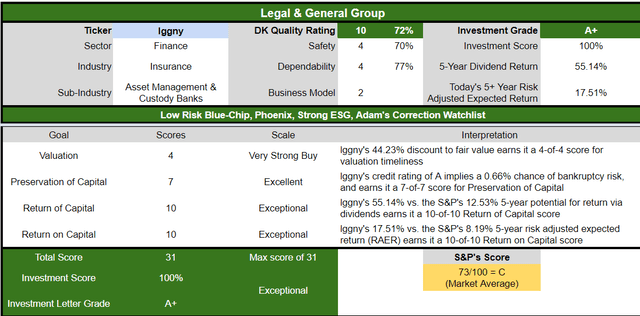

Let me show you the three reasons why Legal & General Group Plc (OTCPK:LGGNY) is one of the best bear market blue-chip bargains of 2022. One that offers not just a safe 9.2% yield, but potentially life-changing opportunities to retire in safety and splendor in the coming years and decades.

Reason One: UK Financial Markets Are In Turmoil…Creating Incredible Blue-Chip Bargain Hunting Opportunities For Long-Term Investors

First, here’s the bottom line up front on LGGNY.

-

UK company, so no dividend tax withholdings

-

BUT the ADR fee is approximately 5% of the dividend

-

LGEN is the UK-listed version of the stock with no ADR fee

-

if you can buy LGEN through your broker, then you avoid the ADR fee

-

otherwise, the yield is 5% lower, or a still beautiful 9.0%.

LGGNY has crashed in recent weeks primarily due to the chaos in the UK, and is now down 40% off its highs.

-

the mini-budget proposed by the new Truss government included 45 billion pounds worth of tax cuts

-

part of a 400 billion pound stimulus package

-

funded entirely with debt.

The bond market in the UK refused to go along with the plan, creating a financial crisis for the UK.

-

long-term UK bonds crashed as much as 50% in 2 days

-

5X the volatility of Bitcoin

-

triggering a margin call for the $1.6 trillion LDI pension system in the UK.

Pension funds in the UK follow Liability Driven Investing or LDI.

-

matching duration of liabilities with bonds using derivatives (and leverage)

-

if bonds collapse at the rate they have, then pension funds get margin calls

-

90% of pension funds were on the verge of bankruptcy.

The Bank of England stepped in with a temporary three-week bond-buying program to calm markets.

-

since then, the UK’s treasury secretary (Secretary of the Exchequer) has been fired

-

and replaced by the former foreign secretary (Secretary of State)

The Truss government is at risk of being replaced by the conservative party and is now primarily seen as a lame-duck government.

This backdrop of chaos and confusion has sent LGGNY crashing to valuations only seen in the Pandemic and Great Recession.

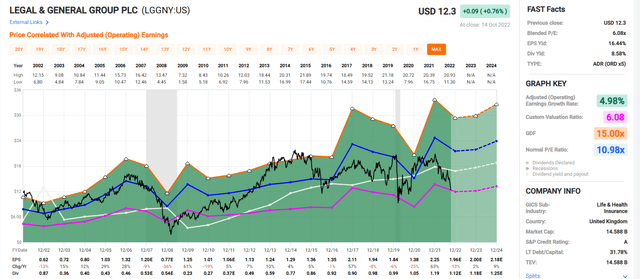

P/Es Not Seen Outside The Pandemic And Great Recession

FAST Graphs

The last time LGGNY was this undervalued, it soared 79% in the next year and delivered Buffett-like 19% annual returns for the next decade.

-

5.7X return in the next ten years

How can we be confident that LGGNY isn’t facing another “Lehman moment”? That we’re not “catching a falling knife” at the start of another Great Financial Crisis in the UK?

Management came out on October 4th to reassure investors that the company was not at significant risk from the financial chaos.

“LGIM acts as an agent between our LDI clients and market counterparties and therefore has no balance sheet exposure.” – LGGNY

LGGNY has no direct exposure to the crisis.

“Despite volatile markets, the Group’s annuity portfolio has not experienced any difficulty meeting collateral calls, and we have not been forced sellers of gilts or bonds.

One of the strengths of the UK insurance regime is that we regularly monitor and stress our capital and liquidity requirements to a 1 in 200 stress level to withstand shocks, as we have seen in the past few days.

We hold multiple buffers over these prudent requirements and have a wide array of tools available to manage collateral calls – for example, being able to post various types of assets, or assets in other currencies, as collateral…

Volumes continue to be written at margins and capital strain in line with our long-term average. We expect the UK annuity portfolio to be self-sustaining again in 2022. ” – LGGNY.

OK, so management says all is well. But, then again, Lehman and Bear Sterns were speaking the same things right before they went over a cliff in 2008.

So, this is where we turn to independent confirmation.

Legal & General Credit Ratings

|

Rating Agency |

Credit Rating |

30-Year Default/Bankruptcy Risk |

Chance of Losing 100% Of Your Investment 1 In |

|

S&P |

A Stable Outlook |

0.66% |

151.5 |

|

Fitch |

A+ Stable Outlook |

0.60% |

166.7 |

|

Moody’s |

A2 (A equivalent) Stable |

0.66% |

151.5 |

|

AMBest |

A Stable Outlook |

0.66% |

151.5 |

|

Consensus |

A Stable Outlook |

0.65% |

155.0 |

(Sources: S&P, Fitch, Moody’s, AMBest)

Rating agencies continue to rate LGGNY A stable, with a 0.65% real bankruptcy risk.

But here’s more evidence that LGGNY management and rating agencies aren’t missing something large and dangerous.

Credit default swaps are insurance policies bond investors take out against potential defaults and serve as a good proxy for real real-time risk.

-

within 24 hours of the news breaking, we can monitor what the “smart money” on Wall Street thinks

-

millions of dollars on the line, so high conviction bets from the bond market.

LGGNY’s entire risk has been falling in the last week and is up only modestly over the previous months before financial chaos gripped the UK.

The price has been collapsing due to fear, uncertainty, and doubt, but the bond market, rating agencies, analysts, and management all think the investment thesis remains intact.

-

the evidence says LGGNY is NOT a value trap, but an incredible bargain with a safe 9.2% yield

LGGNY has $1.2 billion in short-term liquidity, with no bonds maturing for the next eight years.

Bond investors are willing to lend LGGNY money for 42 years at reasonable interest rates, so their confidence in this company’s long-term prospects is high.

Reasons To Potentially Buy LGGNY Today

|

Metric |

Legal & General |

|

Quality |

72% 10/13 Blue-Chip Quality Asset Manager |

|

Risk Rating |

Low Risk |

|

DK Master List Quality Ranking (Out Of 500 Companies) |

416 |

|

Quality Percentile |

18% |

|

Dividend Growth Streak (Years) |

1 (No Cuts Since Great Recession) |

|

Dividend Yield |

9.2% |

|

Dividend Safety Score |

70% |

|

Average Recession Dividend Cut Risk |

1.0% |

|

Severe Recession Dividend Cut Risk |

3.00% |

|

S&P Credit Rating |

A Stable |

|

30-Year Bankruptcy Risk |

0.66% |

|

LT Risk-Management Global Percentile |

79% Good, Bordering On Very Good |

|

Fair Value |

$21.93 |

|

Current Price |

$12.23 |

|

Discount To Fair Value |

44% |

|

DK Rating |

Potentially Very Strong Buy |

|

PE |

6.1 |

|

Growth Priced In |

-4.8% |

|

Historical PE |

10.5 to 12 |

|

LT Growth Consensus/Management Guidance |

6.5% |

|

5-year consensus total return potential |

21% to 26% CAGR |

|

Base Case 5-year consensus return potential |

24% CAGR (3X the S&P 500) |

|

Consensus 12-month total return forecast |

58% |

|

Fundamentally Justified 12-Month Return Potential |

89% |

|

LT Consensus Total Return Potential |

15.7% |

|

Inflation-Adjusted Consensus LT Return Potential |

13.4% |

|

Consensus 10-Year Inflation-Adjusted Total Return Potential (Ignoring Valuation) |

3.52 |

|

LT Risk-Adjusted Expected Return |

10.92% |

|

LT Risk-And Inflation-Adjusted Return Potential |

8.63% |

|

Conservative Years To Double |

8.35 Vs 15.2 S&P 500 |

(Source: Dividend Kings Zen Research Terminal)

LGGNY is anti-bubble blue-chip pricing in -5% growth but growing at 6.5%.

Analysts expect a nearly 60% gain in the next year, though a near double would be justified by its fundamentals.

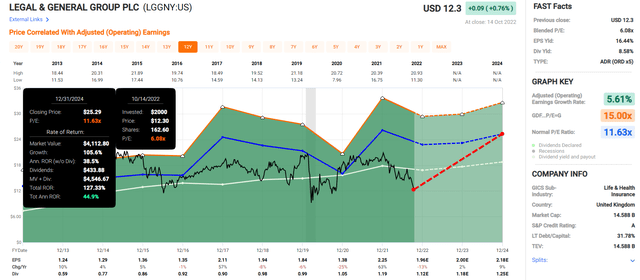

Legal & General 2024 Consensus Total Return Potential

FAST Graphs

If LGGNY grows as expected and returns to market-determined historical fair value by 2024, it could deliver 127% total returns, or a Buffett-like 45% CAGR.

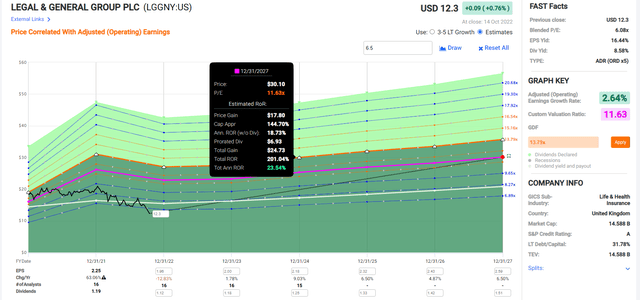

Legal & General 2027 Consensus Total Return Potential

FAST Graphs

LGGNY not only offers a safe 9.2% yield, but could potentially triple in the next five years, delivering Buffett-like 24% annual returns.

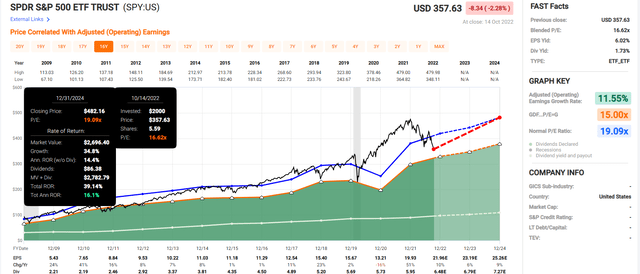

S&P 2024 Consensus Total Return Potential

FAST Graphs

Over the next two years, analysts think the S&P could deliver 40% returns, or 16% annually.

-

LGGNY offers over 3X the short-term consensus return potential of the S&P 500.

S&P 2027 Consensus Total Return Potential

|

Year |

Upside Potential By End of That Year |

Consensus CAGR Return Potential By End of That Year |

Probability-Weighted Return (Annualized) |

Inflation And Risk-Adjusted Expected Returns |

|

2027 |

67.80% |

10.91% |

8.18% |

6.00% |

(Source: DK S&P 500 Valuation Tool.)

Analysts think the S&P can deliver 11% annual returns over the next five years.

LGGNY offers 3X the return potential of the S&P 500 over the next five years.

LGGNY Corp Investment Decision Tool

Dividend Kings

Dividend Kings

LGGNY is as close to a perfect ultra-yield, anti-bubble blue-chip opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

-

44% discount to fair value vs. 10% S&P = 34% better valuation

-

9.2% safe yield vs. 1.9% S&P (4.5X higher and safer yield)

-

50% higher annual long-term return potential

-

2X higher risk-adjusted expected returns

-

over 4X the consensus 5-year income

Reason Two: A Solid Growth Runway For Decades To Come

LGGNY is priced for nearly -5% growth at the moment. But take a look at what growth analysts expect.

|

Metric |

2021 Growth |

2022 Growth Consensus |

2023 Growth Consensus |

2024 Growth Consensus |

2025 Growth Consensus |

2026 Growth Consensus |

|

Sales |

-21% |

5% |

-5% |

3% |

19% |

3% |

|

Dividend (Pounds) |

5% |

10% |

5% |

6% |

4% |

4% |

|

Earnings |

63% |

-13% |

2% |

9% |

8% |

1% |

|

Book Value |

4% |

0% |

8% |

9% |

2% |

8% |

(Source: FAST Graphs, FactSet)

Steady growth in earnings outside of this year’s decline (mostly currency-related) with continuous increase in the dividend every year.

What about the long term?

Management’s guidance is 8% to 9% growth, and analysts are more conservative, expecting 6.5% CAGR over the long-term.

-

6.3% to 11% CAGR growth consensus range from four sources.

How accurate are analysts at using management guidance and their growth models to forecast growth for this asset manager?

Smoothing for outliers, analyst margins of error are 25% to the upside and 20% to the downside.

-

5% to 12% CAGR margin-of-error adjusted growth consensus range.

LGGNY’s historical growth rates, including post-GFC, are consistent with management guidance and analyst expectations.

Its growth catalysts also support 6.5% long-term growth, similar to how fast it’s grown over the last 18 years.

|

Investment Strategy |

Yield |

LT Consensus Growth |

LT Consensus Total Return Potential |

Long-Term Risk-Adjusted Expected Return |

Long-Term Inflation And Risk-Adjusted Expected Returns |

Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

|

Legal & General |

9.2% |

6.5% |

15.7% |

11.0% |

8.7% |

8.3 |

2.31 |

|

Safe Midstream |

6.1% |

6.4% |

12.5% |

8.8% |

6.5% |

11.1 |

1.87 |

|

REITs |

3.9% |

6.1% |

10.0% |

7.0% |

4.7% |

15.2 |

1.59 |

|

Schwab US Dividend Equity ETF |

3.8% |

8.50% |

12.3% |

8.6% |

6.3% |

11.4 |

1.85 |

|

Dividend Aristocrats |

2.8% |

8.7% |

11.5% |

8.1% |

5.8% |

12.5 |

1.75 |

|

S&P 500 |

1.8% |

8.5% |

10.3% |

7.2% |

4.9% |

14.6 |

1.62 |

|

Nasdaq |

0.8% |

11.5% |

12.3% |

8.6% |

6.3% |

11.4 |

1.85 |

(Sources: DK Research Terminal, Morningstar, FactSet, Ycharts)

LGGNY offers a higher safe yield than almost any other investment strategy and superior return potential to even the Nasdaq.

Inflation-Adjusted Consensus Return Potential: $1,000 Initial Investment

|

Time Frame (Years) |

8.0% CAGR Inflation-Adjusted S&P 500 Consensus |

9.2% Inflation-Adjusted Aristocrat Consensus |

13.5% CAGR Inflation-Adjusted LGGNY Consensus |

Difference Between Inflation-Adjusted LGGNY Consensus And S&P Consensus |

|

5 |

$1,468.65 |

$1,553.50 |

$1,881.90 |

$413.25 |

|

10 |

$2,156.93 |

$2,413.37 |

$3,541.55 |

$1,384.62 |

|

15 |

$3,167.77 |

$3,749.18 |

$6,664.84 |

$3,497.08 |

|

20 |

$4,652.33 |

$5,824.36 |

$12,542.57 |

$7,890.24 |

|

25 |

$6,832.64 |

$9,048.16 |

$23,603.87 |

$16,771.23 |

|

30 (retirement time frame) |

$10,034.74 |

$14,056.34 |

$44,420.13 |

$34,385.39 |

|

35 |

$14,737.50 |

$21,836.56 |

$83,594.26 |

$68,856.75 |

|

40 |

$21,644.21 |

$33,923.16 |

$157,316.07 |

$135,671.86 |

|

45 |

$31,787.72 |

$52,699.72 |

$296,053.17 |

$264,265.46 |

|

50 |

$46,684.97 |

$81,869.16 |

$557,142.59 |

$510,457.62 |

|

55 |

$68,563.78 |

$127,183.97 |

$1,048,486.86 |

$979,923.08 |

|

60 (investing lifetime) |

$100,696.06 |

$197,580.66 |

$1,973,147.84 |

$1,872,451.79 |

|

100 (institutional time frame, multi-generational wealth) |

$2,179,486.17 |

$6,702,560.00 |

$310,407,861.90 |

$308,228,375.73 |

(Source: DK Research Terminal, FactSet.)

Over the next 30 years, analysts think LGGNY could potentially deliver 44X inflation-adjusted returns. Over an investing lifetime, if management can deliver the expected growth, a small investment today could turn into a rich retirement tomorrow.

|

Time Frame (Years) |

Ratio Inflation-Adjusted LGGNY Consensus/Aristocrat Consensus |

Ratio Inflation-Adjusted LGGNY Consensus vs. S&P consensus |

|

5 |

1.21 |

1.28 |

|

10 |

1.47 |

1.64 |

|

15 |

1.78 |

2.10 |

|

20 |

2.15 |

2.70 |

|

25 |

2.61 |

3.45 |

|

30 |

3.16 |

4.43 |

|

35 |

3.83 |

5.67 |

|

40 |

4.64 |

7.27 |

|

45 |

5.62 |

9.31 |

|

50 |

6.81 |

11.93 |

|

55 |

8.24 |

15.29 |

|

60 |

9.99 |

19.60 |

|

100 |

46.31 |

142.42 |

(Source: DK Research Terminal, FactSet.)

Reason Three: A Wonderful Company At A Wonderful Price

For 20 years, before and after the GFC, LGGNY has been valued by income investors at 10.5X to 12X earnings.

-

asset managers tend to have higher P/E multiples than insurance companies

-

potentially indicating future multiple expansion

-

though our valuation model doesn’t assume this.

|

Metric |

Historical Fair Value Multiples (12-Years) |

2021 |

2022 |

2023 |

2024 |

2025 |

12-Month Forward Fair Value |

|

13-Year Median Yield |

5.45% |

$22.20 |

$20.73 |

$20.73 |

$25.87 |

$26.97 |

|

|

Earnings |

11.63 |

$26.17 |

$22.79 |

$23.38 |

$29.77 |

$30.94 |

|

|

Average |

$24.02 |

$21.72 |

$21.98 |

$27.69 |

$28.82 |

$21.93 |

|

|

Current Price |

$12.23 |

||||||

|

Discount To Fair Value |

49.09% |

43.68% |

44.35% |

55.83% |

57.56% |

44.23% |

|

|

Upside To Fair Value |

96.42% |

77.56% |

79.69% |

126.37% |

135.64% |

88.56% |

|

|

2022 EPS |

2023 EPS |

2022 Weighted EPS |

2023 Weighted EPS |

12-Month Forward PE |

12-Month Average Fair Value Forward PE |

Current Forward PE |

|

|

$1.96 |

$2.01 |

$0.34 |

$1.66 |

$2.00 |

11.0 |

6.1 |

I estimate LGGNY is historically worth about 11X earnings and today trades at just 6.1X.

|

Rating |

Margin Of Safety For Low Risk 10/13 Blue-Chip Quality Companies |

2022 Fair Value Price |

2023 Fair Value Price |

12-Month Forward Fair Value |

|

Potentially Reasonable Buy |

0% |

$21.72 |

$21.98 |

$21.93 |

|

Potentially Good Buy |

20% |

$17.37 |

$17.58 |

$17.54 |

|

Potentially Strong Buy |

30% |

$15.20 |

$15.38 |

$15.35 |

|

Potentially Very Strong Buy |

40% |

$10.42 |

$13.19 |

$13.16 |

|

Potentially Ultra-Value Buy |

50% |

$10.86 |

$10.99 |

$10.97 |

|

Currently |

$12.23 |

43.68% |

44.35% |

44.23% |

|

Upside To Fair Value (Including Dividends) |

86.80% |

88.93% |

88.56% |

For anyone comfortable with its risk profile, LGGNY is a potentially very strong buy.

Risk Profile: Why Legal & General Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Risk Profile Summary

-

Regulatory/capital requirement risk

-

“Reserves and our assessment of capital requirements may require revision as a result of changes in experience, regulation, or legislation.”

-

“Changes in regulation or legislation may have a detrimental effect on our strategy.”

-

Investment cyclicality risk

-

“Investment market performance and conditions in the broader economy may adversely impact earnings, profitability, or surplus capital.”

-

counter-party risk

-

“In dealing with issuers of debt and other types of the counterparty, the Group is exposed to the risk of financial loss.”

-

disruption risk

-

“New entrants may disrupt the markets in which we operate.”

-

M&A execution risk (potentially overpaying for companies and executing poorly on integrating the acquisition)

-

talent retention risk (tightest job market in over 50 years)

-

data security risk: hackers and ransomware

-

“A material failure in our business processes or IT security may result in unanticipated financial loss or reputation damage”

-

Climate change risk

-

“We fail to respond to the emerging threats from climate change for our investment portfolios and wider businesses.”

-

Global Expansion Execution Risk (now expanding into Europe and the U.S.).

LGGNY has about a dozen risk committees in charge of each of these risks, adapting to and heading off the kinds of risks that investors are terrified about right now.

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Analysis: How Large Institutions Measure Total Risk

-

see the risk section of this video to get an in-depth view (and link to two reports) of how DK and big institutions measure long-term risk management by companies

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

-

S&P has spent over 20 years perfecting their risk model

-

which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

-

this risk rating has been included in every credit rating for decades.

The DK risk rating is based on the global percentile of how a company’s risk management compares to 8,000 S&P-rated companies.

The major things S&P is looking at for LGGNY and asset managers including things like:

-

governance

-

financial inclusion

-

human capital development (skills training)

-

labor relations

-

risk and crisis management

-

the sustainability of its financial model

-

labor retention

-

climate risk mitigation

-

business conduct/scandals.

LGGNY’s Long-Term Risk Management Is The 78th Best In The Master List (84th Percentile)

|

Classification |

Average Consensus LT Risk-Management Industry Percentile |

Risk-Management Rating |

|

S&P Global (SPGI) #1 Risk Management In The Master List |

94 |

Exceptional |

|

Legal & General |

79 |

Good, Bordering On Very Good |

|

Foreign Dividend Stocks |

76 |

Good |

|

Strong ESG Stocks |

73 |

Good |

|

Ultra SWANs |

70 |

Good |

|

Low Volatility Stocks |

68 |

Above-Average |

|

Dividend Aristocrats |

67 |

Above-Average |

|

Dividend Kings |

63 |

Above-Average |

|

Master List average |

62 |

Above-Average |

|

Hyper-Growth stocks |

61 |

Above-Average |

|

Monthly Dividend Stocks |

60 |

Above-Average |

|

Dividend Champions |

57 |

Average bordering on above-average |

(Source: DK Research Terminal)

LGGNY’s risk-management consensus is in the top 16% of the world’s highest quality companies and similar to that of such other blue-chips as

-

Dover (DOV): Ultra SWAN dividend king

-

Target (TGT): Ultra SWAN dividend king

-

Automatic Data Processing (ADP): Ultra SWAN dividend aristocrat

-

Visa (V): Ultra SWAN

-

Bank of Nova Scotia (BNS): Ultra SWAN.

The bottom line is that all companies have risks, and LGGNY is good, bordering on very good, at managing theirs.

How We Monitor LGGNY’s Risk Profile

-

17 analysts

-

4 credit rating agencies

-

21 experts who collectively know this business better than anyone other than management

-

and the bond market for real-time fundamental risk assessment

“When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Legal & General Offers A Relatively Safe 9.2% Yield That Could Change Your Life

Let me be clear: I’m NOT calling the bottom in LGGNY (I’m not a market-timer).

Fundamentals are all that determine safety and quality, and my recommendations.

-

over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

-

in the short term, luck is 25X as powerful as fundamentals

-

in the long term, fundamentals are 33X as powerful as luck.

While I can’t predict the market in the short term, here’s what I can tell you about LGGNY.

-

One of the highest quality, safest, and most dependable ultra-yield blue chips on earth.

-

9.2% safe yield, growing at 6% to 7% CAGR over time

-

15.7% CAGR long-term total return consensus, better than the Nasdaq, aristocrats, S&P 500, and SCHD.

-

44% historically undervalued, a potentially strong buy

-

6.1X earnings (anti-bubble blue-chip)

-

200% consensus return potential over the next five years, 24% CAGR, more than 3X more than the S&P 500

-

2X the risk-adjusted expected returns of the S&P 500 over the next five years

-

over 4X better income potential over the next five years.

Everyone says they want to be like Buffett and “be greedy when others are fearful.” Well, this is your chance.

People forget that stocks never fall 20+% without something going wrong, and individual blue chips don’t fall 40+% without many terrifying headlines.

The difference between a value trap and a potentially life-changing deep value opportunity is all in the fundamentals.

-

is the company’s balance sheet strong or on the verge of collapse?

-

is the company growing or expected to see sales and earnings fall for years?

-

is the dividend sustainable or likely to be cut?

-

is management skilled and battle-tested?

-

is risk management solid or weak?

The answer is obvious when it comes to Legal & General, an A-rated company with 79th percentile risk management and steady growth ahead of it.

This is NOT a value trap, but one of the best opportunities for Buffett-style deep value blue-chip bargain hunting in the 2022 bear market.

The UK is not going to be flailing forever. The FactSet consensus is that the Pound will recover to 1.43 when the crisis has passed.

LGGNY isn’t going to be Wall Street’s whipping boy forever, not when the recession is over, and the dividend has kept growing steadily and safely for several years.

And when the “dust settles,” I can guarantee you that the fear and outright panic we’ve seen in recent years will quickly evaporate.

That’s when the price will recover rapidly, and that incredible 9.2% safe yield will come down hard and fast.

I can’t tell you when the UK crisis will end, but only that it will end.

I can’t tell you when this bear market will end, only that it will end.

And I can say with high confidence that in 5+ years, anyone buying LGGNY today is likely to be very happy they did. And in 10+ years, anyone purchasing this blue-chip today won’t even remember where the bottom was because we’ll all be too busy rolling in safe and growing dividends and Buffett-like returns to care.

Be the first to comment