Baris-Ozer

Maintaining Our Rating

We initiated our coverage on OFS Capital (NASDAQ:OFS) with a “BUY” rating on August 29th, 2022. We cited OFS Capital’s track record of success and the company’s generous shareholder programs that can enhance shareholder value. Since our publication, the company’s stock price has inched higher, rising 3.03% since the time of our writing, which far exceeds S&P 500’s decline of -1.84% during this short time frame. After OFS Capital’s Q3 earnings, we have re-assessed the stock and we reiterating our “BUY” rating as the fundamentals have remained the same, and we liked seeing the company raising its distributions in this quarter. We believe that continued financial performance and shareholder friendly policies will be beneficial for investors.

Q3 Results

Q3 results were within expectations, as the company reported interest rate sensitive changes to the financial performance. As interest rates rose, the company’s investment value was marked down, from $547.7 million to $516.6 million on a quarter-over-quarter basis. Despite the fall in investment value due to interest rates sensitivity, the company’s annualized yield has risen, rising from 9.1% to 11.6%. The higher income yield has contributed to higher adjusted net income per share of $0.33, which is roughly 33% higher than last quarter when management reported $0.24 for the same metric. The bottom line beat is notable, as the market expected only a $0.23 per share, which would be in line with the previous quarter. This earnings beat demonstrates that the market has been generally underestimating this stock.

Furthermore, the company’s balance sheet remains strong. Management reported $13.1 million in cash, which represents roughly 10% of its market capitalization. On the liabilities side, the company reported that 65% of the outstanding debt has a fixed rate, which limits the extent of cost pressures from interest rate hikes. The fact that 65% of its debt is fixed rate, while 94% of its investments is floating rate should be a good capital structure and financing decisions for investors. Overall, we believe that the company’s liquidity position remains solid based on its cash balance as well as its access to other revolving credit facilities.

Distributions

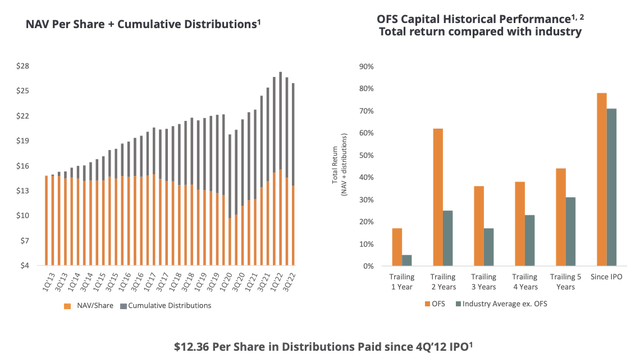

Similar to our previous analysis, we are keen on the company’s trends in distributions, and this quarter, the company raised its distributions from $0.30 per share from $0.29 per share, which represents a 3.4% increase from the previous quarter. As such, the positive trend in distribution continues, and we remain firm in our thesis that the company can be a good source of income for income-oriented investors. Since IPO, the company has paid $12.36 per share in distributions, and as interest rates rise, the company will see higher distributions as 94% of its portfolio has a floating rate. The company’s raw distributions along with the protection of its NAV/share have become a good combination to become a proxy for income generating investment.

Same Macroeconomic Risks

As discussed in the coverage article, OFS Capital is susceptible to macroeconomic risks similar to other financial firms. The risk of a recession next year is high and is well anticipated by the market. Though recent inflation print has alleviated some worries, it remains clear that rates will remain high for the foreseeable future and that current data is far from the Federal Reserve’s 2% target. Nevertheless, we believe distribution hikes along with the company’s quarter-over-quarter rise in net investment income demonstrate the portfolio’s resiliency, and the company’s liquidity alleviates major worries of a downturn from economic deterioration.

Final Word

Q3 earnings have not changed our thesis on OFS Capital. The company has shown that even in a worse interest rate environment, the company can raise distributions and we have witnessed the impact of investment income as a result of rising rates. Though macroeconomic risks remain, the company continues to perform well and we find the Q3 earnings report to be favorable in supporting our view. In all, we maintain our “BUY” rating on the stock.

Be the first to comment