Co-produced with “Hidden Opportunities.”

designer491

Introduction

In today’s market conditions, investors are constantly on their toes with the news. After all, your portfolio is affected by several factors beyond your control. So the average investor decides that waiting with cash is the best resort.

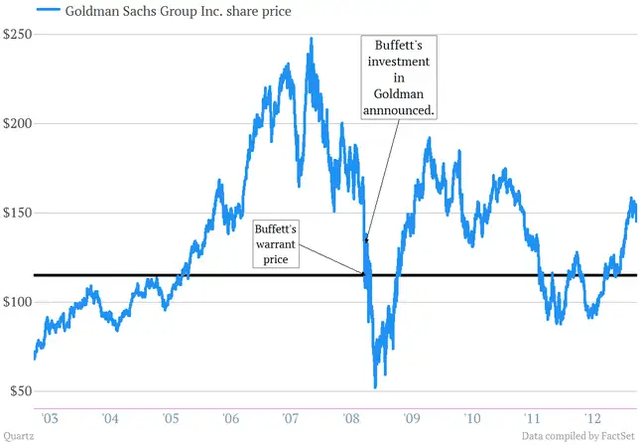

Even the Oracle of Omaha, Warren Buffett, finds himself at the mercy of market swings, but he thinks differently. When everyone thinks it is too risky to invest, he considers it too risky to wait. In 2008, when the markets were plunging in fear, Mr. Buffett picked up a private placement of Goldman Sachs (GS) preferred shares with warrants to acquire common units. The Oracle didn’t exactly buy the market bottom; his investments were underwater for a long time. (Source)

But he didn’t care, he collected $500 million annually from the preferreds and achieved an impressive 35% return (the majority being dividends along with a modest 13% in capital gains).

Mr. Buffett has several publicly known criteria to examine his investment considerations’ fundamentals, quality, and sustainability. The market price action is not one of them. Here is what he said about fund managers in the 1970s:

In 1971, pension fund managers invested a record 122% of net funds available in equities – at full prices they couldn’t buy enough of them. In 1974, after the bottom had fallen out, they committed a then record low of 21% to stocks.

Time and again, investors tend to buy the top of the market and sell its bottom. It is essential to stay focused on your goals. Does a market with discounted securities and sustainable high yields for your patience sound like something that will get you closer to your goals? If so, we have four deeply discounted preferreds from two companies with solid operating fundamentals and yields of up to 9% for you. Without further ado, let us review these picks.

Pick #1: TDS-U and TDS-V Preferreds, Yield 8.7%

In today’s digital age, the internet is becoming as important to humankind as oxygen and water. We are more dependent on our devices today than we were a year before, and this trend is only set to increase. Millions of Americans perform a significant amount of their day-to-day activities on their smartphone and can’t dream of going back to doing things the old-fashioned way. Wireless telecom in the U.S. is dominated by a few players with a tremendous competitive advantage and inelastic demand. Naturally, phone bills will continue to be paid through bull and bear markets, and we want to generate passive income from this stable industry.

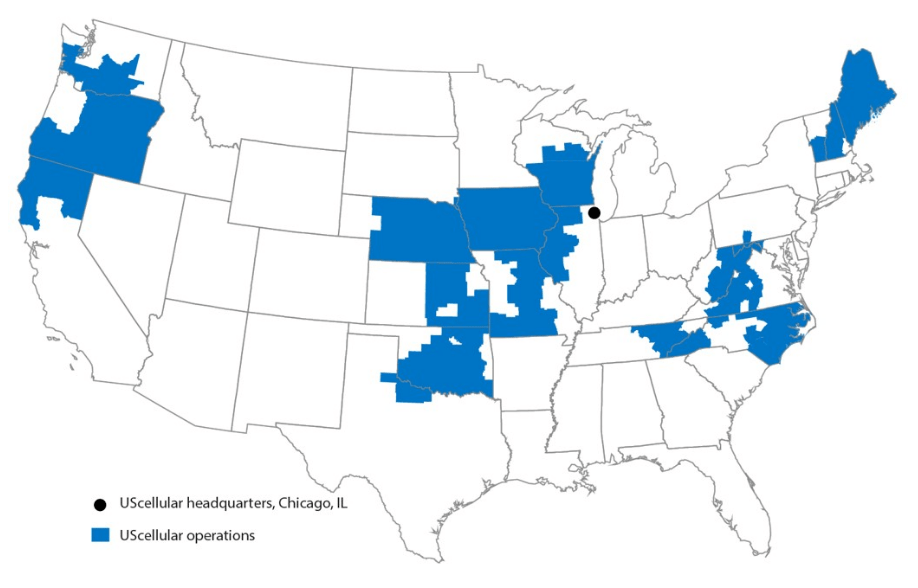

Telephone and Data Systems (TDS) is an 83% owner of U.S. Cellular (USM), the 4th largest wireless company in the U.S. behind Verizon (VZ), AT&T (T), and T-Mobile (TMUS). You probably aren’t alone if you haven’t heard of U.S. Cellular. This carrier doesn’t operate nationwide. They provide telecom services in 21 states and have over 4.8 million paid subscribers. YTD 2022, 76% of TDS revenue came from USM. (Source.)

TDS form 10-Q for 3rd Qtr

During Q3, USM reported 4% Average Revenue Per User (‘ARPU’) growth and a 14% increase in YoY tower rental revenue growth. In addition to its USM investment, TDS maintains a vast fiber infrastructure network. During Q2, TDS reported deploying 33,000 marketable fiber serviceable addresses and increased their service addresses by 7% YoY. The segment’s residential broadband revenues grew 10% YoY.

Being 4th in the telecom space in the U.S. certainly comes with the need to spend more on network expansion, marketing, and other activities to stay competitive in the market. These can be challenging in a rising rate environment. Our objective is current income generation, so we will pursue TDS through preferred shares, where the risk profile is very different and favorable for income investors.

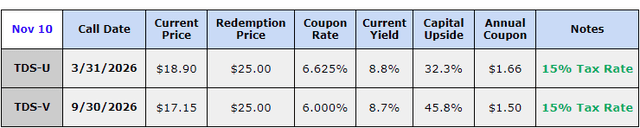

TDS has two preferred stocks outstanding that we will discuss today:

- Telephone and Data Systems 6.625% Series U.U. Cumulative Preferred Stock (TDS.PU)

- Telephone and Data Systems 6.00% Series V.V. Cumulative Preferred Stock (TDS.PV)

Thanks to the fear of the hawkish Fed, TDS-U and TDS-V trade at an attractive ~24% and 31% discounts to par respectively, and carry high 8.7% current yields. Their dividends are qualified and are eligible for favorable tax treatment for eligible investors.

The TDS preferreds offer protections to shareholders due to their cumulative nature. A suspended preferred dividend automatically pauses the common dividend and is unlikely to be pursued unless the company is in serious trouble.

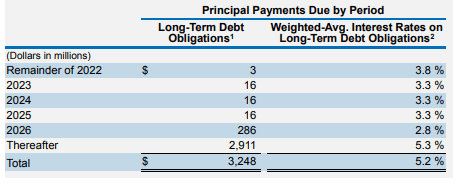

A review of the company’s financials tells us otherwise. At the end of Q2, TDS carried ~150 million in cash and cash equivalents in its balance sheet. YTD TDS’ Adj. EBITDA of $716 million covered the 6-month interest expense over ten times! The company maintains healthy cash flows and is comfortably meeting its debt obligations. TDS spends ~70 million on preferred dividends which are also adequately covered by the company’s EBITDA. Additionally, under ~2% of TDS’ $3.25 billion debt is due before 2026, indicating that the company has adequate flexibility with its cash flow in the near term.

TDS 10-Q

40% of TDS’ long-term debt is variable-rate which carries risks in this rising rate environment. Moreover, TDS’ weighted average interest rate on debt at the end of Q2 was 5.2% which is certainly on the higher side. These are important reminders of why we are not interested in TDS common units. For preferred investors, these are noteworthy items but less critical since business fundamentals illustrate the lower risk profile and demonstrate safety for the dividends and interest payments.

We can see that the preferred distributions are safe and that investors can utilize these deeply discounted prices to lock in high yields. Telecom is a quasi-utility in today’s digital economy, and there are very few players in the U.S. TDS preferreds present an attractive fixed-income opportunity to lock in a 8.7% yield and set yourself up for over 30% capital upside to par during these fearful market conditions.

Pick #2: RTLPO and RTLPP Preferreds, Yield 9.1%

No matter how convenient it is to shop online, and despite more of our everyday goods becoming available to order with a smartphone, there are some items that we need to leave our homes to get.

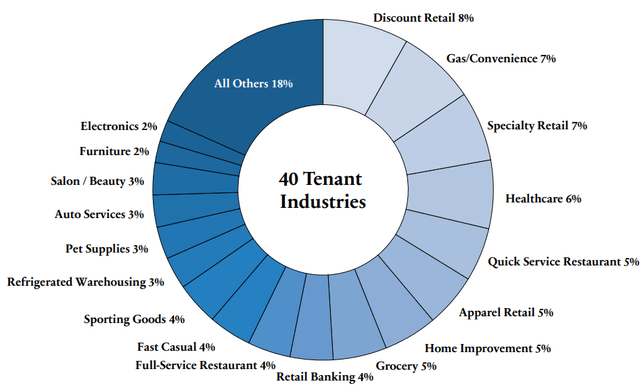

The Necessity Retail REIT, Inc. (RTL) is a Real Estate Investment Trust that is the landlord for physical-retail-necessary businesses like AutoZone (AZO), Home Depot (HD), discount retail stores like Dollar General (DG), and salons and beauty shops where you need to go in person to get services/merchandise. (Source.)

RTL Nov 2022 Investor Presentation

55% of RTL’s portfolio annualized Straight-Line Rent (“SLR”) is derived from Necessity-Based retail tenants that are more resilient to the e-commerce shift and economic cycles. RTL’s portfolio featured a diverse range of tenant industries, with no individual tenant industry totaling more than 8% of portfolio SLR.

RTL Nov 2022 Investor Presentation

RTL’s execution continues to improve, with revenue from tenants in Q2 up 26% YoY to $116.2 million from $91.9 million, and its adjusted EBITDA was up 14% to $71.7 million. RTL continues to improve the sustainability of its AFFO to common dividend coverage, but we are more interested in the higher income safety from RTL’s two preferred stocks:

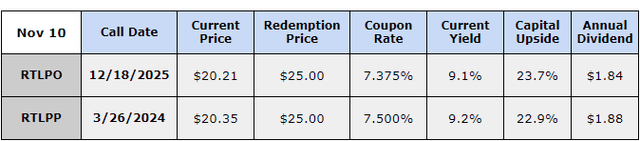

- The Necessity Retail REIT Inc. – 7.375% Series C Cumulative Redeemable Perpetual Preferred Stock (RTLPO)

- The Necessity Retail REIT Inc. – 7.50% Series A Cumulative Redeemable Perpetual Preferred Stock (RTLPP)

RTLPO and RTLPP preferreds present a compelling investment with well-covered distributions and significant capital upside. Let’s see how they accomplish that.

Their current discounts indicate ~23% upside to par value and over 9% yields for investors to stay patient through the market movements. Looking at RTL’s YTD 2022 performance, we see ~6 million spent towards preferred distributions, ~$84 million towards interest expenses, and $83 million towards common stock dividends. Investors must note that RTL’s YTD $104 million AFFO adequately covers the common dividend for the nine months.

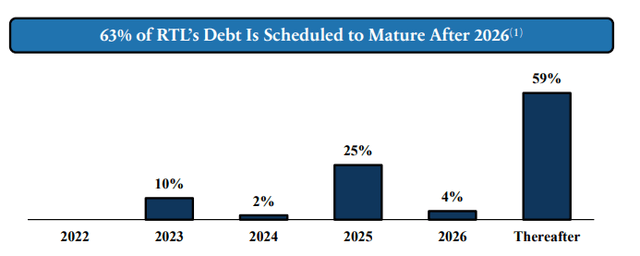

RTL’s cost of debt is low despite rising rates. The REIT has a weighted average interest rate of 4.2%, with 83.1% of its debt carrying fixed interest rates. RTL has a staggering debt maturity schedule, with over 63% of the total debt not due until 2026 and later. Notable interim maturities are:

-

$290 million mortgage notes due 2023

-

$708 million mortgage notes due 2025

RTL Nov 2022 Investor Presentation

RTL ended Q2 with $41 million cash on its balance sheet, placing it in a position of flexibility with its cash flows. The REIT’s tenant base consists of suppliers of necessary goods and services with non-cyclical demand and high immunity to recession pressures. With adequate operational coverage for interest expenses and preferred distributions, RTLPO presents a safe income opportunity for long-term investors, and this discount provides an attractive entry/addition point. Lock in this safe and generous 9.1% yield and set yourself up for ~23% capital upside while the market trembles in anticipation of what the Fed will do next.

Conclusion

If you are shying away from fixed-income securities in a rising-rate environment, you are missing out on years of steady income through market volatility. Opportunity strikes at times when investors run fearfully in search of temporary safe havens. The reality is that they often run away from several otherwise perfectly safe securities, well positioned to weather harsh conditions.

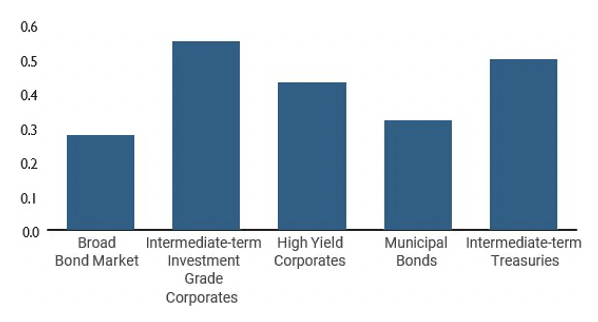

U.S. preferred securities are an asset class highly differentiated from other fixed-income areas because they offer uncorrelated returns to other securities. The image below shows that preferreds act more like investment-grade corporates than either government bonds or high-yield securities, which are more sensitive to interest rates. (Source.)

Advisor Perspectives

Discounted high-yield preferreds from companies with solid fundamentals and inelastic demand are great to buy in these volatile market conditions. Two picks with up to 9% yields to swim in dividend income through Mr. Market’s emotional outburst.

Be the first to comment