Fortinet, Inc. Just_Super/E+ via Getty Images Fortinet

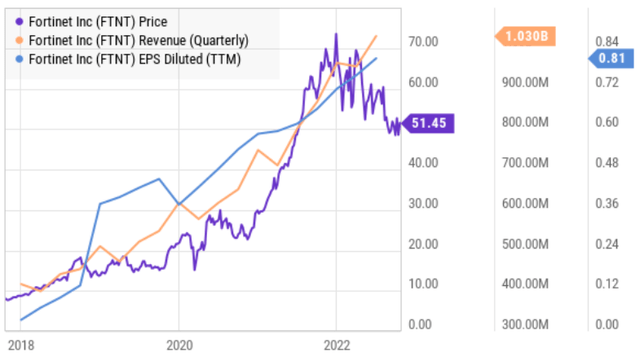

The cybersecurity business we review in this report (Fortinet (NASDAQ:FTNT)) is attractive for a variety of reasons, including its high growth, large total addressable market and attractive valuation. In particular, the shares have sold off hard as the low-interest-rate bubble has burst, but unlike other “pandemic darlings” this one is actually very profitable and generates powerful cash flow (therefore it won’t face the same growth-capital-raising challenges as others that will be paralyzed by higher borrowing rates, lower stock prices for new share issuances, and a slowed economy). Its valuation multiple has been crushed, but its business and earnings keep growing-and likely will for many years to come.

Fortinet: Overview

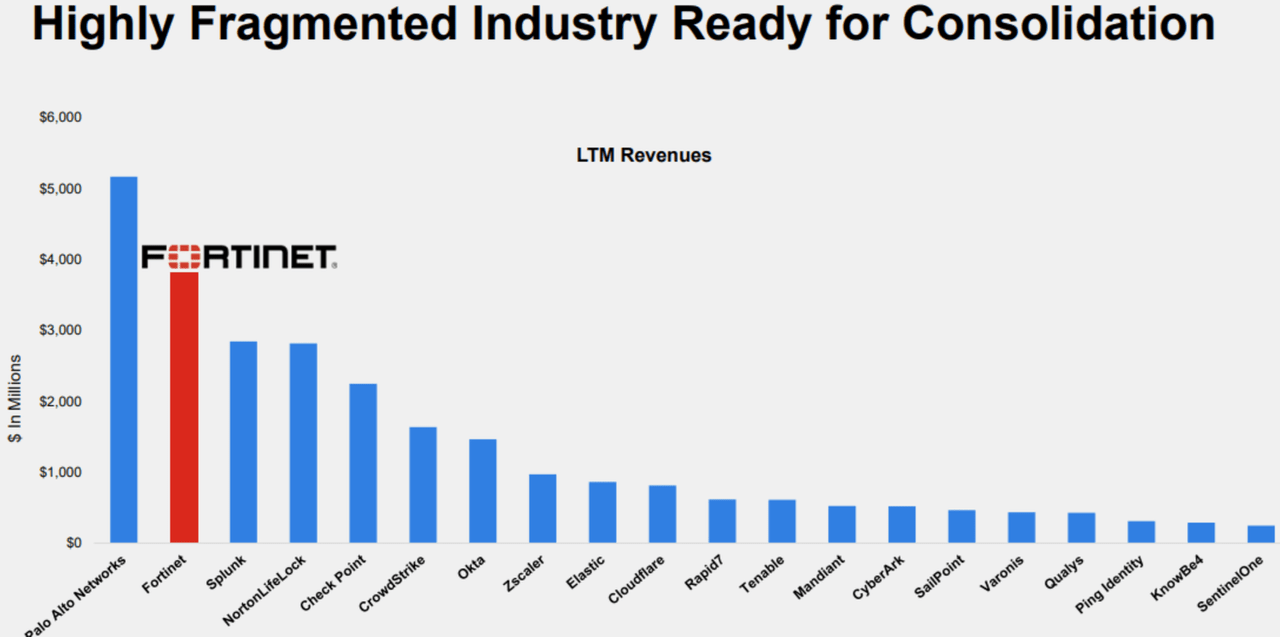

Fortinet is a cybersecurity stock. The company describes itself as “Broad. Integrated. Automated.” More specifically, “the Fortinet Security Fabric brings together the concepts of convergence and consolidation to provide comprehensive cybersecurity protection for all users, devices, and applications and across all network edges.” And over 580,000+ customers currently trust Fortinet with their cybersecurity solutions.

Fortinet Investor Presentation

By the Numbers

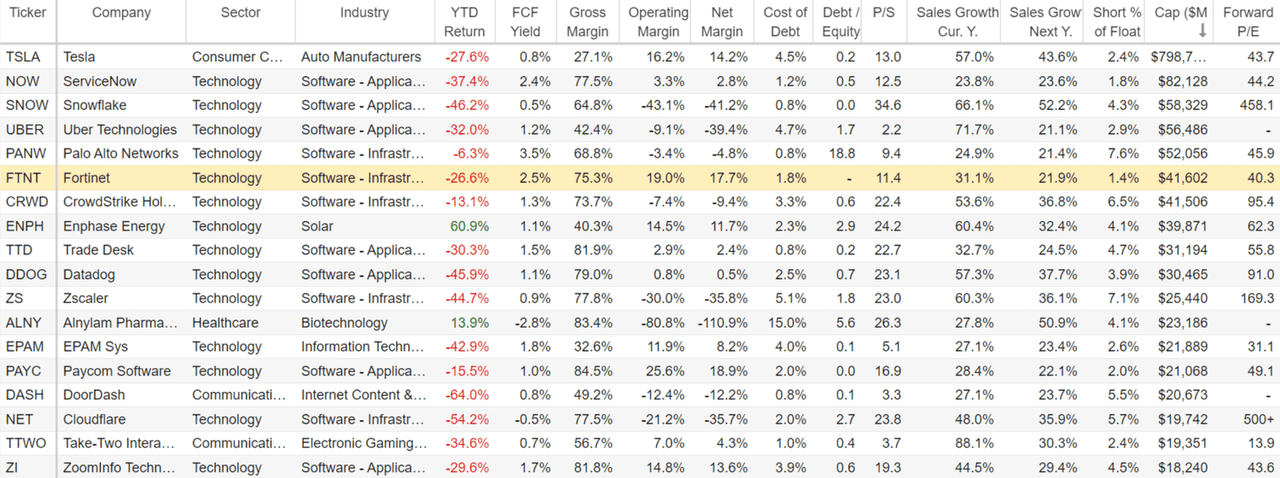

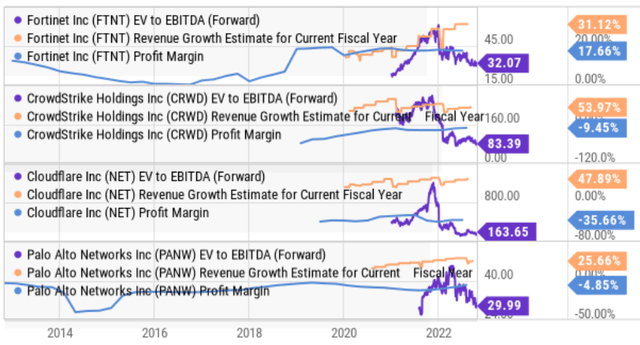

And to put Fortinet in perspective versus other high-growth businesses, here is a look at a variety of critical metrics on high-growth businesses (those with at least 20% expected revenue growth, this year and next) sorted by market cap.

Stock Rover Stock Rover

As you can see, Fortinet is one of the few names on the list that has high growth AND positive free cash flow yield, very strong margins, a low cost of debt and very reasonable valuation metrics (price-to-sales and forward price-to-earnings) relative to its very strong growth rate.

Less Susceptible to Capital Market Challenges

Fortinet has been around since 2000 (founded by current chairman and CEO Ken Xie) and unlike a lot of other high-growth stocks, it is not at the mercy of the capital markets to fund its ongoing growth. For example, many high-growth companies were simply issuing more shares in 2021 to raise more capital for growth. This worked out great while their stock prices were high (i.e. they could raise a lot more money easily), but now that top growth stock prices are down 40%, 50%, 70% and more (see table above) it’s not so easy to raise capital.

Compounding the lower share price issue, is higher interest rates. Before, companies could issue debt at very low interest rates, but now interest rates are higher-thereby making it a lot more expensive to raise capital for growth.

Further still, the economy has slowed (we could be entering an ugly recession) and this simply adds to the challenges other high growth stocks face.

On the other hand, Fortinet has a strong investment grade credit rating (BBB+ and Baa1), and it is already cash flow positive (others are still simply burning cash to fund growth) and Fortinet is profitable (something many high-growth stocks simply are not). In fact, Fortinet has been profitable and free cash flow positive every year since its IPO in 2009 (impressive!). And this combination of positive factors bodes extremely well for Fortinet considering the capital markets are now significantly more challenging, not to mention Fortinet’s future growth opportunities are great.

High Growth, Strong “Moat” Business

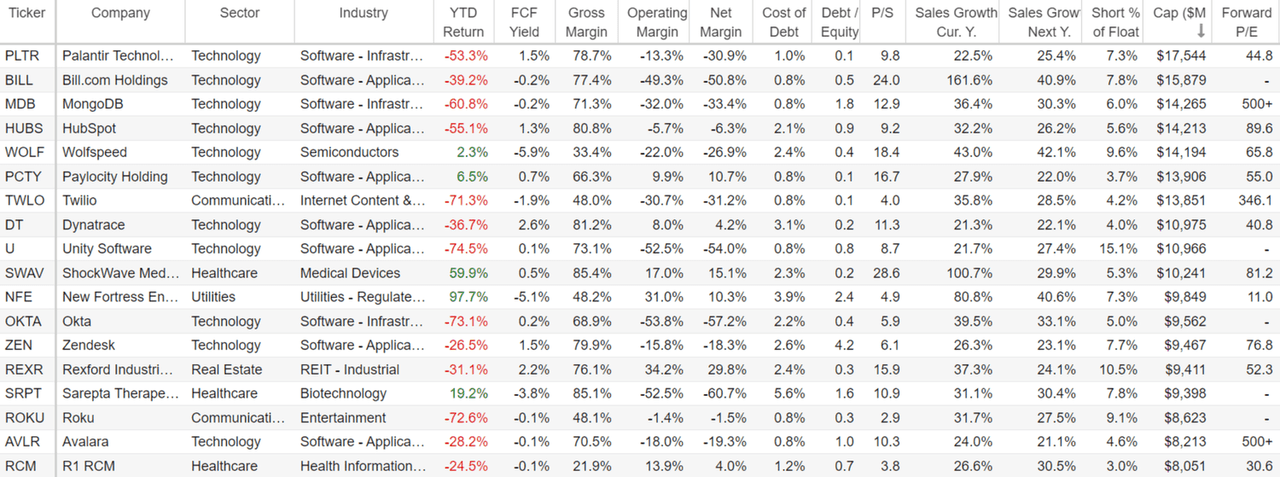

Fortinet’s business is attractive because it has strong growth potential, as measured by its large TAM (total addressable market) and its powerful moat. For starters here is a look at the company’s estimates of the TAM-which remains very large and growing (a good thing!).

Fortinet Investors Presentation

Further, Fortinet is a strong “moat” business, meaning it has attractive and sustainable competitive advantages. For example, unlike other cybersecurity solutions, Fortinet uses a platform approach. And it is this platform approach that creates its moat because it creates a network effect and high switching costs for customers. As per the company’s investor presentation:

“Cybersecurity has traditionally been deployed one solution at a time and was not designed to work well with other deployed solutions while increasing management complexity. A platform approach consolidates point products into a cybersecurity platform, allowing for much tighter integration, increased automation, and a more rapid, coordinated, and effective response to threats across the network.”

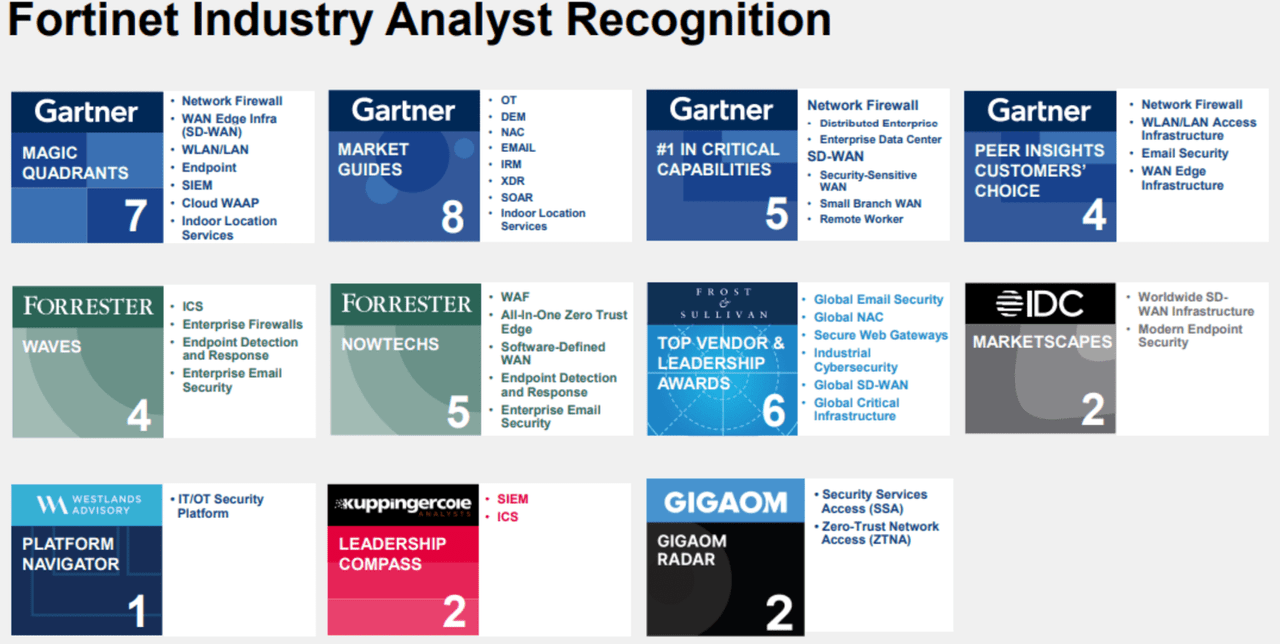

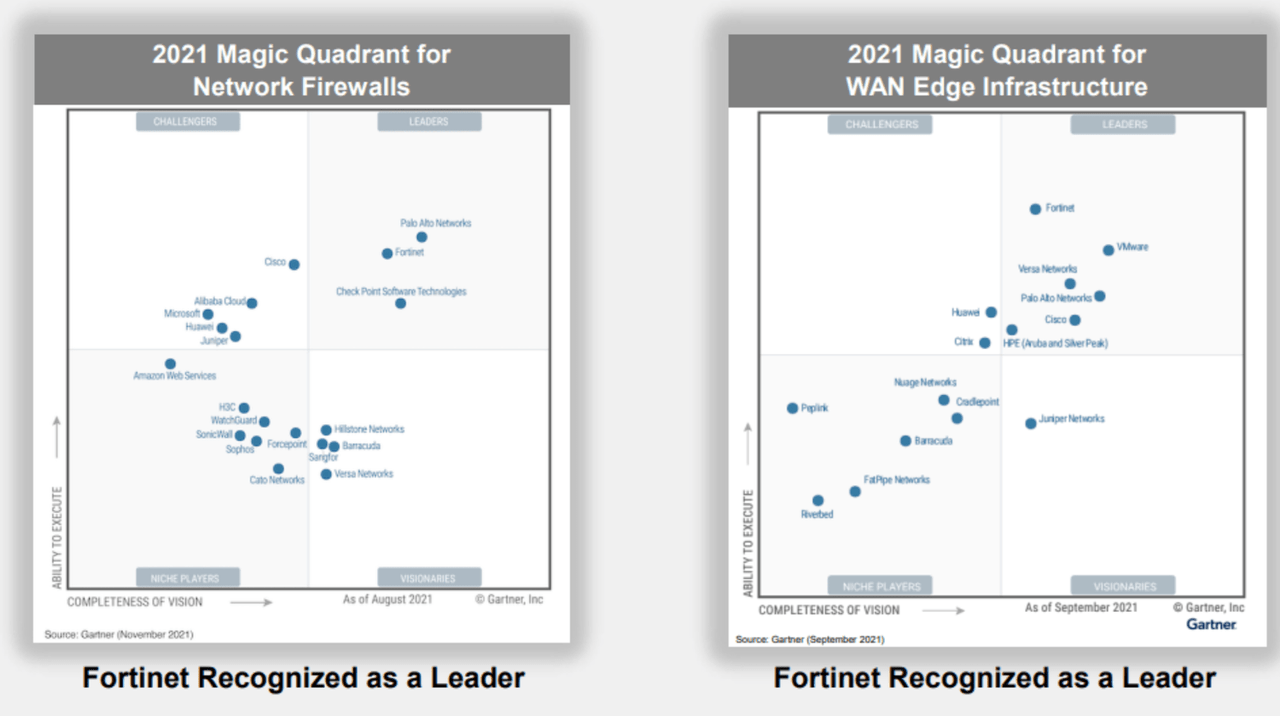

Further still, Fortinet ranks highly among a variety of industry products and solutions, including multiple high “magic quadrant” positions.

Fortinet Investor Presentation Fortinet Investor Presentation

Risks

Fortinet does face a variety of risks, including the potential for an ongoing economic slowdown (recession) which would negatively impact virtually all business, including Fortinet. However, Founder, Chairman and CEO, Ken Xie, noted on the latest quarterly earnings call that the macroeconomic slowdown has actually created opportunities for Fortinet in hiring as competing for top cybersecurity talent has become easier (as competitors have hiring freezes and slowdowns-cybersecurity remains in high demand from clients). Specifically “agreed hiring is relatively a little bit easier compared to like a few quarters ago, especially in the cybersecurity space.”

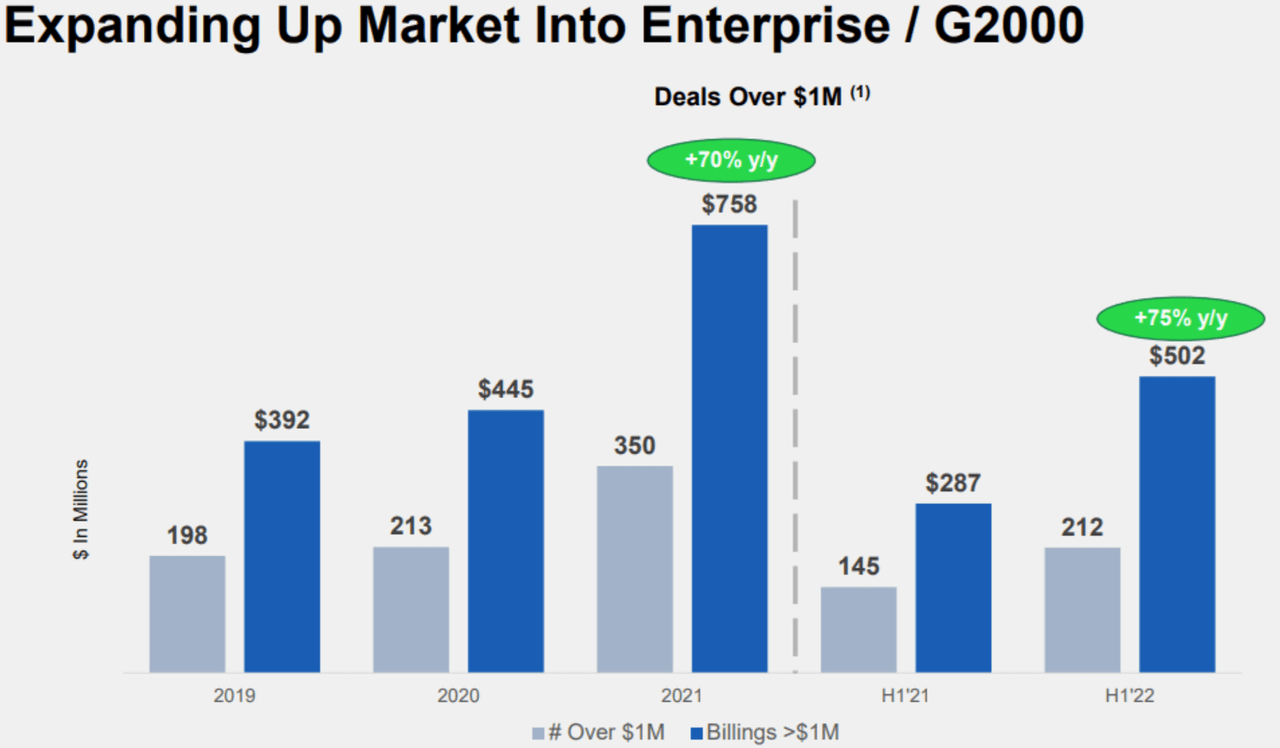

Another risk is Fortinet’s growing effort to expand beyond its traditional “small and mid-sized business” clients and into enterprise level clients. Large enterprise customers currently make up 40% of Fortinet’s business, representing a growing number.

Fortinet Investor Presentation

However, as Fortinet continues its enterprise-level efforts, competitors could step up the competition thereby making it more difficult for Fortinet to grow at its expected rate.

Conclusion

Fortinet stands out among high-growth stocks that have recently sold off hard because it has the business strategy and financial wherewithal to keep thriving for years to come, while other high growth stocks will likely be increasingly challenged. We currently own shares of Fortinet in our Disciplined Growth Portfolio, and we selected it as one of the top ideas in our new report: When The Market Pukes: Buy These 4 Stocks in Buckets.

If you are looking for a powerful growth stock currently trading at a compelling low price (i.e. the shares have lots of long-term upside) Fortinet is absolutely worth considering for a spot in your prudently concentrated long-term portfolio.

Be the first to comment