Joe Raedle

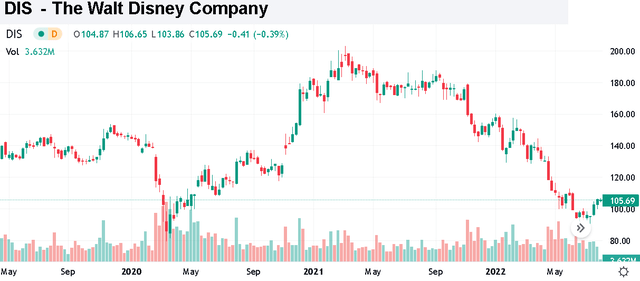

The Walt-Disney Company (NYSE:DIS) has had a rough year dealing with some headline-making controversies in addition to macro headwinds with shares down more than 40% from its 2021 high. Ahead of next week’s fiscal Q3 report, we are reaffirming a bullish call on the stock and expect the next big move to be higher. Reports of strong guest levels across Disney’s theme parks along with continued momentum in streaming services can open the door for an earnings beat. The potential that Disney can brush aside concerns of a slowdown in consumer spending and broader economic weakness may be enough to kickstart a new rally in the stock. In our view, the opportunity here is to pick up a high-quality market leader at a discount that maintains a positive long-term outlook.

Why Did Shares of DIS Fall

The company last reported its Q2 earnings back in May with revenue of $19.2 billion, up 29% year-over-year which also represented a milestone, climbing above its pre-pandemic Q2 2019 benchmark.

On the other hand, EPS of $1.19, while up 37% from the period last year, was still 32% below the result from 3-years ago highlighting the depressed earnings environment. In this case, the issue has been the significant investments toward Disney’s direct-to-consumer streaming services, including Disney+ and ESPN+.

The Media and Entertainment Distribution segment operating income has dropped this year, holding Disney back from even stronger profitability. Compared to significant optimism for subscriber growth goals in 2021, results from peers like Netflix, Inc. (NFLX) which has lost members, have worked to dampen expectations of Disney’s streaming potential.

All this is in the more challenging macro environment. Record inflation, rising interest rates, and global growth concerns have weighed on Disney with fears a hit to consumer spending will come around to pressure on its operating momentum. This will be a key theme to watch in the upcoming quarterly report, while we sense that Disney may still be bucking the trend.

Finally, we mentioned Disney’s controversy this year. A few months back, the company was criticized for its response to the “Parental Rights in Education” legislation in Florida, seen by opponents as violating free speech and equal protection rights for the LGBTQ community. One side of the discussion believed the company did not do enough to block the measure, while supporters of the bill believed Disney overreached by wading into a political topic.

That being said, beyond the internet firestorm with calls for a boycott of Disney products, there hasn’t been any indication the issue materially impacted the company financially. What we can say is that it does explain some of the poor sentiment towards the stock as an additional layer of volatility.

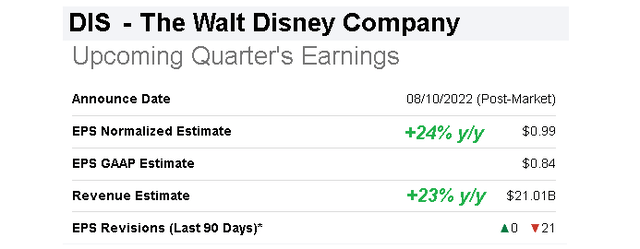

DIS Q3 Earnings Preview

Disney gets a chance next week to set the record straight in what we see as a critical earnings report set for August 10th after the market close. The current consensus is calling for EPS of $0.99, which if confirmed represents a 24% increase over the period last year. The revenue forecast at $21.0 billion, up 23% y/y, would break a quarterly record for the company, driven in large part by the growth in streaming.

We see several reasons to expect a big top and bottom line number with room for Disney to exceed expectations. First, all indications are that the company’s core parks and resorts business has been otherwise immune to any economic slowdown. Specialized Disney-focused publications have been publishing reports all year of the parks being crowded and regularly sold out through the required reservation system. This includes the properties not only in Florida, but also Disneyland in California, and even Disneyland Paris.

The theme here ties into the overall strong demand for leisure and travel as a continuation of pent-up demand following the pandemic. Another dynamic at play is aggressive pricing actions on Disney’s part between not only the daily entry tickets and annual passes but everything from food and beverages to the hotel room rates. Again, the trends suggest consumers are willing to pay up for the Disney experience without the demand missing a beat.

The impact here flows directly into higher margins for the operating segment. This was already confirmed from the company’s last quarterly report but we expect this Q3 to capture the bulk of the summer travel season. For context, Q2 “Parks, Experiences and Products” segment operating income of $1.8 billion at a 26% margin, was up from $1.5 billion and 24% margin in Q2 2019, the year before the pandemic. In other words, the parks business is already more profitable than ever which helps balance the investments toward streaming.

Again, the bigger question mark and where most eyes will be focused on is the results from the media and entertainment distribution group that includes the streaming services. On this point, Disney is still capturing solid growth with Disney+ adding 7.1 million subscribers over the past year in the U.S. and Canada to 44.4 million, or 1.5 million just since Q1. The momentum internationally has also been strong, with 43.2 million subscribers, up 39% y/y.

The attraction of Disney+ compared to the host of alternative streaming platforms is the strength of its legacy catalog and blockbuster properties including “Marvel” and classic animations. Star Wars originals like “The Book of Boba Fett” and “Obi-Wan Kenobi“, which have become the most watched series on Disney+, likely worked to keep subscribers engaged and can support a strong result this quarter.

More impressive has been the momentum in ESPN+, as subscribers grew 62% over the past year to 22.3 million. The company recently announced an increase in the monthly subscription rate from $6.99 to $9.99. The impact here is significant considering the incremental $3.00 per subscriber per month translates into over $800 million in additional annual revenue. While nothing has yet been announced, investors can also look forward to a potential monthly subscription price rate hike to Disney+, which compared to Netflix or even “Amazon Prime” from Amazon.com, Inc (AMZN), appears to be a bargain at the current monthly rate in the U.S. at $7.99.

With this earnings report, updates from management regarding big movie releases this year including “Thor: Love and Thunder” in theaters now, along with “Black Panther: Wakanda Forever” and “Avatar 2” set for later this year highlight the number of moving parts that keep Disney interesting.

DIS Stock Price Forecast

Putting it all together, we sense that the market is underestimating Disney’s growth and underlying trend of firming margins. What we’re seeing is that the pricing actions from management across all segments are a powerful tool that can add to profitability.

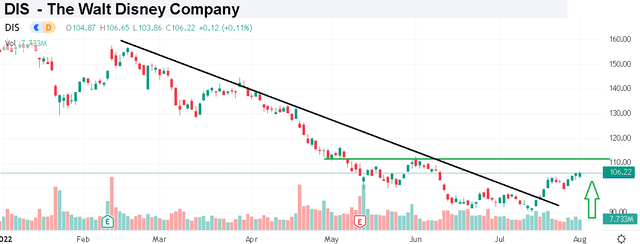

A particularly strong result in the Q3 report from the Parks and Experiences segment could be enough to drive an earnings beat next week, sending shares higher. Favorably, the stock price trading action has turned more positive in recent weeks with DIS up nearly 20% from its recent low. To the upside, a break above ~$112.50 can put the bulls back in control for a further sustained rally.

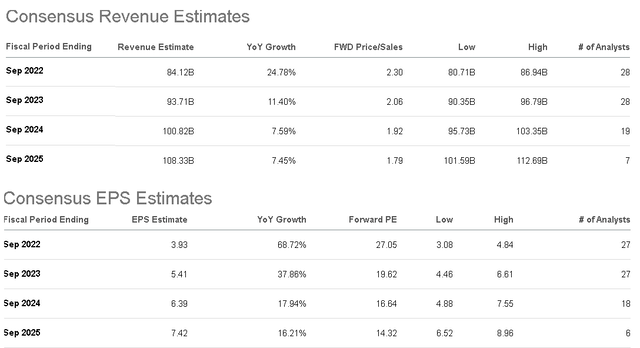

Down the line, the bullish case for Disney is that as earnings outperform expectations, revisions higher to long-term EPS estimates will make shares appear increasingly cheap. According to consensus, from an EPS forecast of $3.93 this fiscal year, earnings are set to climb towards $5.41 in 2023 and $6.39 by 2024.

Part of this momentum considers that next year will benefit from a full period of normalized post-pandemic operations while 2022 got off to a slower start. In our view, DIS trading at a 1-year forward P/E of 20x is compelling to this earnings growth momentum.

Final Thoughts

Our call here is for a strong Q3 report by Disney setting the stage for a sustained rally for the rest of the year. A breakout above $110 can set the stage for a move towards $130 as an upside target over the next few months. Monitoring points will be the segment operating margins and streaming subscriber trends. We’d like to hear from management that demand levels at its parks remain at record levels.

As it relates to risk, consider that broader market conditions remain volatile. A deterioration of global economic conditions from the current baseline into a deeper recession would undermine the earnings outlook. That said, as long as consumer spending levels remain relatively stable and inflation rates begin to trend lower, we’re keeping a more optimistic view. The ongoing pullback in gas prices should be positive for consumer sentiment over the next few months as a positive tailwind for the broader economy.

Be the first to comment