JHVEPhoto/iStock Editorial via Getty Images

Introduction

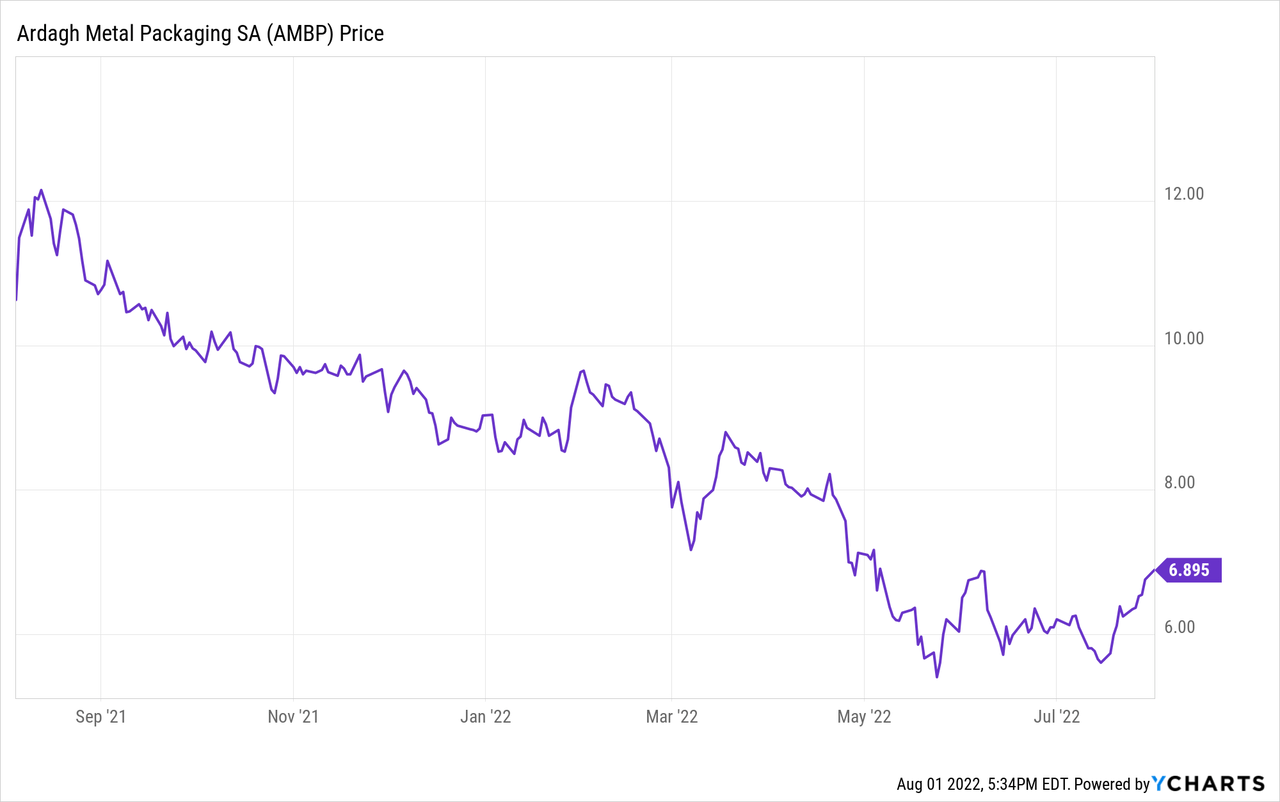

I have liked Ardagh Metal Packaging (NYSE:AMBP) ever since its SPAC deal was announced. The Ardagh Group “sold” the beverage cans business to the SPAC but retained an 85% stake in AMBP. Unfortunately, this has resulted in some self-serving measures as AMBP issued 9% yielding preferred securities to the Ardagh Group. A pity, and it would have been more fair to offer existing shareholders an option to acquire preferred shares in a pro-rata deal with Ardagh Group backstopping the offering.

Unfortunately, that didn’t happen and the 250M EUR preferred share issue was solely taken up by the Ardagh Group when the offering was completed in July. This leads to various corporate governance questions as the largest shareholder seems to be getting a preferential treatment.

The company delivered on its EBITDA promises

Despite this preferential treatment, Ardagh Metal Packaging remains one of the largest positions in my portfolio, but I have not added a single share since the preferred share update and will likely start selling my position sooner than I had originally anticipated (to be clear, I’m not selling now or even below $10, but I may not hold out for the very last dollar to be earned).

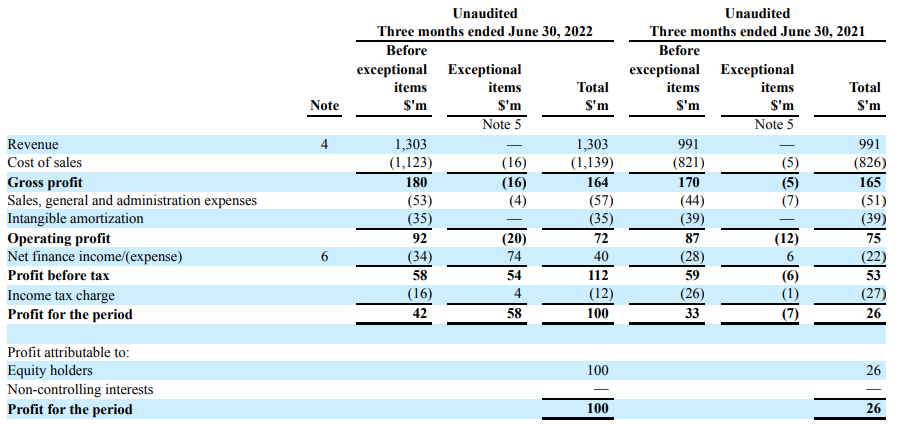

As expected, the reported financial results are still impacted by exceptional items. Looking at the second quarter, the net income before exceptional items was just $42M but there was an impressive contribution to the tune of $58M from exceptional items resulting in a total reported net income of $100M or $0.17/share.

AMBP Investor Relations

This brought the H1 EPS to $0.26/share thanks to the $57M reported net income in the first quarter of the year. Keep in mind that although the reported net income was $157M, almost 60% is coming from those so-called exceptional items.

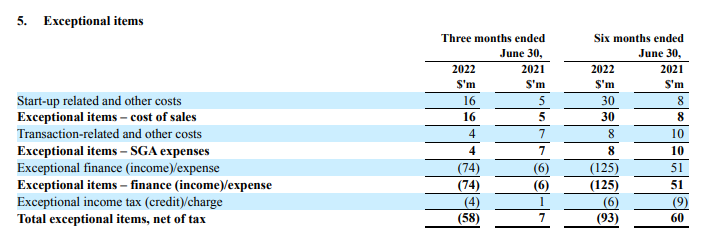

This means it’s important to understand what those exceptional items are. Looking at the breakdown below we actually see positive and negative exceptional items: There were items weighing on the result (start-up and transaction-related expenses) and other items boosting the net income.

AMBP Investor Relations

The $125M in exceptional finance income is related to the gain in the fair value of the earnout shares while there also was a $21M FX loss. So the combination of these two elements boosted the income by $125M. As AMBP’s share price went down, the odds of having to pay the earnout shares are decreasing as those milestone payments are not tied to the EBITDA or profit but to the share price with $13/share as the minimum share price level.

This means that as the share price is moving up again now, AMBP will likely report an exceptional finance loss as the share price gets closer to the $13 level.

One important item we should keep in mind: The company delivered on its $180M adjusted EBITDA guidance as the adjusted EBITDA came in at $181M.

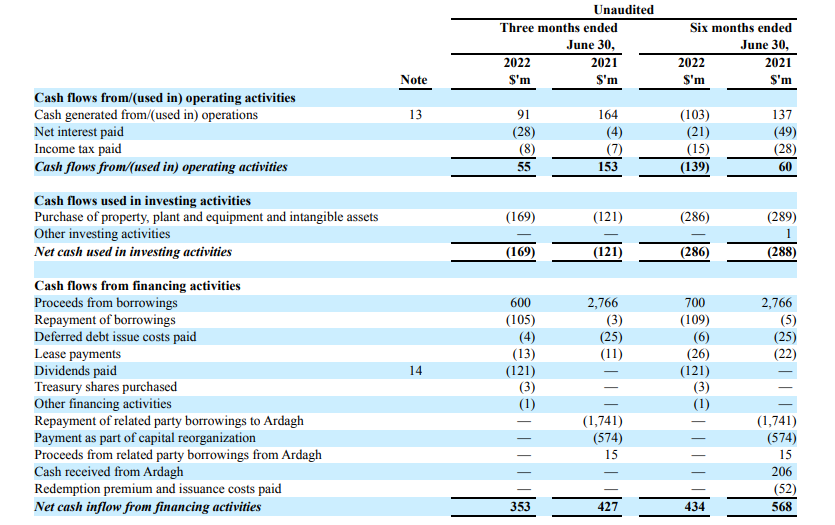

The cash flows remain strong and the tipping point should be reached soon

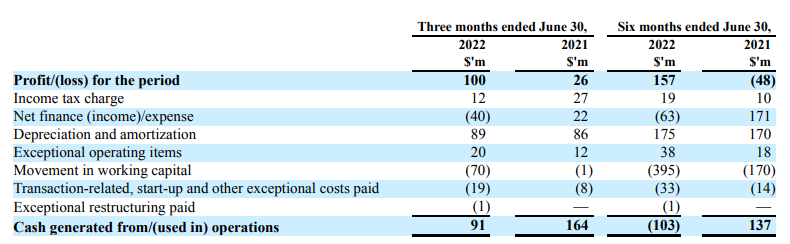

In my previous article I mentioned I was expecting to see a sustaining free cash flow result of approximately $450M for this year so I definitely wanted to check up on that progress. In the second quarter, the operating cash flow came in at $55M which is just about a third of the operating cash flow in Q2 of last year.

AMBP Investor Relations

However, the starting point used by Ardagh Metal Packaging was the $91M “cash generated from operations” which already includes a bunch of non-cash items and the investment in the working capital position. The footnotes to the financial results provide a more detailed overview and we see the $91M starting point included about $90M in non-recurring items. This means the operating cash flow was actually approximately $145M, and after deducting the $13M in lease payments, $132M appears to be a good starting point for the free cash flow calculation. Note: The amount of taxes paid are relatively low while the interest expenses are relatively high and they should compensate for each other making the $132M a realistic starting point.

AMBP Investor Relations

We see the capex was $169M. The vast majority is obviously related to Ardagh’s growth plans as it’s still in full construction mode.

While the company did not literally provide the sustaining capex, during the conference call it became clear the “adjusted EBITDA minus the sustaining capex was $152M.” As we know the adjusted EBITDA was $181M, math tells us the sustaining capex was just $29M in the quarter. This means the sustaining free cash flow in the second quarter was approximately $103M while the sustaining free cash flow in the first half of the year was pretty similar. This means AMBP is perhaps tracking slightly below my anticipation to see a $450M sustaining free cash flow, but not far below as two new production lines will contribute to the H2 results.

That being said, the Q3 EBITDA guidance of $175M seems to indicate we shouldn’t expect too much additional EBITDA to be generated so it’s perhaps a bit doubtful we will see the $450M in sustaining free cash flow this year but it would be my minimum expectation for next year. We can likely point to energy costs for the shortfall here and AMBP’s management indeed mentioned on the call it will be able to hike its prices in Europe in 2023 so that should help to boost the EBITDA and free cash flow.

Investment thesis

The updated guidance now calls for a high single-digit volume growth rather than a mid-teens growth rate, and on the Q2 conference call, the AMBP management was referring to an expected slowdown in the hard seltzer markets which caused AMBP to be a bit more cautious. This also will have consequences for AMBP’s growth pattern and it looks like certain expansion projects may be delayed to bring the supply increase more in line with the anticipated demand increase. That’s interesting because even though this would indicate the 2024 EBITDA targets won’t be met, AMBP would generate and retain more free cash flow in the process, making the balance sheet safer.

I also appreciate the share buyback program but it will be interesting to see if there will be a tender offer of some sorts. Considering the float is less than 100 million shares right now, there aren’t a whole lot of shares that can be repurchased for $200M. At the current share price, the ongoing $200M share buyback would allow AMBP to repurchase about 30% of the float which would make it look like the Ardagh Group may be looking to take AMBP private again.

I’m holding onto my position (which still is a top-3 position in my personal portfolio). Intrinsically, AMBP is very cheap but the main shareholder is calling the shots here and we should not automatically assume minority shareholders will be treated equal (as we saw with the preferred share issue).

Be the first to comment