retouchman/iStock via Getty Images

Things have been particularly difficult in the investment world recently, largely because of concerns over the state of the economy. The obvious downside to this is that shareholders have, for the most part, lost money over the past several months. But the upside is that it has led to the opportunity for investors to buy quality companies on the cheap. One firm that has fallen rather significantly this year and that seems to offer strong upside moving forward is Crown Holdings (NYSE:CCK). As a global player in the packaging market, with an emphasis on selling beverage, food, and aerosol cans and ends, as well as glass bottles, specialty packaging, and more, the company may not seem like the most exciting prospect to be considered at this time. But when looking at the company’s fundamental performance, it does seem to make for an attractive ‘buy’ prospect at this time.

Looking through the pain

Back in January of this year, I wrote a rather bullish article about Crown Holdings. In that article, I talked about the company’s global reach and discussed how attractive its fundamental performance, particularly involving its cash flow generation, has been over the past few years. I also concluded that shares were trading at levels that should be considered appealing enough for investors who are working for a quality operator. At that time, I rated the company a ‘buy’, reflecting my belief that it should generate returns for investors that exceed what the broader market should see. Since then, shares have actually declined, with losses for investors of 25.4%. While incredibly painful, this is only marginally worse than the 23.9% drop seen by the S&P 500 over the same window of time.

Seeing as how any of my ratings are supposed to look at performance potential relative to what the broader market should achieve, I don’t count the decline in price that investors saw in recent months to be terribly significant. Although the firm performed at a level far below what I would expect in a normal market, its losses were not that much greater than the index. What’s really interesting, however, is that this performance came even at a time when most of the company’s fundamental performance remained strong. To see what I mean, we should first touch on how the company ended its 2021 fiscal year. Because, after all, when I last wrote about it, we only had data covering through the third quarter of that year.

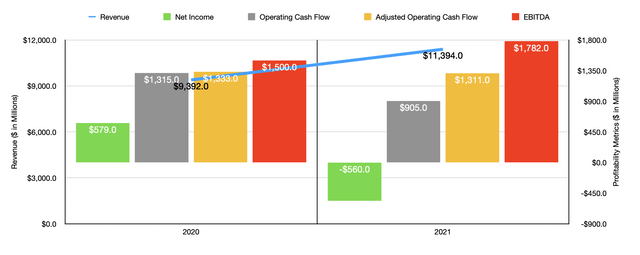

Author – SEC EDGAR Data

For 2021 as a whole, Crown Holdings generated a revenue of $11.39 billion. This translated to a 21.3% increase over the $9.39 billion the company generated the same time one year earlier. Most of this increase seems to have been related to the price increases as management pushed through higher costs to its customers. However, the company did see volume increases, including to the tune of 9% for its beverage can operations. From a profitability perspective, the picture was somewhat more complicated. For instance, during that year, the company generated a net loss of $560 million. That compares to the $579 million profit experienced in 2020. It’s worth mentioning, however, that a significant problem for the company during the 2021 fiscal year was a $1.52 billion hit associated with its other pension and post-retirement expenses. By comparison, that number just one year earlier was $43 million. The disparity disappears to some degree when you look at other profitability metrics. For instance, operating cash flow fell more modestly from $1.32 billion to $905 million. If we adjust for changes in working capital, it would have gone from $1.32 billion to $1.31 billion. And over that same window of time, EBITDA actually increased, climbing from $1.50 billion to $1.78 billion.

While the 2021 fiscal year data is important, what’s more important is how the company has been performing so far this year. During the first half of the year, revenue came in strong at $6.67 billion. That’s 23.1% higher than the $5.42 billion the company generated in the first half of the 2021 fiscal year. This increase came even as the company suffered to the tune of $153 million as a result of foreign currency translation. Detailed specifics were not provided, but we do know that the company benefited from higher unit volumes in most of its markets, the exception being in Brazil, and it also benefited from increased sales prices aimed at offsetting the impact of inflation.

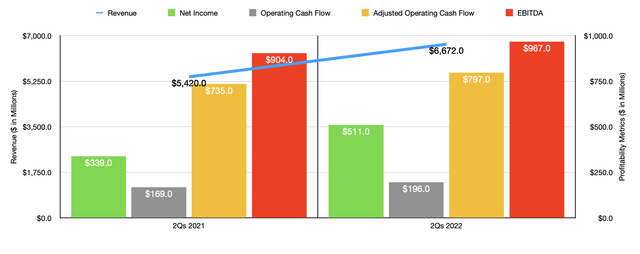

Author – SEC EDGAR Data

On the bottom line, the picture has been even better for the firm. Net income in the first half of the 2022 fiscal year totaled $511 million. That’s 50.7% higher than the $339 million generated the same time last year. Operating cash flow also increased, climbing from $169 million to $196 million. And if we adjust for changes in working capital, it would have risen from $735 million to $797 million. We also saw an increase when it came to EBITDA, with the metric increasing from $904 million to $967 million. Given this strong performance, it should come as no surprise to investors that the firm allocated $600 million toward share repurchases in the first half of the 2022 fiscal year. It’s probable that similar purchases will take place moving forward as well.

Management has not provided a great deal of guidance when it comes to the 2022 fiscal year in its entirety. But they have said that earnings per share should be between $7.65 and $7.85. This should come even though the company is expecting headwinds to the tune of $0.50 per share because of a strong dollar and increased energy costs throughout Europe. At the midpoint, this should translate to net income of $942.4 million. No guidance was given when it came to other profitability metrics. But if we annualize the results seen so far for the year, we should anticipate an adjusted operating cash flow of $1.42 billion and EBITDA of $1.91 billion.

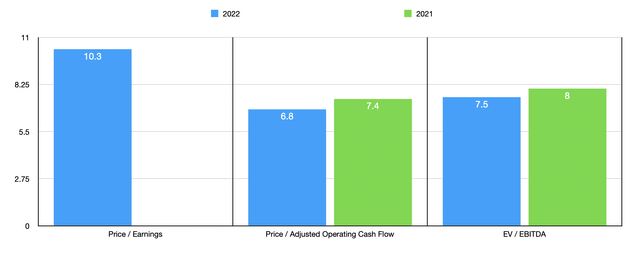

Author – SEC EDGAR Data

Based on these figures, the company is trading at a forward price-to-earnings multiple of 10.3. There was no positive multiple using data from 2021. The forward price to adjusted operating cash flow multiple should be 6.8. That’s down from the 7.4 reading that we get using data from last year. Meanwhile, the EV to EBITDA multiple should come in at 7.5. That stacks up against the 8.0 reading that we get using data from last year. As part of my analysis, I also compared the company to five similar firms. On a forward price-to-earnings basis, these companies ranged from a low of 5.8 to a high of 24.7. And using the EV to EBITDA approach, the range is between 6.8 and 12.3. In both cases, two of the five firms are cheaper than Crown Holdings. Using the price to operating cash flow approach, the range is between 6.3 and 17.5, with only one of the five companies cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Crown Holdings | 10.3 | 6.8 | 7.5 |

| AptarGroup (ATR) | 24.7 | 17.5 | 12.3 |

| Berry Global Group (BERY) | 5.8 | 6.3 | 7.3 |

| Silgan Holdings (SLGN) | 10.6 | 11.3 | 9.8 |

| Ball Corp (BALL) | 14.9 | 13.2 | 13.1 |

| Greif, Inc. (GEF) | 7.4 | 7.0 | 6.8 |

Takeaway

The data that we have today suggests to me that Crown Holdings is doing quite well for itself and I fully suspect that the trend will continue. It’s certainly possible that the company could experience some weakness if the economy does pull back materially. But that would certainly be a temporary issue. On an absolute basis, shares are definitely trading at attractive levels, while the stock looks slightly on the low side compared to similar firms. For all of these reasons, I have decided to keep my ‘buy’ rating on the enterprise right now.

Be the first to comment