jimfeng

The iShares Residential Real Estate Capped ETF (NYSEARCA:REZ) brands itself as a potentially interesting pick for investors looking to avoid office real estate while taking advantage of some of the benefits of real estate markets and the REIT asset class. REITs perform well in our part of the macroeconomic cycle, and while REZ offers a bucket of them, there are some problem areas that make it less than unimpeachable. With real estate markets naturally being priced in due to the amount of households that invest in the market, solidity is key, and we’d look elsewhere from REZ for that. In reality, while residential may sound good, the multiples are looking a tad extended. Better get into specialty assets where the proposition is clearer and yields sometimes higher.

Breakdown of REZ

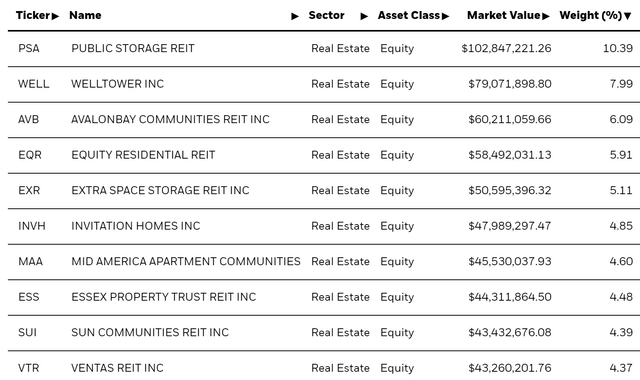

REZ has some skew towards certain holdings.

REZ Breakdown (iShares.com)

The first of which is Public Storage REIT (PSA) which operates facilities in which people can store their stuff. Self storage real estate was already a market with growing interest from institutions but the pandemic further charged the market bringing multiples very high to a 3.3% earnings yield and a smaller 2.47% dividend yield as far as REITs go. It’s definitely a solid exposure, especially because 15% of its market cap is in other public REIT holdings, but market interest in the segment means that there may be too much excitement around the issue while occupying a 10% spot in the whole ETF. However, as far as defensive allocations go there’s nothing wrong with it.

Second on the list is Welltower (WELL) which in our opinion is more troubled. Owning a lot of real estate for older people at staffed locations, they were of course hit very hard by COVID-19. The stock has only now recovered to around pre-COVID levels with apprehension in the market still quite apparent. Management is focusing on the demographic appeal of the company, in that the population pyramid for western countries including the US will funnel residents into staffed facilities. While this is true in principle, we think that while COVID-19 can be ignored for much of the population, Welltower’s markets might just be the exception with a lasting COVID-19 impact. While we think the impact of COVID-19 can be operationally controlled for the business, these specialised residential markets have this sore spot, and the recovered multiple to over 100x is maybe a little premature. Moreover, we cannot know what comes next in the COVID-19 saga, it isn’t irrelevant and won’t become so for some years.

Conclusions

AvalonBay (AVB) is a company that owns a lot of multi-family real estate in post-industrial America. We think that as far as an interest in residential real estate goes, AvalonBay might alone be a better pick than a rather redundant REIT ETF, where REITs are already asset portfolios. Post-industrial US has an edge to it as a real estate market, where real estate prices have really caught up to the rest of the US, and yields off Avalon aren’t bad at 3%. REZ overall has too many non-traditional family real estate exposures. PSA looks like a solid pick whose assets should retain value as private markets also continue to look to allocate dry powder, but some needlessly risky and expensive other allocations could be avoided with some direct REIT picks in AvalonBay and others that are similar.

But we have to point out that the yields on these real estate assets are far below normal levels. Residential should be getting you a pre-tax yield of 5%. A real bargain is at 7% when buying property directly and you’re willing to get your hands dirty. 3% pre-tax shows that the market is extended. While residential real estate is in principle an attractive sub-market, we’re concerned about rates turning that cycle around and doing so quite soon.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment