FrozenShutter

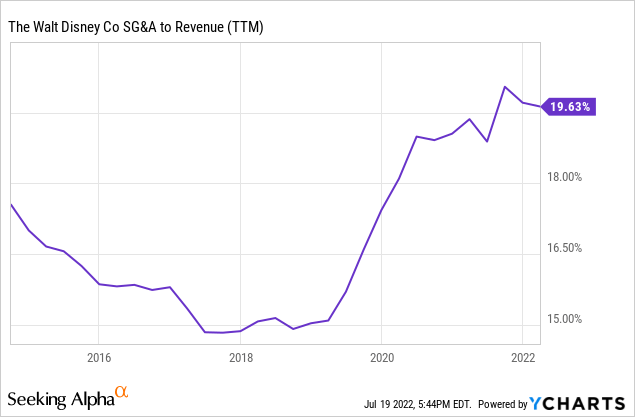

The Walt Disney Company (NYSE:DIS) shares have declined by 50% since their peak in 2021 after the COVID reopening trade. In 2019, Disney bought Twenty-First Century Fox [TFCF], which included Hulu, for $69.5 billion through a mixture of cash and stock. The company also launched Disney+, which, despite its significant subscriber base and growth, continues to be a loss-making unit. Then the COVID pandemic hit. Disney Parks were working through a slow recovery in FY21. Finally, intense competition on streaming platforms between Netflix (NFLX), Prime Video (AMZN), HBO Max, Apple TV, and Paramount has been a battle over subscribers. During this time, Disney’s SG&A to revenue spiraled from mid-teens to about 20%, which crushed its operating margins.

Disney missed Q2 estimates in May as well, which primarily came from the earnings line at $1.08 EPS, which was below the Street consensus of $1.19. The disappointment was that operating costs came in higher than what was expected. If we look back on the Q4 2021 earnings call, though, this “surprise” was not all that shocking. Management mentioned how inflationary pressures were a challenge through wages and new projects. Not to mention things like merchandise, food and beverage, etc.

Fortunately, inflation breakeven readings have relaxed since their top in March/April of 2022. Personally, I believe inflation prints have peaked, so Disney should begin benefitting from decelerating inflation as it continues to raise prices across its operating segments (more on that later).

Reading Between the Lines

However, I think the market has become too focused on expense management. It’s understandable given the mayhem with Netflix and that investors have soured on streaming company valuations in general. However, Netflix is being questioned for future subscriber growth versus losses in 2023. Others are doing okay but not knocking it out of the park. Disney, however, is seemingly in a league of its own and is firmly in growth mode.

In the Q2 conference call, an analyst questioned management’s approach on spending related to content to acquire subscribers and the associated returns:

“First would be, Bob, it seems that the equity markets are now focused on kind of the cost to achieve subscriber growth and maybe not just focused on the sub numbers as much as the cost to achieve. So I wonder with you, given the rising content costs you’re seeing in things like sports and competition around the globe, how do you measure maybe the need to drive shareholder returns versus attaining those sub targets that were laid out in 2020?”

Management gave a logical response in that they are seeking to drive growth first in order to achieve profitability later:

So as you know, we’re very carefully watching our content growth — content cost growth. And we reaffirmed, as you heard earlier, our targets, our guidance on both subs and on profitability. So we think they move together. It’s obviously a balancing act, but we believe that great content is going to drive our subs, and those subs then in scale will drive our profitability. So we don’t see them as necessarily counter. We see them as sort of consistent with the overall approach that we’ve laid out.”

So far it seems to be working. Disney’s market share of Disney+ combined with its 67% ownership in Hulu currently places Disney as #2 in the streaming service industry. In the meantime, investors have to deal with Disney’s approach of generating operating losses today, which actually masks the true earnings potential of the company.

In Q2 2022 earnings, Disney reported subscriber growth for ESPN+, Disney, and Hulu of 62%, 33%, and 10%, respectively. Total subscribers across all three categories totaled 205.6 million. Netflix has 221 million subscribers. Netflix also stated that they will be cutting spending dollars on films and TV shows due to help curb losses. That’s a natural response, but it certainly helps Disney from a market share perspective. So it probably won’t be long before Disney surpasses Netflix for the #1 position.

The proof is also in the content itself. Not only does Disney have a great library going back decades, but they are also putting the pedal to the metal on programming, production, technology, distribution, and marketing costs. For context, Q2 operating expenses were up from $3.2 billion last year to $4.4 billion this year, which is substantial on a run rate basis.

I think it’s pretty clear that if you have a family with kids, it’s a given that Disney+ is a staple in the household. However, management also disclosed that about 50% of their subscribers are families without kids. So that really speaks to the high interest in their content versus other platforms. A few key examples are the Star Wars and Marvel franchises, among others. These two series, for instance, naturally compel viewers to watch related films and shows while waiting for highly anticipated releases. This behavior promotes word of mouth and effectively subscriber retention. Disney can then come in with price increases roughly equivalent to peers, which it is currently doing.

Disney parks operating performance is also finally normalizing. Total revenues expanded from $3.2 billion to $6.7 billion year-over-year in Q2, and operating losses swung to a $1.8 billion operating profit. However, international was still a drag of negative $268 million as attendance is still low at 46%. To add color on pricing, the average guest per room is spending about $434 domestically versus $353 pre-pandemic, or a 23% increase. So once attendance returns to full capacity again, the company will have added considerably more revenue and derive some operating leverage there.

Earnings Potential

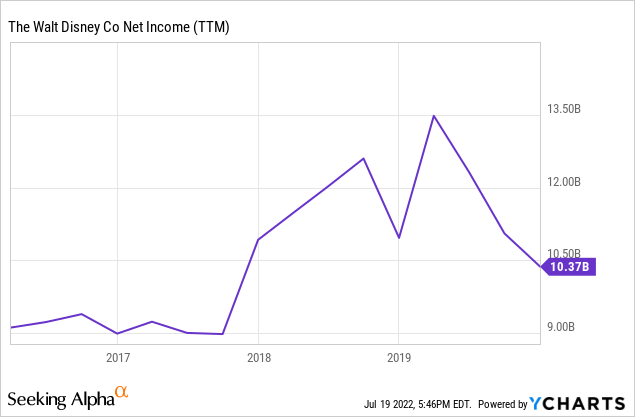

Prior to the pandemic, Disney earned between $11 billion and $13 billion excluding its acquisition of TFCF.

Historically, TFCF earned an average of $4 billion per year. So a baseline, consolidated Disney will likely earn somewhere ~$15 billion. Some costs have increased for Disney’s parks and streaming content, but on balance, my expectation is that management would either sustain profit margins or achieve slight accretion through synergies and price increases over time. Also, remember that Disney has unique IP and should be able to remove legacy costs from its acquired Fox/Hulu assets.

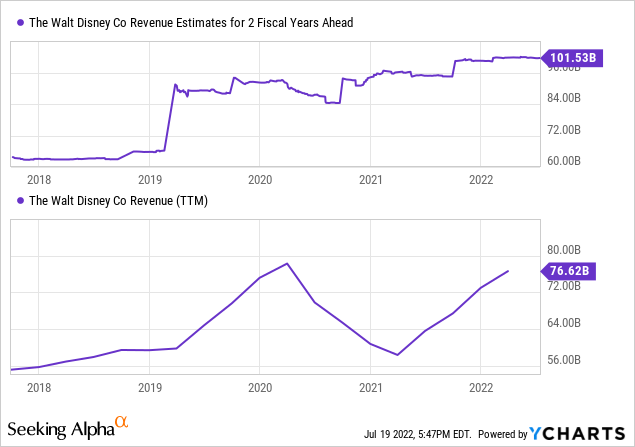

Currently, analysts are estimating that Disney will exceed $100 billion of revenue in the next two fiscal years, which is substantial growth versus the current $76.6 billion.

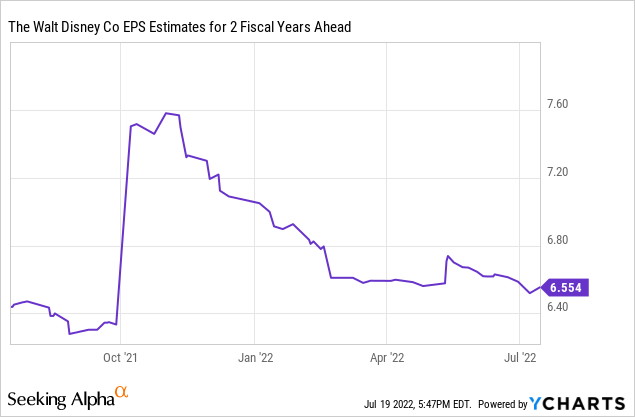

Turning to earnings, the Street is targeting EPS of about $6.50 in FY24. It seems that cost increases are largely baked in and price increases being rolled out across its operating segments should only improve margins from here. My hunch is that EPS estimates should not revise much lower, if at all. That equates to $12 billion in earnings, which is still below my estimate of $15 billion. That’s not to say that $15 billion is a ceiling by any means, but it’s certainly a target that’s achievable in the coming years, which would land at $8 EPS.

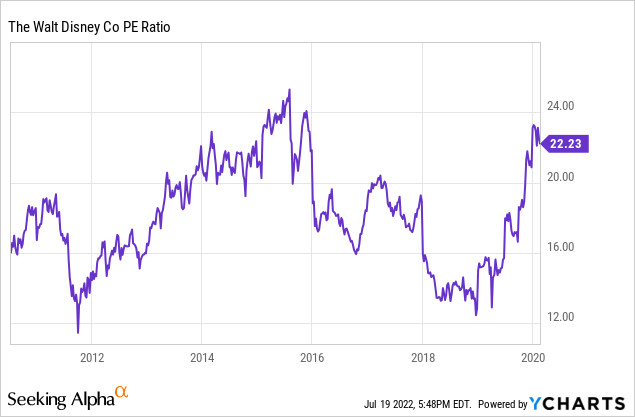

Prior to the pandemic, Disney traded between a P/E ratio of 12x and 24x, or an average of 18x. Given Disney’s growth runway and normalization of operating margins, I would give it a fair value estimate of $118/share assuming $6.55 in EPS. As EPS approaches $8, my fair value estimate would adjust closer to $140-150/share, which implies about 50% upside from current levels.

Key Risks

There are a variety of risks, which include but are not limited to the following:

- A recession could impact park attendance and/or future pricing power.

- Streaming companies could accelerate content spending, which could impair streaming platform growth and/or negatively impact content ROIC.

- Revenue growth could underperform expectations and/or margins may not revert as well as anticipated.

- The cruise line industry remains weak and Disney is expanding its cruise business with three additional ships to a total of seven. Although not significant, underperformance here could drag on operating results.

Bottom Line

Disney is not without risks, particularly with a recession looming and other streaming services spending billions to attract and retain subscribers. Broader economic risks, increased streaming competition, and/or misexecution by management could introduce additional downside. However, I think the company currently sells at a discount that more than reflects such risks. I believe shares will eventually return to their fair value of $140-$150/share over the long term. How do you think DIS will perform? Let me know in the comments section below. As always, thank you for reading.

Be the first to comment