cyano66

One of the hardest hit companies throughout 2022 has been standalone streaming giant Netflix (NASDAQ:NFLX). With concerns over significant competition from more traditional entertainment companies that have launched their own streaming platforms and weakness in subscriber numbers, shares of the business have plummeted. From the start of the year through the close of business on July 19th, the stock has plummeted by 66.5%. Fortunately for investors, something of a reprieve has been granted. After the market closed on July 19th, shares of the business soared by 7.9% after having previously risen 5.6% on July 19th itself. This comes as management beat their own rather dire expectations for the second quarter of the company’s 2022 fiscal year. On top of that, the company revealed expectations for the third quarter of the year that, while far from great, weren’t horrible either. What this latest quarter does show is that management has very little ability to forecast what the near-term looks like for subscriber numbers. So that does add to the uncertainty for investors. But even if the company can stabilize to match the kind of performance that it achieved last year, it may not be a horrible prospect to consider.

It’s all about the numbers

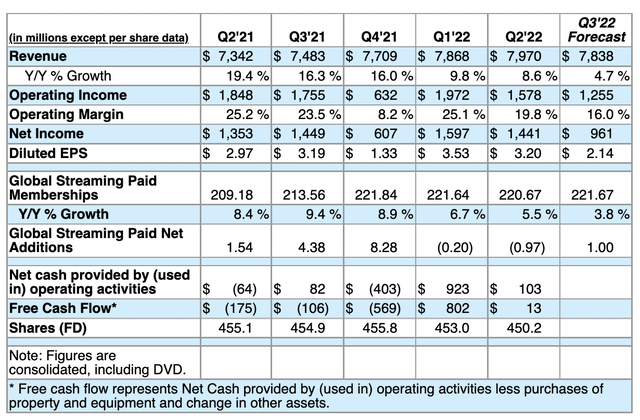

Investors in Netflix were shocked earlier this year when management announced that, for the first quarter of the year, the company had experienced a decline in total global streaming paid memberships in the amount of 0.20 million for that period. Such a revelation was very uncharacteristic of the company that had long been considered a growth juggernaut. Of course, had it not been for its decision to cease operations in Russia as a result of the conflict between Russia and Ukraine, the total number of subscribers during that time frame would have actually risen by roughly 0.50 million. Although this is still bad in the historical context of things, it paled in comparison to management expectations for the second quarter of this year.

At the time, they said that they would likely lose a further 2 million global streaming paid members. This is blamed on multiple factors, including front loading of customers during the pandemic years and also because of a limitation caused by the adoption rate of connected televisions. I posited, in a prior article, that the company’s high price compared to other streaming services also probably played a role. The rise of so many other streaming platforms from large companies with tremendous content libraries and significantly more resources than Netflix that could be used for the creation of exclusive content would also prove problematic for the company.

Netflix

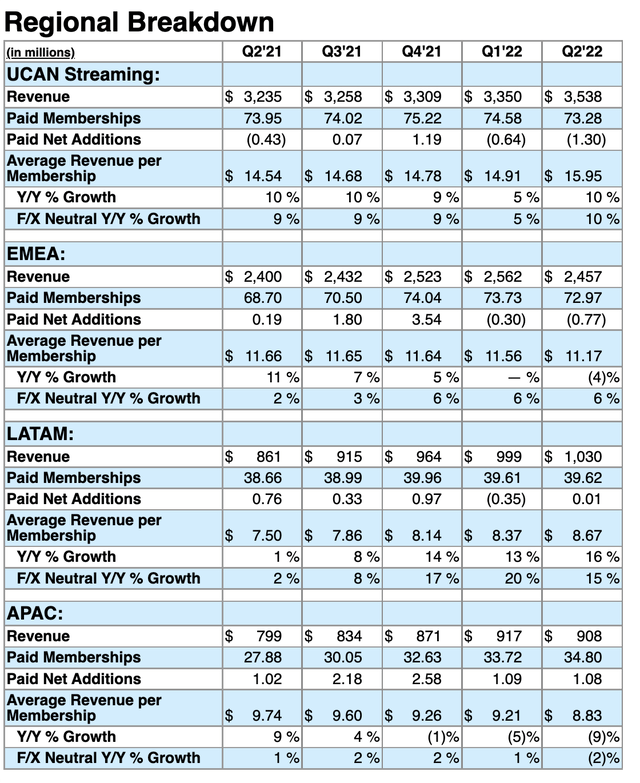

Fortunately for investors, the picture for the company did look better than what management anticipated. Instead of losing 2 million global streaming paid members, the company lost less than half that at 0.97 million. Though it is worth noting that not every paid member is equal for the business. In the UCAN market, which consists of the US and Canada, the company lost 1.30 million subscribers. On average, these members brought in $15.95 per month each in the latest quarter. The company also lost 0.77 million paid members under its EMEA (Europe, Middle East, and Africa) unit, an area responsible for roughly $11.17 per month in revenue per paid member. In the LATAM (Latin America) unit, where the company generates just $8.67 in revenue per paid member, it added just 0.01 million subscribers during the quarter. And in the APAC (Asia Pacific) region, where it added 1.08 million paid by members, it generated average revenue of just $8.83 per month. So in addition to seeing the number of paid members decline, the company also saw the pain take place in its most profitable markets and saw the good news come in its least profitable markets.

Netflix

If there is one good thing besides not being hit as hard on the subscriber numbers as previously anticipated, it’s that the company is currently forecasting a return to growth on that front in the third quarter. At present, the company expects to add 1 million global streaming paid members to its platform, taking the size of its platform up to an all-time high of 221.67 million. With that, combined with increased pricing in recent months, revenue should come in at $7.84 billion. Although this 4.7% increase year over year compared to the $7.48 billion reported one year earlier is still below the $7.97 billion experienced in the second quarter, much of that has to do with foreign currency fluctuations. Instead of growing by 4.7%, management said that revenue would increase by 12% compared to the same time last year if we were ignoring foreign currency fluctuations.

This performance by the company should result in earnings per share of $2.14. That is down from the $3.19 reported the same time one year earlier. In particular, the company should see its operating margin decrease from 23.5% in last year’s third quarter to 16% this year. That should ultimately bring net income down from $1.45 billion to $961 million. No forecast was given for operating cash flow. But with $82 million in cash flow generated in the third quarter of last year, it is possible the company could be in the negative on that front the same time this year.

At the end of the day, a great question to ask is what kind of upside potential, if any, a company like Netflix has. Although the firm is still the largest single streaming platform in the world, I do not believe that it can outperform some other players. In particular, I see The Walt Disney Company (DIS) eventually replacing it as the largest streamer on the planet. And on top of that, I believe that developments related to this current fiscal quarter could prove bullish for the industry as a whole. Given the number of paid subscribers lost by Netflix and the forecast of further strength next quarter, I am further comforted by the decision of Disney to, reportedly, increase pricing on ESPN+ from $6.99 per month to $9.99 per month starting in August. In the case of both firms, the pricing increase on Disney’s side and the expected return to growth for Netflix suggest to me that the market is not yet overly saturated to the point that some investors might have feared.

| Company | EV / EBITDA |

| Netflix | 14.6 |

| Warner Bros. Discovery (WBD) | 4.3 |

| Paramount Global (PARA) | 7.6 |

| The Walt Disney Company | 15.1 |

In general, I do think that some of the competitors in this space will outperform Netflix moving forward. The probability of this seems greater when you consider that Disney is planning to spend $32 billion on content this year, with much of it dedicated to streaming. That compares to the $18 billion in planned spending that has been hinted at by Netflix. Even with that said, there could still be some opportunity for investors in the standalone streaming service. After all, if the company can stabilize its performance to match what it achieved in over the past 12 months, it should generate EBITDA moving forward of $6.69 billion. At present, shares of the company imply an enterprise value of roughly $98 billion. That would translate to an EV to EBITDA multiple of 14.6. This is slightly lower than the forward EV to EBITDA multiple for Disney of 15.1, but it is quite a bit higher than the 4.3 estimated for Warner Bros. Discovery and the 7.6 estimated for Paramount Global.

Takeaway

Usually, when I see an industry leader plunge as much as Netflix has in recent months, my first inclination is to consider buying the stock. In truth, if the company can stabilize its operation, it might provide some upside potential. But on the whole, the picture just does not look fantastic. Yes, the company did outperform prior expectations. But when looking at the bigger picture, I cannot help but to think that there are better places for investors to put their money. Although more expensive, at least Disney brings with it a vast portfolio of other valuable properties. And it looks as though other streaming companies are trading cheaper than Netflix is. While I wouldn’t go so far as to categorize Netflix as a ‘sell’, I do think that, at best, it is a ‘hold’ for now.

Be the first to comment