jetcityimage

Exxon Mobil Corporation (NYSE:XOM) is in the greatest position in years, because to favorable market trends. The company’s shares rose in 2022 amid a crude oil price that exceeded $120 per barrel in March.

The Russian invasion of Ukraine, as well as concerns about supply constraints, aided crude oil price hikes.

Having said that, West Texas Intermediate crude oil prices have significantly pulled back recently, most notably falling below $100 per barrel, as more economic indications point to a recession.

Exxon Mobil will be unable to sustain a significant price adjustment in the crude oil market, in my view, providing an opportunity to benefit.

Core Investment Assumption: Crude Oil Prices Have Peaked

Crude oil prices are expected to peak in 2022. Oil prices momentarily surpassed $120 per barrel in March following Russia’s invasion of Ukraine in February.

Prices have recently fallen after briefly reaching a 10-year high as investors assess the likelihood of a worldwide economic recession. Crude oil prices have not historically lasted at 10-year highs for very long, and rapid, steep spikes in market prices, which led to record-level profits at corporations such as Exxon Mobil, were frequently followed by periods of substantially lower prices. I have no reason to believe that things will be different this time.

Crude Oil Prices (Tradingeconomics.com)

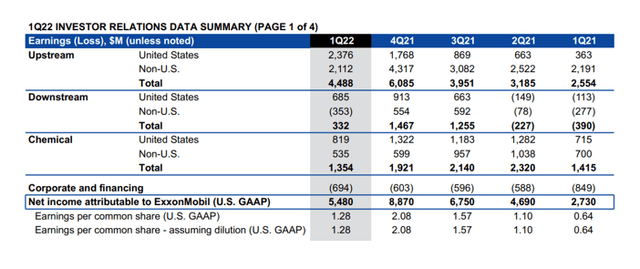

The increase in crude oil prices drove Exxon Mobil’s earnings higher by 100% YoY to $5.5 billion in 1Q-22. Companies do not experience such large price changes in well-balanced marketplaces.

Exxon Mobil’s profits increased by 76% YoY in the upstream division, mainly to dramatically higher crude oil prices in the first quarter. Exxon Mobil’s fourth-quarter profit of $6.1 billion kicked off a (brief) trend of above-average quarterly profitability for the corporation when crude oil prices began to rise in 4Q-21.

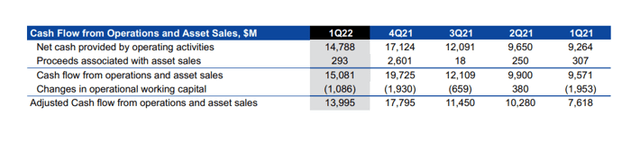

Exxon Mobil saw large cash flow tailwinds as a result of record crude oil prices and higher margins. The company’s adjusted cash flow increased significantly in the last two quarters. Exxon Mobil’s cash flow in 4Q-21 increased by 82% above the preceding three-quarter average.

Given that crude oil prices maintained above $100 per barrel for the whole of the second quarter, Exxon Mobil’s earnings for 2Q-22 will be impressive. However, they are expected to fall in the future.

Cash Flow From Operations (Exxon Mobil)

Recession Signals Vs. Contra Indicators

Last week’s inflation report showed 9.1% inflation, marking another consecutive four-decade high, fueling fears that the central bank could steepen the interest rate path. With inflation looking out of control and the central bank forced to act more aggressively, the likelihood of a recession has increased significantly this year.

The reduction in the pricing of basic materials such as copper, aluminum, and other components that are essential to a wide range of industrial and consumer products is another major indicator that speaks to increased recession risks for the global economy.

Last week, copper prices fell to a 20-month low, falling below $7K per ton for the first time since 2020. Because copper is utilized in industrial machinery and construction, it is frequently used as a proxy to assess the health of the world economy.

Aluminum, a vital raw element in the building industry, is among the other industrial metals whose prices are falling. Commodity price declines reflect reduced supply and weaker demand, both of which point to a drop in economic activity in 2022.

The labor market is one crucial sign that does not support a recession. Recent employment figures for the United States show that 372K new jobs were created in June, implying that recession fears may be overstated, at least in terms of employment.

How I Am Playing The Expected Downfall Of Crude Oil Prices And Lower Earnings/Cash Flow For Exxon Mobil

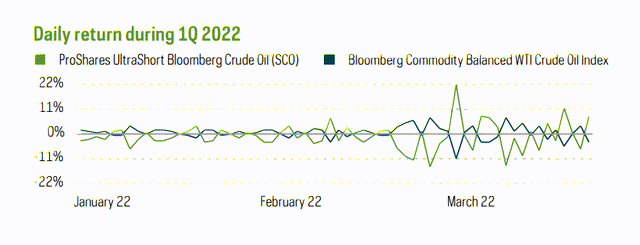

I’ve decided to take a 50/50 strategy on the projected drop in crude oil prices. This approach entails purchasing put options on Exxon Mobil as well as the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), which aims to produce a daily price move of -2x the daily crude oil market move. The return of the inverse crude oil ETF is -2x that of its underlying benchmark, the Bloomberg Commodity Balanced WTI Crude Oil Index. SCC is therefore a leveraged ETF that magnifies price movements in the underlying index.

Daily Return During Q1-22 (Proshares.com)

For further information on the ProShares UltraShort Bloomberg Crude Oil ETF, click here.

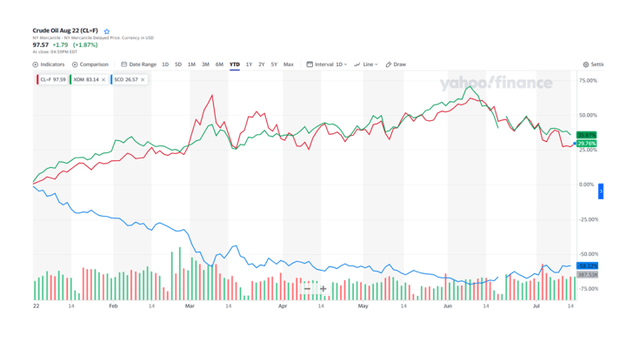

Exxon Mobil has closely tracked the general market trend since crude oil prices rose in 2022, whereas the ProShares UltraShort Bloomberg Crude Oil ETF has plunged by nearly 60%.

Crude Oil Tracking VS XOM And SCO (Yahoo Finance)

Understanding The Risks

In the case of Exxon Mobil, I purchased put options with a strike price of $70 and one year until expiry. The current price of Exxon Mobil is $84.54, meaning the puts have no intrinsic value.

Because I am just investing a small portion of my available cash (each position represents 1% of my investable assets), the risks are not very significant. In the worst-case scenario, there will be no intrinsic value to the puts. However, because the ETF is leveraged, there are more risks with SCO. The leveraged form of the ETF (-2x) introduces additional risk, but because this investment will be small for me (each holding represents 1% of my investable assets), the risks are not excessive.

I expect crude oil prices to fall to $55-$60 per barrel by the end of the year. A dramatic rise in crude oil prices would be the death nail for my speculative thesis on Exxon Mobil and the ProShares UltraShort Bloomberg Crude Oil ETF.

My Conclusion

Exxon Mobil’s run is gone, and it’s either time to sell or switch to the other side. Crude oil prices never truly stayed at 10-year highs for long and have already begun to fall. Together with broadly declining commodity prices, crude oil prices are likely to decline further, especially if more signs begin to show recession warnings.

Even though Exxon Mobil is expected to report strong results for 2Q-22, a decline in the crude oil market is expected to weigh Exxon Mobil down.

I believe that my investing strategy, which focuses on Exxon Mobil put options as well as investing in the inverse, leveraged oil ETF, is a risk-controlled way to profit on the predicted decrease in crude oil prices.

Be the first to comment