NicoElNino

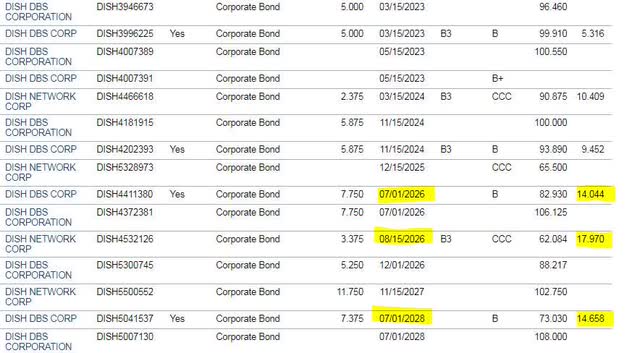

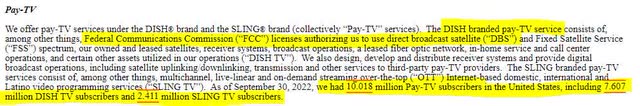

DISH Network Corporation (NASDAQ:DISH) is a communications company that specializes in television and wireless cell phone service. The company’s pay tv services are comprised of satellite television and a streaming TV service through Sling TV. The wireless division includes prepaid cellular phones services under various brands such as Boost Mobile. The company’s debt maturing in 2026 and outwards is yielding above 14% to maturity. Despite the attractive yield and various business channels, an investment in Dish Network debt is simply too risky for me.

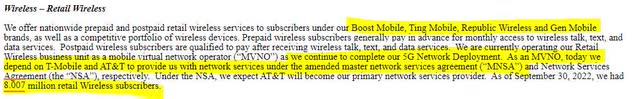

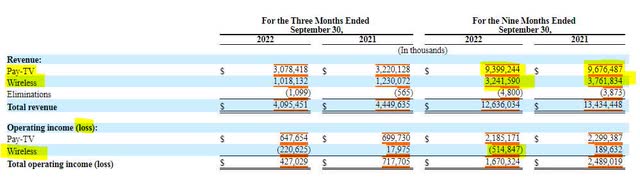

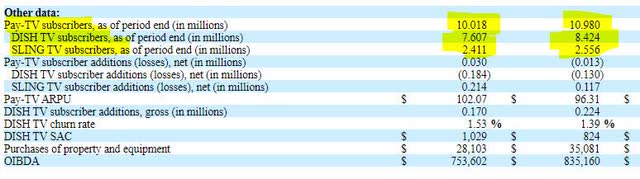

Dish’s financial performance has deteriorated notably this year. In the nine months ending September 30th, the company reported an $800 million decline in revenue compared to the same period last year. At the same time, expenses increased slightly. This led to a dollar-for-dollar drop in operating income. A deeper dive into the revenue data shows that the declines occurred in both of the company’s business lines where there were subscriber declines.

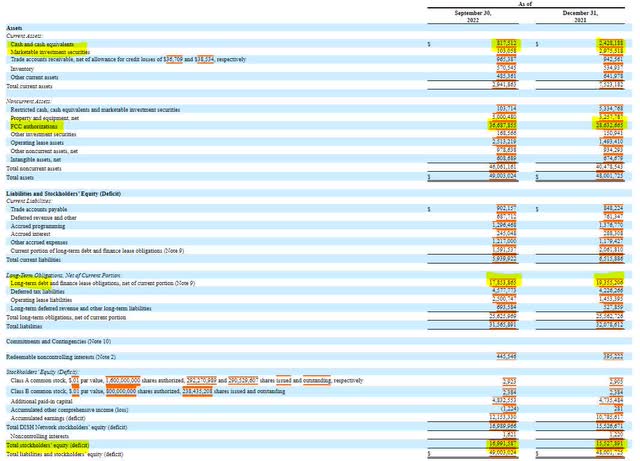

Dish’s balance sheet shows large capital investments in 2022. The company invested most of its cash into FCC authorizations. Dish was also able to reduce its long-term debt by approximately $1.5 billion. The company’s FCC authorizations and property/equipment accounts for over 80% of their total assets. Despite the eroding profits and massive asset investment, Dish has been able to grow shareholder equity by nearly $1.5 billion in the past nine months.

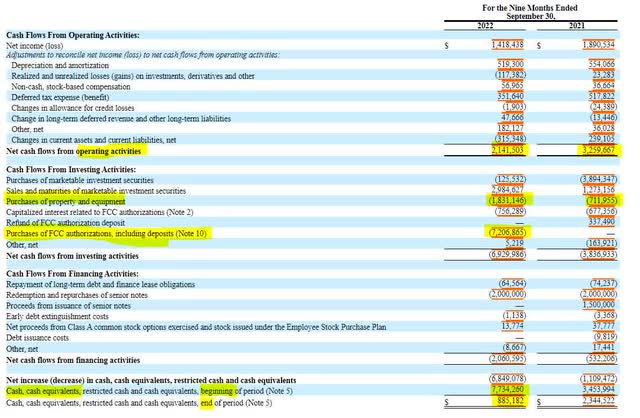

Dish’s statement of cash flow dives deeper into the asset investments and debt reduction in 2022. The erosion of the business’s operation caused a $1.1 billion decline in operating cash flows, nearly 1/3 rd of the operating cash flow from the same period a year ago. The company increased its capital expenditures, leading to only $300 million in free cash flow so far this year versus $2.5 billion a year ago. The bulk of Dish’s cash went towards the $7.2 billion purchase of FCC authorizations and a $2 billion debt redemption. Dish’s cash position going into the fourth quarter leaves it little margin for error.

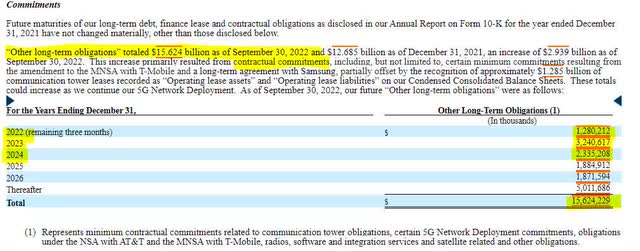

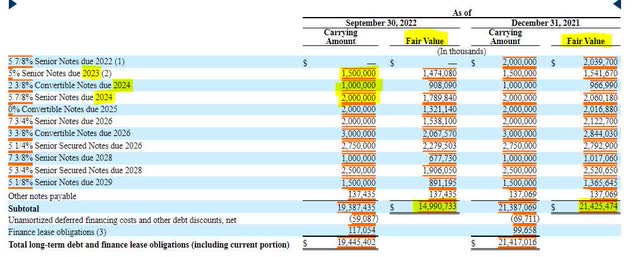

Aside from the decline in operating performance, Dish has made $15.6 billion in long term commitments, with approximately $7 billion needing to be funded by the end of 2024. These obligations are not listed as a part of the company’s balance sheet. These commitments are in addition to the need to refinance or fund $4.5 billion in debt due within the same timeframe. Needing $11.5 billion to fund these obligations with little cash and declining operating metrics is challenging, to put it modestly.

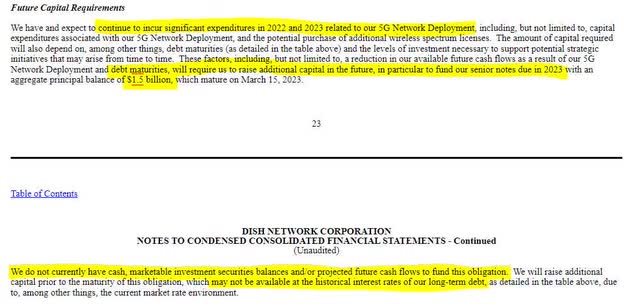

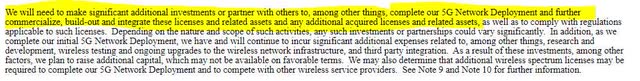

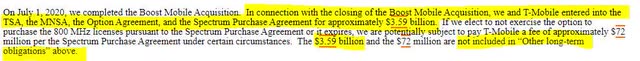

Dish is not naïve to the reality of its situation. Within the notes of its most recent SEC filing, the company acknowledged it does not have the cash on hand to meet its near-term debt and capital expenditure obligations. On top of everything else, the company needs to finish its investment in its 5G Wireless network. Later in the filing, the company hints at also owing $3.59 billion as a part of closing its Boost Mobile acquisition. At a minimum, I’m expecting Dish to attempt a major debt exchange on its near-term notes next year, and that exchange could require debt investors to take a haircut.

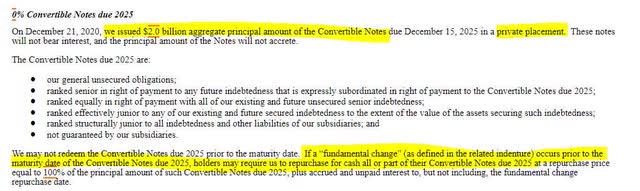

One possible solution for Dish is to be acquired by a larger entity. The company acknowledges that the pay TV industry is mature and highly competitive with larger companies able to scale and acquire customers. While an acquisition may help debt holders, there is a major hurdle that investors should be cognizant of. At least $3 billion of the company’s convertible debt can be triggered by its holders as redeemable for cash if a fundamental change were to occur. These provisions to trigger bond redemptions will likely deter an acquisition, especially in a higher rate environment where M&A has significantly deteriorated.

While Dish’s investments in its assets are needed to stabilize its business, the erosion in customers across all lines of its business, combined with the massive long-term obligations and near-term debt wall make this company too risky of an investment.

Be the first to comment