sturti

Inflation is not always the main problem, or indeed a problem at all. Sometimes, though rarely, deflation is a more serious threat, and we need to shelve many of the orthodoxies we have held so dear. – Gavyn Davies

The Invesco KBW Premium Yield Equity REIT ETF (NASDAQ:KBWY) is an investment vehicle that offers exposure to 28 domestic equity real estate investment trusts (“REITs”). There are both good and bad facets to a potential investment in KBWY, and I will attempt to cover that in this article

Factors to consider

The small-cap factor

Quite unlike most of the other alternatives in this space, KBWY tracks a modified dividend yield weighted index. With this mode of weighting, you’re likely to see a portfolio that tilts toward small-cap and mid-cap names with limited exposure toward large-caps; you’re also likely to gain access to a few micro-cap names which would certainly enhance the risk profile of this fund. Nonetheless, just for some context, note that ~82% of the portfolio consists of small-cap stocks, with the market cap of certain stocks dipping even lower than $300m.

If you’re a subscriber to The Lead-Lag Report, you’d note that my utilities signal (last week, utilities had outperformed the S&P500 by over 5%) recently switched to risk-off mode, which means two of my inter-market signals are now signaling risk-off conditions. When you’re faced with a scenario such as this, I’m not sure it makes a great deal of sense to increase allocation towards small-cap-based products

Inflation narrative on the cusp of losing its grip?

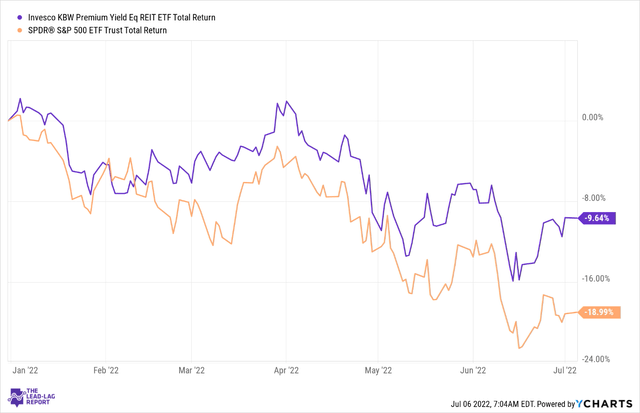

If you consider KBWY’s performance this year, one must admit that it hasn’t been too shabby. Yes, it’s down in low single-digit terms, but it has still managed to outperform the broader markets by 2x.

I’d like to think that much of the outperformance is on account of the innate, yet underappreciated, strength of REITs during high-inflationary periods. Most REITs have rent clauses that account for inflationary spikes, and REIT dividends, too, tend to be rather effective in negating the effects of inflation; just for some context, over the last 20 years, 90% of the time, REIT dividends have grown at a much superior rate to the Consumer price index.

So far, so good, but I’d be interested to see how REITs fare when the inflation narrative begins to dim, even as we see growing recession risks. If you’ve been following my commentary over the last six to twelve months, you’d note that the inflation-to-deflation switch is something I’ve been postulating for quite some time now.

Yes, inflation may still be above 8%, but the keenly watched PCE (which the Fed tends to obsess over) has been sliding for four straight months and has hit levels of 4.7%, from peak levels of 5.7%. Meanwhile, oil supplies have been inching up, even as gas pump prices have been cooling. Commodity prices, too, look to have reversed course. Basically, all of this is coalescing into a more palatable inflation landscape than we’ve seen in recent months.

If the market starts getting comfortable with the idea of inflation hitting a ceiling, you’re likely to see a rotation out of this landscape into some of the other defensive options, as the bigger risk of deflation still looms.

When deflationary risks creep up, I can’t imagine real estate serving as a magnet for fund flows, and KBWY, with its greater focus on high-risk small-caps, could remain particularly susceptible to fund outflows.

Sector exposure

What could perhaps help mitigate negative sentiment towards KBWY is perhaps its focus towards commercial REITs over mortgage REITs. The housing market had enjoyed a solid post-pandemic blitz but there’s no doubt that the wind has gone out of its sales over the last few months.

Within commercial REITs, KBWY has a keen focus on the retail sector. In fact, the top holding is The Necessity Retail REIT (RTL). During the pandemic, this sector was decimated by the shift to e-commerce, and many people were suggesting that we could see a permanent shift away from brick-and-mortar. It hasn’t quite panned out that way. If anything, recent reports from Forrester and ICSC show that an overwhelming majority of retail transactions will take place in physical stores, whilst a large chunk of online orders will be fulfilled at physical locations. The pandemic is also less of a deterrent these days, and all these things point to likely higher occupancies, which means lease terms will also likely be renewed at much superior terms than what we’ve seen in recent years.

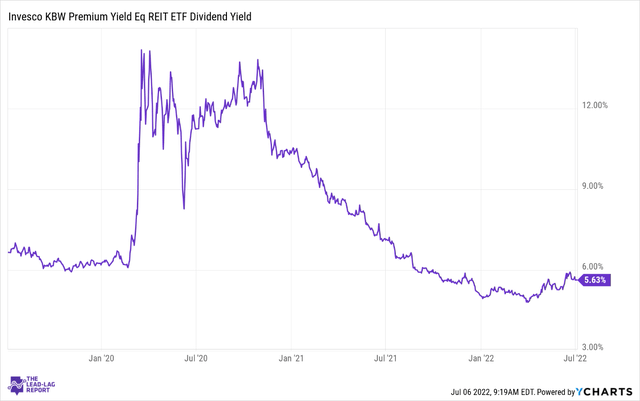

Current yield is not the most compelling

Looked at in isolation, KBWY’s current yield of 5.63% appears to be very attractive, but when you consider the ETF’s own history, this is quite a sub-par number. Just for some context, over the last 5 years, KBWY’s average yield has been much superior at 7.76%, whilst it had even crossed levels of 14% at one point.

Conclusion

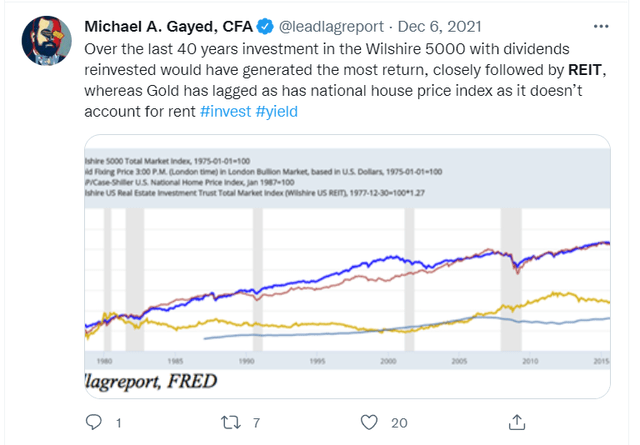

As noted in The Lead-Lag Report, over a long period of time, REITs have proven to be an exemplary source of wealth generation. They have delivered returns almost on par with the Wilshire 5000, even as other asset classes have been more subdued.

KBWY’s focus on small-cap names, should – on paper at least – provide a much superior growth runway (relative to large-caps) to help facilitate even better returns. However, as noted in this article, this is probably not the most opportune time to be considering an entry in this product. I would be inclined to be neutral at this point.

Be the first to comment