Byrdyak

Nouriel Roubini (known by the press as “Dr. Doom”) recently authored an essay calling for a stagflationary debt crisis and a 50% bear market in stocks. Dr. Michael Burry (the star of The Big Short) has also recently called for the S&P 500 (NYSEARCA:SPY) to fall 50% or more. Of course, predictions of Armageddon from people who made a correct call in the past will always get a lot of media attention. But are these bearish predictions plausible?

Could Stocks Plunge 50%?

Roubini’s main argument is essentially that government debt levels and entitlement spending are far too high in the West, leaving policymakers a Catch-22 between causing massive inflation or allowing a market crash to play out without being able to step in and stop it. The prediction is among the most bearish forecasts on Wall Street. Roubini himself is a larger-than-life figure, periodically attracting the attention of New York tabloids for wild parties at his Manhattan condo.

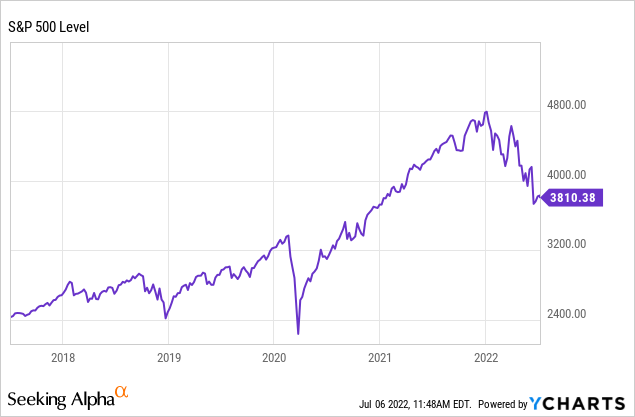

Burry is more low-key but just as bearish. He has similarly argued that we’re in the “greatest speculative bubble of all time in all things,” and has called for stocks to fall over 50%. These calls are a little extreme, but if you look at a 5-year graph of stocks, they don’t seem completely out of the ballpark.

A 50% fall in the S&P 500 from the peak would imply a price of roughly 2400 on the index. 2400 on the S&P 500 sounds almost unthinkable to those buying stocks at current prices, but the S&P 500 traded around that price twice in the last five years, first during the winter 2018 selloff, and second during the early-COVID rout in March 2020.

While these predictions are eye-catching, they seem far more plausible than what actually happened in the 2000s, for example when stocks traded in 2009 to the same prices they traded for in 1997! As crazy as these predictions seem, I actually could see stocks hitting 2400 in a super stagflationary scenario, although it’s not my base case by any means. I don’t view this as likely, but if that happens, what would be crazier in the end?

- The S&P 500 back to 2400?

- Or the fact that it went to nearly 4800 in the first place in the middle of a global pandemic?

If you’d sold a small business in 2017 and closed your eyes for five years, a future path where stocks returned at some point to where you bought them wouldn’t be that crazy-and you’d also have pocketed dividends the whole time. Similarly, if I told you five years ago that investors would be tripping over themselves to buy high-flying tech stocks for 100x earnings, many of you would have laughed at me. But here we are.

Corporate earnings have risen substantially in the last few years, but the bears’ point here is that the reason why corporate earnings have risen so much is due to a parade of deficit spending, unsustainable tax cuts, and quantitative easing policies. Under the hood, we have an unhealthy, rapidly aging population and unprecedented government debt loads in the United States. These are going to be very expensive to deal with over the next 20 years.

The Aging Of America (US News)

Debt and demographics have been the bane of Europe and Japan’s existence over the last decade. Now, these same trends are going to be a formidable headwind for the United States as well as our population follows Europe’s path. We dug into these issues in detail in an article last month, comparing the potential of technology to fix problems with the potential of demographics and weak politicians to create them. The next 10 years are going to be an uphill, but not impossible battle for stocks. Not everyone is this bearish, though. Notably, Wharton finance professor Jeremy Siegel is bullish, saying investors “won’t be sorry” if they invest money now. A solid majority of Wall Street strategists are at least cautiously bullish as well.

The long story short of the bears’ arguments is that investors probably aren’t paying enough attention to how much of the market’s success was driven by tax cuts and stimulus rather than actual growth in productivity! If taxes have to come up and interest rates stay higher, the S&P 500 may not return to 4800 for quite some time. But if the market trades 30%+ lower than the peak, investors would be getting much better compensation for the long-term risks that bearish investors like Burry and Roubini are calling attention to.

I’m not as negative as Burry, Roubini, or other prominent bears. I’m certainly not as bearish as “Rich Dad” Robert Kiyosaki, who recently warned his readers to stock up on canned tuna for the coming Depression. But things are likely to get worse before they get better. I’ve hung a probable fair value for the S&P 500 of roughly 3200-3300 based on where I see earnings coming in. I see earnings at ~$190 for 2022 and ~$200 for 2023 without massive stimulus helping out. This implies over 10% downside from here at a 17.5x earnings multiple (year-end S&P at 3325) and over 20% downside at a 15x multiple (year-end S&P at 2850). And the multiple going to 15 wouldn’t just happen on its own, but would likely only come about if the Fed is initially unable to control inflation and is forced to raise rates more aggressively. In an all-out panic, a 12 multiple on $200 earnings (or an earnings collapse) would get you to Burry and Roubini’s target.

The lesson here from the bears is that government stimulus isn’t a magic trick, and stocks probably need to trade back to at least where they were pre-COVID given that the economy hasn’t fundamentally improved. Still, my base case is certainly not that valuations will collapse to the point where we go down ~50% from the high and approach S&P 2400.

This said-these will be the battleground data releases between bears and bulls:

What Investors Should Watch

- United States June Consumer Price Index, July 13th. The inflation report for June comes out next week, and it’s critical for stocks to see some deceleration in CPI. Another red-hot number (relative to expectations) is likely to be half the puzzle that could push stocks towards the worst-case scenario outlined by Burry and Roubini. There’s some good news here on the inflation front- oil and commodities have sold off heavily in the past couple of weeks. Expect a big swing in either direction after CPI is released.

- The July Fed Meeting, July 27th. CPI will be the first volley, but the Fed will return the serve in its July meeting. After this meeting, they don’t meet again until September, so I would expect a firm message to markets, even if stocks throw another tantrum. Financial conditions are tightening, but they aren’t exactly tight yet. Case in point- The price of the S&P 500 is up about 58% over the past five years. Even down ~20% YTD here, stocks might not exactly be the buy of a lifetime.

- Q2 earnings season, throughout July and August. A lot of financial companies report early in the season, while tech heavyweights like Apple (AAPL), Amazon (AMZN), and Tesla (TSLA) report later in July. The markets right now seem to be pricing a “hard landing,” with lower earnings but also lower inflation. Market expectations are only for 2.3% annual inflation over the next 10 years as of my writing this. If you think this price is too low, then you can buy TIPS (TIP) and you’ll make money. If you think it’s too high, then buy the 10-year Treasury (IEF). Meanwhile, the NASDAQ (QQQ) recently was down over 30% for the year (declines over 20% in my experience strongly imply that the market doesn’t believe analyst earnings estimates). This is one reason that I don’t think stocks are in quite as much trouble as Burry and Roubini think they are-if earnings come in low then inflation probably will come down, and if inflation stays hot then earnings should be better than I expect. But if I’m wrong about this – then that indicates the worst-case scenario and would be what would drive stocks down 50% from peak to trough.

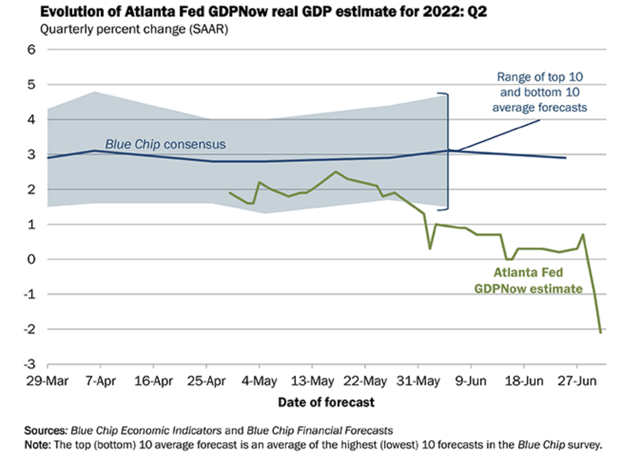

- Recession? Speaking of recessions, we seem to be in one. The Atlanta Fed’s GDPNow model’s latest run shows the economy contracting by 2.1% in Q2 after shrinking by a revised 1.6% in Q1.

Are We In A Recession? And How Much Does It Matter

I called Grandpa Kane this week to ask about his experience with getting through recessions.

In the first recession of his adult life, he said job interviews were impossible to come by, so he joined the US Army. During the second recession, when he was in business (he was a CPA), he said that the rise in unemployment eventually helped his business as people transitioned from W-2 jobs to being in business for themselves. I also thought I’d go broke when we locked down during COVID, but my business actually increased.

The stock market is in trouble, but consider that the national income in the US is likely to be in the neighborhood of $23 trillion this year. That’s a lot of money up for grabs for those with unique talents, the willingness to take risks, or even just those who are reliable and willing to work hard. If we get a 2008-style recession and GDP drops 4-5%, then that’s still ~$22 trillion in national income up for grabs. If you’re not overleveraged or a forced seller, the recession that we’re likely in is likely more of a buying opportunity than a threat to you and your family.

Markets generally underreact initially to changes in the business cycle or earnings, leading to well-known anomalies like momentum and post-earnings announcement drift. This time seems no different, and I think there’s some risk that we as investors find ourselves in the earnings-season-from-hell in a couple of weeks. For these reasons, I think there’s another 10% or so of downside to fair value for stocks with the possibility that we go lower.

Bottom Line

Even a broken clock is right twice a day, and extremely bearish warnings get big media attention. But for a prediction from somebody who’s likely to turn around and start buying stocks if they go lower rather than preaching the end of times, Morgan Stanley chief strategist Mike Wilson recently hung a target price for the S&P 500 of between 2900 and 3100 in a recessionary scenario. Of the bears, I think Wilson might have the right number here. If we temporarily go lower than his low-range forecast of 2900, it will likely be driven by Fed panic and a lack of liquidity rather than stocks truly only being worth 50% of what they were last year.

July and August look full of potential traps for investors. Stocks are still a little expensive and in a downtrend, and earnings estimates still don’t seem realistic. Investors should consider buying risk-free I Bonds, paying down debt, and only putting money in stocks so as to get employer 401k matches for now. All signs are that you will be getting stocks cheaper in a few months than you can get them now. I’d wait a bit to put money to work in stocks.

What do you think? Share your thoughts below in the comments!

Be the first to comment