Khaosai Wongnatthakan

Investment Thesis

Affirm (NASDAQ:AFRM), the leading buy now pay later solution, is about to head into earnings.

We know that the amount of interest in this space has positively exploded of late. There is now so much competition for BNPL products from seemingly everywhere. Even the likes of Apple (AAPL), which one would typically not see in the financial space. Not to mention well-founded peers such as PayPal (PYPL) and quite literally countless others.

Is there enough of an addressable market for all these players to be profitable? Or perhaps, I should say, do the likes of Affirm actually need to be profitable?

Maybe investors will continue to be enamored enough with Affirm to continue to support management’s ambition?

I stand torn. I can sympathize with both the bears and the bulls. Hence, I’m upgrading my rating to neutral.

Revenue Growth Rates Still Expected to be Strong

Recall that Affirm is about to report fiscal Q4 2022, and will soon enter fiscal 2023.

The bear in me immediately highlights that the US is either in a recession or about to enter one. In that case, discretionary purchases would be curtailed, and by extension, the use of Affirm would be meaningfully reduced.

Needless to say, that would have a knock impact on its near-term ability to grow at close to mid-40s% in H1 2023.

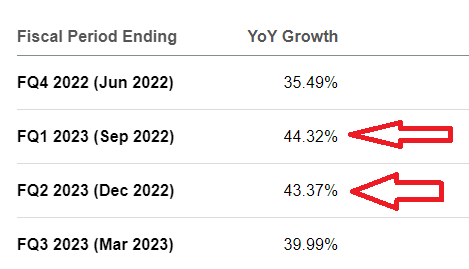

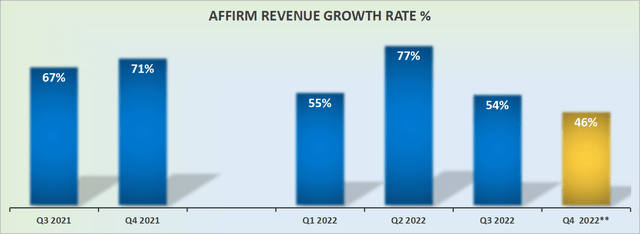

AFRM revenue growth rates

Indeed, as you can see above, for now, analysts are still extremely optimistic that not only Affirm will continue to grow into Q1 2023, but actually, meaningfully accelerate.

To me, this is fundamentally at odds with what I’m seeing in the market. There’s high inflation, higher interest rates, higher petrol prices, higher food prices. Simply put there’s a cost of living crisis.

Yet analysts continue to expect that Affirm will easily overcome its Q4 growth rates and guide for an even stronger H1 2023, with Q1 2023 (quarter ending September 2022) to accelerate its revenue growth rates.

This is clearly contrary to what one would expect to see in a recession.

Profitability, Does It Matter?

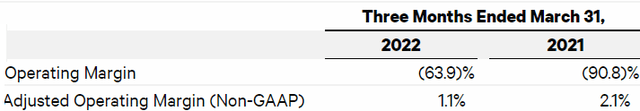

Affirm guides that by the end of the next fiscal year, Q4 2023 (quarter ending June 2023), Affirm will reach adjusted profitability.

It may of course reach that target sooner, say perhaps by Q3 2023. But what will its profitability actually look like?

This is a question that I’ve struggled with when it comes to Affirm. There’s Affirm’s version of profitability and there’s GAAP profitability. In between these two, there are more than 6,000 basis points.

Even if Affirm sees a path to improve its profitability there’s very little likelihood that the business will be GAAP profitable. But does this actually matter?

I’m not sure it does.

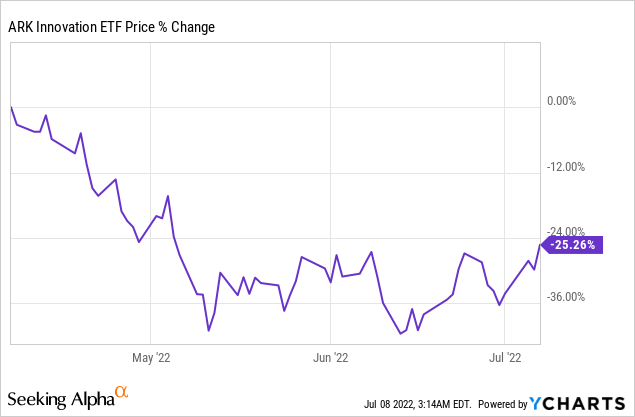

There’s no question that risk assets appear to have found a temporary floor. If we use the ARK ETF (ARKK) as a proxy for what we all know as unprofitable ”disruptors”, the market appears to believe that enough is enough.

Indeed, if you think about it, this side of the market has been selling off for more than a year. In fact, we all know that this side of the market saw its bubble pop back in February 2021.

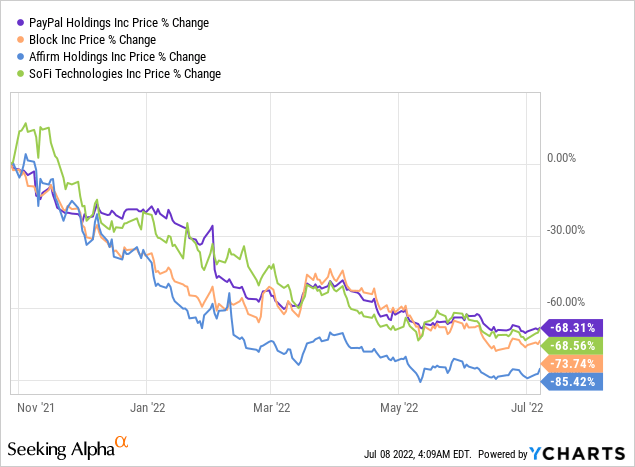

Even though a few stocks would then continue to soar higher in early fall 2021, now the market has fully repriced lower and the vast majority of these fintech companies, to the best of my knowledge, are down +65% in a few months.

Could this mean that the market has now washed out nearly all its enthusiasm for this space?

Valuation – Priced at 4x Fiscal 2023 Sales

At the most superficial level, if we assume that Affirm’s revenues grow 30% into next year, that means that Affirm’s revenues will reach $1.7 billion in fiscal 2023. That would put Affirm’s stock priced 4x forward sales.

For their part, as I noted earlier, analysts are still expecting that Affirm will grow in fiscal 2023 by more than 40%. Could Affirm’s tie-up with Amazon (AMZN) and Shopify (SHOP) sufficiently help Affirm grow at 40% CAGR?

It’s difficult to see how. After all, Amazon and Shopify themselves are reporting slowing growth rates.

On the other hand, this is a penetration story. That Affirm is increasingly penetrating eCommerce platforms, so even if the underlying companies are slowing down post-Covid, Affirm could still report robust growth. At least that’s the bull case.

The Bottom Line

It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. (John Maynard Keynes)

As Keynes contends, a lot of times, it’s the market’s perception that matters most. For example, throughout its narrative, Affirm proclaims that it’s disrupting credit card companies by delivering an ”honest financial product” for consumers.

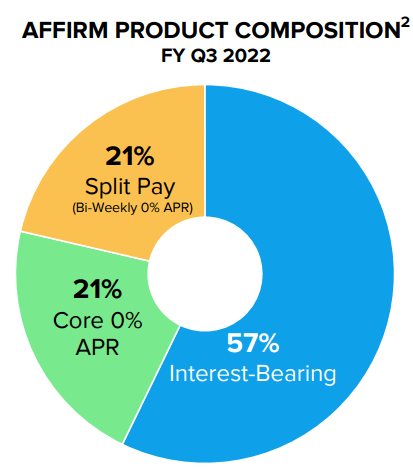

Q3 2021 presentation

But as you know, Affirm’s business works by charging its consumers interest-bearing rates.

Q3 2021 presentation

As you can see above, more than half its products carry an interest-bearing rate. This is after all a credit card company, with different clothes.

In conclusion, I’m neutral on AFRM.

Be the first to comment