Khosrork

This article was published on Dividend Kings on Monday, February 13th, 2023.

—————————————————————————————

You might have noticed that the stock market is doing something that most people didn’t expect. After a rather painful 2022, the consensus was expecting a weak first half for stocks, followed by the start of a new bull market in the second half.

The reasoning was simple, elegant, and so far... wrong.

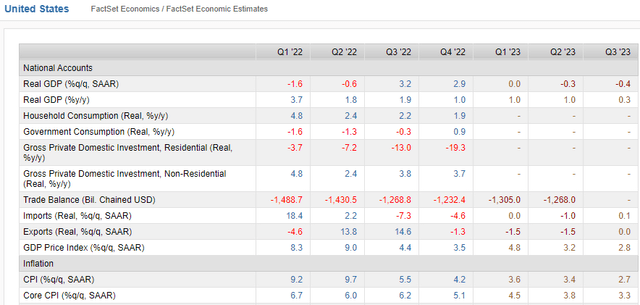

The economy was expected to fall into recession in the first half of 2023. That’s still the FactSet consensus.

FactSet Research Terminal

However, recent economic data has come in better than expected, both in the US and globally, and now the recession is expected to begin in Q2 2023, not Q1.

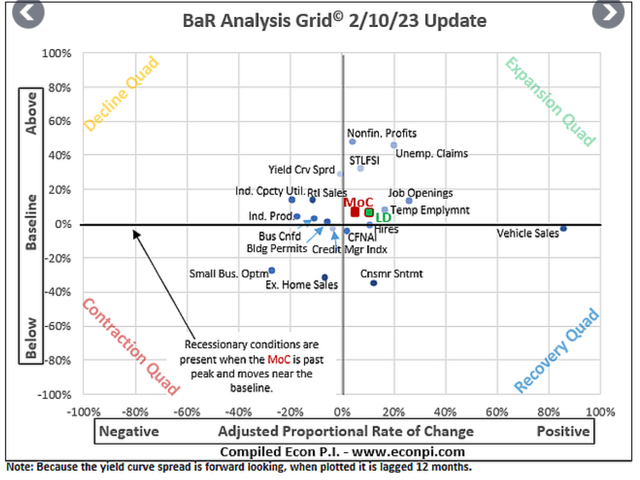

David Rice

The overall average of 18 economic and nine leading indicators has been improving to the point that a soft landing now looks possible.

Apollo Management’s base case is not a soft or hard landing but a “no landing” scenario where the economy doesn’t even slow. They think it could keep growing at 2% to 3% all year, surprising everyone.

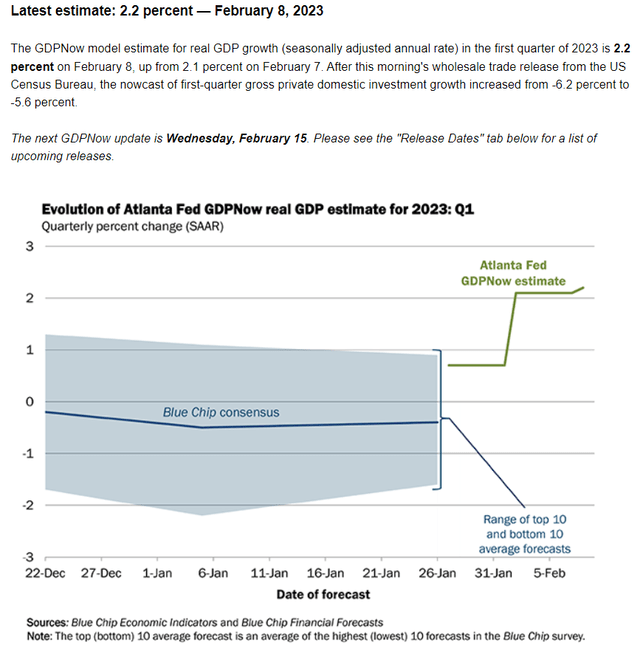

Atlanta Fed

That’s far from the consensus, but the Atlanta Federal Reserve real-time GDP growth model does agree that, for now, this appears to be happening.

Bloomberg Consensus S&P Bear Market Bottom Scenarios… Less Scary The Longer It Takes To Go Into Recession

| Earnings Decline In 2023 | 2023 S&P Earnings | X 25-Year Average PE Of 16.8 | Decline From Current Level |

| 0% | $217.25 | $3,656.32 | 10.6% |

| 5% current consensus | $206.39 | $3,473.50 | 15.1% |

| 10% | $195.53 | $3,290.69 | 19.6% |

| 13% (average since WWII) | $189.01 | $3,181.00 | 22.2% |

| 15% | $184.66 | $3,107.87 | 24.0% |

| 20% | $173.80 | $2,925.05 | 28.5% |

(Source: Dividend Kings S&P Valuation Tool, FactSet, Bloomberg)

At the start of the year, Morgan Stanley, the most accurate forecaster of 2022, expected the stock market to fall 20% in Q1, hit bottom, and then begin a new bull market.

Now the consensus is for stocks to only fall about 15% from here, retesting the lows of October before the new bull market begins.

- Consensus bottom now Q2 to Q3

While the potential range of outcomes is wide (it always is), it’s looking like we’re currently stuck in a stock market no-man’s land.

- The economy is too strong for earnings to fall the historical recession amount

- Interest rates and market valuations are too high for stocks to fall significantly

There is also the issue of a lot of institutional buyers who were caught offside by 2022. They were underweight stocks coming into the year, and according to Bloomberg, most still don’t believe the January rally.

- The 8th best in US market history

In other words, it’s now looking like we might be stuck in a trading range for the next few months or even possibly the rest of the year.

My best educated guess, based on the most recent data, is that stocks are likely to fall 5% to 10% sometime in 2023, and potentially 15% before bottoming in the first half.

The reason the slower-than-expected mild recession matters is that the longer it takes to begin, the less the market will care about 2023 results.

Wall Street’s favorite valuation metric is 12-month forward earnings. In other words, by June the street will be 50% looking at 2023 earnings and 50% 2024.

And given that it’s looking more likely that this will be the mildest recession in history, the earnings declines we see in 2023 could be closer to -5% to 0% than the historical average and median 13%.

The probability of a 20% EPS decline is looking ever less likely.

So what does this mean for dividend investors?

Be Aware Of The Big Picture But Don’t Trade Your Portfolio Based On it

I deal in facts, not forecasting the future. That’s crystal ball stuff. That doesn’t work.” – Peter Lynch

As an economic nerd (my major in college), I love keeping up with the latest data about the economy, inflation, and earnings forecasts.

But guess what? Whether the recession in 2023 is mild, severe, or we don’t get one at all, ultimately doesn’t matter to your long-term plans.

I watch Bloomberg, so you don’t have to. I stay on top of the latest data, so that I can tell you why the market is doing what it’s doing, and what the probability ranges are for the next few months.

Purely so that you are prepared for almost anything that’s coming next, and don’t panic sell.

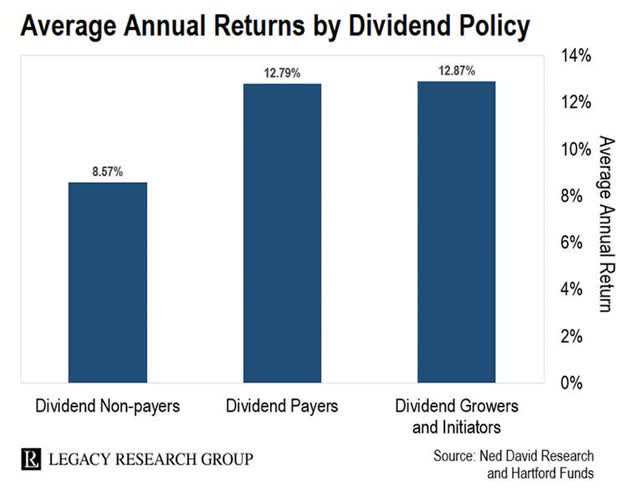

But long-term dividend blue-chips are the best-performing asset class in history.

Legacy Research

Yes, different economic cycles will result in different types of stocks under or outperforming, but no matter what happens with the economy in 2023, there is one thing that’s likely true about 2024.

We’re likely to have stronger growth in 2024 than in 2023, which means that dividend-growth stocks will likely have a banner year.

So let me show you how to quickly and easily find the best dividend growth blue-chips potentially set to soar in 2024... and beyond.

How To Find The Best Dividend Growth Stocks For 2024 In 1 Minute

Let me show you how to screen the Dividend Kings Zen Research Terminal, which runs off the DK 500 Master List, to find the best dividend growth blue-chips with exceptional return potential in 2024.

The Dividend Kings 500 Master List includes some of the world’s best companies, including:

- Every dividend champion (25+ year dividend growth streaks, including foreign aristocrats)

- Every dividend aristocrat

- Every dividend king (50+ year dividend growth streaks)

- Every Ultra SWAN (as close to perfect quality companies as exist)

- The 20% highest quality REITs according to iREIT

- 40 of the world’s best growth blue-chips

| Step | Screening Criteria | Companies Remaining | % Of Master List |

| 1 | Reasonable Buy Or Better | 319 | 63.80% |

| 2 | Quality 10+ (Blue-Chip Or Better) | 292 | 58.40% |

| 3 | 0.5% Yield Or Higher (dividend stocks) | 262 | 52.40% |

| 4 | 15+% long-term return potential (hyper-growth returns) | 45 | 9.00% |

| 5 |

Sort By Long-Term Return Potential |

0.00% | |

| 6 | Select 5 Of Your Favorite Companies From The Top 12 | 5 | 1.00% |

| Total Time | 1 Minute |

12 Dividend Growth Blue-Chips Potentially Set To Soar In 2024

Source: Dividend Kings Zen Research Terminal

Now let me give you a short intro to my favorite five out of this screen.

5 Dividend Blue-Chips Potentially Set To Soar In 2024

Here they are in order of highest to lowest long-term return potential.

- Yield + long-term consensus growth potential

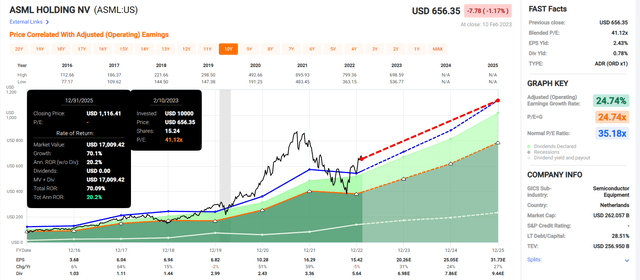

ASML Holding (ASML): The Ultimate Chip Stock

Further Reading

DK Quality Rating: 99% very low risk 13/13 Ultra SWAN

Current Price: $656.35

Fair Value: $705.73

Discount: 7%

DK Rating: Potentially good buy

Yield: 0.8%

Long-Term Growth Consensus: 25.7%

Long-Term Total Return Potential: 26.4%

(Source: FAST Graphs, FactSet)

If ASML grows as expected and trades at historical market-determined fair value by the end of 2025, investors should earn 70% or 20% annually.

- 2X more than the S&P 500 consensus

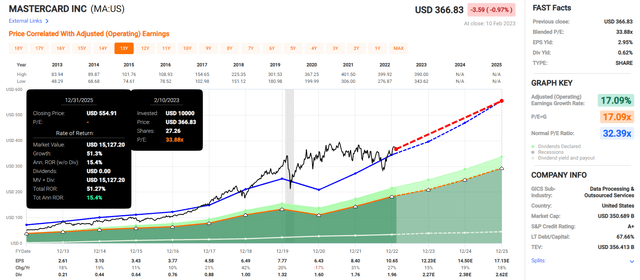

Mastercard (MA): The Ultimate Bet On The Future Of The Global Economy

Further Reading

DK Quality Rating: 100% very low risk 13/13 Ultra SWAN

Current Price: $366.83

Fair Value: $412.70

Discount: 11%

DK Rating: Potentially good buy

Yield: 0.6%

Long-Term Growth Consensus: 22.6%

Long-Term Total Return Potential: 23.2%

(Source: FAST Graphs, FactSet)

If MA grows as expected and trades at historical market-determined fair value by the end of 2025, investors should earn 50% or 15% annually.

- 75% more than the S&P 500 consensus

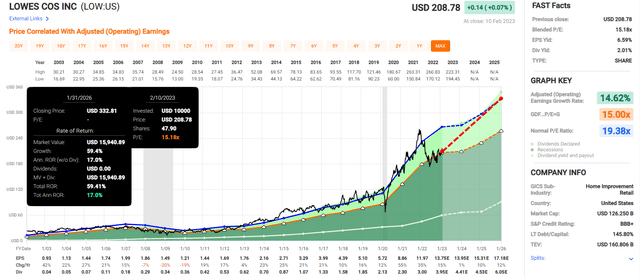

Lowe’s (LOW): A Dividend King With Buffett-Like Return Potential

Further Reading

DK Quality Rating: 100% quality, very low risk 13/13 Ultra SWAN dividend king

Current Price: $208.78

Fair Value:$275.42

Discount: 24%

DK Rating: potentially strong buy

Yield: 2.0%

Long-Term Growth Consensus: 20.6%

Long-Term Total Return Potential: 22.6%

(Source: FAST Graphs, FactSet)

If LOW grows as expected and trades at historical market-determined fair value by the end of 2025, investors should earn 60% or 17% annually.

- 2X more than the S&P 500 consensus

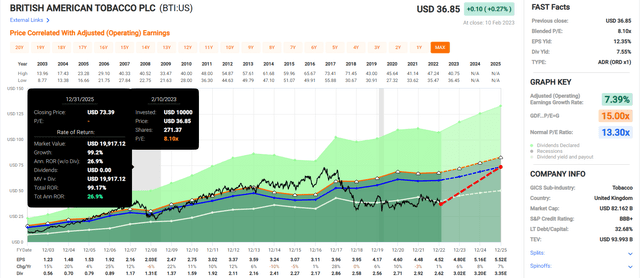

British American Tobacco (BTI): The Growth King Of Its Industry Is A Coiled Spring

Further Reading

DK Quality Rating: 99% very low risk 13/13 Ultra SWAN global aristocrat

Current Price: $36.85

Fair Value: $65.49

DK Rating: Potentially Ultra Value buy

Yield: 7.6%

Long-Term Growth Consensus: 9.1%

Long-Term Total Return Potential: 16.6%

(Source: FAST Graphs, FactSet)

If BTI grows as expected and trades at historical market-determined fair value by the end of 2025, investors should earn 100% or 27% annually.

- 3X more than the S&P 500 consensus

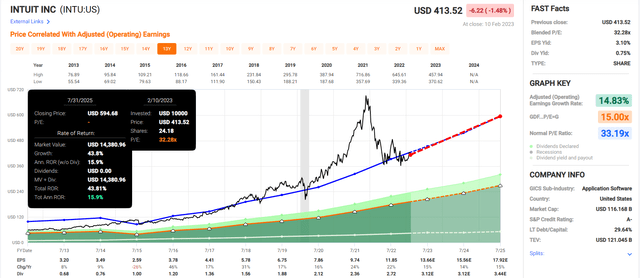

Intuit (INTU): If You Hate Doing Taxes, You’ll Love Intuit

Further Reading

DK Quality Rating: 99% very low risk 13/13 Ultra SWAN

Current Price: $413.52

Fair Value:$414.11

Discount: 0%

DK Rating: potentially reasonable buy

Yield: 0.8%

Long-Term Growth Consensus: 16.4%

Long-Term Total Return Potential: 17.2%

(Source: FAST Graphs, FactSet)

If INTU grows as expected and trades at historical market-determined fair value by the end of 2025, investors should earn 44% or 16% annually.

- 50% more than the S&P 500 consensus

Bottom Line: These 5 Dividend Blue-Chips Are Potentially Set To Soar In 2024

Let me be clear: I’m NOT calling the bottom in any of these blue-chips (I’m not a market-timer).

13/13 Ultra SWAN quality does NOT mean “can’t fall hard and fast in a bear market.”

Fundamentals are all that determine safety and quality, and my recommendations.

- Over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- In the short term; luck is 25X as powerful as fundamentals

- In the long term, fundamentals are 33X as powerful as luck

While I can’t predict the market in the short term, here’s what I can tell you about ASML, MA, LOW, BTI, and INTU.

These are industry-leading world-beater dividend growth Ultra SWANs (sleep well at night).

They have great balance sheets, very adaptable management, excellent long-term risk management scores from S&P, and are all trading at reasonable to outrageously attractive valuations.

I can’t tell you when they will return to historical fair value, just that they eventually will if they keep executing as they have for the last several years.

And no matter what happens with the economy in 2023, 2024 is likely to be a better year for GDP and earnings growth, and that means faster-growing companies are likely to have a great year.

- Falling rates in 2024 should help

If you buy one or more of these five dividend growth legends today, I’m very confident you’ll be happy with the results in 5+ years.

And in 10+ years? You’ll likely feel like a stock market genius.

Be the first to comment