AsiaVision

A Quick Take On Dingdong

Dingdong (NYSE:DDL) went public in June 2021, raising approximately $95.7 million in gross proceeds from an IPO that priced at $23.50 per ADS.

The firm provides online grocery shopping and delivery services for consumers in China.

Given future growth risks and difficulty valuing DDL due to its changing focus on efficiency over growth, I’m on Hold for DDL until we gain more visibility into its operating trajectory and US listing status.

Dingdong Overview

Shanghai, China-based Dingdong was founded to create an online-source for groceries and other daily consumer products in the Yangtze River Delta region.

Management is headed by founder and CEO Changlin Liang, who was previously founder of iYaya.com and MaMaBang App.

The company’s primary offerings include:

-

Groceries

-

Consumer products

-

30 minute delivery goal

The company seeks new users & customers through its online website and mobile ordering app that it promotes primarily through online digital media channels.

Dingdong’s Market & Competition

According to a 2019 market research report by China Daily, the market for food delivery services reached nearly $66 billion in 2018.

This represents a 112% increase from the previous year.

The market was expected to more than double by 2021, with the effects of the COVID-19 pandemic likely to increase that growth trajectory substantially due to the increased desire of consumers to receive their food and groceries via delivery, at least during the 2020 main pandemic period.

Also, the largest players in the industry include Meituan and Ele.me; China’s ride hailing firm Didi Chuxing also entered the market in 2018.

Dingdong’s Recent Financial Performance

-

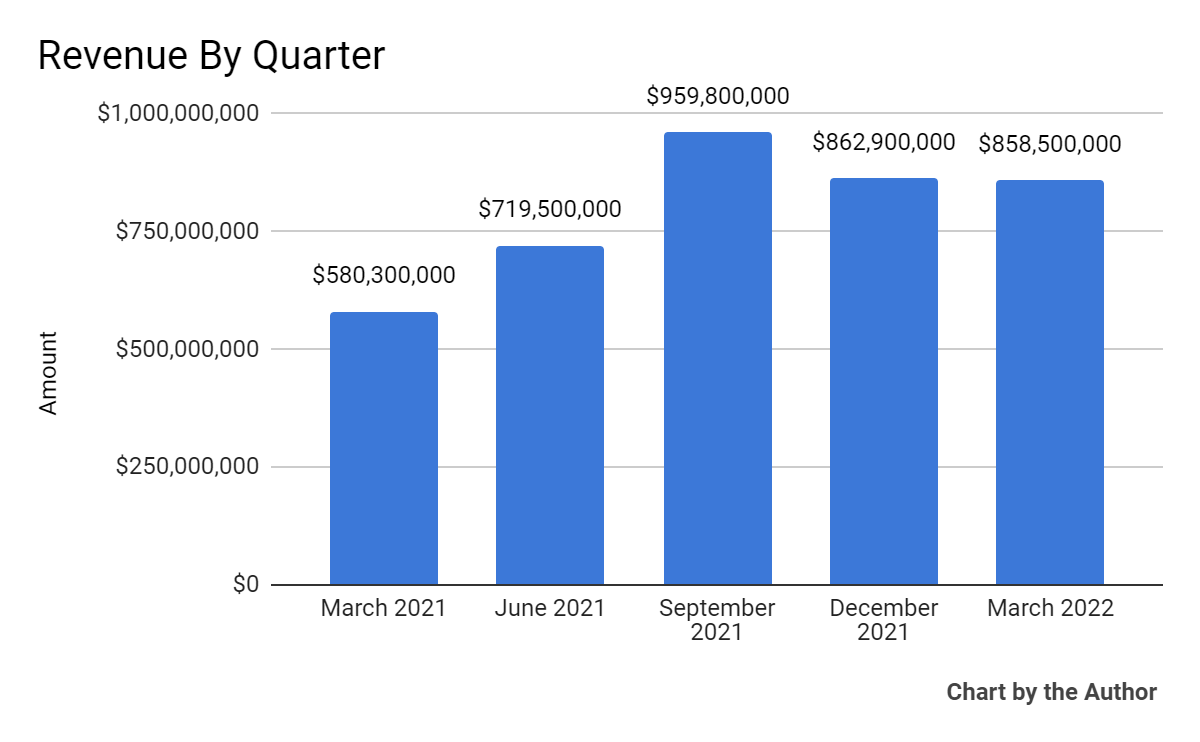

Total revenue by quarter has risen but that growth has moderated in recent quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

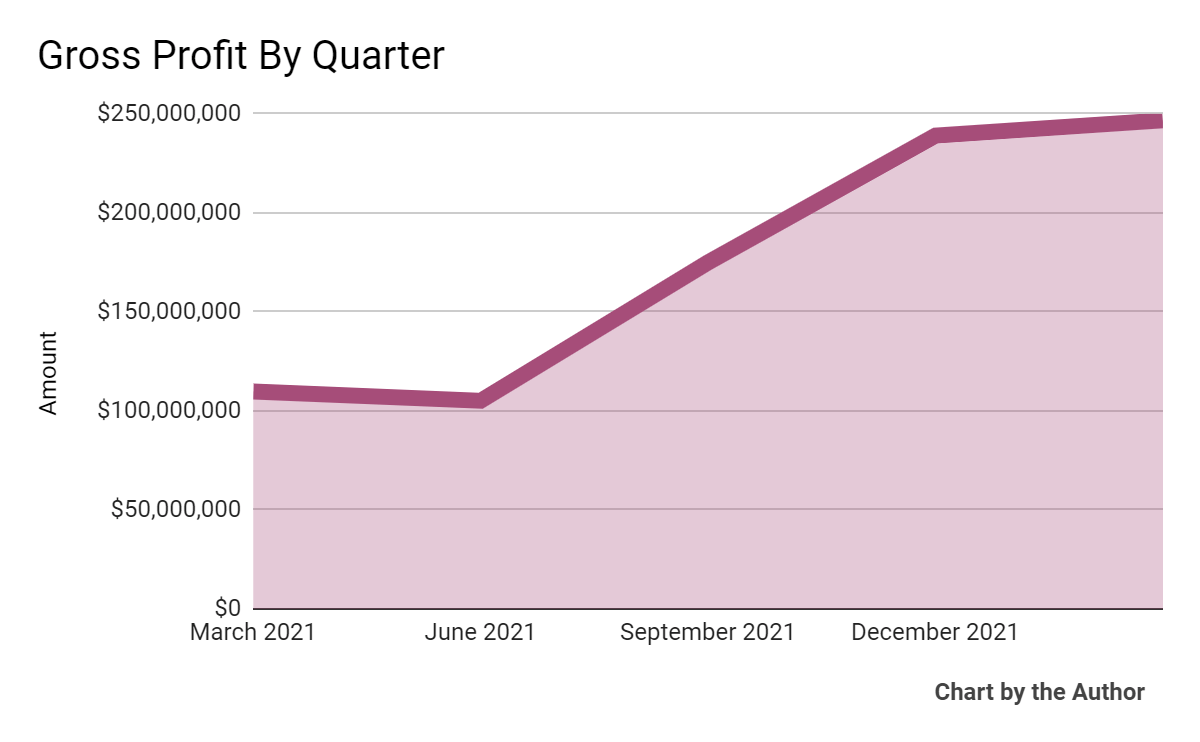

Gross profit by quarter has risen markedly:

5 Quarter Gross Profit (Seeking Alpha)

-

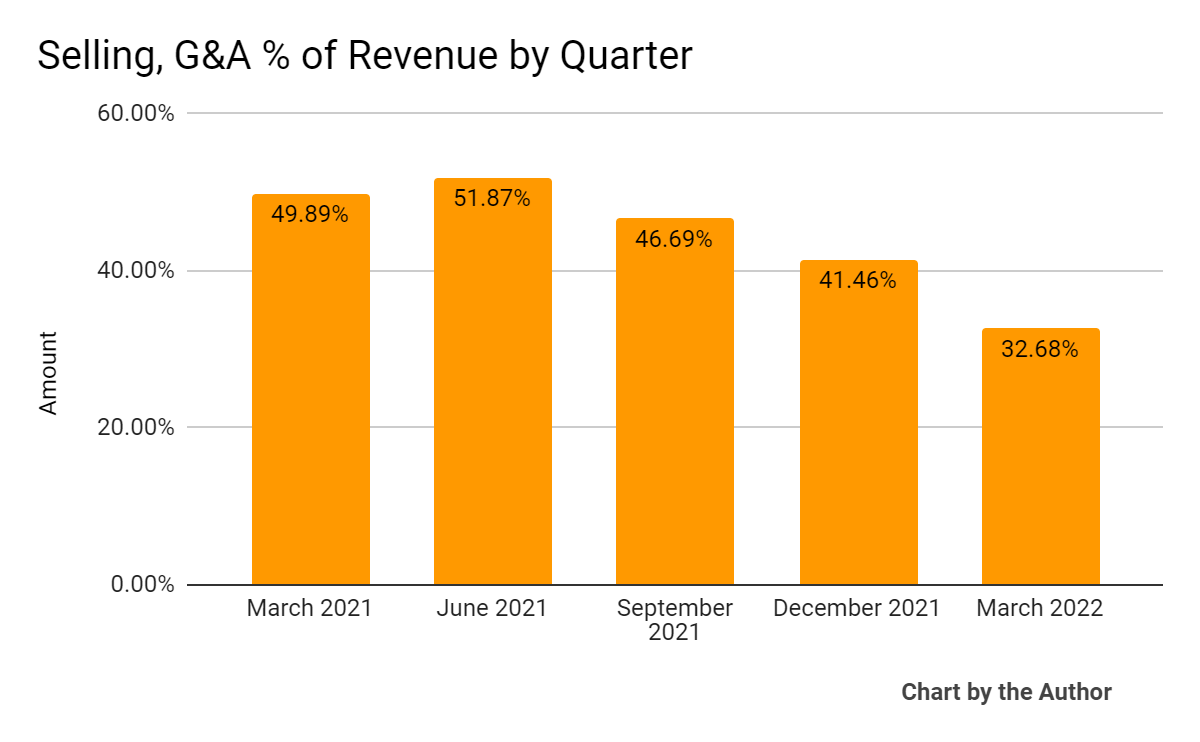

Selling, G&A expenses as a percentage of total revenue by quarter have dropped as revenue has risen:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

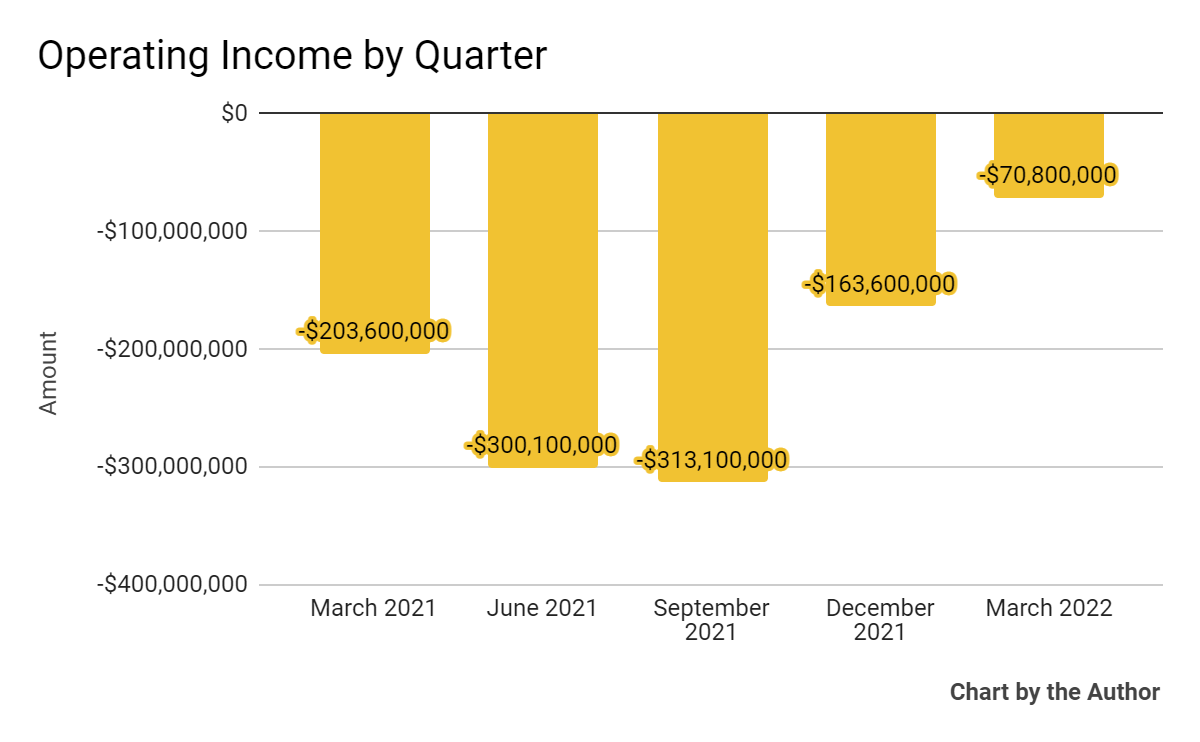

Operating losses by quarter have improved in recent quarters, although are still large:

5 Quarter Operating Income (Seeking Alpha)

-

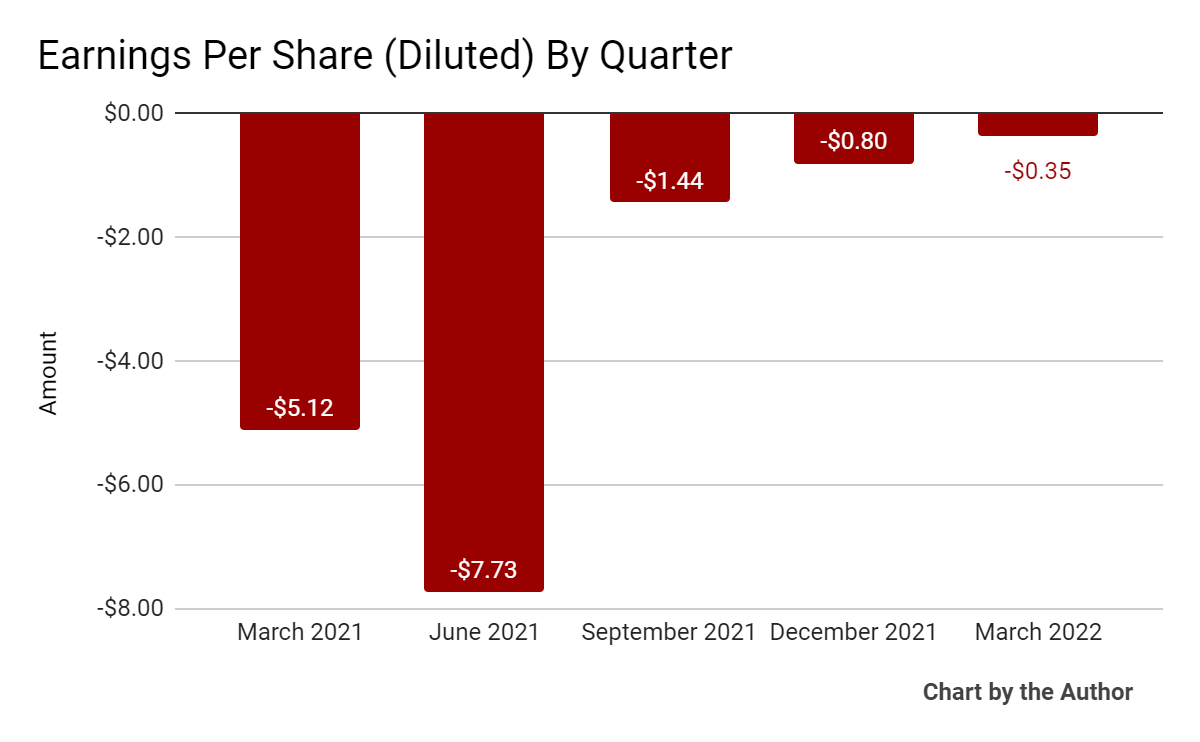

Earnings per share (Diluted) have also improved but remain considerably negative:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

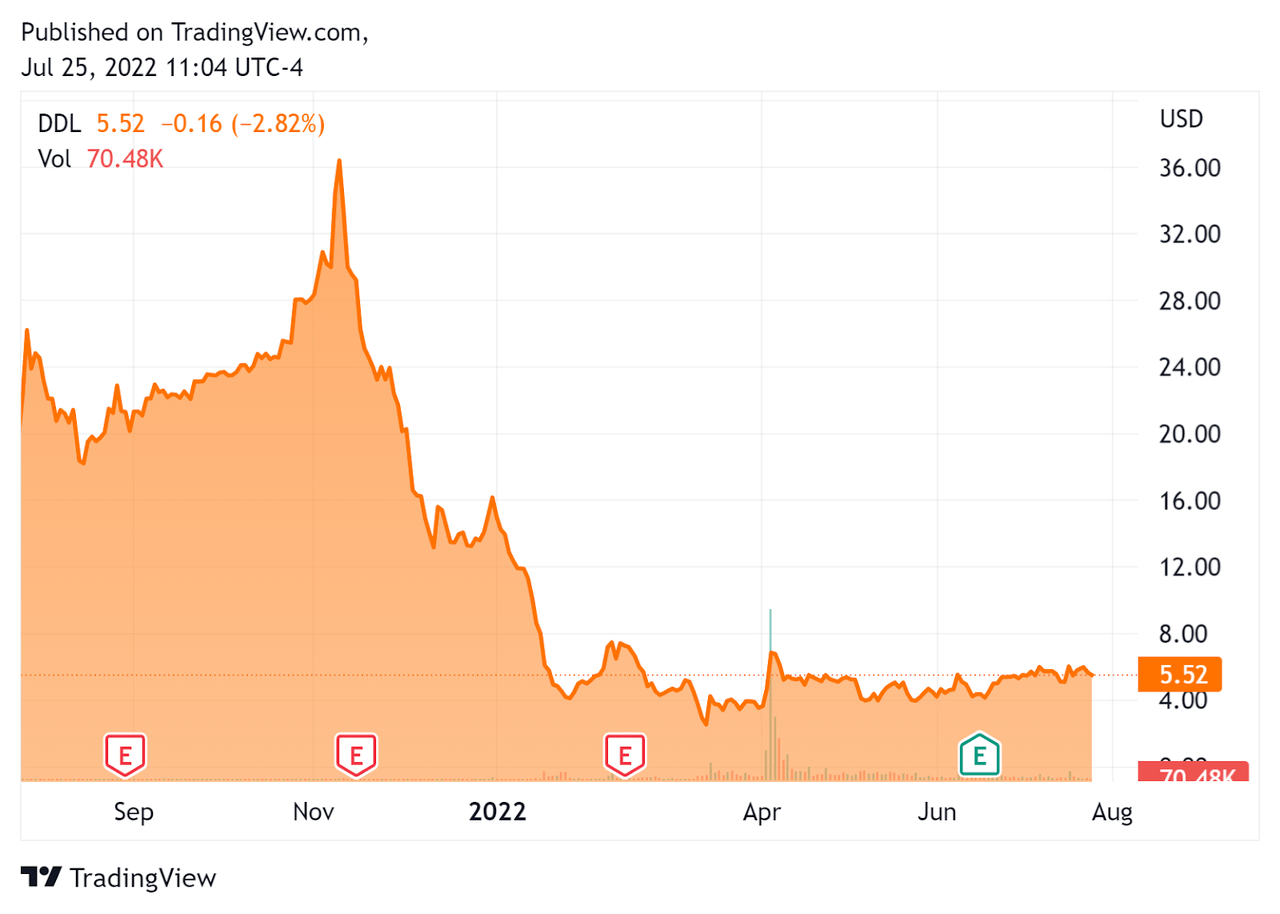

In the past 12 months, DDL’s stock price has dropped 71.9 percent vs. the U.S. S&P 500 index’ fall of around 10.3 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For DDL

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$1,290,000,000 |

|

Market Capitalization |

$1,230,000,000 |

|

Enterprise Value / Sales [TTM] |

0.38 |

|

Price / Sales [TTM] |

0.29 |

|

Revenue Growth Rate [TTM] |

73.63% |

|

Operating Cash Flow [TTM] |

-$794,430,000 |

|

Earnings Per Share (Fully Diluted) |

-$10.32 |

(Source – Seeking Alpha)

As a reference, a relevant partial and much larger public comparable would be Meituan (OTCPK:MPNGF); shown below is a comparison of their primary valuation metrics:

|

Metric |

Meituan |

Dingdong |

Variance |

|

Enterprise Value / Sales [TTM] |

4.87 |

0.38 |

-92.2% |

|

Operating Cash Flow [TTM] |

-$1,710,000,000 |

-$794,430,000 |

-53.5% |

|

Revenue Growth Rate |

39.26% |

73.6% |

87.5% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

Commentary On Dingdong

In its last earnings announcement (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its continuing strategy shift of ‘efficiency first, with due consideration to scale.’

As a result, its operating losses were reduced, but still remained substantial.

Additionally, management is focusing on ‘prioritizing product capabilities as our primary growth driver,’ rather than spending as much on marketing.

As to its financial results, revenue rose by 43.2% year-over-year, consisting of 43.1% growth in product revenue and 52.7% increase in service revenue.

Product revenues grew due to an increase in order volume and average order value and service revenue rose due to an increase in the subscriber base to its membership program.

On the expense side, sales and marketing dropped 44.7% while G&A expenses rose nearly 26% and product development costs increased 49.5%.

Fulfillment expenses were flat year-over-year, but decreased to 27.3% as a percentage of total revenue and management noted increasing ‘supply chain efficiency.’

For the balance sheet, the firm finished the quarter with cash, equivalents and short-term investments of $766 million, no long-term debt but $504.3 million in short-term borrowings.

Looking ahead, management did not provide any forward guidance, other than the hints that it would prioritize efficient growth after several quarters of large operating losses as the pandemic waned in China and the company’s cost structure was out of sync with market conditions.

Regarding valuation, the market is valuing DDL at very low revenue multiples and it is difficult to determine a reasonable valuation given the uncertainties of pandemic lockdowns in China, which tend to favor its operations as consumers order online in lockdown regions.

A risk to the company’s outlook is a full reopening of the Chinese economy which may reduce revenue growth.

Another risk is that the company was recently added to the SEC’s list of companies at risk of delisting due to lack of PCAOB access to their audit papers.

Given these risks and difficulty valuing the company due to its changing focus on efficiency over growth, I’m on Hold for DDL until we gain more visibility into its trajectory and US listing status.

Be the first to comment