Oil markets and energy stocks have gone from bad to worse in response to Saudi Arabia effectively declaring an oil price war over the weekend. Today’s piece addresses some of the key investor questions that have stemmed from the move in oil prices. Specifically, we discuss MLP distributions, leverage, and counterparty risk.

What’s happening with oil prices, and what are the implications for US production and midstream?

On Friday, OPEC and Russia were unable to reach an agreement on production cuts, with Russia objecting to the proposed cut stemming from OPEC’s meeting on Thursday. In response, Saudi Arabia initiated an oil price war by slashing its oil prices in global markets and threatening to increase production. Last Friday’s -10.1% move lower in oil prices now pales in comparison to Monday’s -24.6% shellacking of oil prices. WTI crude oil closed at $31.13 per barrel, which is a few bucks above the relative bottom of $26/bbl from February 2016.

Oil prices at these levels will force producers to respond by further reining in capital spending and drilling activity. Looking back to 2014, oil prices began to sharply fall after the OPEC meeting in late November 2014, but US oil production continued to grow through April 2015. In other words, it may take months for production to noticeably decline. Wells already on production will likely keep producing, though they will be subject to natural decline rates. The bulk of a shale well’s production comes from its first year. With fewer new wells offsetting those declines, overall US production is likely to decrease for a time until oil prices incentivize additional drilling. Barring any agreement from OPEC or Russia on production, a decline in US production will likely be needed to help balance the oil market.

What are the implications for midstream? At a high level, midstream providers should be protected by minimum volume commitments or take-or-pay agreements if volumes begin to decline, though company contracts may vary. For midstream names focused on gathering, fewer new wells limit growth opportunities. For longer-haul pipelines, if long-term contracts happen to expire while production is declining, midstream may struggle to renew or replace those contracts, though expirations across assets and even for the same pipeline are likely staggered to mitigate risk.

Are distribution cuts on the horizon?

Distribution coverage for the constituents of the Alerian MLP Infrastructure Index (AMZI) averaged 1.5x for 4Q19, which implies a 50% cushion between cash being generated and cash paid as distributions. Coverage was at the high watermark of recent years. EQM Midstream (NYSE:EQM) has already announced a 67% distribution cut for 1Q20, but including the impact of the cut, the AMZI’s yield was 11.6% as of last Friday. Typically, MLPs would begin announcing their 1Q20 distributions in mid-April, and by then, they may have greater clarity around the market environment and the positioning of their customers.

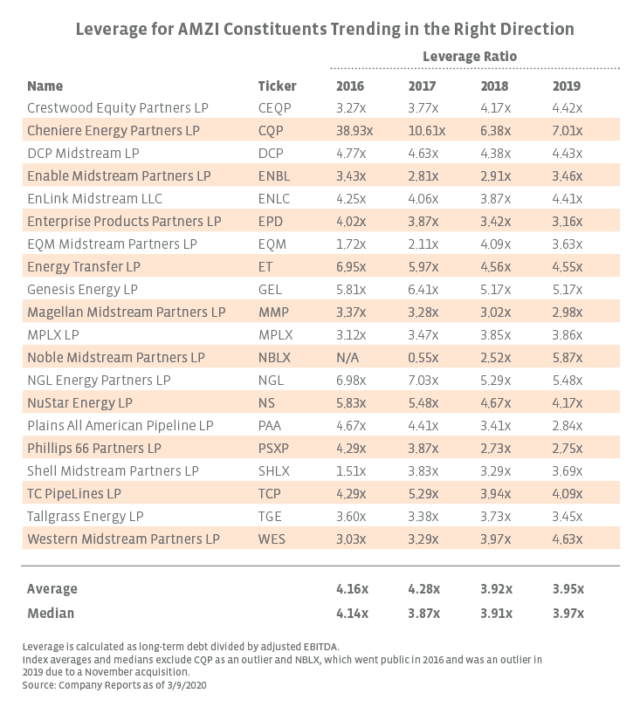

Clearly, there were several distribution cuts in the aftermath of 2014, but MLPs and their business models have evolved since then. Looking back to 2014-2016, MLPs had higher leverage (see table below), the burden of incentive distribution rights in many cases, and a significant reliance on equity capital markets to fund the massive build-out of energy infrastructure necessitated by the shale revolution. When equity markets closed on them, some MLPs had to cut their distributions in order to redirect cash flows to reduce leverage or to fund growth capital. This time around, midstream is not dependent on equity capital markets for funding growth projects, leverage has improved, and growth capital spending is generally declining (read more). In short, midstream MLPs are better positioned for this downturn than in 2014, and payouts may be more resilient than in the past given the more sustainable business models of today.

What about counterparty risk and E&Ps as midstream customers?

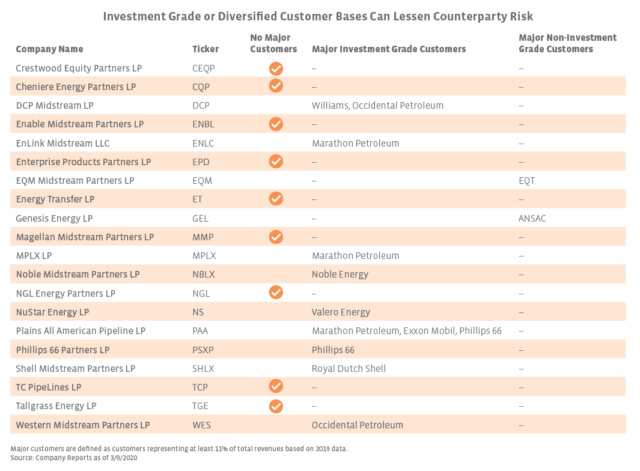

Counterparty risk reflects the concern that midstream companies are exposed to producer customers that could be under stress and potentially unable to fulfill their end of contracts as activity declines. Overall, the MLPs in the AMZI are either exposed to a large, investment grade customer or provide services to a variety of customers, which helps diversify counterparty risk. In reviewing 2019 annual reports, nine constituents representing 46.3% of the index1 by weighting have a diverse customer base without a single major customer (those that represent 11% or more of an MLP’s total revenue), while nine constituents possess a major customer that is investment grade rated accounting for 11% or more of total revenue (see table below).

Two AMZI constituents with less than 4% weights in the index – EQM Midstream Partners (EQM) and Genesis Energy (NYSE:GEL) – have a non-investment grade major customer. EQT (NYSE:EQT) accounted for 69% of EQM’s 2019 revenue and holds a BB+ rating from S&P (new gathering agreements were recently announced between EQM and EQT), while ANSAC is a private company without a rating that comprised 15% of GEL’s 2019 revenue. The five largest constituents in the AMZI Index seem to be well-positioned in terms of counterparty risk, with three of the five not having a single customer accounting for 11% or more of 2019 revenues – Energy Transfer (NYSE:ET), Enterprise Products Partners (NYSE:EPD), and Magellan Midstream Partners (NYSE:MMP). Plains All American Pipeline’s (NYSE:PAA) three largest customers accounted for 35% of 2019 revenue, and all were investment grade. MPLX’s (NYSE:MPLX) biggest customer is its sponsor Marathon Petroleum Corporation (NYSE:MPC) at 56% of 2019 revenues, which also holds an investment grade rating and as a refiner is less exposed to the absolute price of crude.

Bottom line

Admittedly, the future path of oil prices and the impact to producers remains to be determined. However, for midstream MLPs, Monday’s selloff may reflect compounded fears that extrapolate some of the issues from 2014-2016 to today – despite the improved financial positioning of MLPs. Counterparty risk will likely remain in focus as the slump in oil prices continues, but AMZI constituents benefit from diversified and/or investment grade customer bases. While the near-term picture is cloudy at best, the long-term view for midstream MLPs remains intact in terms of playing a vital role in energy markets while offering investors attractive income, diversification, and real asset exposure.

1 As of the December 20, 2019 quarterly rebalancing.

Disclosure: © Alerian 2020. All rights reserved. This material is reproduced with the prior consent of Alerian. It is provided as general information only and should not be taken as investment advice. Employees of Alerian are prohibited from owning individual MLPs. For more information on Alerian and to see our full disclaimer, visit http://www.alerian.com/disclaimers.

Be the first to comment