iprogressman

Investment Thesis

Digital Turbine’s (NASDAQ:APPS) Q1 2023 (this current fiscal year) shows that the company is not immune to the slowing macro environment.

What’s more, compared to this time last year when the business had made several large acquisitions and had very strong tailwinds to its back, today Digital Turbine looks like a different company.

Digital Turbine’s CEO Bill Stone candidly describes to investors that the business today is in a trough. Something that the market has long ago asserted.

That being said, Digital Turbine is clearly pricing in a significant amount of pessimism with its stock priced at 8x EBITDA. Hence, I’m tepidly bullish that the worst is now over for shareholders.

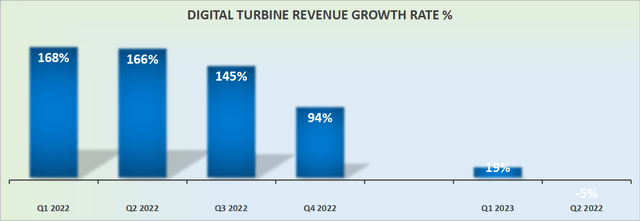

Digital Turbine’s Revenue Growth Rates Slow Down

Digital Turbine changed its accounting last quarter to recognize its revenues on a net basis rather than a gross basis.

Digital Turbine changed its accounting in an effort to make the business more comparable with peers in its industry. This was done in an effort to improve the multiple on its stock.

Indeed, companies that report high gross margins often get rewarded with a higher multiple. And the goal here is to in the short term change investors’ perspective, which would help to add some support to its share price.

However, over the long term, the only thing that matters is the business’ growth in intrinsic value. And here, frustratingly, Digital Turbine is coming up short, as Digital Turbine guides for negative 5% growth for the quarter ahead.

In fact, CEO Bill Stone echoed that insight on the earnings call by stating:

[…] With some of the demand slowing down and the macro headwinds, I think it’s created a trough for our business in the present, but we really view that as a temporary thing going forward for us.

So this gets us to the core of the thesis.

What’s Going to Drive Digital Turbine Forward?

Digital Turbine will improve as soon as advertising demand picks up. CEO Bill Stone, a CEO that comes across as both knowledgeable and honest, describes that Digital Turbine is well-positioned to capture advertising dollars as an increasing number of its products gets installed on more mobile devices.

That being said, Stone notes that in the very near term Digital Turbine is facing multiple tough headwinds, from lapping Covid strength, to inflationary pressures to a slowing economy.

In short, there’s nothing affecting Digital Turbine that isn’t affecting the rest of the advertising sector as a whole.

And until the economy starts to show some light at the end of the tunnel, the advertising sector is going to remain weak.

Profitability Isn’t Moving Higher Fast Enough

It’s now nearly one year since Digital Turbine had its Investor Day.

At the time, investors such as myself were seduced by its alluring guidance, that over the next 3 years or so the business would see close to $1 billion of EBITDA.

However, Digital Turbine’s Q2 2023 EBITDA guidance when taken together with its reported Q1 2023 EBITDA appears to point to Digital Turbine in the best case reaching around $250 million of EBITDA this year.

This implies somewhere close to a 30% CAGR increase in EBITDA from last year, but nowhere to the +100% EBITDA CAGR that investors were pointed to in last year’s Investor Day.

It’s tough to say, but it appears that Digital Turbine overpromised and underdelivered. At least for now.

APPS Stock Valuation – All Ad Tech Companies Are Cheap

Digital Turbine is priced at 8x EBITDA. This is obviously not an extended multiple.

However, when we consider that other advertising companies are also priced cheaply, such as Meta (META) which is priced at approximately 15x this year’s free cash flow, while Digital Turbine is likely to be priced at 20x free cash flow, this only reinforces my argument.

Digital Turbine appears to be cheap, but so what? So are all advertising companies, with the expectation of The Trade Desk (TTD) which remains the anomaly in this space.

Simply put, the market has become truly disenchanted with ad tech companies.

On the other hand, the market has admittedly been vaguely right. Because after all is said and done, Digital Turbine is pointing towards negative y/y revenue growth rates.

Thus, why would investors be willing to pay a premium on a company that is just as cyclical as a commodity?

After all, at least with commodities, those companies are priced cheaply and their total number of shares outstanding is moving down rapidly.

While with Digital Turbine, the guidance for Q2 2023 points to its total number of diluted shares increasing by 8.3% y/y, even as its revenue growth rates are guided in the negative direction.

The Bottom Line

With the power of hindsight, when I was recommending Digital Turbine in 2021 the stock had got over its skis. Today, I believe that Digital Turbine has swung fully the other way, and the stock is now pricing in a lot of doom and gloom.

However, until investors gain confidence that the advertising space is back on steady footing, the stock is very likely to be dead money for a while longer.

Be the first to comment