skodonnell

Introduction

The start of 2022 was eventful for Holly Energy Partners (NYSE:HEP) who completed their Sinclair acquisition, which laid the foundations for unitholders to see a higher yield coming, as my previous article highlighted. It was very encouraging to see management flagging higher distributions coming during 2023, which stands to see their already high yield of 8.16% become even more desirable. After the recent wave of Master Limited Partnerships being acquired by their parent companies, it begs the question of whether they have the same fate but alas for unitholders looking for an easy payday, it seems that no takeover is coming.

Executive Summary & Ratings

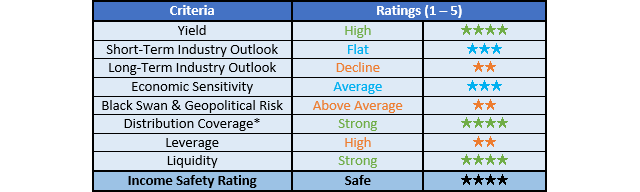

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

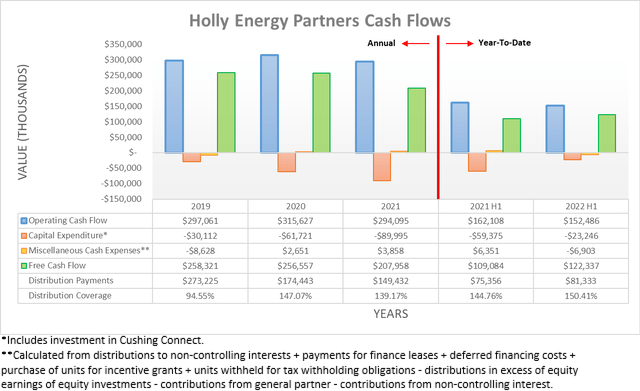

On the surface, their cash flow performance following the second quarter of 2022 appears lackluster given their operating cash flow for the first half was down 5.93% year-on-year to $152.5m versus $162.1m during the first half of 2021, despite being the first full quarter with contributions from their new Sinclair assets. Even if zooming into the second quarter of 2022 in isolation, their operating cash flow of $80.7m was barely any higher year-on-year versus their previous result of $80m during the second quarter of 2021.

Despite looking concerning, thankfully two moving parts beneath the surface skewed this comparison unfavorably. The first of which being their temporary working capital movements, which is a common culprit and if removed, sees their underlying operating cash flow for the second quarter of 2022 at $86.6m and thus 8.04% higher year-on-year versus their previous equivalent result of $80.2m during the second quarter of 2021.

Whilst already showing an improvement, this comparison was also skewed by their second quarter of 2022 results seeing significantly higher turnaround expenditure of $6.6m that was included within their operating cash flow, whereas their second quarter of 2021 results only saw a very minor amount of $0.5m. If removed along with their working capital movements, it sees their results for the second quarter of 2021 and 2022 at $80.7m and $93.2m respectively, which now represents an increase of 15.49% year-on-year and thus is near the approximate 20% boost expected when conducting the previous analysis.

If they continue seeing circa $90m per quarter of operating cash flow, once these temporary setbacks alleviate, it would annualize to circa $360m. They should translate the majority of this into free cash flow given their consistent barebones capital expenditure, which saw its highest point in recent history during 2021 at only $90m before falling back lower during the first half of 2022 to only $23.2m. Even if their high point of $90m was utilized to create a margin of safety, they would still be looking at generating circa $270m of free cash flow. Since their quarterly distributions of $0.35 per unit only cost $177m per annum given their latest outstanding unit count of 126,440,201, it sees strong coverage of circa 150%. Apart from making their distributions safe, it also leaves ample scope to fund higher distributions, which now appear to be on the horizon, as per the commentary from management included below.

“Looking to ’23 to your question about distribution growth, at this point, I think we would urge to increasing the distribution itself. We will evaluate buybacks, as you know, HEP is not the most liquid stock. So it’s not necessarily that we want to reduce the float, it may not be in the best interest of HEP, but if that’s a better option we will go ahead and do it, but right now, I’d say it’s going to take the form of distribution increases.”

-Holly Energy Partners Q2 2022 Conference Call.

It is very encouraging to see management clearly flagging that higher distributions are likely coming during 2023. Whilst the extent they grow their distributions remains to be seen, at least it was positive to see a preference for distributions instead of unit buybacks because in my view, the former provides a more tangible and quantifiable benefit.

Before moving onwards, it feels worthwhile to discuss another interesting topic that was discussed during their second quarter of 2022 conference call. Lately, there have been several similar Master Limited Partnerships being acquired by their parent companies, such as PBF Logistics (PBFX) most recently, which saw analysts asking if this same fate lays in their future too via a roll-up into their parent company, HF Sinclair (DINO). They did not completely rule out such an outcome one day in the future but nevertheless made it clear that it presently does not stack up due to their relative sizes, as per the commentary from management included below.

“And so far a roll-up has not made sense from that perspective. It’s probably worth pointing out here that HEP is relatively large, relative to HF Sinclair and that affects any sort of per share math you might do.”

-Holly Energy Partners Q2 2022 Conference Call (previously linked).

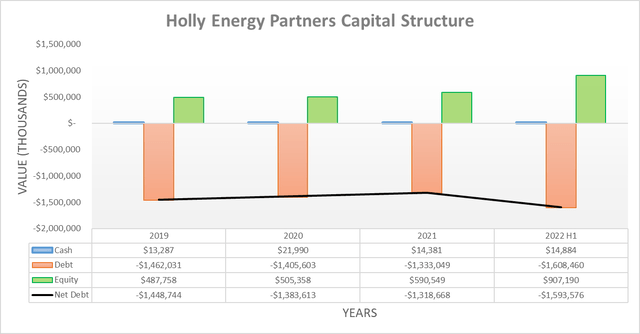

After seeing their net debt spike during the first quarter of 2022 to $1.619b on the back of their Sinclair acquisition, their free cash flow during the second quarter pushed it down to $1.594b following the second quarter. Even though this only represents a decrease of 1.59%, it nevertheless sees them trending in a positive direction for a modest mid-to-high single-digit decrease per annum. Since their strong distribution coverage sees a sizeable gap between the cost to fund their distribution payments and their free cash flow, they still have room to grow them without completely jeopardizing their deleveraging.

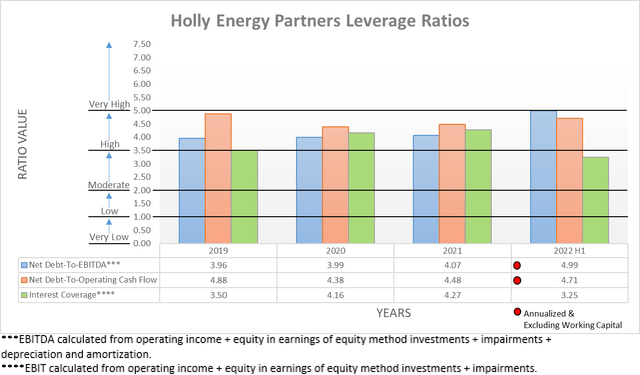

Now that the additional earnings from their new Sinclair assets started to flow through to their financial statements, it sees their leverage decreasing materially with their net debt-to-EBITDA dropping to 4.99 versus its result of 5.27 when conducting the previous analysis following the first quarter of 2022. As expected when conducting the previous analysis, this now sees their leverage out of the very high territory with their result landing below the threshold of 5.01, as also seen elsewhere with their net debt-to-operating cash flow at 4.71. When looking ahead, as they see more quarters with earnings from their new Sinclair assets and slightly lower net debt, their leverage should continue edging lower. Since high leverage does not necessarily endanger their solvency, their modest pace of deleveraging is not necessarily concerning and thus does not significantly impede their ability to grow their distributions.

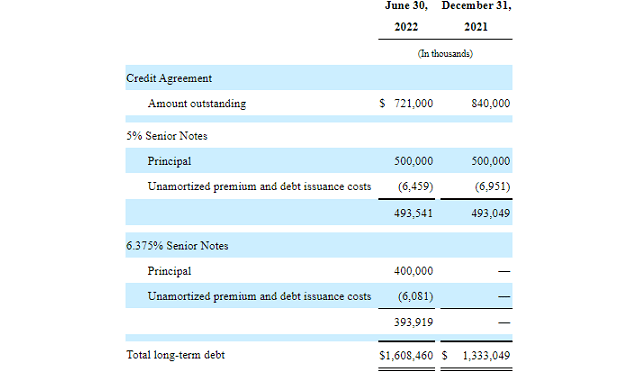

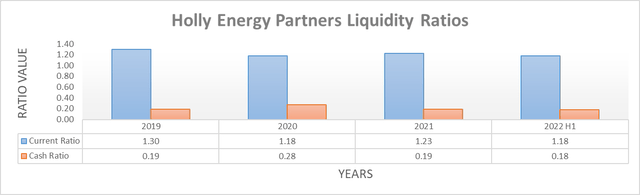

It was positive to see that they continue sporting strong liquidity with a current ratio of 1.18 and a cash ratio of 0.18, which help reduce the risks of their high leverage. As expected when conducting the previous analysis, they cleaned up their debt structure during the second quarter of 2022 through their 6.375% senior note issuance that effectively refinanced $400m of their credit facility, as the table included below displays. Apart from boosting their credit facility availability to $479m and thus buying more breathing room, it also extended their maturity profile with their new senior notes maturing in April 2027 versus July 2025 for their credit facility, whilst their 5% senior notes are not maturing until February 2028.

Holly Energy Partners Q2 2022 10-Q

Conclusion

The recent wave of takeovers across Master Limited Partnerships may had seen unitholders hoping for an easy payday, although this does not appear forthcoming, it was still very encouraging to see management flagging higher distributions are coming during 2023. Since they already offer a high distribution yield of 8%+ with strong coverage, it could be said that unitholders can still get an easy payday by simply sitting around waiting for their quarterly payments. When combined with the evidence of higher cash flow performance flowing from their new Sinclair assets that helped begin pushing their leverage lower, I now believe that upgrading to a strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Holly Energy Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment