andresr

Investment Thesis

My primary thesis for Digital Turbine (NASDAQ:APPS) is (1) it serves as a critical middleman between OEMs/operators and publishers, and (2) it owns the end-to-end digital supply chain from the demand-side platform (“DSP”) to an ad exchange to the supply-side platform (“SSP”) after their major acquisitions of Appreciate, AdColony, and Fyber. Once integrated, they can remove tons of inefficiencies in the supply chain and create multiple cross-sell opportunities to drive incremental revenue and margins.

In this article, I attempt to go through Digital Turbine’s 2Q23 earnings call and provide my thoughts on the quarter. In summary, the fundamentals are intact with Mobile Posse set to resume its growth in FY23, Single-Tap’s progress since 1Q23 is well on track, and the device distribution footprint continues to grow strongly. They are also looking to build new capabilities on AdColony and Fyber to drive more ad dollars, and more importantly, they displayed gross margin improvements and strong operating margin, which I believe can trend higher if things execute accordingly and growth re-accelerates in FY23. While valuation does look uncertain today, I believe there are uncertainties built into the valuation for good reasons.

On-Device Solution

APPS 10-Q

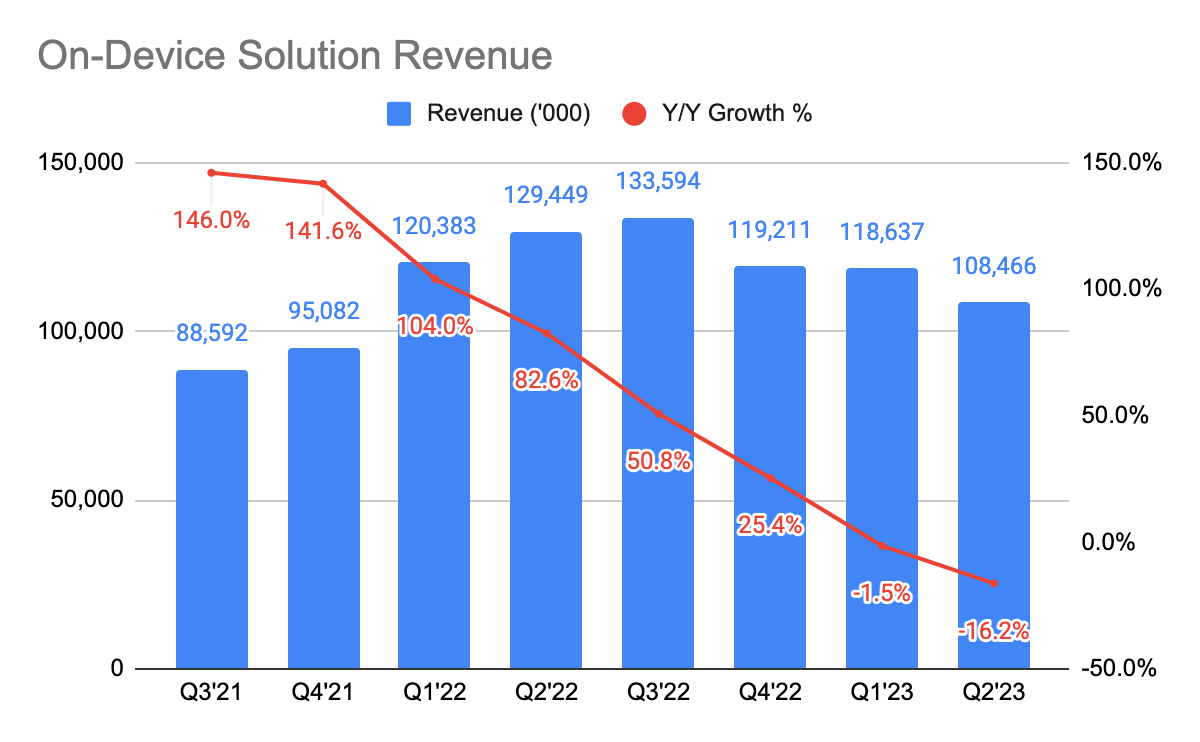

The 2Q23 revenue came slightly above the expected revenue guidance, and the Y/Y growth declined by 16.2%. This is a result of (1) management’s focus on gross margin improvements which led to lower revenue, (2) a decline in ad-spent due to macro, (3) weak content media or Mobile Posse revenue due to the shift in customer acquisition strategy.

During the 2Q23 earnings call, management disclosed that they had rolled out the postpaid content revenue product with Verizon (VZ) and, soon AT&T (T):

“We have launched our postpaid Verizon content native relationship and are now on 50 different device models. And as we ramp with Verizon expand with AT&T and focus less on this prepaid content revenue product, we expect our content media business to resume growth in 2023.”

APPS 10-Q

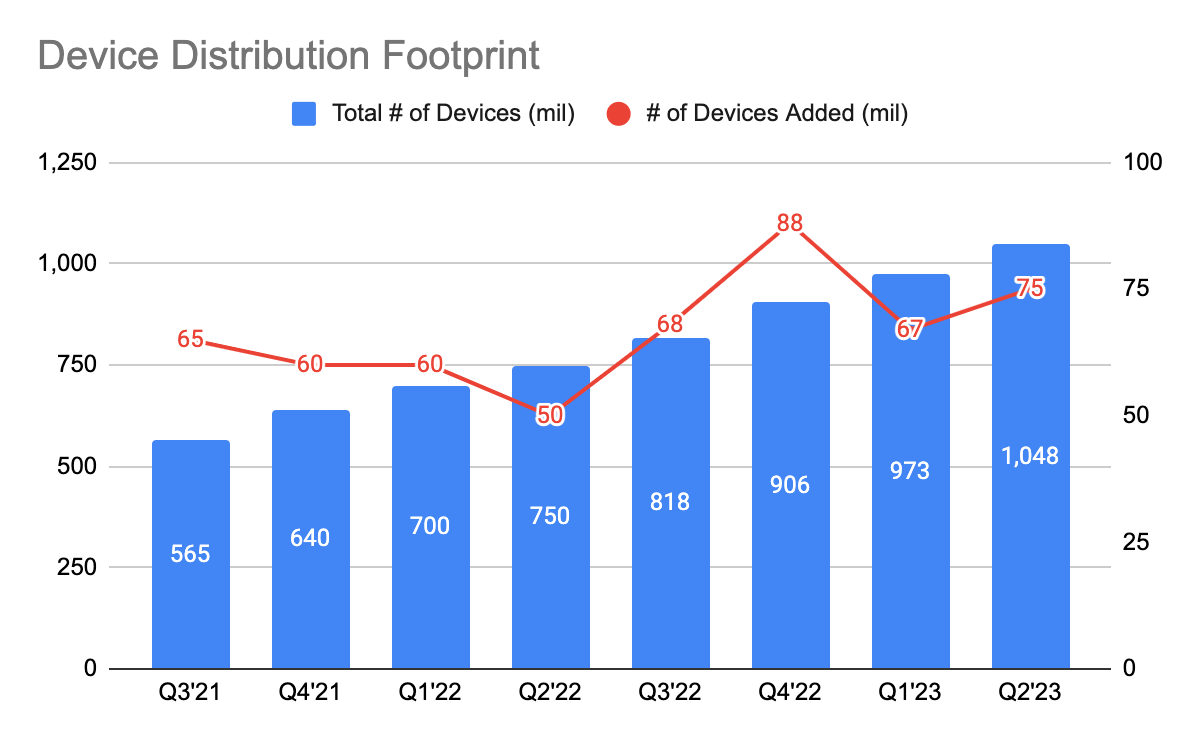

Partners continue to roll out more devices via Digital Turbine as it added 75 new devices, bringing it to a total of 1,048 devices as of 2Q23. The company is establishing itself as a critical partner for partners to monetize their devices.

Recall that in the previous earnings call, CEO Bill Stone stated that they are rolling out Single-Tap to 5 partners by 2Q23, and this quarter, they are on track to doing so. Furthermore, he mentioned that they had partnered up with Google (GOOG) (GOOGL) to sell the Single-Tap licensing product on the Google Cloud marketplace, with 2 additional high-profile partners expected in the next couple of quarters.

App Growth Platform

APPS 10-Q

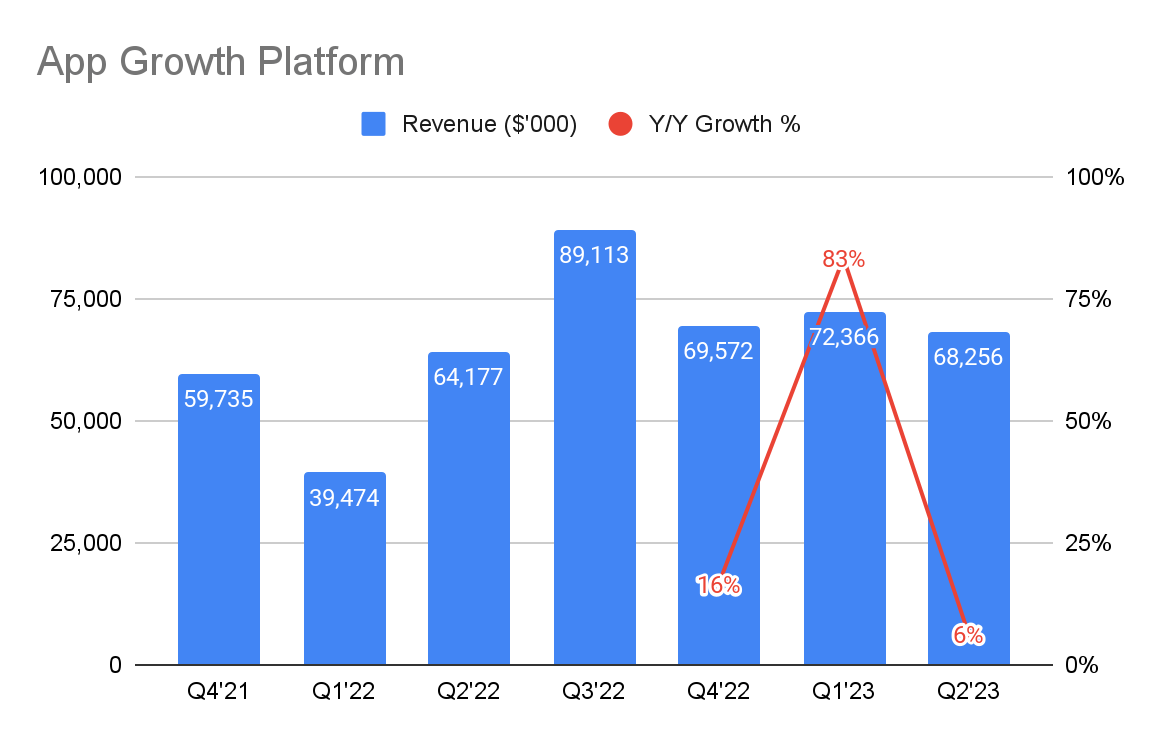

There is nothing much to touch on the app-growth platform, except that the revenue growth was rather weak, and the company is building new capabilities on AdColony and Fyber to drive more ad dollars:

“We want to build on that success and have been busy building many new capabilities that are just beginning to launch in the market and should serve as nice growth catalyst, and how we can cast a much wider net for the ad dollars that are out in the market.”

Profitability

APPS 10-Q

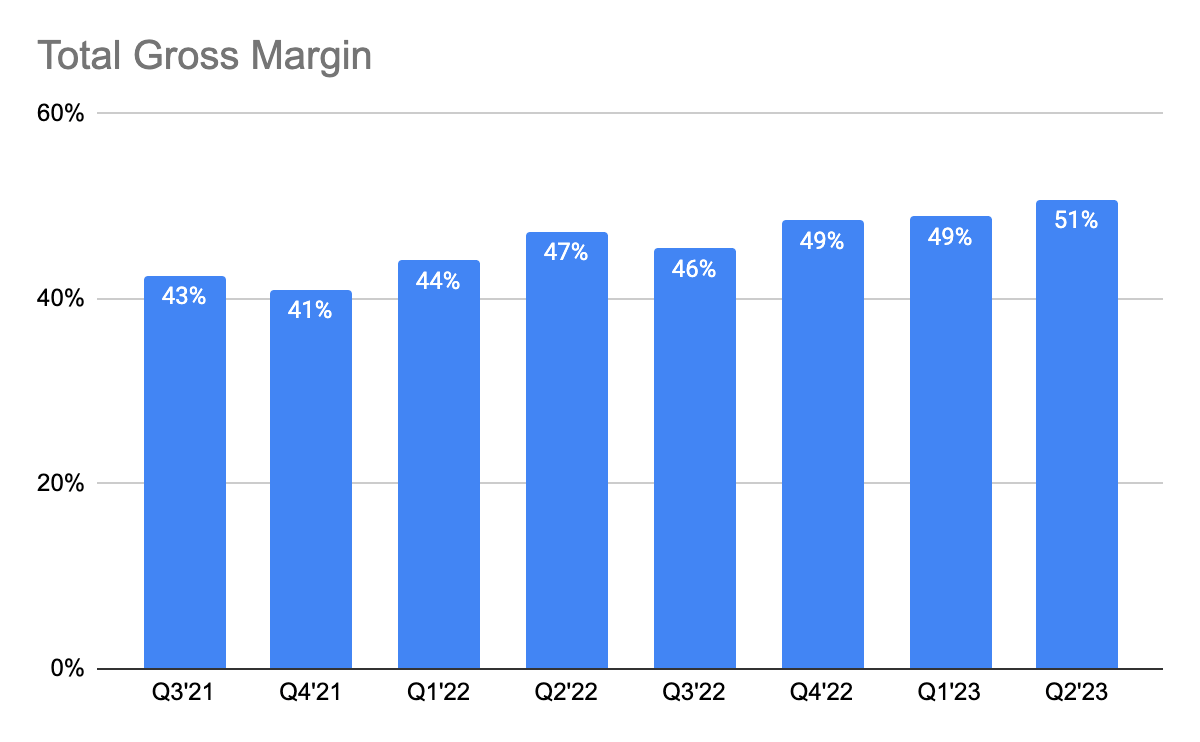

One of the highlights is the improvements in gross margins. Previously, management has decided to focus on gross margin improvements which will come at the expense of revenue trade-off. As accounting terms require the company to report its “revenue share and licensing revenue” as cost of revenue, its reported gross margin would have been the 66%. Given the asset-light business model of its app-growth platform, cost synergies, and growth reacceleration in FY23, I do think the gross margin can trend higher.

APPS 10-Q

APPS 10-Q

(Source: APPS 10-Q)

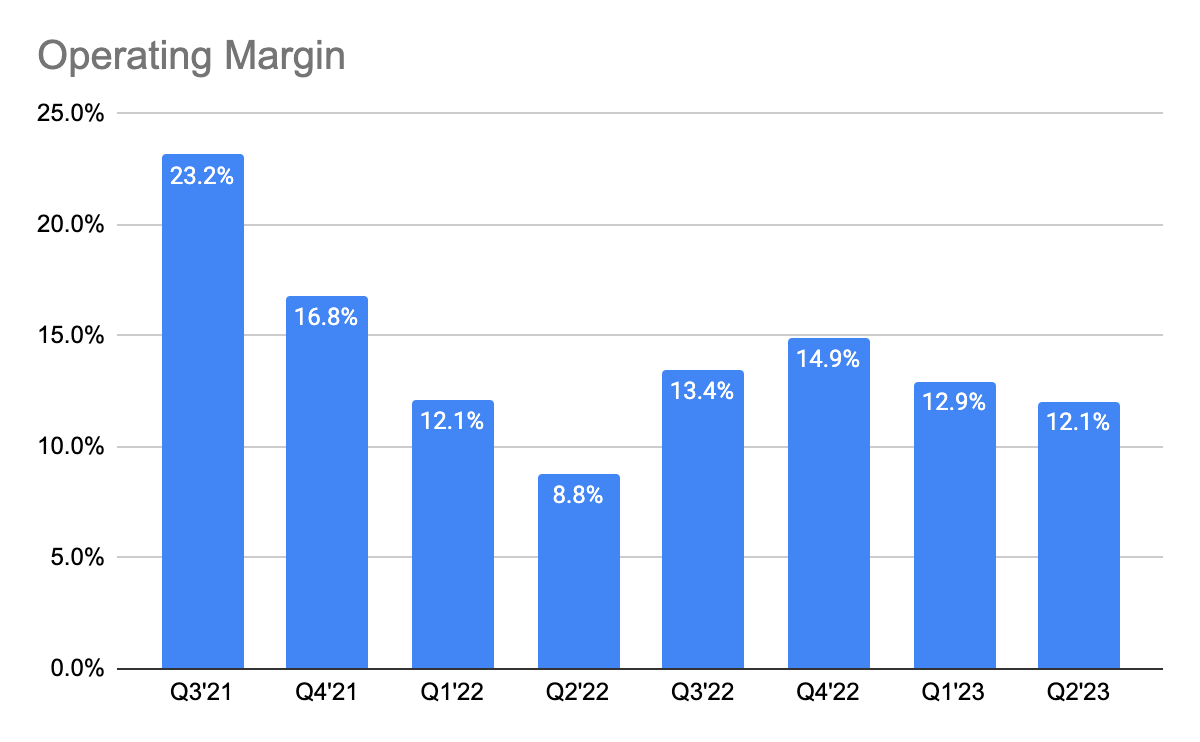

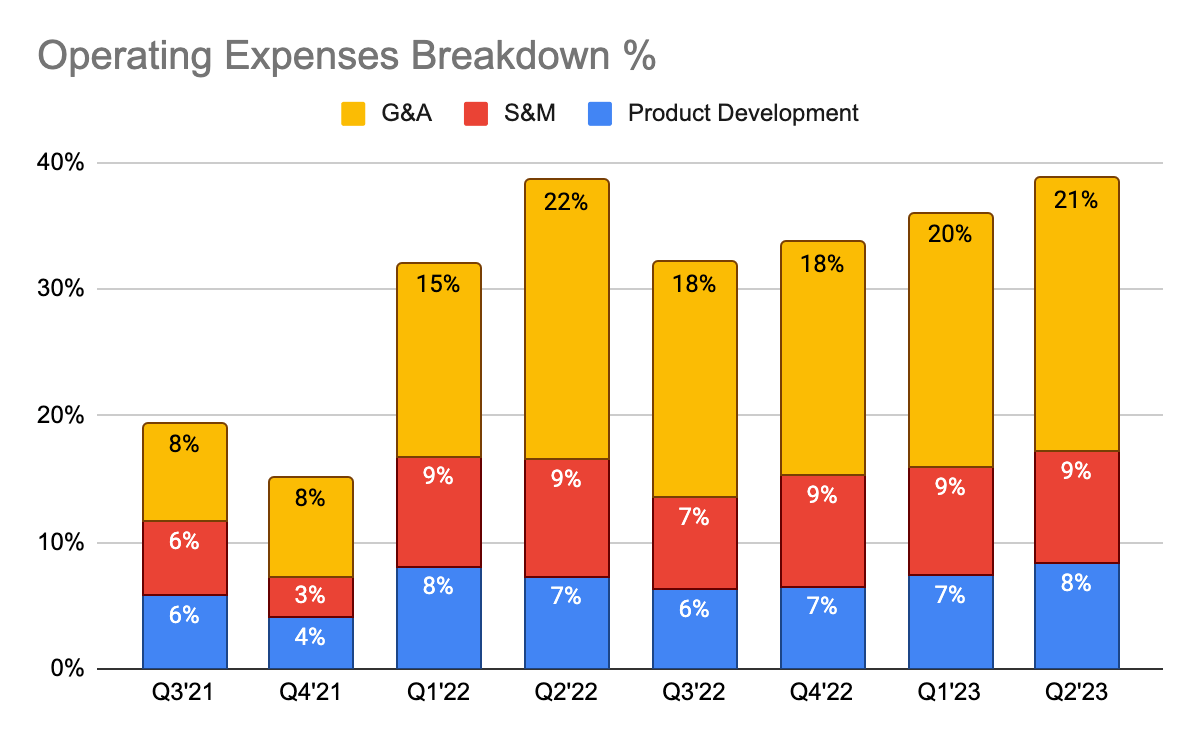

Instead of looking at adjusted EBITDA, I’d prefer to use operating margin as (1) it does not include stock-based compensation (“SBC”) and other one-off expenses such as transaction expenses, and (2) it only looks at profitability from the company’s operation. In my view, this is much simpler as opposed to looking at adjusted EBITDA.

Here, we see that its operating margin has declined sequentially to 12.1% from 12.9% in 1Q23, as a result of higher reinvestments as its operating expenses as a proportion of revenue increased during the quarter. Furthermore, the company’s profitability has certainly made it better positioned to invest for growth given the macro-environment. And as growth re-accelerates from FY23, its operating margin is likely to increase over time.

Valuation

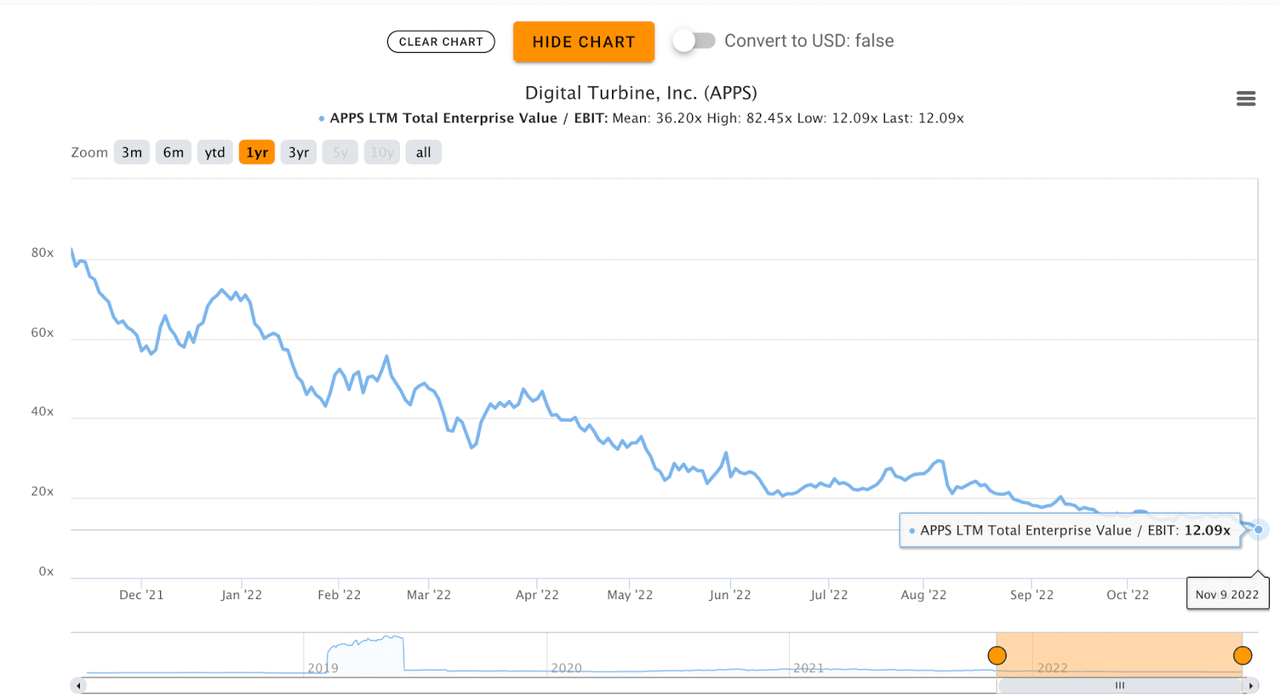

TIKR

Its current last 12 months EV/EBIT stands at 12.09x and given that growth is likely to reaccelerate in FY23, I certainly think that the valuation is reasonable today. On the other hand, though, I may argue that there are a few uncertainties that should be priced into the valuation including (1) the impact of macro on ad-spent in 2023, (2) the progress of Single-Tap (i.e. number of partners, revenue contribution), and (3) mobile posse rollout. Perhaps, investors looking for more clarity can consider waiting on the sidelines.

Conclusion

All in all, it was a rather great quarter for Digital Turbine given that Single-Tap’s progress is on track, the growing number of devices, and the rollout of the postpaid Mobile Posse product with Verizon and AT&T. As for the app growth platform’s (i.e. Fyber and AdColony) revenue growth was rather weak, but management is building new capabilities to drive higher ad dollars. Profitability wise, the company continues to be really strong, which is a strong advantage in the current macro environment. At the valuation today, I believe there are uncertainties priced into the valuation as investors are sitting on the sidelines while monitoring their execution.

What are your thoughts on the quarter? Let me know in the comment section below!

Be the first to comment