stockinasia

Thesis

The Walt Disney Company (NYSE:DIS) disappointed the market with a softer than expected Q4 quarter, and a somewhat gloomy outlook for future profitability. Intermittently losing as much as 15% during the trading day following the announcement, Disney shareholders needed to stomach the stock’s sharpest drops since 2001.

Although the earnings release is most certainly disappointing, investors should consider that most of the negativity is driven by a weak macro-economic environment. As I see it, Q4 results do not contribute any information that might hint on structural challenges – Disney’s wealth of intellectual property still leads the entertainment industry. And accordingly, long-term focused investors might consider buying the dip.

For reference, DIS stock is down about 49% YTD, versus a loss of 16% for the S&P 500 (SPY).

Disney’s Q4 Results

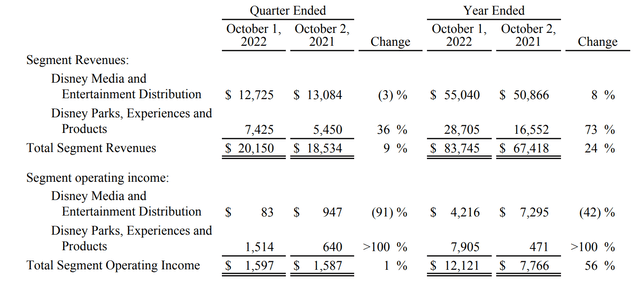

Disney’s Q4 2022 results disappointed against analyst consensus estimates: During the period from July to end of September, Disney generated total revenues of $20.25 billion, which compares to $18.5 billion for the same period one year earlier (9% year-over-year growth) and to approximately $21.5 billion estimated by analyst consensus ($1.25 billion miss). GAAP earnings per share came in at 9 cent, which is in line with Q4 2021 – but again, analyst consensus has expected earnings of about 35 cents (26 cents miss).

Disney’s disappointing results were driven by weaker- than-expected demand for the company’s “Parks and Experiences” – although sales for the segment jumped by 36% year-over-year, to $7.4 billion. Moreover, while the DTC streaming platform performed strongly, adding 14.6 million total subscriptions (of which 12.1 are attributable to Disney+), profitability for the streaming remained out of reach.

Disney’s CEO Bob Chapek commented:

2022 was a strong year for Disney, with some of our best storytelling yet, record results at our Parks, Experiences and Products segment, and outstanding subscriber growth at our direct-to-consumer services, which added nearly 57 million subscriptions this year for a total of more than 235 million

Peak Losses For DTC Streaming?

In Q4 2022, losses for Disney’s DTC business expanded to $1.47 billion, versus a loss of $0.63 billion for the same period one year earlier. According to management commentary, the deteriorating profitability was driven primarily by higher losses at Disney+, and to a lesser extent by worse than expected results at Hulu and ESPN+ (so all streaming verticals performed below Q4 2021).

But Disney has also said that the company expects losses to “narrow” going into 2023. And if the macro environment doesn’t deteriorate further, management is aiming for DTC segment profitability by 2024.

In my opinion, an increased focus on profitability is the right strategic move. Investors should consider that with 235 million subscriptions, Disney’s streaming empire (including Disney+, ESPN+ and Hulu) has already overtaken Netflix (NFLX), which reported 223 million subscribers a few weeks ago.

But in any case, profitability for the DTC segment is likely to be lower/or similar than what the cable business offers. In my opinion, it is reasonable to assume an operating margin for the segment close to 10% by 2025 – but very unlikely higher.

Not Recession-Proof

Like many of the world’s best businesses, Disney is not fully recession-proof. And a softer than expected Q4 quarter has added to concerns that Disney’s short-/mid-term financial performance might be less stellar than hoped.

However, management has highlighted a few levers that might support better profitability even in a recessionary environment. For example, the company has voiced plans to increase the ad-free subscription for Disney+ to $11, up from $8 prior. Similar price increases are expected across the board for Disney’s entertainment parks. Moreover, Disney is evaluation options to realize “meaningful efficiencies,” which would likely imply OPEX discipline through restructuring and (perhaps) employee layoffs.

Target Price Estimation

To derive an estimate of a company’s fair implied valuation, I am a great fan of applying the residual earnings model. This anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

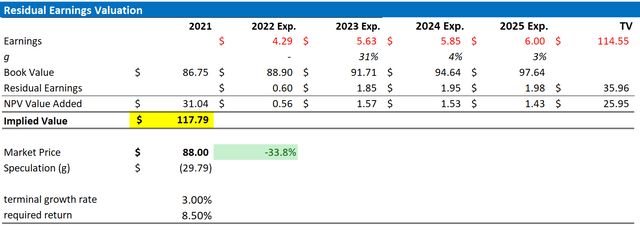

With regard to my Disney’s stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on Disney’s cost of equity at 8.5%.

- For the terminal growth rate after 2025, I apply 3%, which is about one percentage point higher than global nominal GDP growth, and thus quite conservative in my opinion.

Given these assumptions, I calculate a base-case target price for DIS of about $117.79/share.

Analyst Forecast, Author’s Calculation

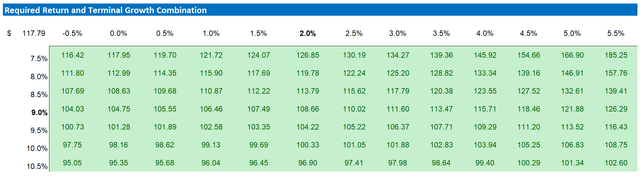

My base case target price does not calculate a lot of upside. But investors should also consider the risk-reward profile. To test various assumptions of cost of equity and terminal growth rate, I have constructed a sensitivity table. Note that the matrix looks very favorable from a risk/reward perspective.

Analyst Forecast, Author’s Calculation

Conclusion

It is not often that Disney misses on both revenues and earnings. And the aggressive stock price reaction post Q4 underscores this argument.

Although I acknowledge Disney’s (temporary) challenges – which includes also the closure of Shanghai Disneyland with absolutely no certainty regarding a reopening soon – I would like to point out that most headwinds for Disney are caused by the macro-environment, not by company-specific challenges.

Given that Disney remains the “king” of content, and has recently also captured the crown of streaming, I advise investors to remain confident that Disney stock will rebound. Personally, I value DIS stock at $ 117.79/share. My price target is anchored on a residual earnings valuation with analyst consensus EPS as the main input. I reiterate a “Buy” rating for Disney stock.

Be the first to comment