WangAnQi

A few months ago, I wrote an article on the Global X Uranium ETF (NYSEARCA:URA) giving an overview of the fund as well as fundamental reasons to be bullish on uranium for the long-term. I saw two macro drivers to be bullish: 1) nuclear power has much lower carbon emissions than fossil fuels, and 2) after Russia’s invasion of Ukraine, governments around the world will be reassessing their energy security.

The latest Japanese announcement for concrete plans by year-end for their nuclear sector reinforces my bullish arguments above. Increasingly, governments are coming to the realization that nuclear power is the most sustainable way to achieve their green energy initiatives and maintain energy security.

Japan Returns To Nuclear

Overnight, we got news that Japan is returning to nuclear power to secure its energy supply. Importantly, not only is Japan looking to restart idled reactors, but it is looking to build new reactors. The prime minister has tasked officials to come up with concrete plans for the nuclear sector by the end of the year.

According to a Financial Times article on the subject:

“As a result of Russia’s invasion of Ukraine, the global energy situation has drastically changed,” Kishida said on Wednesday. “Whatever happens globally, we need to prepare every possible measure in advance to minimise the impact on people’s lives.”

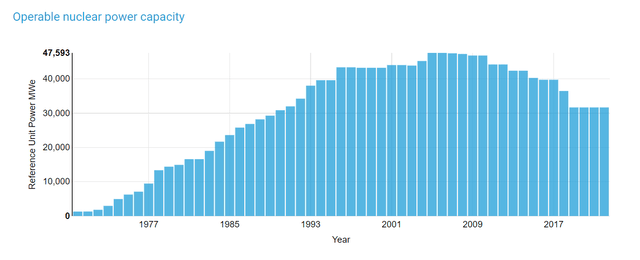

Japan Has One Of Largest Operational Fleets

Recall, Japan has one of the largest fleet of operational nuclear reactors (Figure 1). However, since the Fukushima disaster, only 10 of the 33 operational reactors have been restarted. If Prime Minister Kishida can credibly offer a path to restarting the idled reactors and build new reactors, expect a tightening of the uranium supply/demand balance in the coming years.

Figure 1 – Japanese nuclear reactor fleet (world-nuclear.org)

Prices Have Stalled; Japan Could Be Spark

After a wild rally in the immediate days after Russia’s invasion of Ukraine, the uranium price has settled to just below $50/lb U3O8. We expect this announcement from the Japanese prime minister to spark some momentum in uranium prices, and hence uranium equities.

Figure 2 – Uranium prices stalled (tradingeconomics.com)

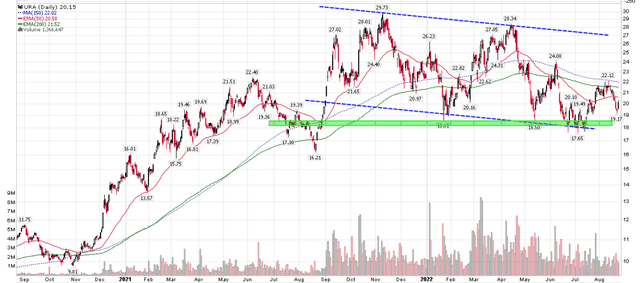

Technical Picture Has Improved

In my last article, I highlighted $18-19 as the key support zone for the URA ETF. Price tested the zone multiple times, ultimately holding and rallying off it (Figure 3). At the current juncture, unless support breaks, I am expecting URA to trade back to the higher end of the broad consolidation zone between $19 to $27.

Figure 3 – URA technical picture has improved (Author created with price chart form stockcharts.com)

Risks

Risks to the uranium bull thesis remains; obviously another black swan nuclear accident could derail many restart plans (note Russia was perilously close to starting one when it attacked Ukraine’s nuclear power stations in the early days of the invasion).

Also, as we had highlighted before, URA contains significant exposures to uranium developers (29%) which depends on well-functioning capital markets. If capital markets suffer large drawdowns, the URA will not be immune.

Finally, URA has 21% invested in a single security, Cameco (CCJ). Recently, when Kazamtomprom announced plans to increase production, uranium equities, including CCJ, took a severe hit. If Japan were to restart idled reactors, that should go a long way to boost demand and allow CCJ to restart its McArthur River mine next year without causing large price dislocations.

Conclusion

The latest Japanese announcement for concrete plans surrounding the nuclear industry by year-end reinforces my bullish stance on the uranium sector. I believe more and more governments around the world will come to the conclusion that nuclear power is the most sustainable way to achieve their green energy initiatives and maintain energy security.

Be the first to comment