jax10289/iStock Editorial via Getty Images

Beyond any doubt, one of the most iconic names in the restaurant space, at least as far as the U.S. market goes, is Denny’s (NASDAQ:DENN). With diners that are often open 24 hours a day, seven days a week, serving breakfast, lunch, and dinner offerings all day long, the company has become a staple for those who are on the go. Due to some fundamental peculiarities, this year has proven to be rather interesting for the company. At first glance, revenue and profits are rising nicely. The revenue picture is definitely an accurate portrayal of the company’s health, but when you dig deeper into the profit figures, you find that things aren’t exactly as great as they look to be. Ultimately, the restaurant chain is far from being a bad prospect. But given that it continues to shrink its physical footprint, I do believe that there are better opportunities for investors to consider.

Not as tasty as it looks

Back in early June of this year, I wrote an article that took a rather neutral stance on Denny’s. In that article, I talked about how the company had struggled over the prior few years, with sales falling as the number of locations the company had an operation dropped. At that same time, however, I did also acknowledge that the company had been showing signs of recovery and I also said that shares were not unreasonably priced. This all combined to help me form the opinion that the stock probably did offer some upside potential. But at that moment, I still felt as though it was too early to be bullish about the firm. So as a result, after finding myself teetering on the edge between rating it a ‘hold’ and a ‘buy’, the first to denote my opinion that the stock should more or less match the market’s return moving forward, while the second to denote that it should outperform the broader market, I opted for the former out of an abundance of caution. From a strictly share price perspective, it seems as though I was a bit too bearish. While the S&P 500 is up by 1.3% since that time, shares of Denny’s have generated a return of 23.1%.

This return disparity stems from continued top line growth achieved by the business. We need only consider how the company performed during the third quarter of its 2022 fiscal year. Sales during that time came in at $117.5 million. That’s 13.2% higher than the $103.8 million generated the same time last year. What is really remarkable is that this growth came even as the number of Denny’s locations in operation dropped, falling from 1,647 to 1,613. During this time, the number of company-owned Denny’s units increased from 65 to 66, while the number of franchised units fell from 1,582 to 1,547. Units that are owned by the company do bring in greater sales for it than franchised units do. In addition to that, the company also benefited from a 7.1% increase in same-store sales associated with company-owned locations and from a 1.1% increase in domestic franchise same-store sales. The other key driver behind the company’s growth was its acquisition of Keke’s Café for $82.5 million. That brought 53 locations onto the company’s portfolio, 8 of which are company-owned, with the remaining 45 being owned by franchisees.

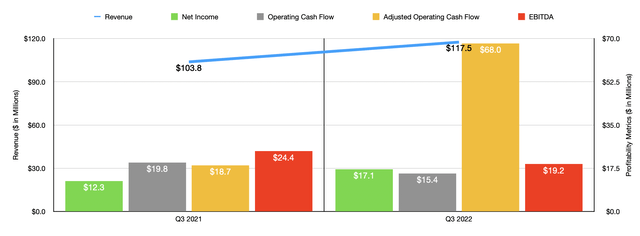

All of this is pretty straightforward. But where things start to get tricky is when you look at bottom line results. Net income, for instance, rose nicely year over year, climbing from $12.3 million in the third quarter of 2021 to $17.1 million the same time this year. Operating cash flow, however, dipped from $19.8 million to $15.4 million. Over that same window of time, the adjusted figure for operating cash flow, which excludes changes in working capital, skyrocketed from $18.7 million to $68 million, while EBITDA fell from $24.4 million to $19.2 million. It’s not uncommon to see some variation in these results. But it is uncommon to see such wild swings. Digging deeper, we did find some problems. For instance, product costs for the company grew from 24.6% of sales to 27.7%, while payroll and benefits expenses rose from 37.5% to 38.6%, and the cost of franchise and license revenue grew from 47.9% of sales to 53%. Fortunately, this was offset some by reduced general and administrative costs. But that alone was not enough to offset the aforementioned issues. Instead, the company benefited to the tune of $10.5 million from what management calls ‘other non-operating income’. This was up from the $2.4 million reported one year earlier. This change was mostly related to gains associated with valuation adjustments for designated interest rate hedges that the company has on its books. Because of the nature of these swaps, I do think the most appropriate valuation metric to pay attention to for the bottom line for Denny’s would be its EBITDA since it removes this from the calculation.

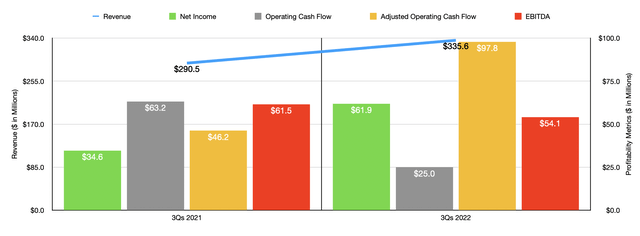

Results for the third quarter of 2022 look a lot similar to how the company performed for the first nine months of the year as a whole relative to the same nine months of last year. Revenue rose from $290.5 million to $335.6 million. Over that same window of time, profits jumped from $34.6 million to $61.9 million. However, cash flow dropped, declining from $63.2 million to $25 million even at a time when the adjusted figure for this more than doubled from $46.2 million to $97.8 million. And, once again, EBITDA for the company took a step back, declining from $61.5 million to $54.1 million. Just as was the case in the third quarter, this special line item for the company played a role in performance for the first nine months as a whole, amounting to gains of $52.7 million in total. Without this, profit figures would have been less appealing than they were.

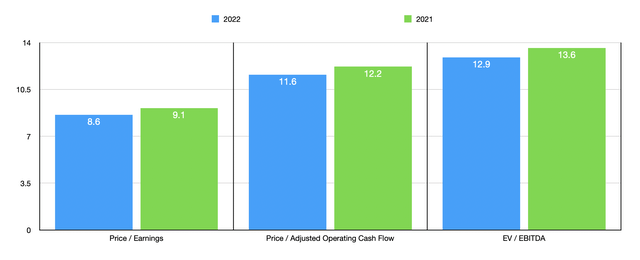

Although management only recently reported results for the third quarter, they did say that domestic systemwide same-store sales for the fourth quarter should grow by between 1% and 3%, while EBITDA should come in at between $21 million and $23 million. If we take this year’s EBITDA compared to last year’s and assume that normalized profits and cash flows would follow a similar trajectory, we would get net income of $82.3 million and adjusted operating cash flow of $61.2 million. This all would imply a forward price to earnings multiple in the company of 8.6, a forward price to adjusted operating cash flow multiple of 11.6, and a forward EV to EBITDA multiple of 12.9. By comparison, using the data from 2021, these multiples would be 9.1, 12.2, and 13.6, respectively. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 15.4 to a high of 745.7. Of the companies with positive results, our prospect was the cheapest of the group. Using the price to operating cash flow approach, the range was from 9.3 to 27.1. In this scenario, only one of the five was cheaper than our target. And finally, using the EV to EBITDA approach, the range was from 9.1 to 120.7. In this case, three of the five companies were cheaper than Denny’s.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Denny’s | 8.6 | 11.6 | 12.9 |

| Ruth’s Hospitality Group (RUTH) | 15.4 | 9.3 | 9.3 |

| BJ’s Restaurants (BJRI) | 745.7 | 13.7 | 14.1 |

| Chuy’s Holdings (CHUY) | 24.9 | 13.3 | 9.4 |

| El Pollo Loco Holdings (LOCO) | 18.8 | 12.3 | 9.1 |

| Kura Sushi (KRUS) | N/A | 27.1 | 120.7 |

Takeaway

Based on what data we have at our disposal, we are seeing some nice improvements for Denny’s. Sales continue to grow thanks to stronger comparable store sales and the aforementioned acquisition management completed. I still don’t like to see a decline in organic locations year over year. To me, that is a long-term problem for the company that needs to be corrected. From a valuation perspective, I wouldn’t say that shares are unreasonably pricey at all. But given the volatility the company is experiencing from a fundamental perspective, I still don’t feel comfortable rating at any higher than a ‘hold’ at this time.

Be the first to comment