spooh

Inflation is ravaging and it poses a formidable challenge for dividend investors. Companies that raise their distributions and have recession-resistant growth profiles offer dividend investors a solution to this economic problem. Magellan Midstream Partners (NYSE:MMP) generates a considerable amount of distributable cash flow from its diversified energy operations and the midstream firm has fee-protected cash flows. The midstream company supplies both distribution growth as well as a high yield and the units are selling at an attractive P/DCF ratio!

Magellan Midstream: A fee-based operating model that generated predictability

Magellan Midstream is a publicly traded partnership that operates in two core businesses: refined products and crude oil. The midstream firm owns 9,800 miles of refined petroleum products pipelines as well as 54 connected terminals and 47 million barrels of storage capacity. The refined petroleum business, which mainly consists of the transport of gasoline and diesel fuel for a fixed price, is complemented by 2,200 miles of crude oil pipelines. About 72% of the firm’s operating margin in FY 2022 came from refined products while the other 28% come from its crude oil operations.

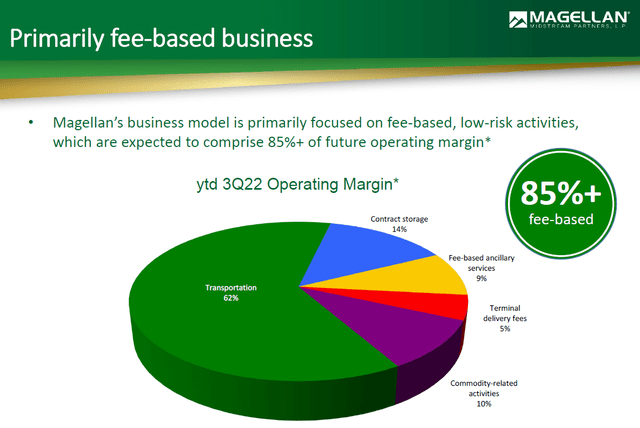

The key benefit to investing in a midstream business like Magellan Midstream is that they, unlike producers, don’t rely as much on market prices. Magellan Midstream chiefly operates on the basis of fee-based contracts which remove commodity price risk and result in highly predictable cash flows for the midstream firm and its unitholders. About 85% of the firm’s cash flows are supported by fee-based contracts.

Source: Magellan Midstream Partners

Predictable cash flows and good distribution coverage

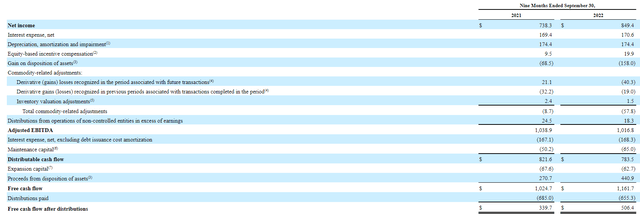

The fee-based nature of Magellan Midstream’s business results in predictable and fairly low-risk distributable cash flows for the midstream firm. Distributable cash flow is the cash flow available for distribution to unitholders after maintenance capital spending.

Magellan Midstream’s business operations generated $783.5M in distributable cash flow in the first nine months of FY 2022. The firm paid out $655.3M in distributions in the first nine months of the year which calculates to a comfortable distribution coverage ratio of 1.2 X. Magellan Midstream has said that it targets at least an annual distribution coverage ratio of 1.2 X for the foreseeable future as well. Considering that the midstream firm expects $1.1B in distributable cash flow this year (see next section), Magellan Midstream’s distribution for FY 2022 is covered by an expected factor of 1.25 X.

Source: Magellan Midstream Partners

Raised guidance for FY 2022 and DCF-based valuation

Magellan Midstream raised its FY 2022 guidance for distributable cash flow by $10M to $1.1B due to the firm seeing good momentum in its business in the third-quarter. Magellan Midstream currently has a market cap of $10.6B, meaning $1.1B in expected distributable cash flow translate to a P/DCF ratio of 9.6 X. Kinder Morgan (KMI), a rival in the midstream business, trades at a P/DCF ratio of 8.9 X. I like both Magellan Midstream and Kinder Morgan and believe both companies could out-perform the broader stock market in a high-inflation world due to the delivery of predictable distribution growth. You can read why I like Kinder Morgan here.

Distribution growth

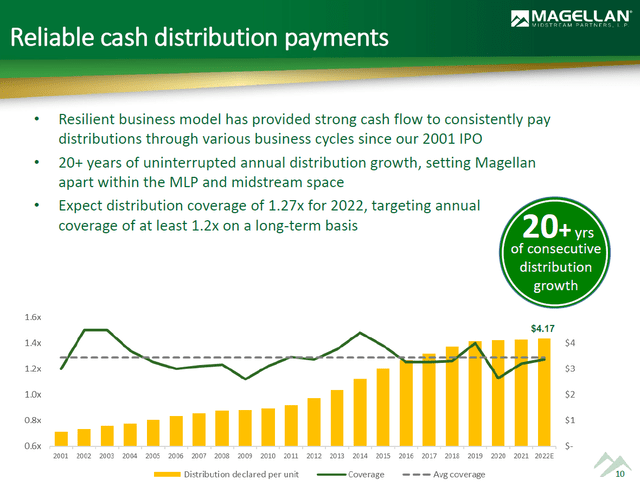

Magellan Midstream is a distribution champion because the company raised its unit distribution consistently over many years. The most recent raise was just announced in October and it proves Magellan Midstream’s commitment to distributing the majority of its distributable cash flow to unitholders. Distribution growth is also a welcome offset to inflation which is weighing on investors.

Magellan Midstream raised its distribution to $1.0475 per unit, showing a 1% increase over the previous rate. On an annualized basis, units of MMP now pay a 8.1% yield. Magellan Midstream has a very long history in delivering distribution growth for its unitholders: for more than two decades Magellan Midstream has raised its distribution, and based off of the latest increase, the total distribution has been raised a massive 698% since the firm’s IPO in 2001.

Source: Magellan Midstream Partners

Risks with Magellan Midstream

The biggest risk for Magellan Midstream, as I see it, is the regulatory environment which has become more hostile to companies active in the fossil fuel industry. If midstream companies are unable to expand their pipeline networks and their transportation capabilities are curtailed, Magellan Midstream may see slower distributable cash flow growth and a lower valuation factor as a result going forward. Commodity price risk, on the other hand, is not a big risk factor for the firm since most of its contracts are based on fees.

Final thoughts

Magellan Midstream has a growing distribution, fee-based and highly predictable cash flows and strong distribution coverage. For those reasons, I believe that the midstream firm is a very defensive investment for dividend investors and that it could out-perform in both a high-inflation market as well as a recessionary environment. The midstream firm has a well supported distribution and the valuation factor based off of distributable cash flow is very reasonable considering that the units pay a high distribution yield of 8.1%!

Be the first to comment