Sergey Pakulin/iStock via Getty Images

Long ago, we were calling attention to the value of bottled water and beverages, because they enrich food industry companies. We noted pleas from activists for freshwater public ownership, government management, and community empowerment over water choices. Corporate leaders argue the private sector can better manage limited freshwater resources, for they have profit incentives.

Warning Signs

Zurn Elkay Water Solutions Corporation (NYSE:ZWS) is a stock to watch. Zurn operates in an essential industry. The company specializes in modernizing water delivery systems and solutions. Its market cap of $5.24B makes it a noteworthy player among its peers, almost all of which get a bullish rating from analysts.

Every drop of fresh water needs to be delivered effectively and efficiently. Drops cannot afford to be wasted. Water prices are shooting up as is the cost of delivering fresh water; droughts are threatening supply, and America’s infrastructure is aging. Think Flint and, as you read this, the turmoil over growing water shortages in Western states.

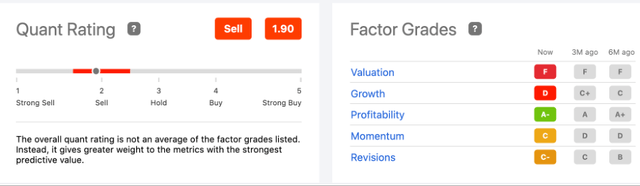

Zurn Elkay’s numbers are not strong. We believe there is a potential opportunity but not without significant risk of the stock performing badly. Seeking Alpha issued a red warning recently. Seeking Alpha’s Quant Rating is notably slipping toward the “strong sell” side. Factor Grades have not improved over the past six months. According to S A, the stock’s characteristics are

historically associated with poor future stock performance. ZWS is overpriced and has declining growth when compared to other Industrials stocks, to the point that it gets a Sell rating from our Quant rating system. Stocks rated Sell or worse by our Quant rating system have massively underperformed the S&P 500… The company has Price / Cash Flow (TTM) of 75.66 while the Industrials sector median is 16.47.

Quant Rating/Factor Grades ZWS (seekingalpha.com/symbol/ZWS/ratings/quant-ratings)

The stock can be volatile. The shares tend to be sensitive to market fluctuations. Its Beta is 1.24, and there is widespread concern about the company’s valuation. Based on the company’s historical multiples, past financial performance, and analysts’ projections of future earnings, Zurn Elkay sports a high valuation at over $29.

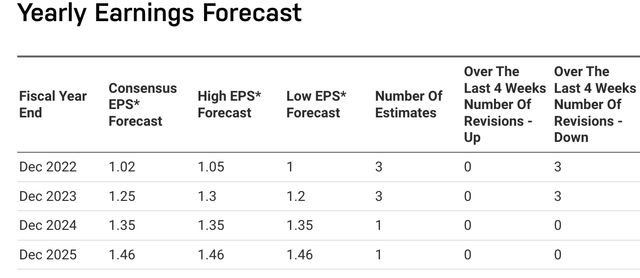

We conclude its true current value is about $19, that’s down around one-third from the current share price. The EPS last year for Q3 was $0.55. We expect the EPS for the Q3 ’22 to be only a quarter and between $1.02 and $1.05 for FY ’22. They scheduled the next earnings report for release near the end of October. Overall, Zurn Elkay does not fully quench our thirst for a water stock investment.

Positive Signs

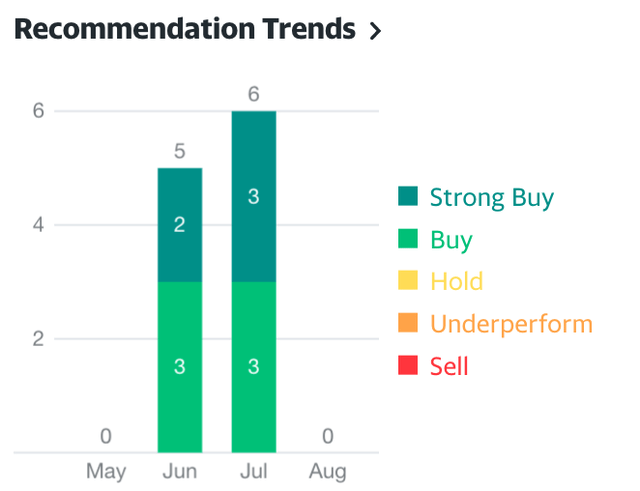

Zurn operates in an essential industry for which the future is bright but changing. We are moderately bullish about the future of the stock, especially on any dip in the price. In our opinion, Zurn Elkay is a well-managed global company able to meet the growing demands of delivering clean water. Top managers are working at the company for over ten years and know the industry. Perhaps, surprisingly, there is positive sentiment for the stock in the financial community.

The consensus among Wall Street Analysts is a “strong buy.” Three out of five S A authors this year are bullish. Two others expect Zurn Elkay to underperform and rate the stock a “hold.”

Though the share price tumbled nearly 20% since the beginning of the calendar year, shares are +2.7% over the last 52 weeks. They jumped +161.2% over the past five years. Earnings forecasts appear good.

Zurn Elkay Earnings Forecast (nasdaq.com/market-activity/stocks/zws/earnings)

Carrying the Water

Zurn Elkay Water Solutions Corporation designs water systems in and around non-residential buildings. The company manufactures and installs them. Services include finish plumbing, drainage and interceptors, water control and backflow, fire protection, PEX pipe fittings and accessories, and repair parts.

Zurn Elkay installs hand and hair dryers, and baby changing stations (World Dryer). The company sells stainless steel fixtures under the Just Manufacturing brand name for food services, government, healthcare, hospitality, institutional, and residential markets. Zurn Elkay Water Solutions Corporation was re-incorporated in 2006 but is in business for 120 years. Its headquarters is in Milwaukee, Wisconsin.

Quarterly Highlights

- On July 1, 2022, Zurn Elkay Water Solutions completed the acquisition of Elkay Manufacturing Company, a market leader on commercial drinking water systems.

- After the acquisition, net sales in Q2 ’22 increased 17% to $284 million compared to $244 million in the same quarter last year.

- Organic growth was +15% plus +2% from acquisitions.

- Net income popped to $36 million (diluted EPS from continuing operations of $0.28) compared to $21 million (diluted EPS from continuing operations of $0.17) Y/Y.

- Adjusted EBITDA(1) was $64 million (22.6% of net sales) compared with $56 million (22.8% of net sales) Y/Y. SG&A fell from $1§0M to $7M.

- The quarterly dividend was raised from $0.03 per share to $0.07 per share.

- Net debt leverage of 2.0x as of June 30, 2022.

In March 2020, Zurn Elkay’s debt hit $1.44B. The company paid down the debt to $537.3M ending June 29, 2022, but the net debt-to-equity ratio is a high of 186.1%. Debt is not well-covered by operating cash flow, in our opinion. The company holds ~$110.4M in cash and equivalents, including $209M in receivables.

The current dividend yield, 0.40%, is not especially attractive to investors. The yield falls significantly below the sector average of 1.6% yield. Top management is on board for more than a decade each; they buy and sell shares with no notable trend.

Hedge funds increased their holdings in each of the two previous quarters. Hedge fund added 364.7K shares during the last quarter.

Plugging the Holes

The demand for clean water products and services that Zurn Elkay Water Solutions Corporation offers is drastically increasing. Companies like Zurn Elkay make the difference between demand and supply. Otherwise, community life devolves, crises spawn, and tensions grow.

The company forecasts earnings and revenue will be higher over the next three fiscal years:

- In FY ’22, revenue is forecast to be +47.8%.

- It is forecast to rise another 31.5% in FY ’23.

- By 2024, revenue has the potential to top $1.8B.

Earnings are forecast to grow by +25% per year. The average share price target over the next 12 months is $34 per share. That is an increase of around 11%.

Sentiment (finance.yahoo.com/quote/ZWS?p=ZWS&.tsrc=fin-srch)

Management has to plug the financial holes leaking money. They must creatively deal with the debt, and cover the dividend and interest payments. The path is open since net profit margins rose to 8.6% from 5.3% Y/Y. Elkay was a big deal to Zurn, resulting in a one-off and shareholder dilution of 46.8% growth in outstanding shares. The sentiment is strong; management can turn this around, and we think retail investors with a healthy risk tolerance should look closely through any muck for clear water signs relative to ZWS shares.

Be the first to comment