Andrii Dodonov

A Quick Take On AvidXchange

AvidXchange Holdings, Inc. (NASDAQ:AVDX) reported its Q3 2022 financial results on November 2, 2022, beating expected revenue and EPS estimates.

The company provides enterprises with cloud-based accounts payable and cash flow management software.

While AVDX has increased forward guidance and beaten previous guidance recently, I’m more cautious about its outlook in 2023 due to macroeconomic risks.

I’m on Hold for AVDX for the near term.

AvidXchange Overview

Charlotte, North Carolina-based AvidXchange was founded to develop a cloud-based AP accounting and payments system aimed at middle-market companies and their suppliers.

The AP system offered by AvidXchange provides real-time visibility into payable cycles and helps reduce manual processes. It automates payments, invoicing and reconciliation, and provides secure payment solutions, tagging and analytics capabilities.

The system also simplifies the process of creating, sending, and tracking invoices, while helping businesses to optimize their cash flow.

Management is headed by co-founder, Chairman and CEO Michael Praeger, who has been with the firm since inception and was previously co-founder of PlanetResume and InfoLink Partners.

The company’s primary offerings include:

-

AP Automation Software

-

AvidPay Network

-

Cash Flow Manager.

The company’s direct sales and marketing approach includes sales visits, attendance at industry conferences and trade shows, email campaigns, direct mail and telemarketing. Indirectly, the firm works with independent resellers that build relationships with their own customers.

AVDX also sells through third-party software providers like RealPage, MRI Software and SAP Concur.

These third-party software providers are integrated with the company’s systems, allowing buyers to purchase products more easily and with more detailed information regarding the product and pricing.

AvidXchange’s Market & Competition

According to a 2021 market research report by Verified Market Research, the global market for accounts payable software was an estimated $8.77 billion in 2020 and is forecast to reach $17.6 billion by 2028.

This represents a forecast CAGR (Compound Annual Growth Rate) of 9.1% from 2021 to 2028.

The main drivers for this expected growth are a growth in middle-market and small organizations in adopting accounts payable software and a continuing trend toward cloud-based systems.

Also, users have continuing concerns about security related to data authentication, which may act as a brake on the growth of demand in the market.

Major competitive or other industry participants include:

AvidXchange’s Recent Financial Performance

-

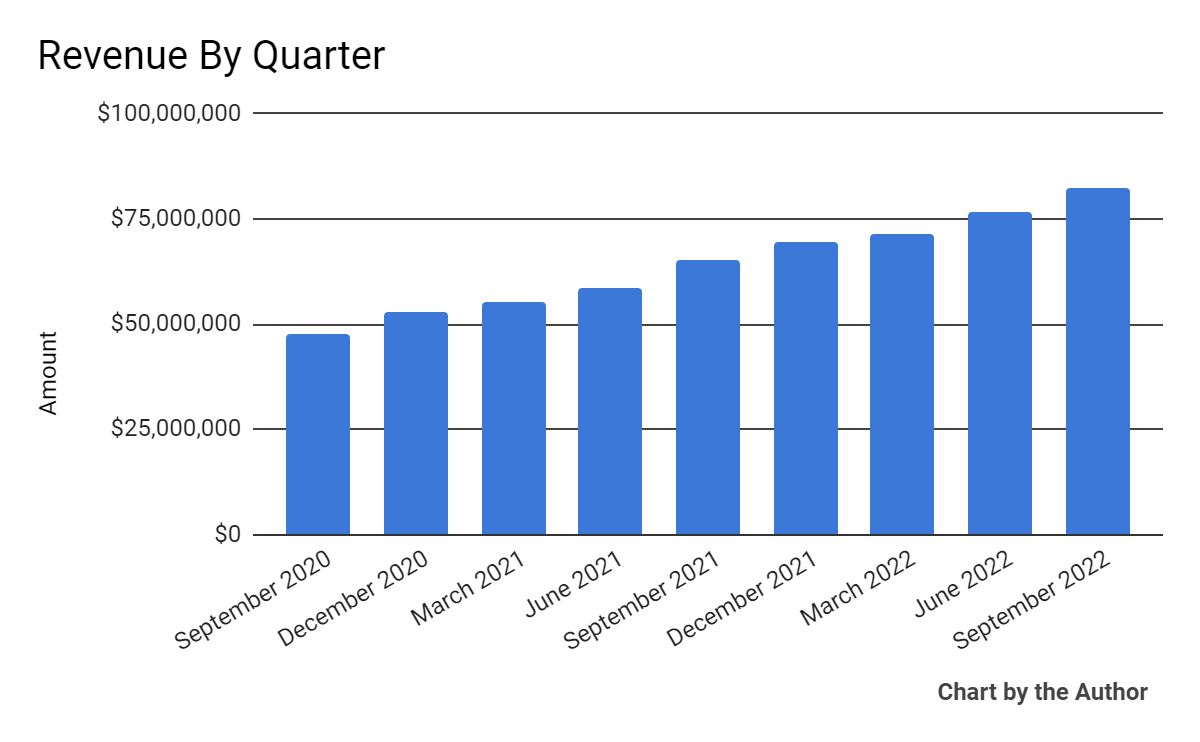

Total revenue by quarter has risen according to the following trajectory:

9 Quarter Total Revenue (Seeking Alpha)

-

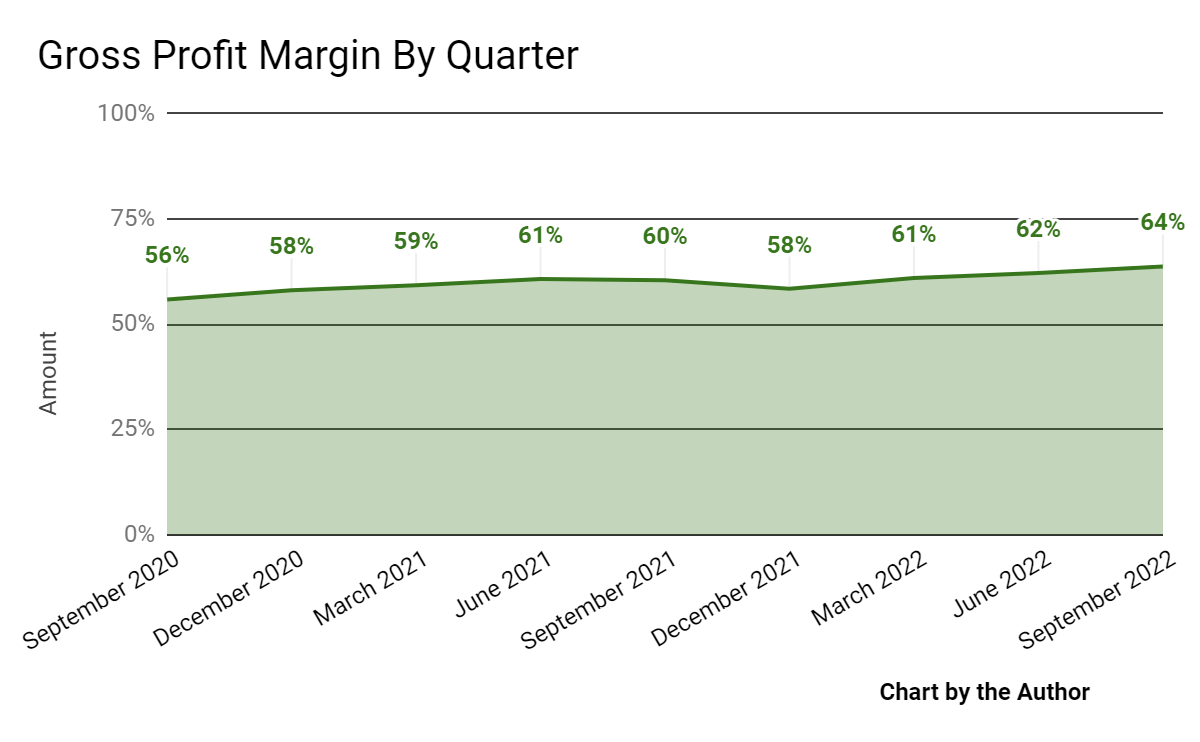

Gross profit margin by quarter has trended higher in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

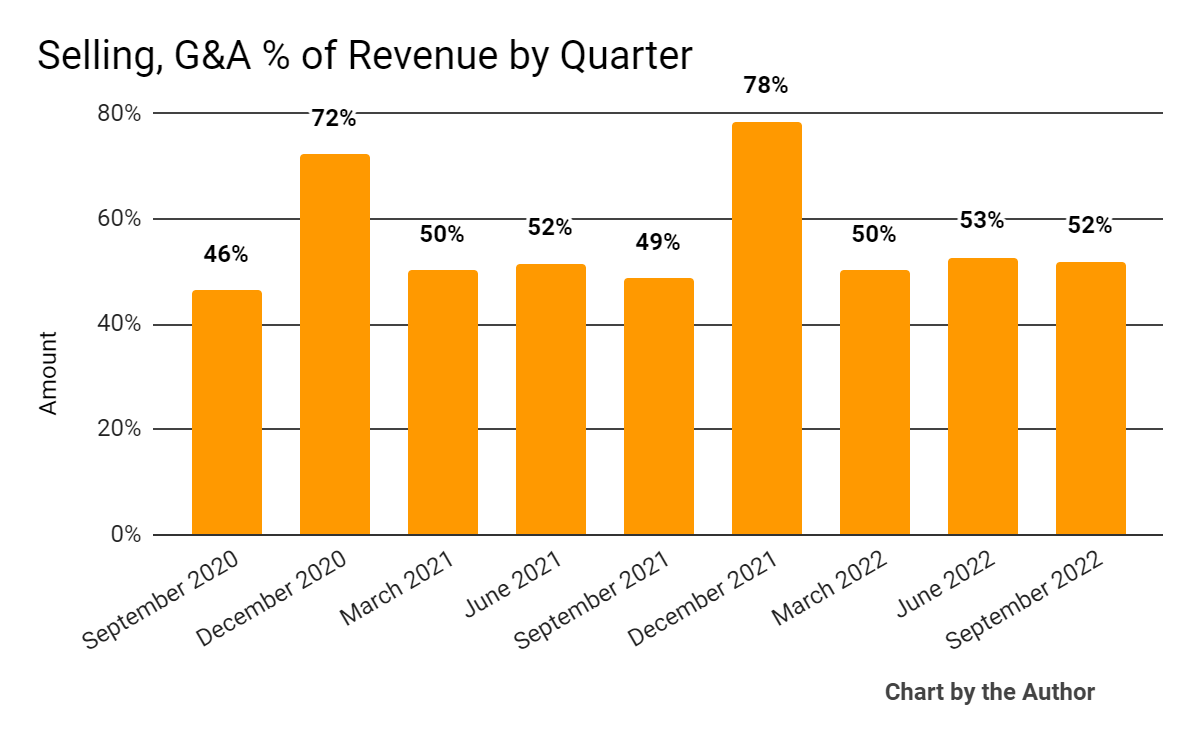

Selling, G&A expenses as a percentage of total revenue by quarter have grown slightly in recent quarters, meaning the company is getting slightly less efficient at generating additional revenue in terms of SG&A expenses:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

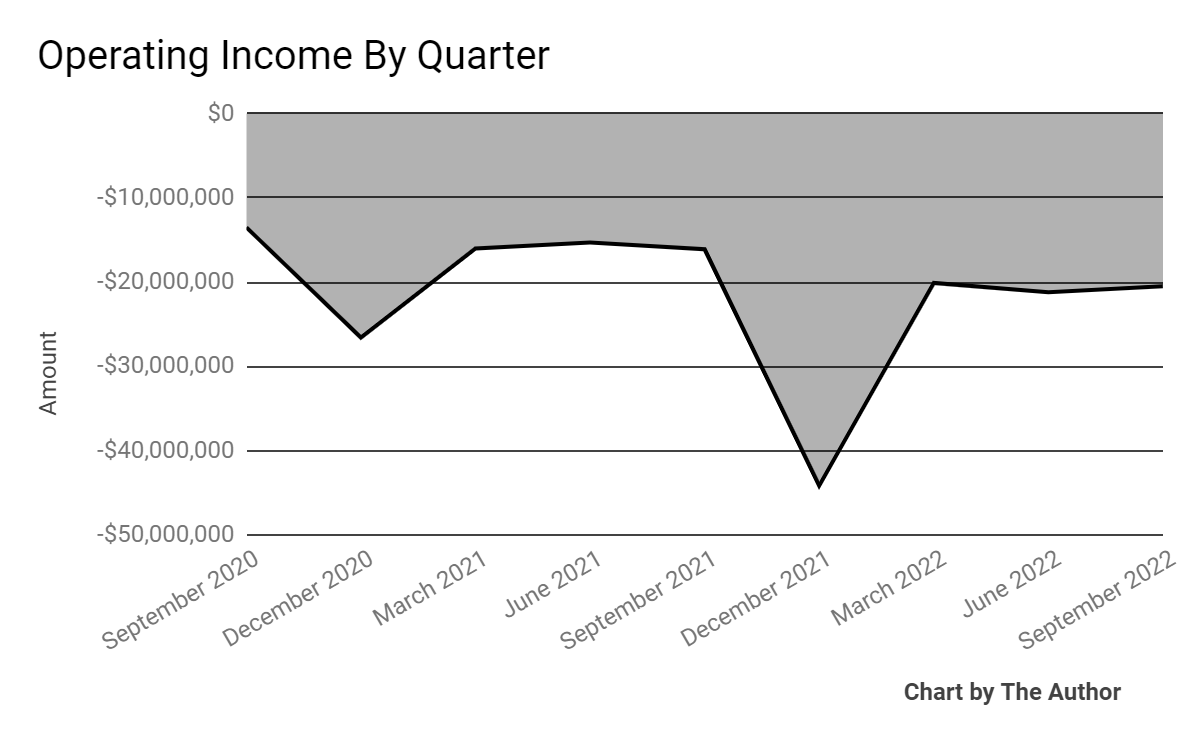

Operating income by quarter has remained negative, per the chart below:

9 Quarter Operating Income (Seeking Alpha)

-

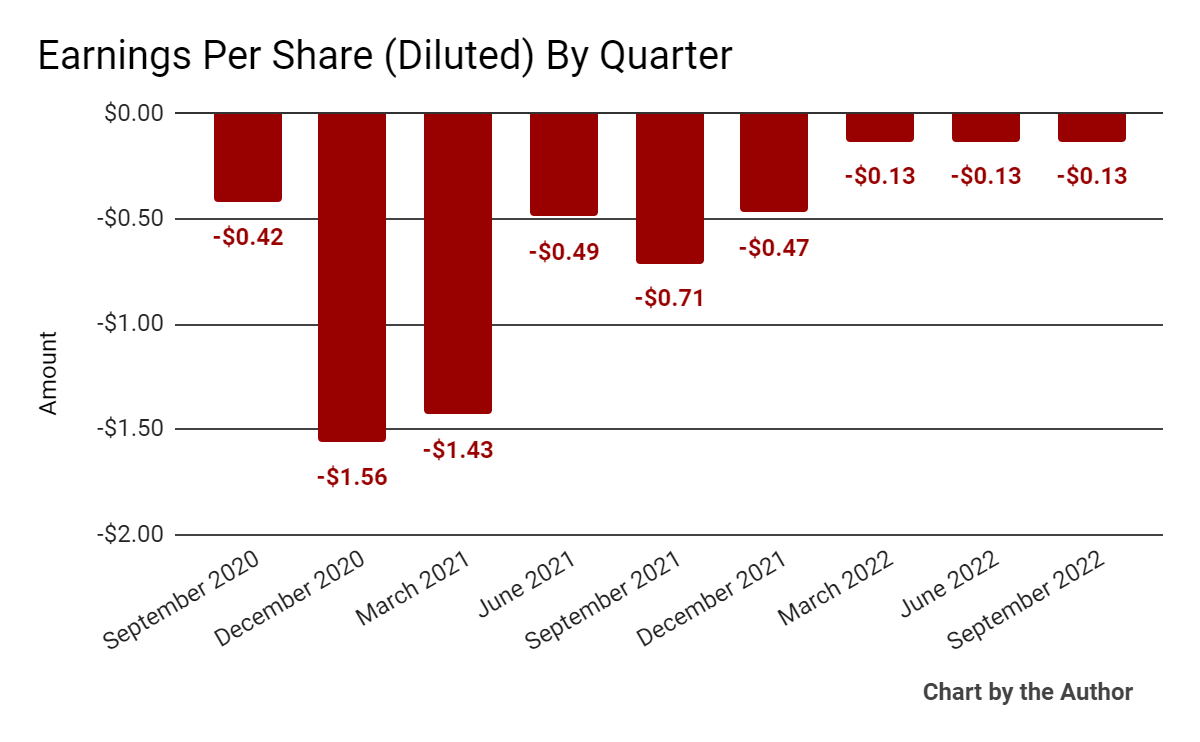

Earnings per share (Diluted) have also remained substantially negative:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP.)

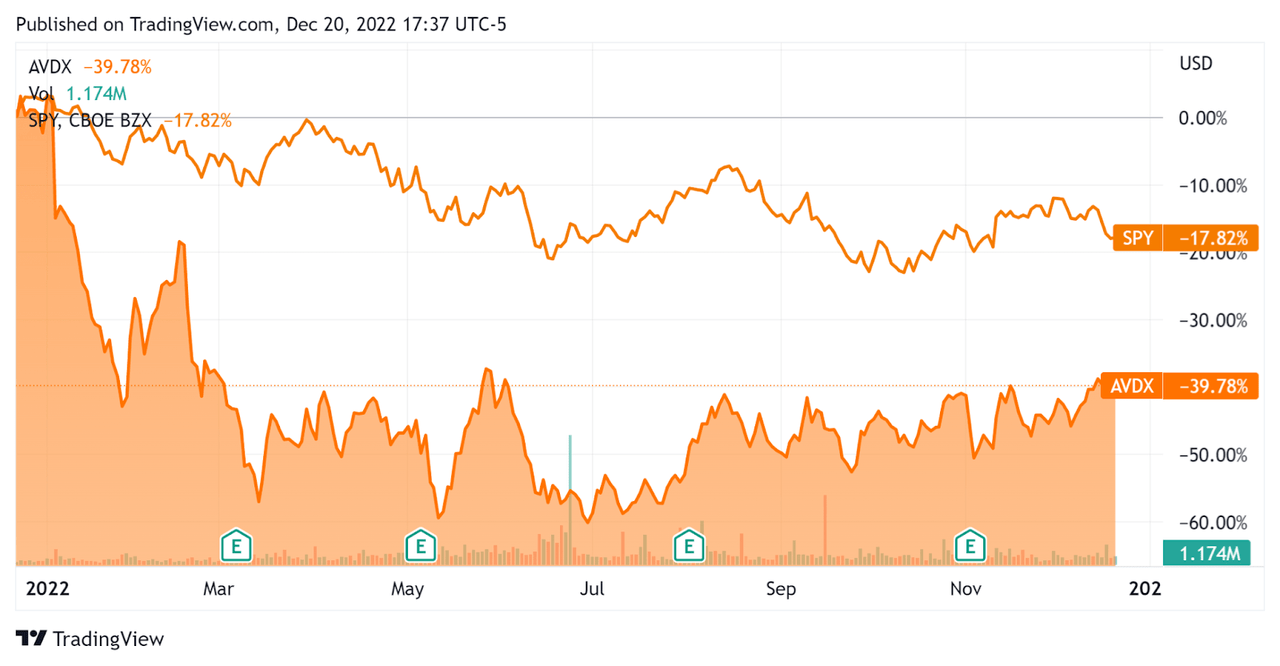

In the past 12 months, AVDX’s stock price has fallen 39.8% vs. the U.S. S&P 500 Index’s (SPY) drop of around 17.8%, as the comparison chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For AvidXchange

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

5.1 |

|

Revenue Growth Rate |

29.1% |

|

Net Income Margin |

-49.5% |

|

GAAP EBITDA % |

-24.5% |

|

Market Capitalization |

$1,847,956,100 |

|

Enterprise Value |

$1,536,368,000 |

|

Operating Cash Flow |

-$57,216,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.86 |

(Source – Seeking Alpha.)

As a reference, a relevant partial public comparable would be Coupa Software Incorporated; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Coupa Software |

AvidXchange Holdings, Inc. |

Variance |

|

Enterprise Value / Sales |

9.0 |

5.1 |

-42.8% |

|

Revenue Growth Rate |

17.6% |

29.1% |

65.0% |

|

Net Income Margin |

-41.3% |

-49.5% |

20.1% |

|

Operating Cash Flow |

$214,320,000 |

-$57,216,000 |

–% |

(Source – Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

AVDX’s most recent GAAP Rule of 40 calculation was only 4.5% as of Q3 2022, so the firm is in need of significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

29.1% |

|

GAAP EBITDA % |

-24.5% |

|

Total |

4.5% |

(Source – Seeking Alpha)

Commentary On AvidXchange

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its hybrid go-to-market marketing strategy, which utilizes its robust integrations approach.

By using referral resellers and white label resellers, middle market customers are ‘able to digitally transform their back office’ while increasing the size and reach of the AvidXchange network, “as buyers bring their buyers, thereby maximizing network density…”

Management believes these “flywheel” effects will make the company more resilient during economic downturns.

As to its financial results, total revenue rose 26.4% year-over-year, higher than the previous guidance.

Management did not disclose any company retention rate metrics.

AVDX’s Rule of 40 results have been disappointing as of the most recent trailing twelve-month period.

Gross profit margin rose 4 percentage points year-over-year due to increasing total transaction yield and operational improvements.

SG&A as a percentage of revenue rose year-over-year, while operating losses were sequentially flat, as was loss per share.

For the balance sheet, the company finished the quarter with bash, equivalents and short-term investments of $508.4 million and $128 million in debt.

Over the trailing twelve months, free cash used was $60.3 million, of which capital expenditures accounted for $3.1 million in cash used.

Looking ahead, management increased full-year 2022 revenue guidance to $314.5 million at the midpoint of the range and non-GAAP EBITDA loss to $18.5 million at the midpoint.

Regarding valuation, the market is valuing AVDX at an EV/Sales multiple of around 5.1x.

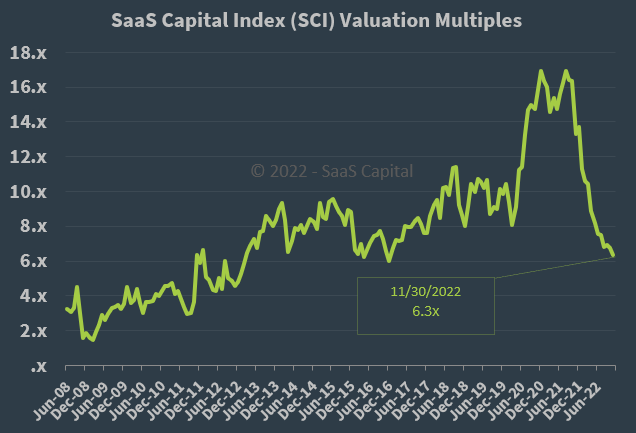

The SaaS Capital Index of publicly held SaaS (software as a service) companies showed an average forward EV/Revenue multiple of around 6.3x on November 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, although AVDX is not strictly a SaaS revenue company, it is currently valued by the market at a discount to the broader SaaS Capital Index, at least as of November 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles and lower its revenue growth trajectory.

A potential upside catalyst could be an end to interest rate increases, potentially reducing the downward pressure on valuations in companies that are using capital.

While AVDX has increased forward guidance and beaten previous guidance recently, I’m more cautious about its outlook in 2023 due to macroeconomic risks.

So, I’m on Hold for AVDX for the near term.

Be the first to comment