Daniel Wright/iStock Editorial via Getty Images

Kinder Morgan, Inc. (NYSE:KMI) is one of the largest midstream companies in the world with an almost $40 billion market capitalization. The company has a more than 6% dividend yield, and a double-digit DCF (distributable cash flow) yield, that will enable continued investments and shareholder returns despite the impact of rising costs and interest rates.

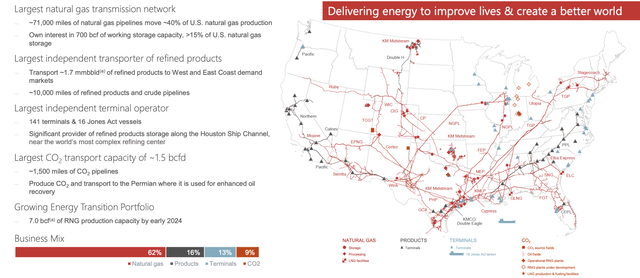

Kinder Morgan Infrastructure

The company has a unique portfolio of infrastructure that will continue to support shareholder returns.

Kinder Morgan Investor Presentation

The company has the largest natural gas network in the world with roughly 71 thousand miles of natural gas pipelines transporting roughly 40% of U.S. natural gas production. The company is also the largest independent transporter of refined products and independent terminal operator with massive CO2 capacity.

The company does have substantial CO2 production, and growing renewable natural gas, but overall its portfolio is still very heavily concentrated in fossil fuels, with more than 90%.

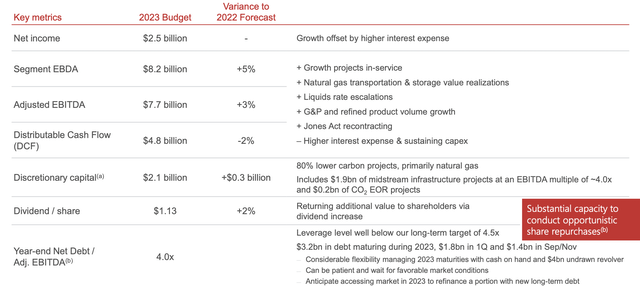

Kinder Morgan 2023 Guidance

Kinder Morgan’s 2023 guidance is expected to support continued shareholder returns.

Kinder Morgan Investor Presentation

The company is guiding for $7.7 billion in adjusted EBITDA and $4.8 billion in DCF. The company is spending $2.1 billion in discretionary capital leaving roughly $2.7 billion. That’s enough to cover the company’s 6.3% dividend yield, while still leaving it with several hundred $ million leftover for the company.

The company’s year-end net debt to adjusted EBITDA of 4.0x is incredibly manageable. The company’s discretionary capital spending will go primarily towards natural gas but we expect it’ll get reasonable returns that’ll support additional shareholder returns. We’d like to see an increased focus on share repurchases versus capital spending.

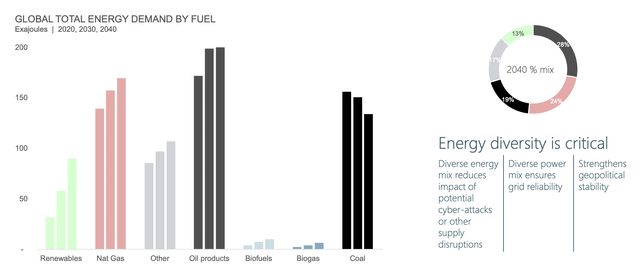

Kinder Morgan Changing Environment

Kinder Morgan is continuing to adjust its portfolio for a changing environment, but it’s avoiding renewables.

Kinder Morgan Investor Presentation

Universally, companies around the globe have acknowledged that coal demand will decrease substantially. Many have also acknowledged that renewables will increase substantially to become a massive part of the global energy mix. However, natural gas and oil products are still expected to be a major and growing portion of the mix.

In a world where climate change needs to be addressed, the company isn’t building up its renewable portfolio at all in a fast growing market. That’ll hurt the company’s ability to continue its returns.

Kinder Morgan Shareholder Return Potential

Kinder Morgan’s continued reliable cash flow will enable strong shareholder returns. However, the company is taking advantage of the market to invest heavily in capital expansion, which has no guarantee yet of panning out. Regardless, in the meantime, the company will continue paying out a more than 6% dividend and investing heavily in its portfolio.

There are numerous advantages in the midstream space and the company has an incredibly strong portfolio.

The company’s debt is below its long-term targets and the company is continuing to pay a reasonable dividend that can form a strong base for shareholder returns. The company’s goal from here in the intermediate term seems to be capital spending over shareholder returns, and we expect that to continue for the next several years.

We would like to see a shift at some point to increased share repurchases.

Thesis Risk

The largest risk to our thesis is the company’s continued lack of long-term evolution to a changing market. The company is right that natural gas and oil will remain strong over the coming decades, however, in the long run, the company is not adjusting to a changing renewables environment. That could hurt its ability to continue providing shareholder returns.

Conclusion

Kinder Morgan has a unique portfolio of assets, one of the strongest asset portfolios in the country. The company is heavily focused on oil and natural gas, and it’s working to rapidly ramp up its volumes here. The company’s continued billions in annual capital expenditures here will enable it to continue ramping up its volumes.

The company’s DCF enables the company to both continue paying for its growth capital spending and continue its strong dividend that it can modestly increase. We’d like to see Kinder Morgan, Inc. ramp up its modest share buybacks, but regardless of how the company spends its capital, we expect it to be able to generate strong returns.

Be the first to comment