DonNichols

On Monday, November 7, 2022, natural gas and electric utility NiSource Inc. (NYSE:NI) announced its third-quarter 2022 earnings results. As is the case with most utilities, the company delivered relatively slow growth year-over-year, which was generally in line with what analysts expected. The company is positioned to continue this growth going forward, which should allow it to continue to make a reasonable investment proposition to the conservative investors that typically buy utility companies. When this is combined with the company’s respectable 3.64% current yield, we see the potential for a reasonable total return over time. This is something that may surprise some readers as the market currently is exhibiting a great deal of favoritism toward electric utilities over natural gas ones. This is largely caused by the belief that natural gas will soon be obsolete as a fuel source but as we will see in this article, this belief has no grounding in actual fact. When we combine this all with a reasonably attractive valuation, we can see that NiSource could make a good core holding in a conservative portfolio today.

As my regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from NiSource’s third-quarter 2022 earnings report:

- NiSource reported total revenue of $1.0895 billion in the third quarter of 2022. This represents a 13.56% increase over the $959.4 million that the company reported in the prior-year quarter.

- The company reported an operating income of $156.7 million in the reporting period. This compares quite favorably to the $147.1 million that the company reported in the year-ago quarter.

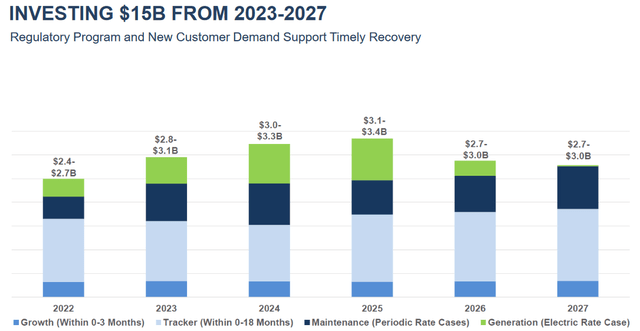

- NiSource reiterated its plan to invest approximately $15 billion into its infrastructure over the 2023 to 2027 period.

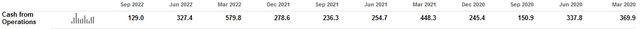

- The company reported an operating cash flow of $129.0 million in the most recent quarter. This represents a 45.41% decline over the $236.3 million that the company reported in the equivalent quarter of last year.

- NiSource reported a net income available to the common shareholders of $52.0 million in the third quarter of 2022. This represents a 5.26% increase over the $49.4 million that the company reported during the third quarter of 2021.

One of the defining characteristics of NiSource is that the company tends to enjoy remarkably stable cash flows over time. We can see this reflected in these highlights as both revenue and net income showed year-over-year growth but, admittedly, it was not as strong as the growth that we sometimes see from companies in other sectors. The biggest reason for this overall stability is that the product that NiSource provides to its customers is generally considered to be a necessity for our modern way of life. After all, natural gas utilities typically are responsible for supplying most of the heating fuel used by homes and businesses in their service area, which is something that most people do not want to live without. In addition, how many people would be willing to sacrifice having electricity in their homes? As such, people will normally prioritize paying their utility bills over spending money on discretionary expenses during periods of time in which money gets tight. This is something that frequently happens during recessions or periods of economic weakness, which is a fairly apt description of the current conditions in the United States. Thus, this quality is something that may appeal to potential investors.

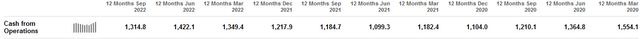

We can see the company’s general stability over extended periods of time as well. This chart shows the company’s trailing twelve-month operating cash flow over the past several quarters:

(all figures in millions of U.S. dollars)

As we can see here, there is a great deal of stability from period to period. We do typically see much more fluctuation as we look at the individual quarters though:

(all figures in millions of U.S. dollars)

This is because the majority of NiSource’s business is its natural gas utilities. The primary use of natural gas is in space heating so it tends to experience much higher consumption during the winter months. After all, heating is not especially needed during the summer in most parts of the United States. As a result, revenues tend to drop significantly during the summer months, which has an impact on the second and especially third quarters of the year. Overall, though, the company’s cash flow tends to be much more stable when we look at any given twelve-month period as clearly shown above.

However, as investors, we are not interested in mere stability. We like to see growth and fortunately, NiSource is positioned to deliver this growth. The way that the company is going to do this is by growing its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the rate base allows the company to increase the price that it charges its investors in order to earn that allowed rate of return. The usual way that the company can increase its rate base is by investing money into upgrading, modernizing, or possibly even expanding its utility-grade infrastructure. NiSource intends to do exactly this. As stated in the highlights, the company plans to invest approximately $15 billion into its rate base over the 2023 to 2027 period:

We can see that the majority of the planned spending comes in the early to middle years, during which time a fairly significant percentage of the spending will be in electric generation. We will discuss what this means later. The important takeaway here is that this spending should be sufficient to allow the company to grow its earnings per share at a 6% to 8% rate over the period. When we combine this with the current 3.64% dividend yield, investors should be looking at a 10% to 12% total annual return, which is very nice for a conservative utility stock.

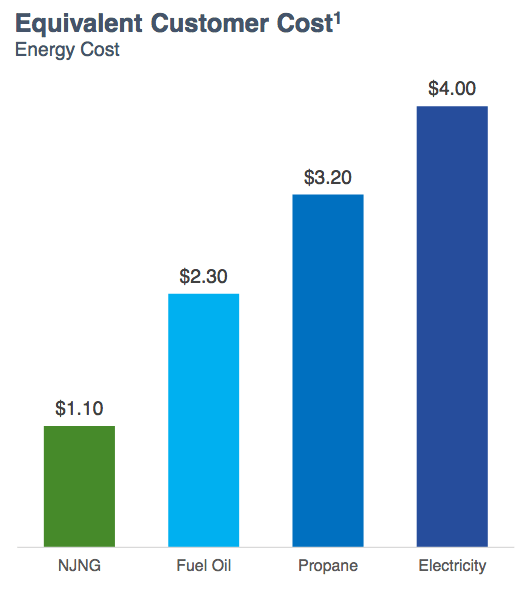

One thing that we have been hearing about from politicians, activists, and the media lately is electrification. This process refers to the conversion of things that are historically powered by fossil fuels to the use of electricity instead. The most commonly cited areas for conversion are transportation (electric cars) and space heating, which is of course the biggest use of utility-supplied natural gas. This is why some people have come to believe that natural gas utilities like NiSource will soon be obsolete. However, this scenario is highly unlikely to play out the way that its promoters expect. The biggest reason for this is that natural gas is much more efficient than electricity at producing heat. As such, it is much more expensive to heat a building with electricity, even considering the increase in natural gas prices that we have seen over the course of this year. In fact, according to the Energy Information Administration, it can cost up to four times as much to heat a house with electricity as it does with natural gas:

New Jersey Resources/Data from U.S. EIA

It seems highly unlikely that very many people will be willing to let their heating bills increase to this degree, not to mention the cost of replacing their current HVAC system. This is especially true for people of limited means or that live in cold climates. As such, we can conclude that the belief about the obsolescence of natural gas utilities is misguided. It makes no sense to avoid NiSource based simply on that belief as the company’s business is not going anywhere.

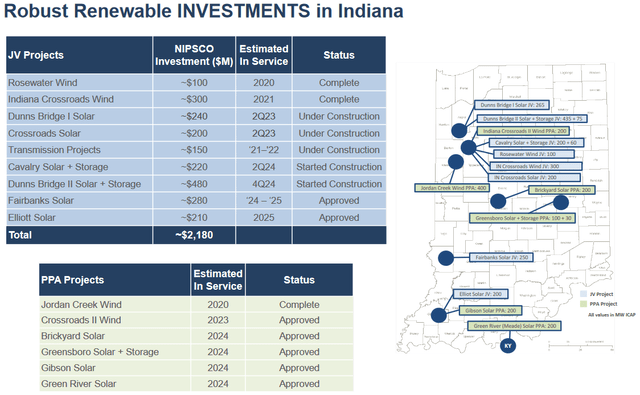

With that said, we do see that the company is investing a significant sum of money into the generation of electricity. Primarily, it is investing in the construction of renewable generation plants as part of its goal to reduce its greenhouse gas emissions by 90% by 2030 and methane emissions by 50% by 2025 compared to its 2005 levels. To that end, the company is retiring most of its coal generation capacity by the end of the decade but it has begun construction on a number of renewable generation facilities to replace these plants already:

As we can see, the company has a number of projects in various stages of construction that are expected to come online by 2025. It seems unlikely that this will appeal to the incredibly wealthy environmental, social, and governance funds though as the natural gas utility still accounts for the lion’s share of NiSource’s revenue and income. There are likely still some people out there though that the company is making at least some efforts to appeal to this cohort.

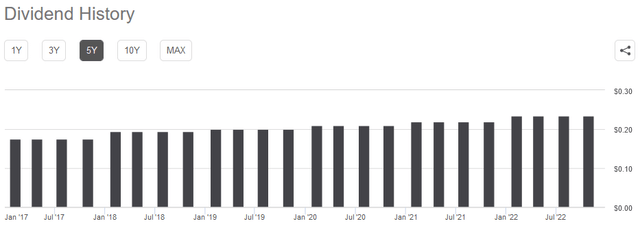

One of the biggest reasons why investors purchase shares of utilities is because of the high yields that these companies tend to possess. Indeed, NiSource is no exception to this as the company’s 3.64% current yield is significantly higher than the 1.55% yield of the S&P 500 index (SPY). In addition to boasting a market-beating yield, NiSource also has a long track record of increasing its dividend annually:

The fact that the company increases its dividend annually is quite attractive during inflationary environments, such as the one that we are in today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. This can make it seem as though the investor is getting poorer and poorer with the passage of time. The fact that the company increases the amount that it pays out helps to offset this somewhat and helps us maintain the purchasing power of the dividends that we receive from the company. As is always the case though, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be forced to reverse course and suddenly reduce the dividend since that would both reduce our incomes and most likely cause the stock price to decline.

The usual way that we evaluate the ability of a company to pay its dividend is by looking at the free cash flow. A company’s free cash flow is the amount of money that was generated by its ordinary income that is left over after the firm pays all of its bills and makes all necessary capital expenditures. This is the amount of money that is available to do things such as reducing debt, buying back stock, or paying a dividend. During the trailing twelve-month period that ended September 30, 2022, NiSource had a negative levered free cash flow of $704.2 million. This is obviously not nearly enough to pay any dividend but the company still paid out $427.5 million over the period. At first glance, this is certainly somewhat concerning.

However, it is common for utilities like NiSource to finance their capital expenditures through the issuance of equity and especially debt while paying the dividend out of their operating cash flow. This is due to their general stability and the incredibly high costs involved of constructing and maintaining utility-grade infrastructure over a wide geographic area. During the most recent trailing twelve-month period, NiSource had an operating cash flow of $1.3148 billion. This was more than enough to cover the $427.5 million that was paid out in dividends with a great deal of money left over for other purposes. Overall, this dividend appears to be quite safe and investors should not really have to worry about a cut here.

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like NiSource, we can generally value it by looking at the price-to-earnings growth ratio. This is a modified form of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to the company’s earnings per share growth and vice versa. There are, however, very few stocks that have such a low ratio in today’s overheated market so the best way to use this ratio is to compare the company against several of its peers to see which offers the most attractive relative valuation.

According to Zacks Investment Research, NiSource will grow its earnings per share at a 6.82% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 2.61 at the current price. Here is how that compares to some of the company’s peers:

|

Company |

PEG Ratio |

|

NiSource Inc. |

2.61 |

|

Atmos Energy (ATO) |

2.48 |

|

New Jersey Resources (NJR) |

3.04 |

|

Northwest Natural Holding (NWN) |

4.31 |

|

Southwest Gas Holdings (SWX) |

3.49 |

As we can see, NiSource generally compares fairly well to its peers as it is cheaper than every company here except for Atmos Energy when earnings per share growth is considered. This thus could be a good time for a potential investor to get into the stock.

In conclusion, NiSource’s latest earnings report showed us largely what we can usually expect from this company. It posted relatively modest year-over-year increases in revenues and earnings as well as presented a plan that is likely to allow it to continue this growth going forward. Despite the noise about natural gas utilities going away in the near future, this is unlikely to happen and people will most likely continue to use natural gas to provide cooking and space heating within their homes for many years to come. When this is combined with a reasonably attractive dividend yield and valuation, we can see that NiSource looks like a solid purchase for any utility investor.

Be the first to comment