Marko Geber

Digital Turbine, Inc. (NASDAQ:APPS) is uniquely positioned in the app delivery and mobile ad market, but in the last couple of quarters, growth has disappointed and that doesn’t look like turning around in the near future. However, we think that:

- Much of it is priced in already.

- There is compensation from rising margins, some of it was a deliberate policy choice.

- The longer-term growth drivers remain in place.

- The company remains profitable, reasonably valued, and generates cash with which it is reducing debt (by $60.5M in Q1/23).

FinViz

Growth

We have to say at first we were a little concerned with the revenue growth slowdown to just 5%, even if it doesn’t come unexpectedly in the present rough macro environment.

In fact, given the weak guidance for Q3 (with revenues expected to be down 5%), the present lull in growth is set to get worse.

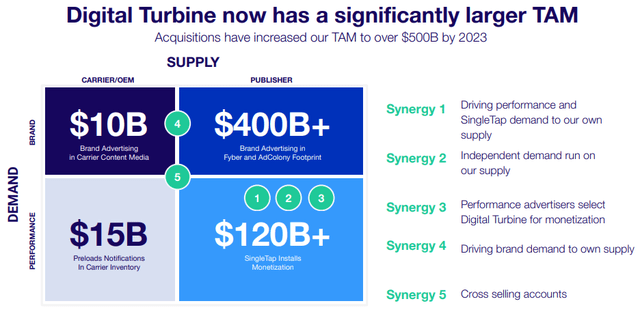

Apart from the macro headwinds, the company is pivoting Content Media from prepaid (good for 90% of its revenue) to postpaid, which has a bigger total addressable market (“TAM”) and more attractive rates. In the short-term, this caused some headwinds, but they have the subscribers of AT&T (T) and Verizon (VZ) to go after.

The company doesn’t really have much damage from inflation. There is some moderate wage pressure and their OEM’s customers are affected by it, but otherwise, there is little harm.

They are also prioritizing margins over growth, in particular with SingleTap, which also explains part of the slowdown.

Margin expansion

However, there is compensation from margin expansion, cash flow and debt reduction even during the downturn:

- RPD (revenue per device) +20% in the US to $5+

- Gross margin +500bp to 50%

- AEBITDA +30% and AEBITDA margin 28%

- Free cash flow (on a TTM basis) +200% to $150M

They had little impact from the Apple IDFA changes, as it’s only 15% of their business.

They are realigning AdColony’s sales force to bigger countries for their brands like the UK and the EU, relying more on channel partners for their smaller markets.

Management argues that operational cost will grow slower than revenues with the company continuing to produce operational leverage.

Longer-term drivers

What we were also looking for was info about the drivers of secular growth (for a more comprehensive look, see their Investor Day Presentation), beyond the cyclical downturn, and there was some positive news:

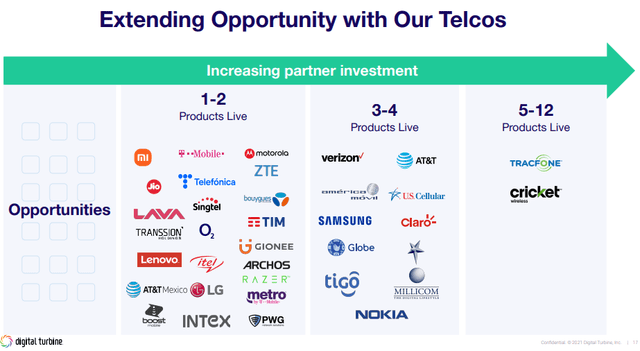

- Adding OEMs and/or carriers, publishers, brands, and media relationships.

- Ignite was installed on 67M mobile phones in the quarter, so that’s still growing (although the growth was overseas, where RPDs are much lower, US installations were down fractionally).

- Impressions are growing on their app business (Fyber and AdColony)

- Licensing ST (SingleTap), with 5+ customers in Q3 and another 5+ in Q4, and this is just the beginning. Management expects this to eventually overtake ST core business, and it produces higher margins to boot.

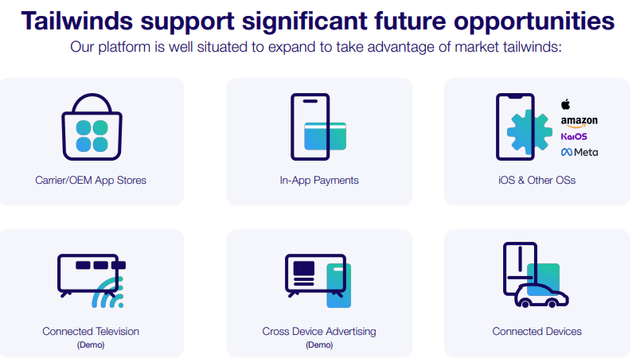

- Adding new products and services. Management mentioned this so we expect this to be fairly soon. They are investing in ad tech scalability and App Store strategies, so stay tuned.

- Upselling:

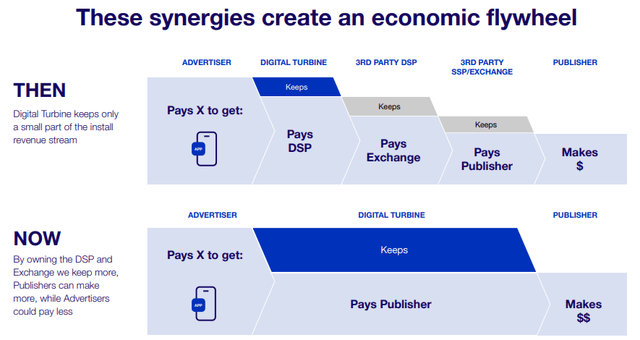

Here is taking out the middlemen, producing a bit of a flywheel:

The company also featured some future growth opportunities:

And last but not least, the synergies from the Fyber and AdColony acquisitions:

No ordinary Adtech company

- Ignite operates on the phone and under the carrier or OEM’s user agreement. This provides the company with a data advantage, improving targeting efficiency and ROI for advertisers.

- The software stack on the phone influences what users see on the prime real estate: the start screen of mobile phones.

- Patented SingleTap provides a distribution advantage by creating much less friction for app downloads. This bestows a 2-5x efficiency advantage, lowering the cost per install by 50%-80%.

- Combined demand and sell-side (a bit like Perion’s iHub) takes out middlemen.

- ST licensing is very high-margin business just taking off and will eventually be larger than ST itself.

- Ignite and ST are applicable to other screens besides mobile phones.

- Positioned to benefit from regulatory change powering carrier app stores, becoming the Shopify of app stores as they have a key element, the ability to port apps from publisher to various app stores.

Conclusion

The growth slowdown has a number of reasons:

- The effects of the macro headwinds on the ad market.

- While Ignite was still growing with 67M installs added in Q2 it’s not really a growth market as revenue is a one-off, produced when new phones are activated, so revenues could start to actually decline.

- Content Media isn’t growing either as it is pivoting towards postpay.

- SingleTap growth figures weren’t mentioned but management argued it prioritized margins over growth.

- What was growing in Q1 was their acquired apps business (Fyber and AdColony), by 13%.

- There was a mild currency headwind.

Near-term (that is, Q2/23) it is getting worse, not better, given the -5% guidance at midpoint. But Q3 is seasonally the best quarter and growth will likely resume at least on a sequential basis.

We still see reasons to be bullish on the shares in the medium term as:

- While growth disappoints, margins are expanding.

- We expect SingleTap growth to resume, and ST licensing to take off.

- Content Media growth should resume with the Verizon and AT&T deals delivering.

- The company has other growth opportunities described above, like bespoke app stores, in-app payments, and the like.

- The shares are not expensive.

But we have to say that the shine has come off the shares when the likes of Perion Network (PERI) managed 30% growth and Magnite (MGNI) by 22.6% while the company has a considerable moat and distinguishing features.

Be the first to comment