gilaxia/E+ via Getty Images

Healthcare Realty Trust Incorporated (NYSE:HR) is an owner and manager of medical office buildings across the US and primarily on or adjacent to campuses. We have covered this REIT a number of times the last couple of years and have been a fan despite not going long the stock for most of the duration. We called it our bond proxy in the last couple of years and recommended playing it via cash secured puts and covered calls, which we did.

Our last piece was back in November of last year and a lot has transpired since then. The medical office space witnessed a love triangle of sorts with HR and Healthcare Trust of America announcing their intentions to merge and Welltower Inc. (WELL) having a “speak now or forever hold your peace” moment. WELL made an offer for HR, unsuccessfully.

HR consummated its merger with HTA recently. Today we revisit our thesis in light of that, the recent results, and rising interest rates.

The Deal

HR-HTA merger was a headscratcher. We felt both parties could have got better deals elsewhere and certainly WELL’s overture backs that for HR. The price paid for HTA was fair but HR used its own undervalued stock, something that generally dilutes out any potential synergies. So while technically there was no overpayment, the stock usage meant that HR did take down its own value. How much was that? Exact amounts are hard to determine as Net Asset Value estimation is an art, not a science. There were further complications as HTA was allowed to sell a bunch of properties and give a special dividend to its shareholders before the two merged. One ballpark way of looking at it is to see how the NAV estimates for HR have moved over time. Back in March 2022, it was estimated that HR NAV was close to $34.50. Today, post merger the estimate is $28.50. Some of this comes from cap rate expansion, but the majority has come from the merger.

Outlook

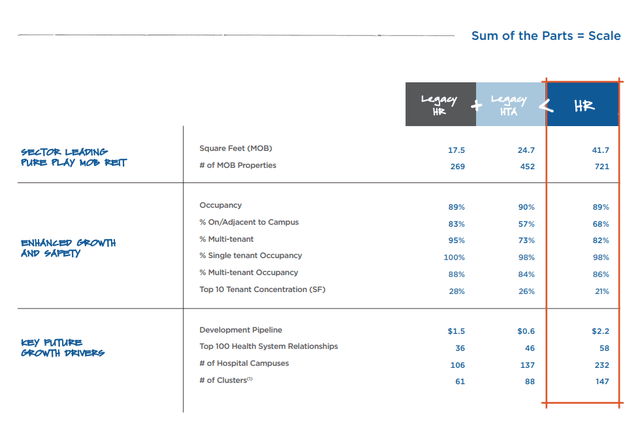

The new company has significantly better scale and a large presence in key markets.

HR Presentation

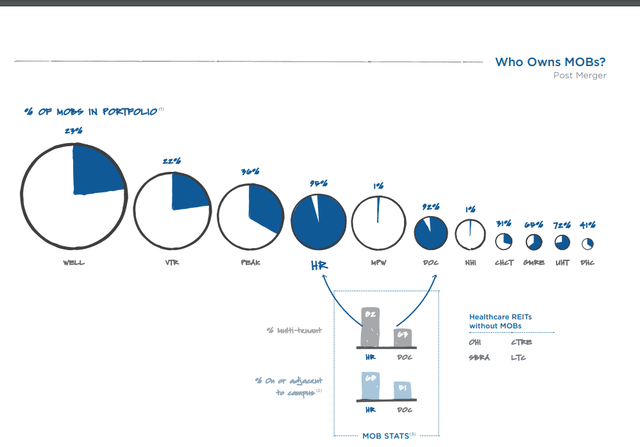

Compared to the other giants like WELL and Ventas Inc. (VTR), HR is extremely concentrated in MOBs.

HR Presentation

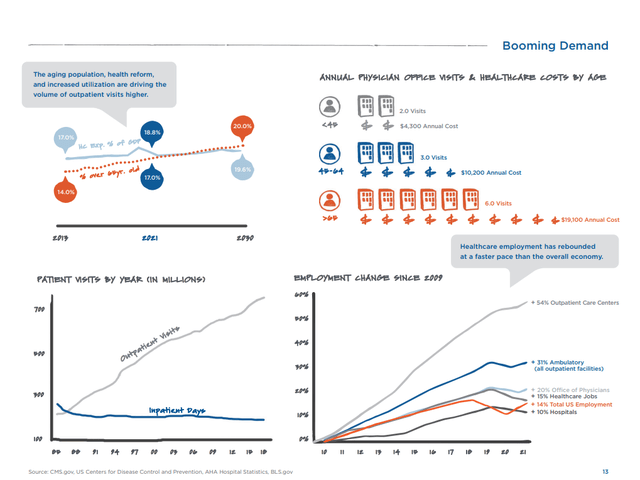

That MOB space is one that has really been the beneficiary of expanding outpatient visits over the years.

HR Presentation

That should continue with the aging demographic tailwind.

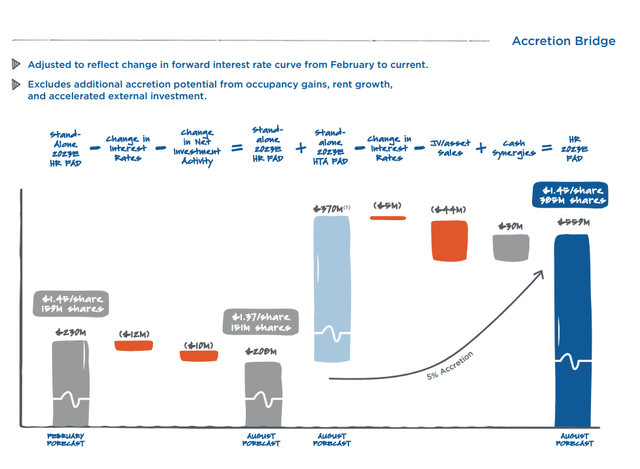

On the negative side, HR is going to have a tough time getting its growth run-rate going when interest rates are rising. Funds from operations or FFO per share will be about the same before and after the merger, despite some modest synergies. Those synergies are being offset by the higher interest rates and we don’t think HR has priced all of it in.

HR Presentation

HR was already given a single bump lower by Fitch, an action we felt was well justified.

The combination improves HR’s asset and geographic diversification, and adds new growth markets. In addition, the increased scale should strengthen access to capital. However, it dilutes the multi-tenant, on-campus exposure, and Fitch expects the issuer will manage to a higher financial policy after merger close, between 6x-6.5x, above HR’s 5x-5.5x range historically.

Fitch views leverage sustaining between 5x-6x, as appropriate for the combined company at ‘BBB+’ and 6x-7x at ‘BBB’, which is approximately 0.5x higher than the ranges for standalone HR, given the merger’s aforementioned positive elements. The Stable Rating Outlook reflects the combined company’s durable cash flows generated by its medical office building portfolio as well as its strong contingent liquidity as measured by UA/UD relative to peers.

Source: Fitch

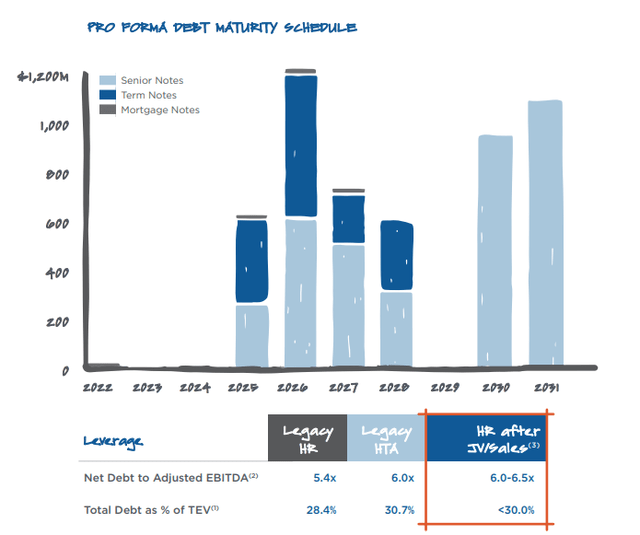

On the plus side, HR has no pressing debt maturities that need to be addressed.

HR Presentation

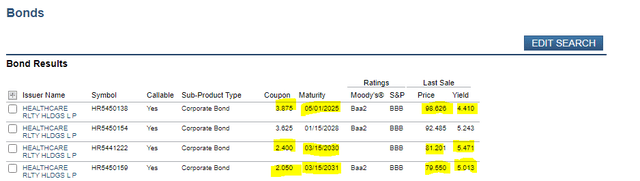

But when they do come up, you can expect some material upward bumps, assuming even the current interest rates hold steady. Bonds maturing in less than three years yield about 4.4%. Longer dated bonds, placed in the heart of the 2021 yield chasing exercise, are now yielding 3% higher.

FINRA

On that level of leverage, you will have some big headwinds on refinancings. The offset here is that there is some serious tailwind from properties that are coming due for leasing at the end of their terms. HR’s CEO addressed this on the most recent earnings call.

Tayo Okusanya, Analyst

One of your peers on their earnings call kind of really talked about a really remarkable mark-to-market of about 8%. I think you guys kind of seeing in the last 3.5% or 3.4%. Just using with everything you’re seeing with inflation, do you expect market to market to accelerate going forward? Or how do you kind of look at that versus the need to kind of manage the client relationship?

Todd Meredith, CEO Healthcare Realty

Yes, it’s a good question. We saw that as well and certainly wouldn’t take anything away from the numbers that physicians reality put up certainly a great quarter of cash leasing spreads. I think in their own remarks, they acknowledge that it’s not exactly what they expect in the next couple of quarters. But I think like them, we would agree there’s definitely tailwinds here that are — give us optimism about continuing to push rate.

And I think with replacement costs being clearly up significantly, build-out costs are up significantly, both for leasing activity as well as development. That gives us some tailwinds to continue to push on rate, even higher rates being a lower cost alternative than something new, a new development. So we’re optimistic. I’m not going to say that at the new norm at all. But you’ve seen us in past years put up some numbers that are getting up to that order of magnitude. So I think our view is we like — we think 3 to 4 is very doable and occasionally getting in the 3 to 5 range is feasible as well. So directionally, I think we’re optimistic on that just like our peers.

Source: HR Q2-2022 Transcript

Management also noted the potential for JVs to create value when they were asked about the limited flexibility in their current dividend payout.

Michael Bilerman, Analyst

You have very limited free cash flow, right, $1.30 of the dividend relative to the $1.45 of FAD next year. Leverage is at the higher end of where you want, so you can’t be as aggressive without selling assets. How do you get to the other side, right? What’s the catalyst that you’re looking for the market to recognize for you to be able to have that cost of capital to be able to embark on that accretive growth?

Todd Meredith

Sure. Yes. Framework and question. I think clearly, where we are today is we’ve just completed the merger. And I think no surprise, that’s why I articulated these 4 priorities in my remarks, clearly, we need to keep demonstrating progress and success on the asset sales in the JV.

Source: HR Q2-2022 Transcript

Verdict

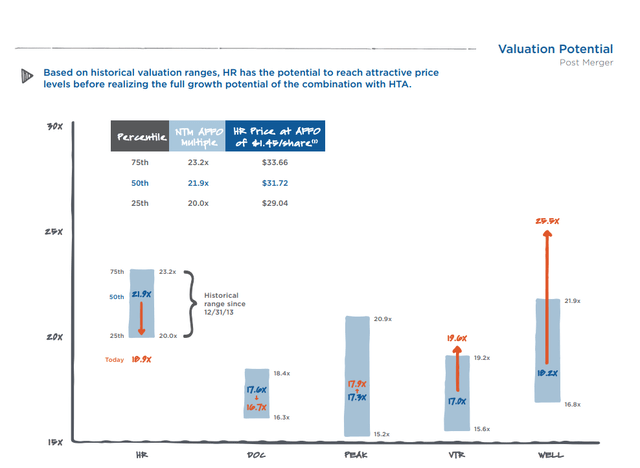

HR has a pool of stable assets that produce very predictable cash flow and can show some modest level of growth. We would not get too excited about the growth from expansion as the market is not giving them any room on either their cost of equity or debt to buy 5% cap rate properties. But you do get a 5% dividend yield here and the stock is not expensive at 18X FFO multiples.

HR Presentation

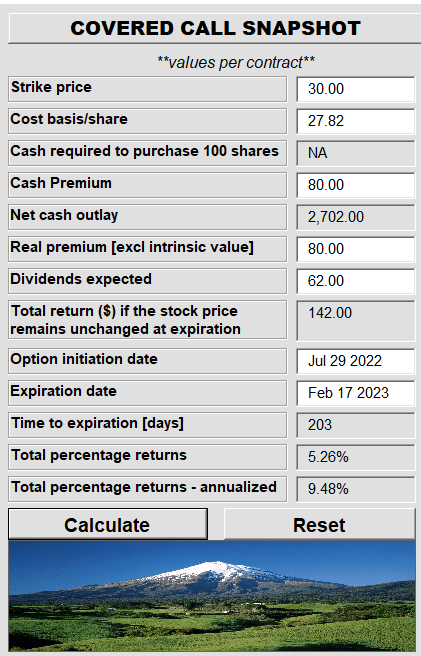

We would look for about 8% total annual returns here, with the bulk coming from dividends, alongside some modest growth in FFO per share. We are not too optimistic about valuation expansion as HR management suggests in the slide above. Higher interest rates, a hostile federal reserve, and the possibility of regular office space competing with MOBs in select markets are headwinds that suggest a lower, not a higher, multiple. On our own positioning, we sold the covered calls on our shares for the $30 strikes to enhance our income.

Conservative Income Portfolio

While HR has been more volatile than we would have liked, the large premiums on both the cash secured puts and the covered calls have offset the bulk of the move lower. These continue to churn out income and help us reach the 7-9% income goal.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment