Evgenii Mitroshin

Thesis

Leading US oil and gas producer Diamondback Energy, Inc. (NASDAQ:FANG) has rewarded investors who plunged into FANG’s capitulation lows in March 2020 and rode the massive recovery.

However, our analysis suggests that recovery has run its course and will likely face significant selling pressure at its June highs. As a result, buying at the current levels no longer offers an attractive reward-to-risk profile in the face of a global recession, causing further demand destruction in underlying energy markets.

The market has also not re-rated FANG despite its remarkable operating performances in 2022, as we believe it is pricing in further cuts in its forward estimates. Therefore, we urge investors to be wary about adding FANG at the current levels, as the price action in the underlying energy markets is a cause for significant concern.

Hence, we urge investors sitting on significant gains to book their profits and cut exposure before the market sends it down further. As such, we rate FANG as a Sell.

Don’t Understate The Impact Of A Global Economic Recession

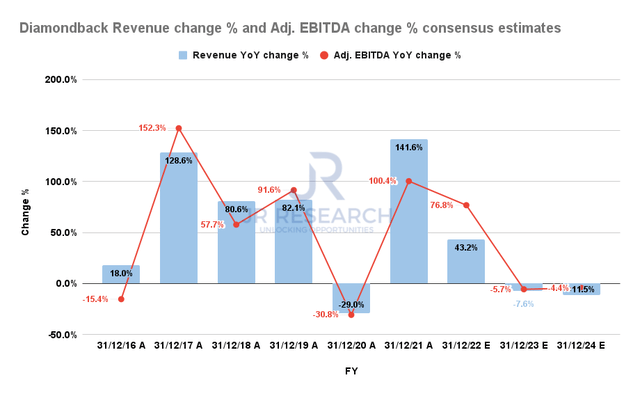

Diamondback Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

After two solid years of outperformance following its remarkable collapse in 2020, we believe it’s reasonable to expect Diamondback’s growth to normalize through FY24.

However, the consensus estimates (bullish) suggest that the normalization is likely to be relatively moderate and not expected to hit its revenue and profitability growth significantly.

But, we urge investors to be cautious as we expect such optimism by the Street to be misplaced if the market anticipates the global recession to hit harder moving forward.

The recent action by OPEC+ is unlikely to resolve further demand destruction, given the existing underproduction among its members, as Bloomberg presented in a recent commentary. Moreover, it highlighted that OPEC+’s cuts are likely “illusory,” leading to an actual cut of “as little as one-tenth of the headline figure.”

Furthermore, OPEC+ also revised its oil demand forecasts for October by nearly 15% lower than September’s estimates, with the potential for further downward revisions. Therefore, if the actual cuts are being hampered by the challenges enunciated by Bloomberg, it should put further downward pressure on oil demand in the near term.

IEA also revised its 2023 oil demand forecasts by nearly 22% “as a result of stronger economic headwinds.” Edward Yardeni also highlighted the increasing fears of a global economic recession, as he articulated (October 13 briefing): “It’s not often that the whole world’s economy faces a synchronized economic slowdown, but that’s what appears to be occurring.”

Hence, we believe investors should not be ruling out further writedowns in forward estimates for Diamondback, as their estimates continue to look overly optimistic relative to what the price action in the underlying markets is suggesting.

Furthermore, RBC Capital cautioned that the impact on Brent crude could be massive in a deep economic downturn. It presented a bear case of $60 per barrel, down nearly 37% from the current levels.

Hence, we believe investors can no longer ignore the risks of a global economic recession on the underlying energy markets, given their significant run-up in 2022. As a result, we postulate investors sitting on substantial gains should consider starting to cut their exposure, before more significant selling pressure appears, triggering rapid sell-downs.

Price Action In Crude Oil Has Likely Topped Out

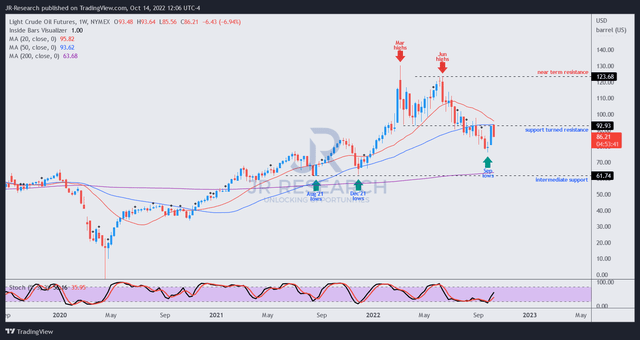

WTI Crude price chart (weekly) (TradingView)

We gleaned that the momentary recovery in WTI crude oil futures (CL1:COM) from the recent OPEC+ production reduction announcement has seen significant digestion, as the market drew dip buyers in astutely.

However, CL1 has already lost its medium-term bullish bias since August. As a result, we believe CL1’s ability to regain control of its 50-week moving average (blue line) doesn’t augur well for the WTI crude. Given the price action, we believe the sellers have used the recent opportunity to sell the rip.

Therefore, we believe the market is likely setting up a further fall toward its intermediate support zone before finding a sustained bottom. Accordingly, the reward-to-risk profile for CL1 is not attractive at the current levels.

Is FANG Stock A Buy, Sell, Or Hold?

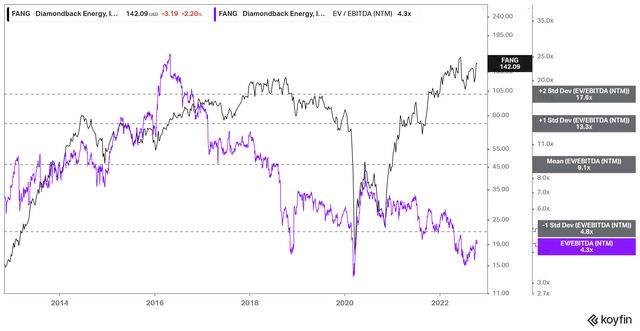

FANG NTM EBITDA multiples valuation trend (koyfin)

With an NTM EBITDA multiple of just 4.3x, well below its 10Y mean of 9.1x, investors could argue that FANG looks pretty cheap. However, note that the oil and gas sector remains a cyclical play, no matter what the perma-bulls tell you.

The market likely knows it too, which explains why it has not re-rated FANG despite its robust operating performances in 2022. So don’t be surprised to see its EBITDA multiples surge much higher when the Street analysts realize they could be too optimistic in their forward estimates with a global recession around the corner.

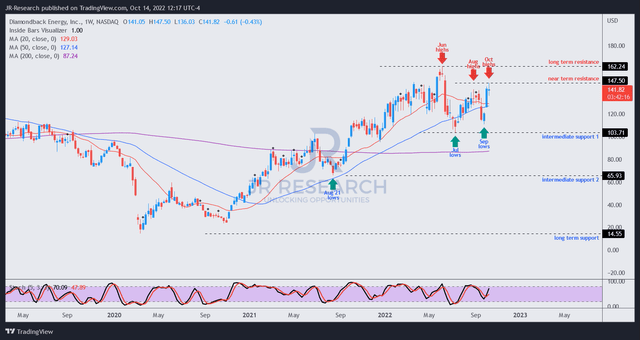

FANG price chart (weekly) (TradingView)

Also, note that FANG’s medium-term chart suggests that the market has drawn in buyers to its October highs, in line with its August highs. However, it remains below FANG’s June highs, which we believe is unlikely to be retaken.

Therefore, the market seems to be setting up FANG for a steeper fall, for FANG to “catch up” with the weaker price action dynamics in the underlying WTI market.

We urge investors to be patient and wait for a re-test of its “intermediate support 1” moving ahead. A failure to sustain that level could see FANG fall toward its “intermediate support 2,” with a bottom between these levels.

As such, we believe the reward-to-risk profile is unattractive at the current levels and urge investors sitting on significant gains to consider cutting exposure.

We rate FANG as a Sell.

Be the first to comment