da-kuk

Thesis

The BlackRock Corporate High Yield Fund (NYSE:HYT) is a closed end fund focused on high-yield debt. The vehicle has current income as its primary objective. Coming from a premier investment manager in BlackRock (BLK), the fund has a very granular approach, with over 1,500 credits in the portfolio.

The fund came out yesterday with a rights offering announcement:

Holders of Shares on the Record Date (“Record Date Shareholders”) will receive one Right for each outstanding Share owned on the Record Date. The Rights entitle the holders to purchase one new Share for every 5 Rights held (1-for-5); however, any Record Date Shareholder who owns fewer than five Shares as of the Record Date will be entitled to subscribe for one Share. Fractional Shares will not be issued upon the exercise of Rights.

The offering expires on October 13, 2022 and has a discount to NAV on expiration date formula to determine the price obtained for new shares:

The subscription price per Share (the “Subscription Price”) will be determined on the expiration date of the Offer, which is currently expected to be October 13, 2022, unless extended by the Fund (the “Expiration Date”), and will be equal to 95% of the average of the last reported sales price per Share on the New York Stock Exchange (the “NYSE”) on the Expiration Date and each of the four (4) immediately preceding trading days, provided that, if such price is equal to or above net asset value (“NAV”) per Common Share at the close of trading on the NYSE on the Expiration Date, the Subscription Price shall be reduced to $0.01 below NAV per Common Share at the close of trading on the NYSE on the Expiration Date (the “Formula Price”). If, however, the Formula Price is less than 90% of the Fund’s NAV per Share at the close of trading on the NYSE on the Expiration Date, the Subscription Price will be 90% of the Fund’s NAV per Share at the close of trading on the NYSE on the Expiration Date. The Subscription Price will be determined by the Fund on the Expiration Date.

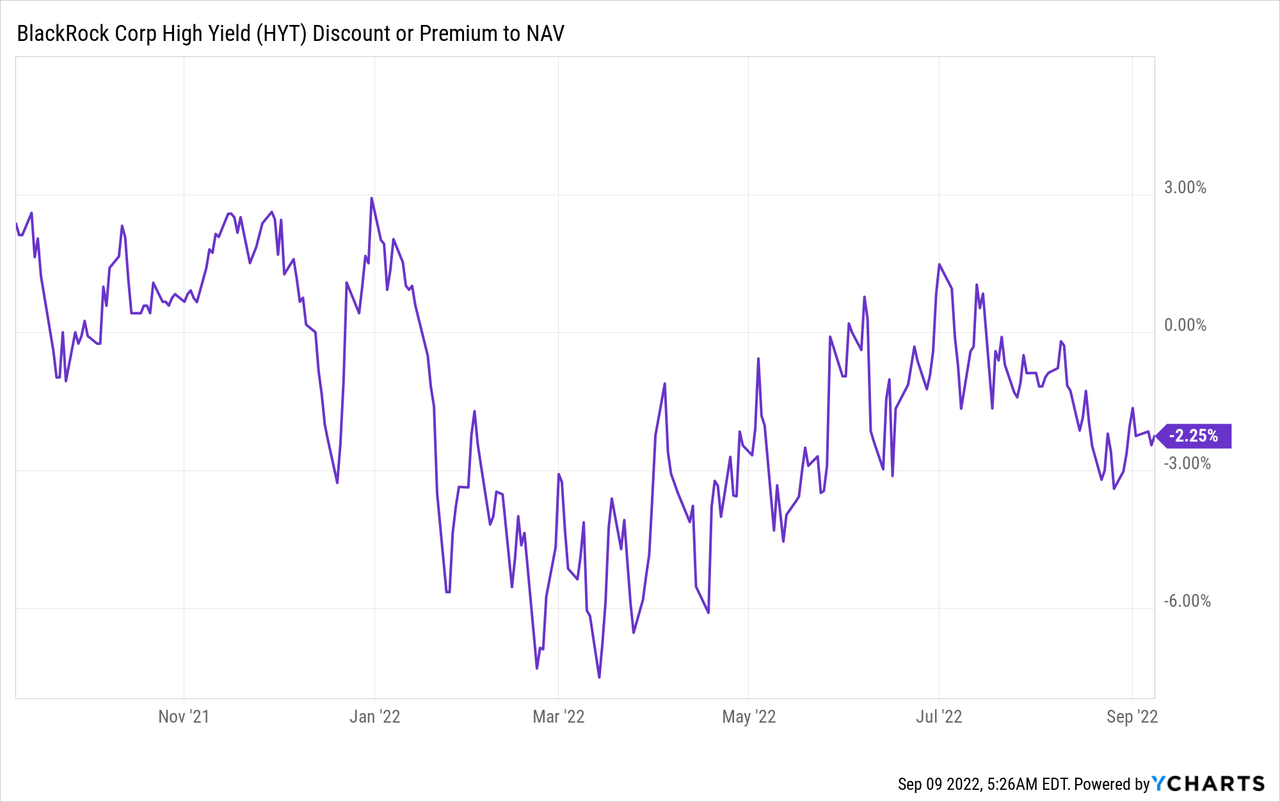

The final subscription pricing will be determined only on the expiration date, but will nonetheless give shareholders an attractive entry point as long as the fund is not trading at a discount to NAV exceeding 10%. The fund is currently trading at a slight discount to net asset value:

The rights offering is transferable and will be available for trading, which means that retail investors who are not otherwise holders in the fund currently can benefit from the rights offering if they choose to do so:

Rights are transferable and are expected to be admitted for trading on the NYSE under the symbol “HYT RT” during the course of the Offer and will cease trading one day before the Offer’s Expiration Date (September 20, 2022 through October 12, 2022). During this time, Record Date Shareholders may also choose to sell their Rights.

The entire process will be run, similarly to other offerings, through a retail investor’s broker:

To exercise their Rights, shareholders who hold their Shares through a broker, custodian or trust company should contact such entity to forward their instructions to either exercise or sell their Rights on their behalf. Shareholders who do not hold Shares through a broker, custodian, or trust company should forward their instructions to either exercise or sell their Rights by completing the subscription certificate and delivering it to the subscription agent for the Offer, together with their payment, at one of the locations indicated on the subscription certificate or in the prospectus supplement.

Please note that the new invested capital will only benefit from the fund’s dividend yield starting with the November 2022 dividend date:

Additionally, the Fund declared a regular monthly distribution payable on September 30, 2022, with a record date of September 15, 2022, and a regular monthly distribution payable on October 31, 2022, with a record date of October 5, 2022, neither of which will be payable with respect to Shares that are issued pursuant to the Offer as such issuance will occur after these record dates. Shares issued pursuant to the Offer will be entitled to receive the monthly distribution expected to be payable in November.

Should you like this Rights Offering?

More often than not, rights offerings are done by funds who “burn” through their AUM by disbursing much more than the underlying asset cash flows. Those offerings ultimately serve to just keep the AUM above a certain threshold and are not accretive to shareholders.

In HYT’s case, things could not be more different. The CEF has a stable NAV, and the current rights offering is a very smart capital raising exercise. HYT has identified Q3 2022 as a very opportune time to buy new collateral. High-yield debt is currently trading at very attractive pricing, and the fund is raising capital to invest at a very opportune time. A very smart play by the fund managers.

Conclusion

HYT is a high-yield debt fund from BlackRock. The vehicle has had a robust historical performance and is trying to take advantage of the current discounted secondary market environment for junk bonds. The current rights offering represents a capital raising exercise for HYT, capital which is to be used to buy new bonds at great entry points. The final subscription pricing will be determined only on the expiration date based on the final four days of market pricing, but will nonetheless give shareholders an attractive entry point as long as the fund is not trading at discounts exceeding 10% of NAV. We like what HYT is doing and consider this a very smart play given current market conditions.

Be the first to comment