Douglas Rissing

The Federal Reserve is preparing to raise the range on its policy rate of interest again when the Federal Open Market Committee meets on September 20 and 21.

Right now I read that the odds are that the Fed will raise the range of the policy rate of interest by 75 basis points, marking the third time in a row that the Fed has moved the range by 75 basis points.

Competition, however, is building up around the world.

The European Central Bank has just raised its policy rate of interest by 75 basis points.

The Bank of England has just raised its policy rate of interest by 50 basis points.

And the Bank of Canada has also just raised its policy rate of interest by a full percentage point.

So, everyone is in the game right now.

The Federal Reserve System is still suggesting that it will continue to raise its policy rate of interest well into 2023.

Mr. Powell is serious about tightening up on the Fed’s monetary policy.

Remember, he told us so in his speech at the Jackson Hole Conference on August 26, 2022.

Securities Portfolio

Furthermore, since May 18, the securities portfolio of the Federal Reserve has declined by slightly more than $100 billion.

In the Fed’s original plan, the Fed would oversee a modest reduction in its securities portfolio in the first couple of months of the “tightening” plan, but this would increase beginning in September and going forward.

The plans for the future months: each month the Fed will oversee a reduction in U.S. Treasury securities of around $60.0 billion every month and a reduction in mortgage-backed securities of around $35.0 billion.

Thus, the securities held outright by the Fed are expected to decline by about $95.0 every month.

This is what Jerome Powell, the Fed’s Chair, has committed to.

There will be playing around in other areas of the Fed’s balance sheet. For example, the General Account of the U.S. Treasury Department has fallen by about $40.0 billion since the middle of March and this has put about $40.0 billion of reserves back in the commercial banking system.

Then there is the account “reverse repurchase agreements.”

Reverse repurchase agreements take place when the Fed sells some securities to a government securities dealer under an agreement to repurchase the securities after one-, two-, or three days.

These transactions are not treated like a regular sale of a security that the buyer now owns permanently.

So, these “sales” cannot really be considered to be “sales” for the purpose of reducing the size of the Fed’s portfolio of securities bought outright.

But, if transacted over and over and over again, the “sales under an agreement to repurchase the securities have the same impact on “Reserve Balances with Federal Reserve Banks” as do an outright “sale” of securities.

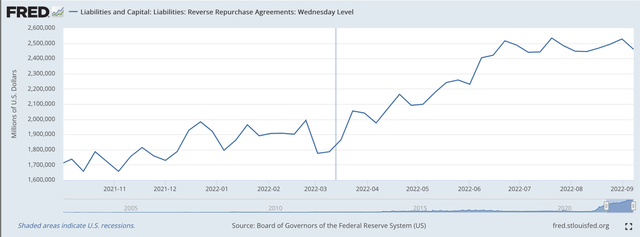

Note in the following chart that reverse repurchase agreements have increased since October 1, 2021, from just under $1.7 trillion to their current level of around $2.5 trillion.

Reverse Repurchase Agreements (Federal Reserve)

Thus, the Fed has seen about $800.0 billion of reserves removed from the commercial banking system over this period of time.

Looking more closely at the data, we see that the reverse repurchase agreements really started to move up in the middle of March 2022, the time at which the Fed first started to raise its policy rate of interest.

In fact, most of the decline in Reserve Balances with Federal Reserve Banks, the proxy for excess reserves in the banking system came from this increase in reverse repurchase agreements.

And, it was this reduction in commercial bank excess reserves that helped the Federal Reserve support the rise in the effective Federal Funds rate.

So, since the middle of March, the Fed has seen its securities portfolio decline a little less than $100.0 billion and it has seen its reverse repos go up by about $600.0 billion and these two actions have accounted for the major part of the decline in commercial bank “excess reserves.”

And, this decline in “excess reserves” helps to account for the rise in the Fed’s policy rate of interest.

Mr. Powell’s Promise

So far, the Fed’s actions have been consistent with the monetary tightening promised us by Fed Chair Jerome Powell.

So, Mr. Powell has started the battle. The open question is whether or not he will finish the battle.

There are still doubts out there in the markets that Mr. Powell won’t follow through.

The battle may get too hurtful, and, in such cases, Mr. Powell may pull back.

Jason Furman, former Chairman of the White House Council of Economic Advisers, writes in the Wall Street Journal about a paper produced by two economists at the International Monetary Fund and printed by the Brookings Paper on Economic Activity that indicates how severe monetary policy might have to get to return the U.S. rate of inflation to the Fed’s policy goal of 2.00 percent.

The research suggests that unemployment might have to return to 6.5 percent for two years to achieve this target.

Mr. Furman presents some ideas on how the Fed might do this, but the ultimate question is whether or not Mr. Powell will stick to the tightened monetary policy he is now advancing in the face of such scary employment results.

There are many investors that still seem to think he will really stick the battle out.

There are others, however, who feel that Mr. Powell’s plans do not go far enough.

The concern is Mr. Powell and the Fed pumped more than $4.0 trillion into the financial system in the 2020-21 period and the current plans do not take Mr. Powell and the Fed back to where they were before all this disarray took place.

That is, Mr. Powell and the Fed really have more work to do than they have admitted to at this time. They may be falling short because they are not admitting to all that they had done fighting the spread of Covid-19 and the Covid-19 recession.

Some critics even claim that Mr. Powell and the Fed are intentionally not including this whole picture.

Long Way To Go

The bottom line still is, that we don’t fully know where we are going.

Hence, markets remain volatile. For example, the stock markets closed up for the second day in a row, even with Mr. Powell, and also, Ms. Lael Brainard, Vice-Chair of the Fed, stating how active the Fed must continue to be in fighting inflation.

Just seems like, over and over again, investors don’t give Mr. Powell…and now Ms. Brainard…full credibility.

Be the first to comment