Editor’s note: Seeking Alpha is proud to welcome Mark Chantler as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

ASOS | Nordstrom Pop-Up At The Grove In Los Angeles Gonzalo Marroquin

Shares of ASOS Plc (OTCPK:ASOMY)(OTCPK:ASOMF) have continued to decline due to the headwinds they’re currently facing. We believe that this is a temporary blip in a phenomenal 20-year track record of profitable growth, and that ASOS will survive and return to profitable growth in the medium term. Even at well below historic levels, this should deliver >35% IRR’s for shareholders from today’s share price.

Business Introduction

ASOS started in 2000 with the idea of sourcing clothing that people saw in movies, on TV shows, or worn by their favorite celebrities. Hence, the name ASOS is an abbreviation of “as seen on screen.” It has since grown into a £4Bn turnover fashion e-tailer whose vision is “to become the world’s number-one destination for fashion-loving 20-somethings.” It listed on AIM in 2001 and on the main LSE in February 2022.

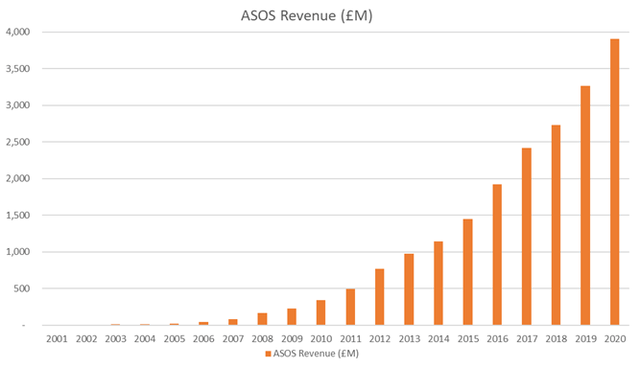

Through its app and website, ASOS markets and sells >100,000 different fashion products across 200 markets in 10 languages. These comprise 17 of ASOS’s own brands (c. 40% of sales) and 850+ other brands (c. 60% of sales). ASOS has grown revenue every single year since its inception, averaging a 28% CAGR for the last 10 years, from £340M to £3,910M. Originally a UK business, it moved into Europe, the U.S., and the rest of the world and has been present in those markets for over 10 years. ASOS now has 26.4M active customers with fulfillment and returns centers in the UK, EU, and the U.S. It employs 3,000 people across fashion, operations, and IT.

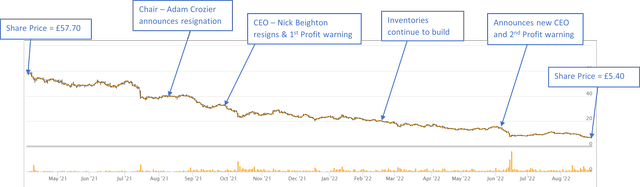

ASOS is currently undergoing a myriad of headwinds including supply chain disruptions, inflationary pressures, inflated inventories, huge management changes, and even newspaper reports of a customer being delivered damaged goods. As a result, the share price has fallen 90% in the last 18 months from a £5.7Bn market cap to £540M, and EBIT has been wiped out from £190M in FY21 to £20M (forecast) in FY22.

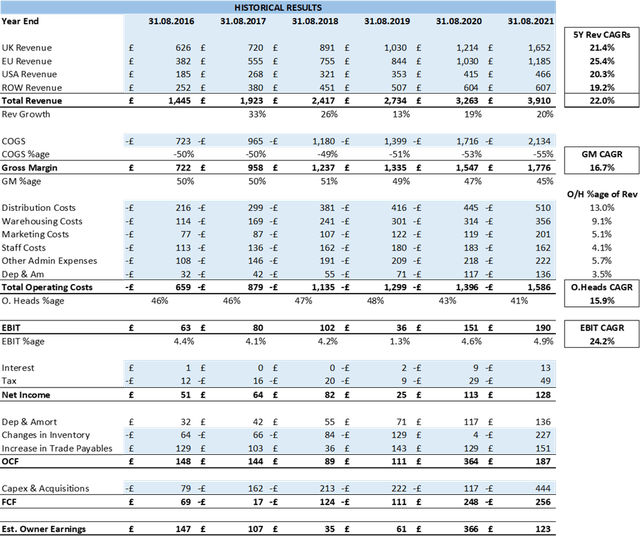

Key Financials

ASOS Historic Financials (ASOS Financial Reports)

The Business Model

ASOS operates a hybrid model of selling its own brands and partner brands. We view the business model in three – heavily interlinked – parts:

- ASOS Brands (Create): 17 own brands with £1.4Bn in sales sold on the ASOS platform and wholesaled to partner platforms to extend their reach.

- ASOS Platform (Curate): Providing everything fashion related for 20-somethings on one platform and using data and the Premier subscription service to improve the customer experience and operational efficiency. This has also recently expanded into ASOS Services, which makes their brand partners their customer for advertising and fulfillment services.

- ASOS Experience (Convert): A global network of fulfillment centers and returns centers that can offer next day delivery and free returns.

Share Price Decline

Following a share price rally from £12 in March 2020 up to £55.70 in March 2021, it has since been an 18-month long, >90% price decline from £55.70 (£5.7Bn market cap) to £5.40 (£540M market cap). This is due to the management changes, profit warnings, and the economic environment ASOS has found itself in.

Core Investment Thesis

Many of ASOS’s problems – namely supply chain issues, inflation, and the risk of a recession – are being faced by all fashion e-tailers that have also suffered large share price declines in the last year. For instance, Boohoo (OTCPK:BHOOY) is down 91% and Zalando (OTCPK:ZLNDY) is down 79%. In addition, ASOS has had sudden and wide-ranging management changes.

ASOS share price is now at its lowest level in 12 years (when it was roughly 5% of the size it is today). It is priced at <3x its peak EBIT in FY21 and 51% of book value. It’s comparatively cheaper than both of its main competitors in Boohoo and Zalando, being priced well below a distressed acquisition price.

Our investment thesis for ASOS is based on answering three questions:

- Will ASOS survive? We will show that ASOS has the liquidity needed to survive a very tough economic environment.

- Will ASOS return to profit? We can see a clear route for ASOS to return to low-mid single digit EBIT margins.

- Will ASOS return to growth? We believe ASOS’s current stall in growth is temporary and that their 20-year track record of profitable growth will continue once they’ve overcome their issues.

If ASOS returns to even moderate growth and profitability levels – far below historic levels – we should expect >35% IRR, with huge additional upside if management can deliver their medium-term goals set out in October 2021.

1. Will ASOS Survive?

ASOS have access to three main lines of debt: £500M in convertible bonds (at 0.75% interest rate, out to April 2026); £350M revolving credit facility (available until July 2024, remains completely undrawn) and a £22M loan from Nordstrom (at 6.5% interest rate, repayment not due for more than five years). Year-end guidance is for net debt to increase to £210M (after changing the treatment of the convertible bonds to all debt).

To stress test ASOS’s liquidity, we have taken very prudent assumptions on their performance going forwards of: zero revenue growth, 0% EBIT in FY23, then 1.5% EBIT from FY24; RCF expires in July 2024 and is not replaced; convertible bonds expire April 2026 and are not replaced; and inventories remain at peak highs and capex continues at £200M per year, despite delivering no growth.

In this scenario, ASOS would have £662M of liquidity in August 2022, dropping to £384M upon expiry of the RCF in 2025 and then (£61M) when the convertible loan notes need to be repaid in April 2026. ASOS’s inventories are currently at record highs of 173 days’ worth of COGS. If ASOS could reduce their inventory levels back to the five-year average of 128 days, this would add +£280M of liquidity to these figures.

2. Will ASOS Return to Profit?

Gross margins have been squeezed since FY18 from 51.2% to 45.4% in FY21, and 43.5% (forecast) in FY22. That’s a total decline of 7.7%. This is due to increased promotional activity and regional pricing (1.5%), increased freight and duty costs (3.2%), lower margin sales mix during COVID (2.8%), and enhanced clearance activity in spring/summer 2021 (1.6%), offset by improved buying margin +1.6%.

Management does not expect gross margins to return to >50% in the medium term, but is expecting them to get back to 47%-48% and EBIT margins to be >4%. For our base case to hold true, we need to see a way back from 0% EBIT in FY22 to 3% within the next five years. Given the degree of uncertainty, we would need to see levers well above 3% for ASOS to realistically return to profitability. We divide these margin opportunities into two buckets:

A) Exceptional/COVID-related costs, which should naturally improve: enhanced clearance activity not recurring +1.5%, inflated freight costs, now declining +1.5%, and the full-year effect of price increases already in place +1%-2%.

Average freight costs – Sept ’20 to Sept ’22 (Freightos Data )

B) Actions and investments to improve margin: continued investment in automation at Atlanta and Lichfield +0.5-1%, continued cost mitigation +1%, marketing spend +0.5%, improved buying margin through fabric consolidation and local sourcing +0.5-1%, and charging for returns +2-3%.

Returns are a key swing factor in ASOS’s profit, and the company has already implemented price increases for their highest return items. ASOS, Zalando, and Shein still offer free returns, but Boohoo, Next, and Zara charge £1.99-£2.50 per parcel (Boohoo brought in their returns charge in July 2022).

ASOS ships 95,200 order per year. Assuming returns stand at 30% today, a return charge of £1.99 per parcel (to match Boohoo) would generate between £57M (if 30% of orders were returned in full) and £190M (if one item from every order was returned). It will be neither of these extremes, but somewhere in between, so 2%-3% of revenue is a sensible assumption.

The above actions could add 9.5%-11.5% to ASOS’s margins. We are not suggesting that ASOS could enact all these measures without a detrimental impact on the customer experience and sales, but it is worth noting that they have a number of levers they can pull to bring margins back up over time, and that 4%-5% of this increase should roll through automatically.

3. Will ASOS Return to Growth?

ASOS Revenue Growth (ASOS Financials)

ASOS has grown revenues every single year since it was founded in 2000. From FY21 to FY22, although ASOS has not stopped growing in nominal terms, the +2% revenue growth from FY21 to FY22 sales figures certainly represents a real decline in sales. Rather than a sudden end to ASOS’s long-term growth or an industry shift back to the high street, we believe that FY22 is an anomaly driven by sales pull forward during the pandemic, supply chain issues, and a change in consumer spending, as more was spent on experiences over fashion.

ASOS estimates its TAM at £326Bn, giving ASOS just 1.2%. Statista expects the fashion e-commerce market to grow by 9.1% CAGR to 2025. While revenue growth is important for the long-term success of ASOS, returning to profitability is a far bigger driver of investment returns for the next five years. If margins improve to 3% EBIT, but ASOS’s sales do not grow at all, we still expect an IRR of >25%.

The Management Team and Incentives

Jose Calamonte (the new CEO) was appointed in June 2022. He is clearly intelligent (having attended MIT and worked at McKinsey) and has a fashion background (having worked for Indetex, Esprit, and Salsa Jeans). He is an internal promotion from CCO where he was an integral part of “Fashion With Integrity” and the medium-term financial plans for ASOS.

Jørgen Lindemann (the new chairman) has a huge amount of experience in digitally lead businesses. He is chair of Miinto, the Danish-based online fashion marketplace, and is on the board of Bambuser AB, the Swedish-based global live video shopping technology company. He also sat on the board of Zalando as a non-executive director from 2016 to 2021.

The CEO and chairman have a great deal of relevant experience and, having listened to both speak for several hours, they come across as passionate, engaging, and intelligent (as you would expect). They are both internal promotions and were involved in the plans laid out at the Capital Markets Day in November 2021. We would usually see this as big positive, but they were both new joiners to ASOS in 2021 and as such hadn’t spent a great deal of time in the business before getting promoted. The management change creates further uncertainty in ASOS and is something we will track carefully in the coming months and years.

Looking at the structure and quantum of ASOS’s long-term incentive scheme (ALTIS), we find the incentive scheme fair and proportionate to deliver shareholder value. If even the threshold payout of ALTIS is achieved, shareholders should expect a 5x-10x return on their investment in the next three years, far above even our bull case.

Competitors

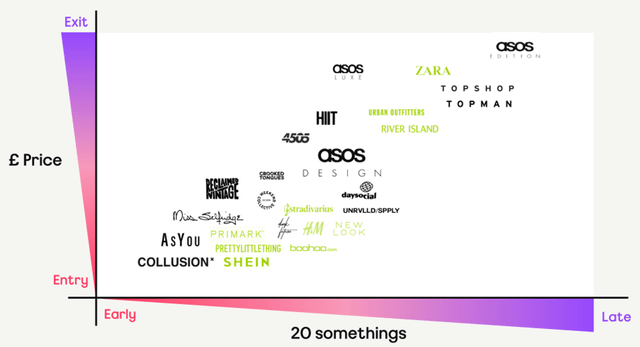

The ASOS brands have many competitors, depending on the age and price point of the target customer:

ASOS Brands Competitors (ASOS Capital Markets Day)

ASOS’s main platform competitors are Boohoo, Shein, and Zalando.

Boohoo is a UK-listed fashion e-tailer with c. £2Bn in revenues. The company only sells its own brands and generally focuses on the cheaper end of the market.

Shein is the world’s largest fashion e-tailer with a turnover of $16Bn (c. £14Bn) across 220 countries. A private business that raised $1bn in April 2022, valuing the business at $100bn, Shein only sells its own brands and is truly fast fashion, adding an average 2,000 items to its store per day.

Zalando is a €10Bn (c. £8.5Bn) revenue business that sells third-party brands across Europe and has the ambition to go from 3% of fashion sales in Europe to 10%.

Both Boohoo and Shein have been linked to a number of scandals around working conditions and underpayment in their supply base, corporate governance issues and accusations of plagiarism. We believe that either Shein or Zalando could be viable acquirers of ASOS. Shein was the underbidder to ASOS on the Arcadia brands and Zalando’s largest shareholder (the Bestseller/Povlsen family) is also ASOS’s largest shareholder. They both trade at significant premiums to ASOS, presenting a large multiple arbitrage for either competitor at 4x-5x ASOS’s current price, with the addition of huge synergies a trade buyer should expect.

ASOS’s Competitive Advantages

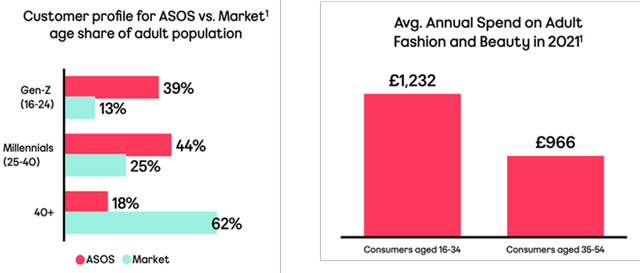

20-Somethings:

We view ASOS’s mission of being the go-to “destination for fashion- loving 20-somethings” as a competitive advantage. 83% of ASOS’s customers are under 40, and the average age of an ASOS customer has stayed constant at 28/29 for the last 10 years.

We believe that age demographic is the right way to orientate the business, rather being focused on only its own brands (like Boohoo and Shein) or only third-party brands (like Zalando). We also believe that 20-somethings is the right age to focus on, as they tend to have a higher focus on fashion and enhanced spending on fashion.

ASOS Customer Base (ASOS Capital Markets Day)

Fashion With Integrity:

Fashion is the third-largest manufacturing industry in the world and, by some calculations, it produces up to 10% of the world’s emissions. Unlike some key competitors, ASOS has taken ESG seriously since they launched FWI back in 2010. ASOS conducted a materiality study in 2020 to update its targets and is focusing on the areas its stakeholders care most about: “be net zero, be more circular, be more transparent, and be diverse.”

ESG is important factor for ASOS’s target demographic. We believe FWI gives ASOS a competitive advantage when customers choose where to shop, but also in avoiding scandals that have hurt their competitors in the past.

Brand Moat:

We would describe both the ASOS platform and ASOS brands as having a moderate brand moat. ASOS has 13.8M Instagram followers and the app has been downloaded tens of millions of times. They are driving loyalty through their focus on 20-somethings, FWI, rewards for students, and their premier program.

ASOS describes its Topshop brand as iconic and feels other brands (like Collision) could also become iconic in the medium term. That said, they clearly cannot command the sort of brand power and premium that genuinely iconic brands such as Coca-Cola, Ferrari, or Gucci can.

Key Economic Risks and Variables

Our investment success will depend on ASOS’s ability to return to low-single-digit EBIT margins and to grow revenues in the medium term. Given ASOS’s current issues and the economic environment, we have used prudent assumptions for both these metrics.

Return to Profitability:

- Base Case Assumption: This assumption is for ASOS to trend back to 3% EBIT over the next five years. This compares to an average 3.9% EBIT in L5Ys and management guidance of >4%.

- Impact of a Miss: Medium – if ASOS only achieves a 2% EBIT, with the same revenue growth assumptions, then a 15x EBIT exit multiple still delivers >25% IRR.

- Risk of a Miss: High – there is a real risk that inflation and a recession will push out the timeline of ASOS’s recovery. However, we believe ASOS can survive any reasonable assumptions and that they will be well-placed when this environment does end.

Revenue Growth:

- Base Case Assumption: 0% growth for FY23, then 8% CAGR FY23-FY27. This compares to 22% in L5Ys.

- Impact of a Miss: Low – 1% less revenue CAGR, reduces IRR from 37% to 32%. Even 0% revenue growth delivers >25% IRR if ASOS returns to 3% EBIT Margins.

- Risk of a Miss: Medium – the revenue growth assumptions used are already prudent when compared to historic levels and delayed by a year. A very large recession could push this back further, though.

Valuation

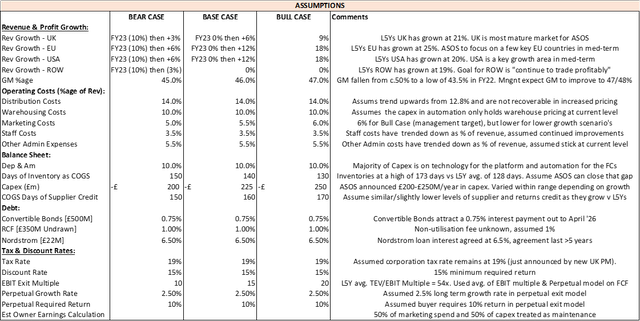

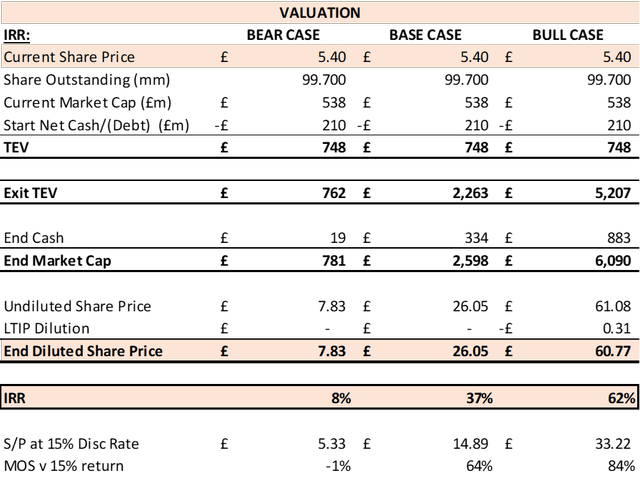

Key Valuation Assumptions (own data) ASOS Valuation (Bear, Base & Best Case)

The base case valuation assumes that ASOS does not start to recover for another 12 months from today (with FY23 matching FY22 at 0% revenue growth and 0% EBIT). We then grow revenues by 8% CAGR (vs. 22% in L5Ys) and improve EBIT to 3% (vs. 3.9% average for L5Ys). The exit multiple used is then 15x EBIT (vs. 54x average for L5Ys).

Even with these prudent assumptions, we produce a 37% IRR with an upside to 62% if management hits their medium-term guidance.

Conclusion

ASOS operates in a tight-margin and highly competitive space. We like ASOS’s approach to the 20-somethings market, its flexibility to sell both its own and third-party brands, and the fact that it has avoided – and should continue to avoid – the scandals that Boohoo and Shein have faced by taking sustainability and supply chain transparency seriously.

For many of ASOS’s headwinds, the worst should already be behind it (supply chain issues, freight cost spikes, and inventory build). For others, they might continue for some time (high inflation and a squeeze in consumer spending) but are ultimately temporary.

To model a breakeven scenario from ASOS’s current share price, you have to assume that – over the next five years – ASOS spends £1Bn in capex and £1.1Bn in marketing, despite not growing revenues, and only makes 1% EBIT margins and sells for 12x EBIT/1.5x EBITDA. Given ASOS’s unbelievable track record of profitable growth since it was founded over 20 years ago, we see this as highly unlikely.

We feel that ASOS has both a large price to value gap against its current share price, and that ASOS’s value will continue to grow over time. The timing of a recovery is highly uncertain, and will be largely driven by external factors. But this has been factored into our base case assumptions, with a year’s delay in any recovery and lower growth rates and EBIT levels going forward.

Be the first to comment