Douglas Rissing

If one looks at the Federal Reserve balance sheet this week, the Fed release H.4.1, “Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks,” one sees that the Fed’s “Securities Held Outright” declined by $19.6 billion.

All the decrease came in U.S. Government securities.

Not much had been done up to this time.

So, is the Fed really starting to reduce its securities portfolio?

For right now, we’ll answer this question with a “yes.”

Overall, Reserve Balances With Federal Reserve Banks, a proxy for the ”excess reserves” in the banking system, rose by just over $100.0 billion, but this rise was primarily achieved by a reduction in “Deposits with the Fed,” the largest decline coming from the General Account of the U.S. Treasury Department.

Reverse repurchase agreements also declined, and this adds reserves to the banking system. Reverse repos fell by almost $50.0 billion.

What we are looking for here is confirmation that the Federal Reserve is going to do what it promised us it would do…reduce the size of its securities portfolio.

So, with the decline of $19.6 billion, we can say that the Fed is really moving to reduce the size of its securities portfolio.

Investors are waiting for such confirmation, because they are not totally convinced that Fed Chair Jerome Powell and the Fed will actually carry out a major tightening of monetary policy to combat inflation.

So, with this week’s results, we can say that it looks as if the Fed has begun its “tightening” journey, a trip that is supposed to take us into the year 2024.

The Current Positioning

The Federal Reserve has been working on its program to fight inflation since the middle of March 2022.

This is when the Fed made its first move to raise its policy rate of interest.

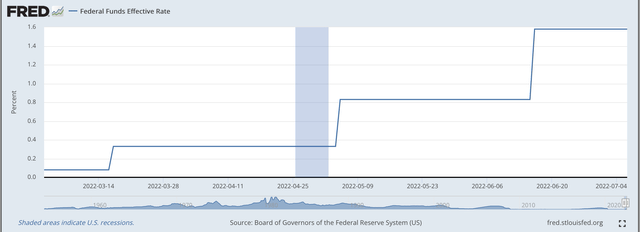

Effective Federal Funds rate (Federal Reserve)

At the March 16 meeting of the Federal Open Market Committee meeting, the committee voted to increase the range for the policy rate of interest by 25 basis points.

In May, the Fed voted to raise the range by another 50 basis points.

And, then again, in June, the Fed voted to raise the range by another 75 basis points.

The Fed has intended to follow up on these moves by beginning to reduce the size of the Fed’s securities portfolio, and, consequently, reduce the size of its balance sheet.

It appears as if the latter part of this move is now underway.

At an earlier date, the Federal Reserve announced its plans for the shrinkage.

Actually, getting started on this process will help the Fed combat some of the concerns over the Fed’s commitment to actually carry out the plan it presented.

Now, we will see what happens.

Next Interest Rate Move

The Fed has another meeting of the FOMC this month, on July 26 and 27.

The Fed is expected to raise its policy range again.

The question that is being debated right now is whether the range will be raised by 50 basis points this time or 75 basis points.

A lot of analysts believe that the Fed is only going to come through with a 50 basis point rise because of all the “good news” that has been announced recently.

Still, Fed officials are talking “strong,” talking up the higher increase.

Then there is the FOMC meeting scheduled for September 20 and 21.

Another 75 basis point increase?

And, of course, there is the planned shrinking of the securities portfolio.

The Fed will be closely watched.

The future is still too uncertain for investors to move one way or the other with a lot of confidence.

The possible behavior of this Federal Reserve Chairman and his Board of Governors is really a question mark at this time.

This is why there is so much discussion in the press over what the Federal Reserve is thinking and what the Federal Reserve is going to do.

Confidence in this Federal Reserve chairman and his Board of Governors is just not that high.

So, markets remain volatile and investors remain unsure.

The Value Of The Dollar

As far as the public is concerned, the value of the U.S. dollar has risen in attention and there is growing discussion about just where the value of the U.S. dollar is going.

Currently, it costs about $1.0150 to purchase one Euro. Also, it costs about $1.200 to purchase one British pound.

The direction, to many, is $1.0000 for both currencies.

What is missing?

To a lot of people, leadership is missing, both in the eurozone and England.

The Federal Reserve, on the other hand, over the past two years or so, has really wanted a strong dollar.

But, what will that mean?

What pressures will foreign exchange prices like that actually bring?

Again, more questions for the future.

Conclusion

The Federal Reserve has a lot to deal with these days.

Uncertainty is going to continue to reign.

Investors will continue to search for a clearer picture of the future.

And, bad things might happen.

Investors today must “stay on their toes,” and keep abreast of what is going on as well as possible.

There is little else that can be done in a period of time like this.

Be the first to comment