cemagraphics

Soft Q3 Reflecting Weak Markets

Diamond Hill Investment Group (NASDAQ:DHIL) reported a weak Q3 reflecting a weak global economy, and bearish stock and bond markets. Revenues declined -30%, while EPS at $3.90 was down significantly from $8.03. Adjusted net operating income after-tax was $3.55 per share, down from $6.41 last year. A net investment loss of $8.0mn in Q3, versus a prior period loss of $2.6mn, also contributed to the decline in net income.

During the quarter, DHIL repurchased $14 million worth of stock [2.5% of market cap] at an average $177 per share. YTD in 2022, almost $36 million has been repurchased, representing 6.6% of the total current market cap. FCF generation continues to be robust, and management also announced a Special Dividend of $4.00 per share, in addition to the regular dividend of $1.50.

AUM at the end of September stood at $26.2bn, down from $30.7bn a year ago. DHIL witnessed net outflows of $760 million, with a 90% majority of the outflows from equity funds.

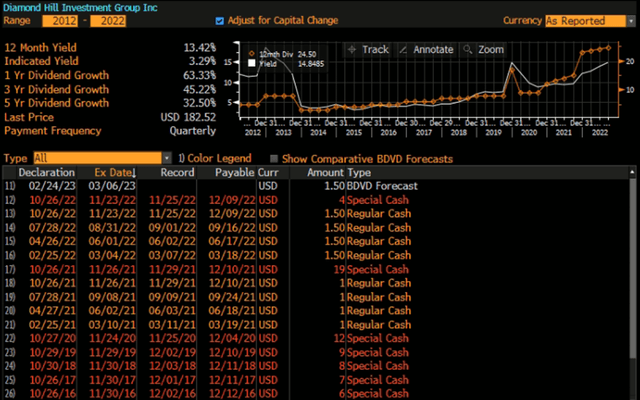

13% Dividend Yield for 2022

Cash and corporate investments held directly by Diamond Hill now amount to $51.00 per share, or 28% of the current market cap. This net cash amount is about flat from 6 months ago, despite the buybacks and large dividend. Additionally, the net cash is after returning a little over $80mn to shareholders through a large dividend and share repurchases in 2021. 2021 dividend yield [regular plus special] amounted to 12.6% and we estimate a dividend yield of around 13% for 2022. In our view, these metrics demonstrate the company’s ability to manage its cash flow and its commitment to generate shareholder value.

Target price of $240.00, 45% further total return

Our target price for Diamond Hill is now set at $240, down slightly from prior $260, reflecting a weaker economy and equity and debt markets. We arrive at this target by using a 12.6x P/E/ on our normal 2023 EPS estimate of $15.00, plus adding back the large net cash. This target represents a potential further total return of around 45%. Diamond Hill’s stock has performed well and has given investors a total return of 101% [including dividends] from our initial recommendation in July 2020.

8.7x P/E, 13% FCF yield, 13% dividend yield

The Diamond Hill Investment Group is an active asset manager, with a 20-year history, over $26bn in AUM and a value investing philosophy. There continues to be no professional Wall Street research coverage of this stock, so it remains relatively undiscovered, in our view. The company has had an excellent 2021, which benefitted from higher inflows, AUM, revenue and operating margins. Our buy recommendation on the stock is predicated on its consistent fund performance, significant cash on the balance sheet, ability to generate robust free cash flows, attractive and inexpensive valuations. As mentioned, net cash to market cap amounts to 28%, which provides huge scope for further special dividends and buybacks.

Conclusion: Strong BS, High Dividend and FCF Yield, Deep Value Multiples

Diamond Hill has been a significant generator of free cash flow over the years, with minimal CAPEX requirements. Looking ahead, with net income expected to return to a normal level in 2023 or 2024, and limited CAPEX needs, we expect Diamond Hill’s FCF yield to be in the 13% to 14% range.

Given this, a low 2023 P/E of 8.7x, and a 2022 expected dividend yield of 13%, we think the stock offers a favorable risk-reward scenario for investors. Our target price for Diamond Hill now is $240, valuing the stock at a P/E of 12.6x, using our 2023 EPS estimate. This represents a total return opportunity of around 45% from current stock levels.

Be the first to comment