Pgiam/iStock via Getty Images

We believe there are signs of capitulation happening in this market. People are giving up. Stocks are getting smashed. Some of the stocks that are holding up better than others are in healthcare and health insurance. But some stocks that should be holding up are getting murdered. Centene (NYSE:CNC) stock has been absolutely crushed. It was down about 25% in the last month. There is panic and fear here and in the broader market. While we like long-term investing and holding good stocks, this has been painful. We actually like the stock in the low $70s for a bounce, and another few sessions of selling and we are compelled to buy. We think it is best played by taking advantage of the high volatility right now in the market and suggest selling out-of-the-money puts for income and/or to define your entry points. Alternatively, we support a buy/write strategy, selling several months out-of-the-money call options to collect the premium. We think this stock rallies hard on the next broader green days in the overall market. Let us discuss why we like this company.

Make no mistake, we are looking for stocks that are offering both value and some growth in this very tough environment. One sector that has done well despite the recent chaos in markets has been healthcare, and specifically, health insurers. They have relatively held up and seen some inflows, though Centene has been spanked. We think this is an opportunity to get long. Why?

This is a longstanding company. Centene has been around for nearly 40 years, founded in 1984. It was started as a nonprofit Medicaid plan by a former hospital bookkeeper of all things. That is the American entrepreneurial spirit at work! It has grown and grown, and grown every few years.

This is exactly the type of company you want to invest in and hang on to long term. Fast-forward to today, and Centene is the largest Medicaid Managed Care Organization. This company is a winner. We still like it even after a 25% pullback. With option premiums so high given the VIX is over 33, selling puts is a winning moneymaking strategy in our estimation. Let us discuss.

For those unfamiliar, Centene is the largest insurance carrier on the Health Insurance Marketplace. Centene is also one of the nation’s largest managed services providers for military families and veterans through its TRICARE program with the Department of Defense.

We like that it has this in place because as a managed service provider for military families, the company has a steady stream of income, as the military and its programs will always have the funding thanks to our tax dollars, and our service members deserve quality coverage, in our humble opinion. In other words, the customer base is large. Centene has also made purchases over the years but also has been doing some divesting, such as offloading PANTHERx Rare, which it bought in 2020. They sold Magellan Rx as well. The money will be used to retire debt and to buy back shares, increasing shareholder value. On top of taking steps to clean up the balance sheet, the performance in the recently reported quarter was solid. In our opinion, this investment offers a combination of growth and value.

While Q3 is now coming to a close and we look forward to seeing those numbers, Q2 was strong. In Q2, revenues spiked 16% to $35.9 billion, rising from $31.0 billion last year. That surpassed consensus by $390 million. That is winning. While the macro situation has gotten worse in the last few weeks with rates rising and the stock market collapsing, Centene’s business should be minimally impacted. That is so key to realize.

With that said, growth is impressive. Traditional Medicaid Members grew to 13.758 million from 12.492 million last year. High Acuity Medicaid members also saw growth to 1.688 million, from 1.531 million. The commercial marketplace was about flat at 2.03 million members while Medicare grew to 1.483 million from 1.183 million members. TRICARE eligible members were also flat.

Bottom line is that the total members overall rose to 26.440 million from 24.673 million a year ago.

This is really positive. The one concern is rising costs, and this is something we will watch for in Q3 when it is reported. That said, in Q2, the cost of service ratio was 85.4% vs 89.6% in the same period in 2021. The decrease in the cost of service ratio stems from picking up the Circle Health business, which always has operated at a lower cost of service ratio. At the same time, selling and administrative expenses increased. The ratio jumped to 8.2% from 7.4% last year. So keep an eye on this.

All told, Centene lost money on a GAAP basis. It lost $0.29 per share. A large reason was that the company took a $1.45 billion charge on its real estate. The company has been selling off assets and taking charges to reduce its real estate footprint. If we account for this charge, the adjusted EPS was $1.77, another beat of $0.18 vs estimates. That is good.

We like the balance sheet too. At the end of Q2, they had $30 billion in cash, investments, and deposits, while also having nearly $800 million in cash and equivalents in some unregulated entities. Total debt is $18.8 billion. We expect this improves with asset sales.

We also love the massive share repurchases. The Centene Board approved a $3.0 billion buyback. So far, they have bought back $450 million worth in 2022.

Valuation

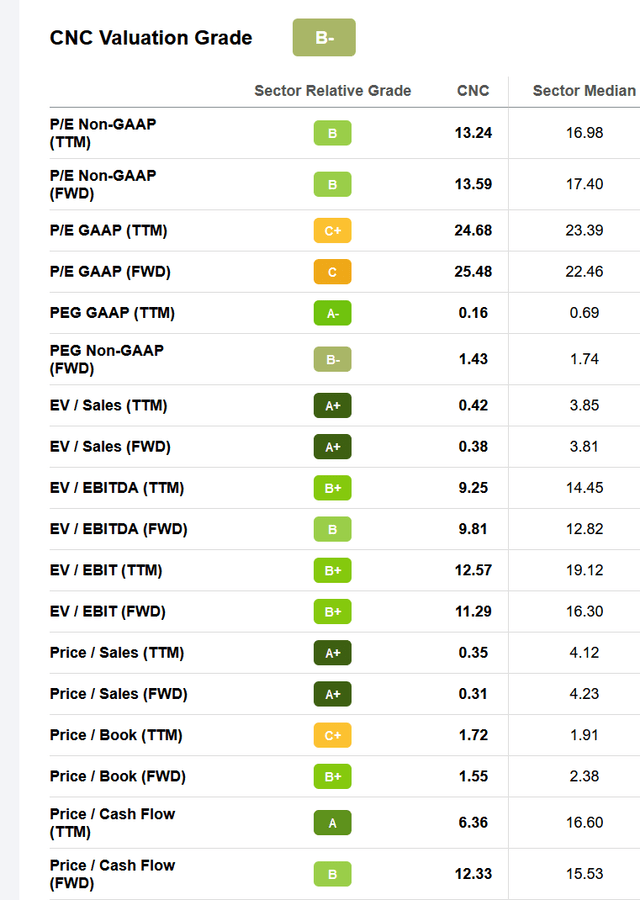

The company has a reasonable valuation.

Centene Valuation-Seeking Alpha

Most notable, the EV/sales is just 0.42, the price/sales is 0.35, the stock is 13.5X FWD EPS, and the price to cash flow is 6.3X. That is pretty attractive relative to the healthcare sector. While the growth is not explosive, after the pullback and the view that revenues should not be too much impacted by interest rates, the valuation makes this attractive.

Final Thoughts

We think selling puts is an easy way to make cash on this one. Growth is somewhat strong and value is attractive. The balance sheet is strong. Healthcare and insurance stocks should do well in the coming months. After a 25% pullback, we see shares as a buy.

Be the first to comment