Petmal

Utilities play an essential part in our road toward net-zero emissions, which will assist future generations in maintaining a sustainable and livable quality of life. Taking advantage of today’s bearish environment and searching for utility firms with strong fundamentals, such as Duke Energy Corporation (NYSE:DUK), which may present a decent pullback opportunity, is a good approach to viewing today’s market.

Duke Energy is one of the utility companies the market has punished; in fact, it is the only one with a negative trailing price return compared to its peers. Perhaps this raises some concerns; however, I believe DUK has a stronger balance sheet than its peers, and today’s decline makes its dividend yield more appealing.

Company Overview

Duke Energy is one of the largest energy companies in the U.S. According to the management, they are among the 10 largest renewable companies in the country. The company received an outstanding award from Guinness World Records for its innovative natural gas power plant. DUK operates under three operating segments: Electric Utilities and Infrastructure, Gas Utilities and Infrastructure, and Commercial Renewables. In Q2 2022, DUK reported a trailing revenue of $26,586 million, better than its FY2021, FY2020, and FY2019 figures. The company’s trailing EPS of $4.94, which is flat compared to FY21 and up from $1.72 in FY20 but remains below its FY19 level, may cause some concern; however, the company’s strong EPS outlook makes it appealing.

DUK’s Electric Utilities and Infrastructures segment enjoys a growing customer base of approximately 8.2 million, up from 7.9 million within its service territory. According to management, they expect this figure to increase over time, as quoted below.

Since the pandemic began, approximately 200,000 new customers have moved into our service areas, boosting the need for energy infrastructure. Commercial and industrial sales rebounded nicely due to increased demand for goods across many sectors. We expect continued expansion in 2022 and project load growth to increase approximately 1.5% in 2022. After ’22, we expect longer-term growth to moderate to flat to 0.5% per year. Source: Q4 2021 Earnings Call Transcript.

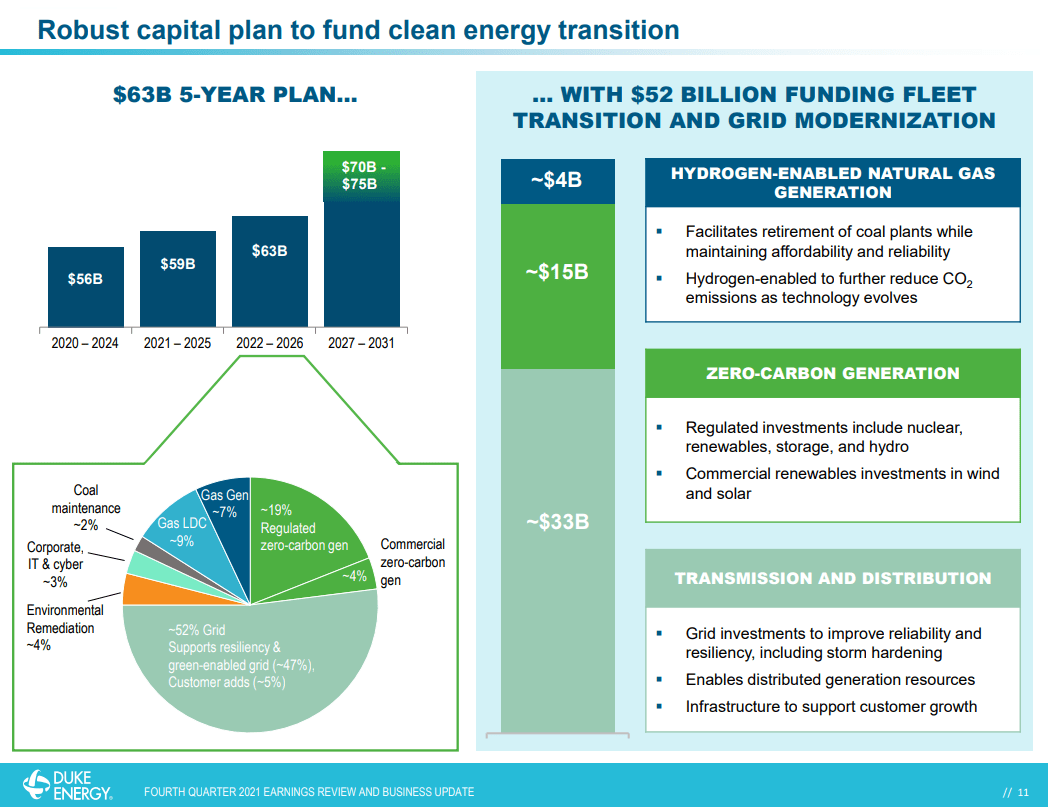

Additionally, DUK boasts a solid capital investment plan that aims to accelerate grid investments and clean energy transition, which will help the company to support customer growth while achieving its net-zero goal in 2050.

DUK: Robust Capital Plan To Fund Clean Energy Transition (Q4 2021 Earnings Call Presentation)

The management allocated 80% of their $63 billion 5-year capital plan to invest directly in their clean energy transition, focusing on opportunities in hydrogen-capable natural gas as well. Management even went so far as to sell a small portion of its Duke Energy Indiana Holdco interest for $2.05 billion to finance this ambitious investment plan.

Additionally, the company enjoys a positive regulatory catalyst, as mentioned below, which supports its plan to provide clean energy to its customers.

In North Carolina, we expect to file a DEP rate case in the fourth quarter, and likely a DEC rate case early next year. Both cases will introduce the modernized rate making tools approved in HB 951, including multiyear rate plans, performance incentive measures and residential decoupling. The NCUC hosted a T&D Technical Conference in late July. DEP presented to the commission and stakeholders and discussed key transmission and distribution investments that enhanced grid resiliency and flexibility, and expand the use of renewables and distributed energy resources on our system.

In South Carolina, Storm Securitization legislation was signed into law in June. This creates a valuable tool to recover prior and future storm restoration costs, while saving customers millions of dollars compared to traditional recovery mechanisms. We expect to file an initial application with the Public Service Commission of South Carolina in August, and expect to issue Store Bonds in late 2023 or early 2024. Earlier this week, we gave notice of an upcoming DEP South Carolina rate case. Our first case to be filed in South Carolina since 2018. We expect to file the case in September and anticipate rates to go into effect in the first half of 2023.

In Florida, we have placed three out of four solar projects planned for 2022 online, and we remain on track to install a total of 300 megawatts of solar by the end of this year.

Shifting to Indiana. The commission approved our $2 billion TDSIC plan, which includes grid modernization investments and improved reliability and resiliency. We will begin executing in 2023 following the completion of our initial TDSIC plan this year. In May, we received a robust response to our request for proposals for generation resources in Indiana. We’re evaluating the proposals now and we’ll incorporate the results into our CPCN filings later this year.

And turning to Ohio. Our electric distribution rate case continues to move forward and the hearing is scheduled to begin in mid-September. In June, we filed an Ohio gas rate case, which is our first detailed review of gas base rates since 2012. Source: Q2 Earnings Call Transcript

On top of this catalyst, DUK also benefits from the recently passed Inflation Reduction Act Law, which provides incentives for clean energy investment. According to the management, this will reduce their service cost through tax credits.

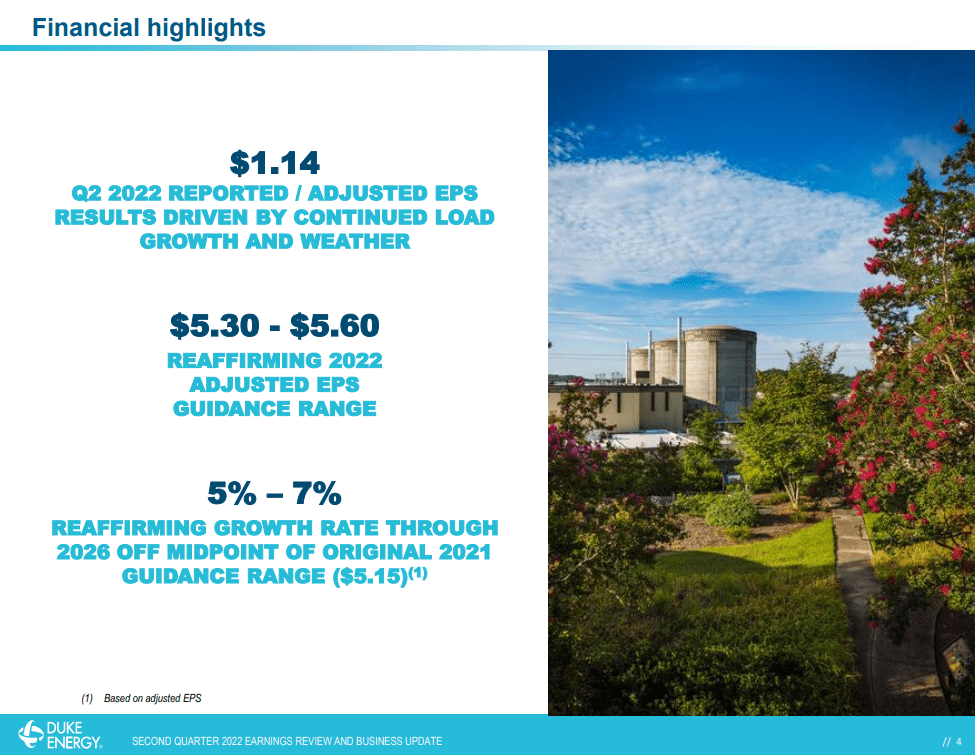

Strong 2026 Outlook

Overall, this strengthens the company’s regulated energy business and makes DUK well-positioned to meet its outstanding EPS guidance, as shown in the image below.

DUK: Financial Highlights (Q2 2022 Earnings Call Presentation)

Another value-added catalyst is news about DUK and Ford (F) currently collaborating to seek opportunities in vehicle-to-grid to optimize grid performance. According to the management, they will start testing in Florida in 2023, and if it turns out to be successful, I believe this will help further the company’s top-line growth.

An Outlier

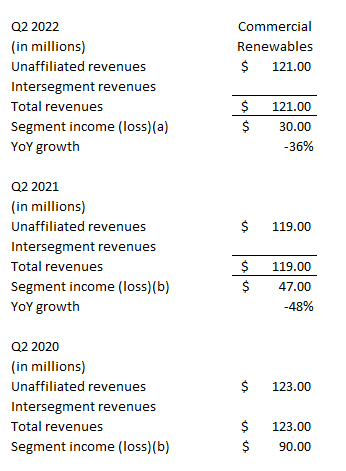

It is reassuring to see that DUK’s regulated energy business is thriving in today’s challenging environment. However, its Commercial Renewable segment, which includes its non-regulated energy business, seems to drag DUK’s total operating segment growth.

DUK: Slowing Commercial Renewable Segment (Company Filings. Prepared by InvestOhTrader)

Looking at the image above, you will see that this segment has consecutively produced a lower figure year-over-year basis. Perhaps this is one of the reasons why the management initiated the strategic review. According to them, DUK’s non-regulated energy business accounts for only 5% of its total earnings and has assets amounting to $7,276 million and a book value of approximately $4 billion.

This could cause a temporary disruption in top-line growth if management sells this segment, or it could result in impairment charges if worse comes to worst, which may negatively impact the management’s EPS outlook for 2026. However, if the management can sell this segment at a profit, I believe we can see another set of capital investments in clean energy.

Punished by the Market

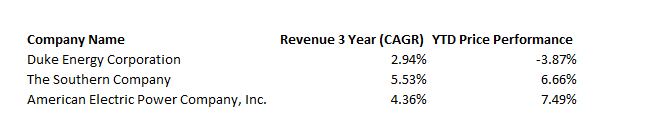

I believe one of the reasons Duke is being punished by the market is due to the concerns about slowing growth.

DUK: Slower Topline Growth (Data from Seeking Alpha. Prepared by InvestOhTrader)

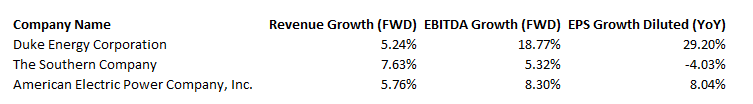

DUK has the only negative YTD performance, as shown in the image above, with 2.94% growth which is relatively slower than its peers, The Southern Company (SO) with 5.53%, and American Electric Power Company, Inc. (AEP) with 4.36%. Although DUK appears to be weaker than its peers historically, its estimated performance next year, particularly its EBITDA and EPS, is projected to outperform its peers, as shown in the image below.

DUK: FWD Estimates (Data from Seeking Alpha. Prepared by InvestOhTrader)

This makes DUK interesting, especially considering its dividend yield of 3.99%, which is better than SO’s 3.72% and AEP’s 3.26%. Investigating DUK’s payout ratio of 74.90% is a bit higher compared to 73.28% of SO and 63.77% of AEP, but below its 5-year average of 105%, I believe DUK is just doing fine.

Another interesting catalyst is that DUK has a better capital structure than its peers, as evidenced by its debt-to-equity ratio of 1.38x, which is lower than SO’s 1.70x and AEP’s 1.57x.

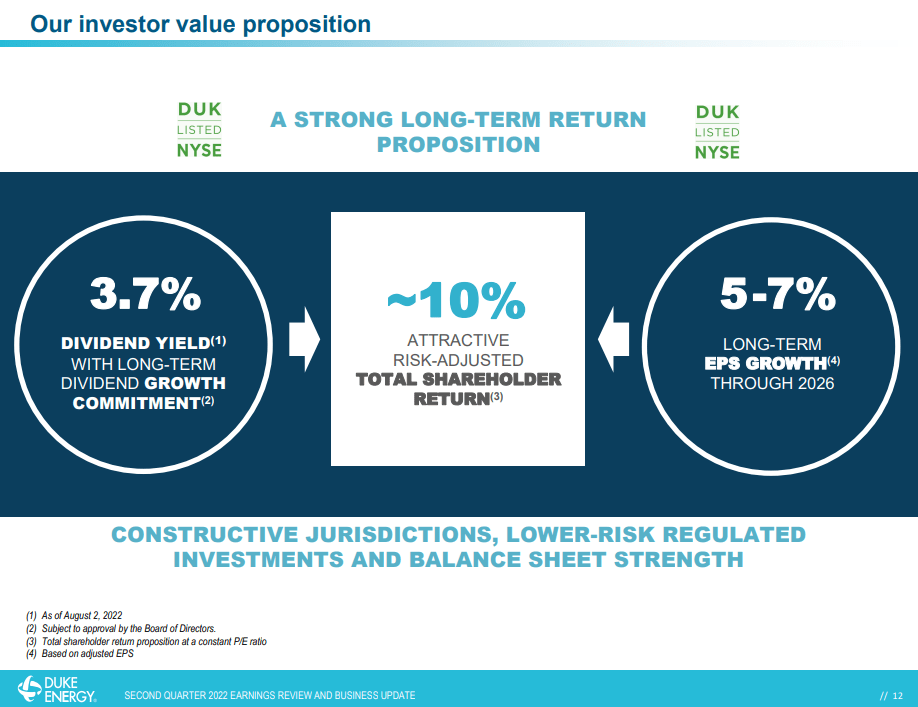

DUK: Relative Valuation (Data from Seeking Alpha. Prepared by InvestOhTrader)

DUK is trading at a trailing P/E of 20.43x, a bit better compared to its peer’s average of 21.71x (including DUK) and at a discount compared to the 26.64x 5-year average. I believe DUK is trading at a considerable discount, especially given its estimated forward P/E of 14.58x in 2026.

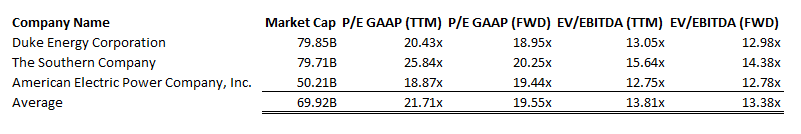

Trading Near Support

DUK: Weekly Chart (TradingView.com)

Looking at the weekly chart, DUK recently broke its short-term support of 20- and 50-day simple moving averages. In fact, we may see a continued fear-driven drop in today’s bearish environment that could push stocks downward. If a correction happens, I believe between $95 and $97 will be a strong support to monitor.

Conclusion

There are risks from today’s rising rate environment, which may induce a further drop; however, we can use this correction to our advantage to purchase DUK at a lower price and a higher yield.

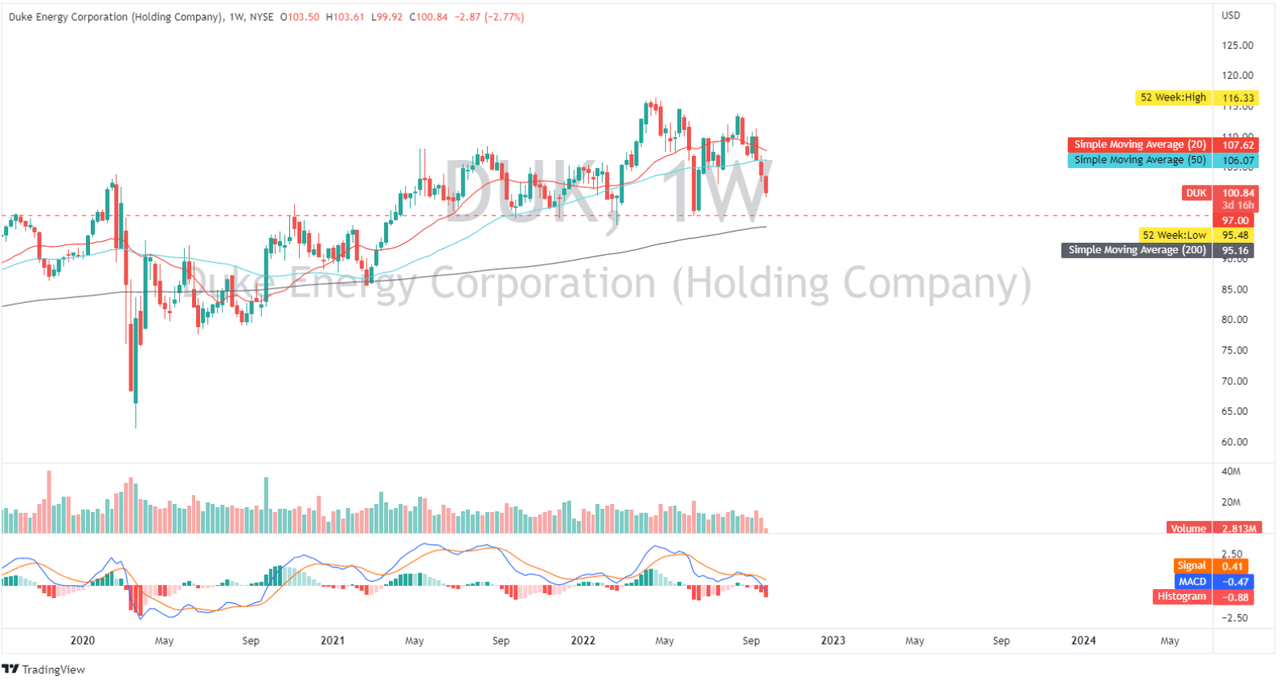

DUK: Total Shareholder Return (Q2 2022 Earnings Call Presentation)

In fact, given its projected EPS growth through 2026 and a potentially higher yield, as mentioned earlier, DUK can provide more than the 10% risk-adjusted total shareholder return benchmark provided by the management. Its solid CAPEX expenditure plan and stable outlook by both Moody’s and S&P for the company make this stock appealing. To summarize, I believe DUK maintains a profitable business despite its ongoing strategic review and remains liquid, with $5.7 billion in total available liquidity, making this an attractive income investment.

Thank you for reading!

Be the first to comment