Douglas Rissing

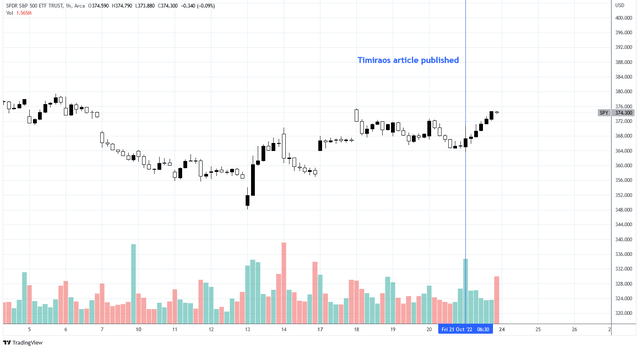

Something big was overlooked by many market participants on October 21st. The Wall Street Journal Chief Economics Correspondent Nick Timiraos published an article that suggested a change in Fed policy may be in progress. Many writers have postulated about a potential “Fed pivot” for months, but this message comes with particular credence.

The reason is because Timiraos has a track record of accurately forecasting Fed decisions, likely with the aid of information released to the WSJ in advance. The reputation has earned Timiraos the nickname of “Fed whisperer.” He correctly forecasted when the Fed would reduce stimulus in 2021. He also correctly expected the first 75 basis point rate hike by the Fed, contrary to the prevailing expectation.

Equity markets including the S&P 500 rallied following the publication of Timiraos’s latest article. Market expectations for the Fed Funds rate according to CME FedWatch Tool changed from last week with a 65% chance of 4.5-4.75% in December to 45% this week. Then, the highest web search volume for the term “pivot” in five years was recorded according to Google Trends.

When Timiraos speaks, I listen.

What did he say, exactly? Does this mean that a Fed pivot is imminent?

Charts by TradingView (adapted by author)

Monetary Policy Is In Debate

The article, titled “Fed Set to Raise Rates by 0.75 Point and Debate Size of Future Hikes,” supported the expectation that the next rate hike in November will be 75 basis points. But the article points to differing views among Fed officials about what the policy should be going forward. Timiraos quotes Fed Vice Chairwoman Lael Brainard in this earlier article:

It will take time for the cumulative effect of tighter monetary policy to work through the economy and to bring inflation down. The moderation in demand due to monetary-policy tightening is only partly realized so far.

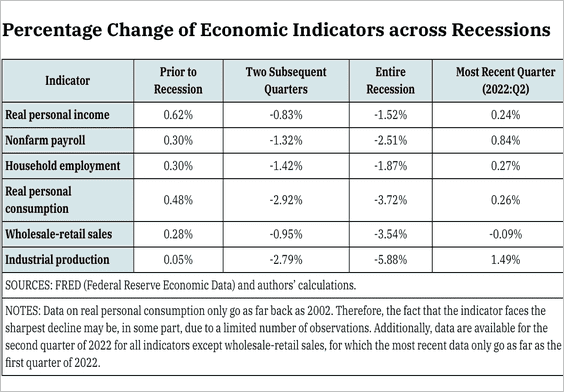

I have to agree with Brainard. The economy is slow to change and the effects of monetary policy, especially at the pace we have witnessed so far, take time to be realized. I’ve been keeping my eye on leading economic indicators for signs of approaching economic weakness and it has not been difficult to find. The data set from The Daily Shot below shows how several indicators, particularly related to employment, have not yet demonstrated recessionary signs, other than wholesale retail sales which recorded at -0.09%.

The Daily Shot (used with permission)

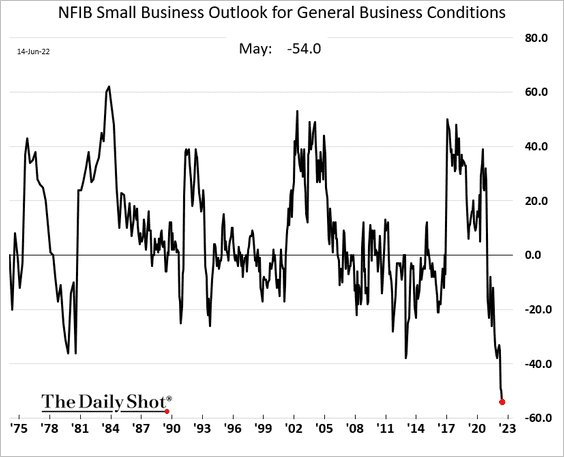

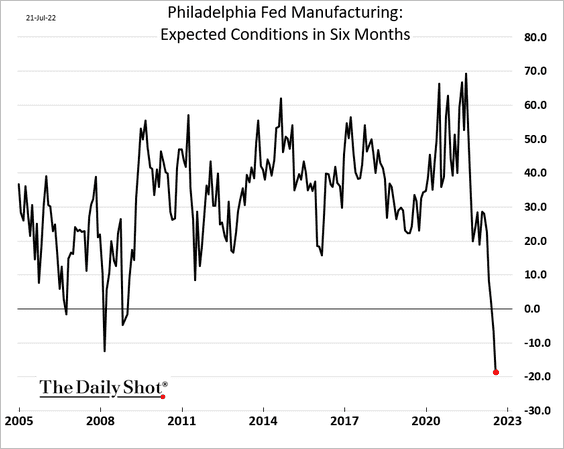

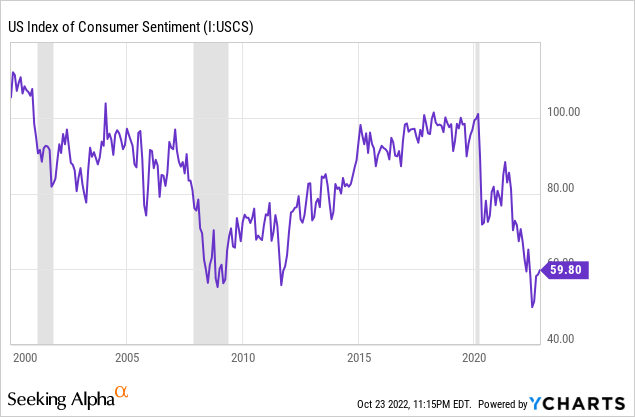

In contrast, several leading indicators including the NFIB Small Business Outlook, Philadelphia Fed Manufacturing expected conditions, S&P Global US composite PMI, and Consumer Sentiment Index are registering multi-year lows in recessionary territory.

The Daily Shot (used with permission)

The Daily Shot (used with permission)

Additionally, on Monday the preliminary October S&P Global Flash US Manufacturing PMI data was released. The report included a Manufacturing PMI reading of 49.9 and Services PMI reading of 46.6. This data under 50 is indicating economic contraction. This is what S&P Global Market Intelligence Chief Business Economist Chris Williamson said in the report:

The US economic downturn gathered significant momentum in October, while confidence in the outlook also deteriorated sharply. The decline was led by a downward lurch in services activity, fueled by the rising cost of living and tightening financial conditions.

The surveys therefore present a picture of the economy at increased risk of contracting in the fourth quarter at the same time that inflationary pressures remain stubbornly high. However, there are clearly signs that weakening demand is helping to moderate the overall rate of inflation, which should continue to fall in the coming months, especially if interest rates continue to rise.

Fed officials are looking at the data and I am sure it is contributing to some of their unease about continued tightening. But plenty of economic data, such as the employment data we just discussed and the stubborn inflation numbers, have yet to respond to policy which is limiting how the Fed can act without compromising their credibility.

Some Fed officials have made statements that suggest they are considering smaller rate hikes while statements from other officials have suggested it’s too early. And yet, this is what Nick Timiraos wrote about future rate hikes:

If the policymakers decide to reduce the size of its hike to 50 bps in December, they’ll have to convince the markets that they’re not backing off of their campaign to combat inflation and they’ll want to prepare investors for that shift in the weeks after the November meeting.

I think we are seeing one of two possibilities: either the entire article is simply conjecture or the Fed is beginning to lay the groundwork for an eventual policy stance change.

Financial Instability On The Rise

In addition to degrading economic indicators, I previously wrote about how financial instability is building in my article Things Are Breaking In Global Financial Markets. Conditions have continued to worsen.

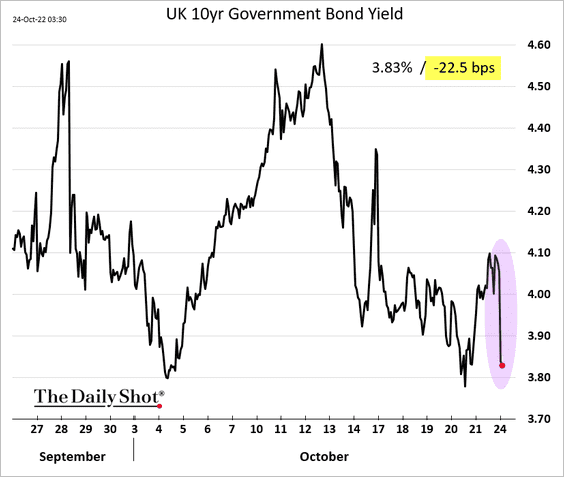

After the Gilt market meltdown and Bank of England intervention, Liz Truss resigned from Prime Minister after only 44 days in office. She is now being replaced by Rishi Sunak who, believe it or not, has a background in finance. Gilts immediately rallied following the news. The BoE is set to commence the sale of Gilt bonds on November 1.

The Daily Shot (used with permission)

After initially offering a $3.1B USD swap line to the Swiss National Bank, the Fed has offered two more swap lines. The first, on October 12 was $6.27B and the second on October 19 was $11B. This is what I wrote about the first SNB USD swap line:

This $3 billion in swap lines is not a significant quantity, historically speaking. But the rate of change deserves attention. If further swap lines are required it will signal that financial stress is accelerating.

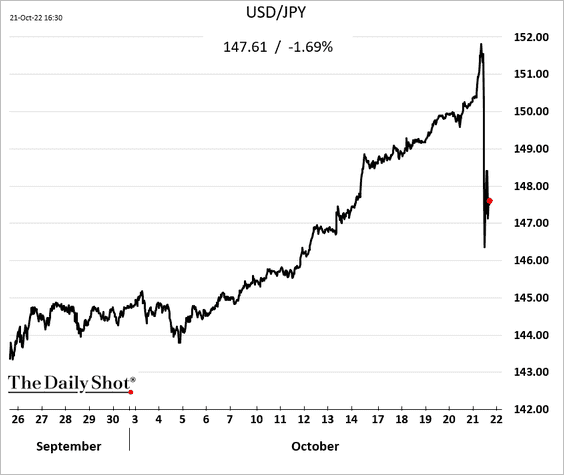

The Bank of Japan continues to intervene in FX markets to try to support the Yen. It is expected that the BoJ has already deployed >$50B in USD reserves. Unfortunately, the efforts do not appear to be successful as the Yen has continued to sell off.

Yen responding to BoJ intervention (The Daily Shot (used with permission))

In somewhat surprising fashion the United Nations made a public plea for the Federal Reserve and other Central Banks to pivot their tighter monetary stance. Members of the United Nations Conference on Trade and Development have warned that the rate hikes are negatively affecting global economic productivity and risking a global recession.

Watch the Yield Curves

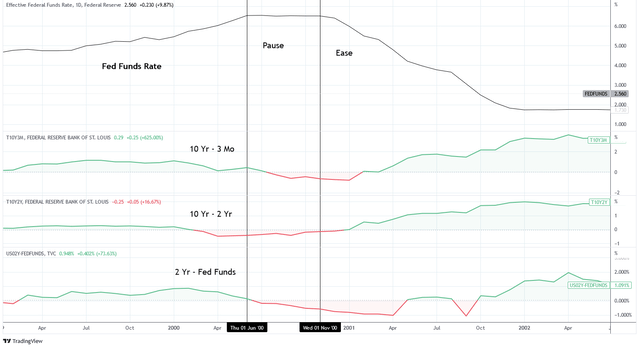

To get a better sense of policy direction I keep a close eye on the yield curves. For historical context, I’m going to look at the time periods of 2000, 2006-07, and 2019 for the 10 year minus 2 year curve, 10 year minus 3 month curve, and 2 year minus Federal Funds rate curve. In the chart below, the yield curves are green when they are positive and red when they invert.

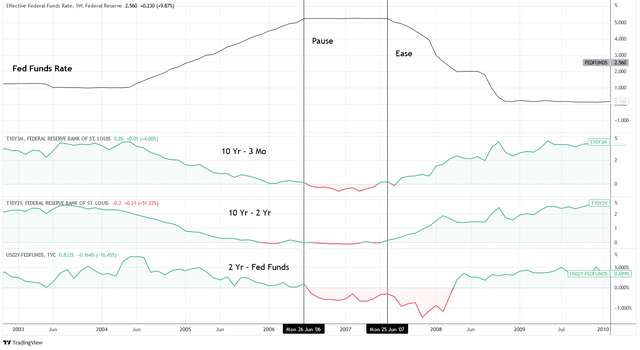

In 2000, the Fed paused hiking the Federal Funds rate as the 2 year Treasury rate minus the Fed Funds Rate inverted. This was several months after the 10-2 year curve had already inverted. The Fed began cutting rates when the 10 year minus 3 month also inverted.

Charts by TradingView (adapted by author)

In 2006-07, the periods of pause and easing transpired similarly:

Charts by TradingView (adapted by author)

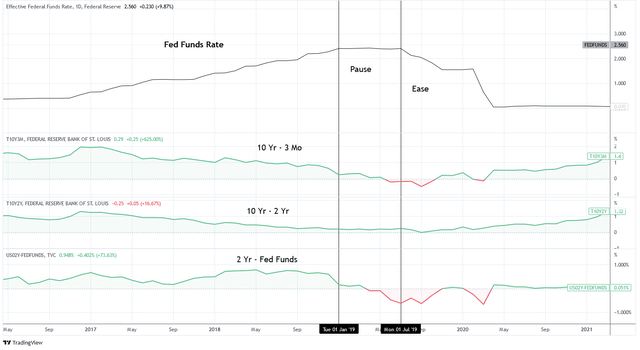

In 2019, rate hikes paused as the 2 year minus Fed funds was beginning to invert and easing began after the 10 year minus 3 month inverted but before the 10-2 year inverted.

Charts by TradingView (adapted by author)

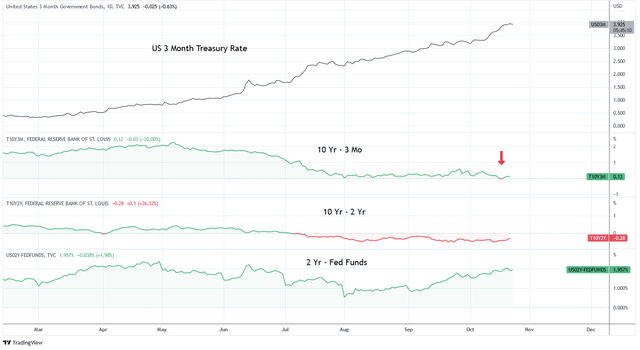

I will use the 3 month Treasury rate to represent the expected Fed Funds rate in the near future. Today, the 10-2 year curve has been inverted since July. The 2 year minus Fed Funds is well above zero at 1.95 and is above the market rate on the 3 month Treasury, representing the future Fed Funds rate. However, the 10 year minus 3 month recorded a slight inversion on October 18th and appears to be in process of imminently inverting.

Charts by TradingView (adapted by author)

Yield curve inversion tends to precede a pause in rate hiking and the start to rate cuts. Of the three we have examined, currently one and a half have inverted. If history is a guide, we are near a policy stance pivot but not quite there yet.

Summary

The effects of monetary tightening are beginning to manifest in economic data and global financial markets. Nick Timiraos writes about how Fed officials are feeling conflicted about the best course of action given that inflation remains stubborn.

The situation reminds me of the episode from the NBC TV show “Friends” where Ross Geller enlists his friends to help him move a couch up a flight of stairs. He relentlessly shouts “pivot!” at his friends to get the couch around a tight corner. But the couch is hopelessly wedged between the wall and stair banister.

Metaphorically, the couch is monetary policy wedged between high inflation and a strong labor market. Market participants continue to shout at the Fed to “pivot!” to no avail.

It will not surprise me if the rate hike in December is 50 basis points. Regardless, I do not consider that to be a pivot. Perhaps this is the Fed’s way of testing the waters before diving in. Or perhaps it’s the first step towards getting that couch around the corner.

Be the first to comment