LauriPatterson/E+ via Getty Images

Investment Thesis

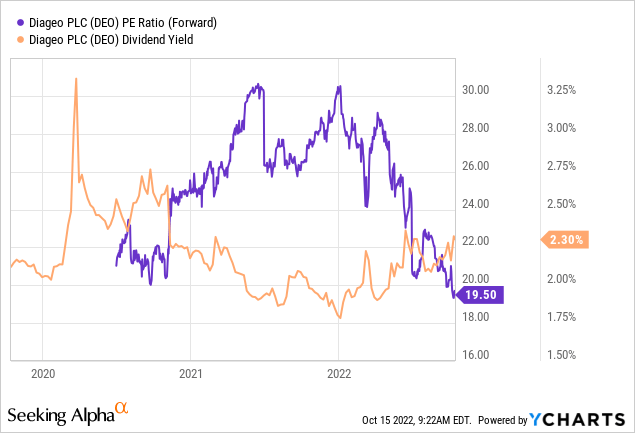

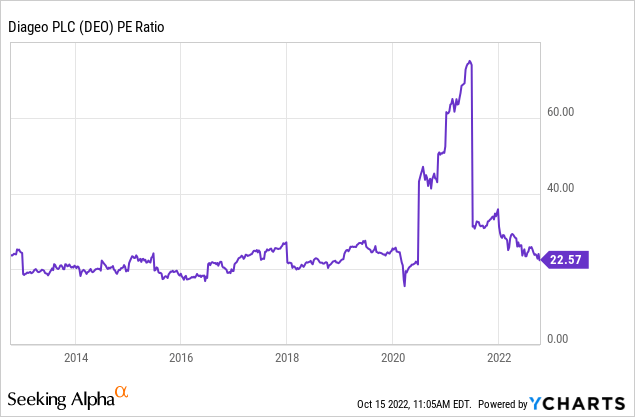

Diageo (NYSE:DEO) has been on my watchlist for a long time, but I haven’t bought it because I thought the stock was too expensive, with P/E valuations between 20 and 30. The company is attractive because, as a global alcohol producer, it is considered a very safe, slow-growing business that should not be significantly affected by almost any crisis. The business model is simple, and everyone understands it because everyone knows their products; alcohol is one of the oldest drugs in the world. Now the stock is cheaper than it has been in years. I think the stock is already a buy here with regard to the next few years. However, I hope to be able to collect the stock even lower.

Alcohol during a recession

By now, it is rather apparent that we are sliding into an almost worldwide recession. Perhaps some countries will be exempt, but in other areas, it may be more severe, possibly Europe, where the company makes 20% of its sales. This usually means the unemployment rate increases and purchasing power decreases.

I was wondering what effect this has on alcohol consumption. Both views make sense. Alcohol consumption could go up as people take escape into alcohol consumption. Or alcohol consumption could fall, as people have less money available, which is an obvious saving point. According to drugfoundation.org, the data point in the direction that alcohol consumption tends to increase during economic booms and decrease during recessions.

In the US, for example, a 1 percent increase in state unemployment corresponded to a 3 percent reduction in alcohol consumption. The decrease was even larger when unemployment went up nationally.

However, according to this site, binge drinking is also rising in a recession. An increase of 5% in unemployment leads to 8% more binge drinking. It seems that it is not the unemployed who get drunk more often but those who still have a job, possibly out of nervousness. Overall, the data point in the direction that people tend to save on alcohol, if only by switching to cheaper alcohol and drinking more at home. In the footnotes under the link, there are many more sources in case someone wants to read up more.

Diageo’s growth

The company was in the past a slow grower, given its defensive business model. Revenue has only grown by about 4% per year over the last five years. Profitability is also relatively flat, but on a solid level. But in the last year, revenue increased 21% YoY. There were share buybacks too, so in total, EPS grew 9% per year over the last five years. Seeking Alpha’s Quant rating gives the stock an A rating for profitability and a C- rating for growth.

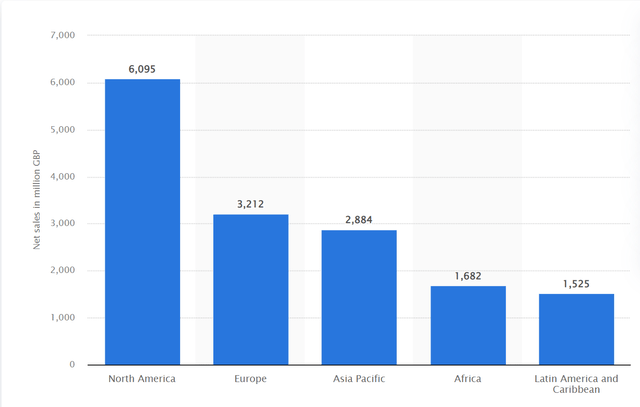

The company still has a lot of potential, especially in countries with a young and growing population, particularly in Africa and Latin America. And the more expensive brands are growing where the middle class is growing. Overall there were the following changes in net sales by region 2022 vs. 2021 (refers to the whole year as their fiscal year already ended June 30):

- North America +17%

- Europe +26%

- Asia Pacific +16%

- Africa +19%

- Latin America and Caribbean +46%

It should be noted that these are net sales, which means costs for marketing etc., are not included here, so these high figures do not result in such high EPS growth figures.

Valuation

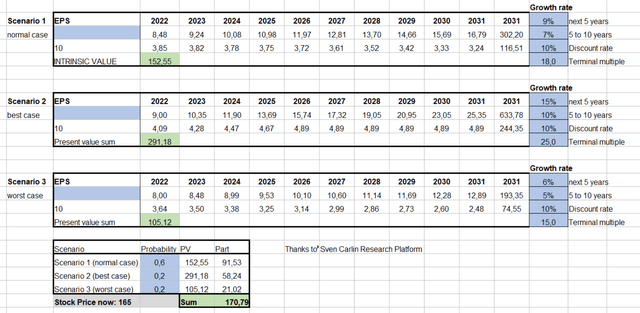

I have created a detailed analysis with three different scenarios to determine the current fair value with a discount cash flow model. The normal scenario is indicated as the most probable variant. Of course, one has to estimate the growth figures roughly, and the calculation is not exact. Nevertheless, I find this approach useful, as it allows us to at least approximate a fair value. In other words, it could be clearly seen if a share was enormously overvalued or undervalued. According to this estimate, the share is trading close to its fair value.

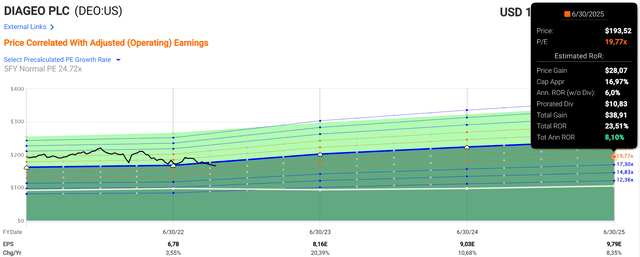

According to fastgraphs, we can expect an 8% annual return by mid-2025 if the stock trades at a P/E of 20. And I don’t think it deserves more than a P/E ratio of 20 since it belongs to the basket of slow-growing, safe companies, similar to Coca-Cola (KO). It is also possible that it deserves less than 20 – certainly a subject of debate.

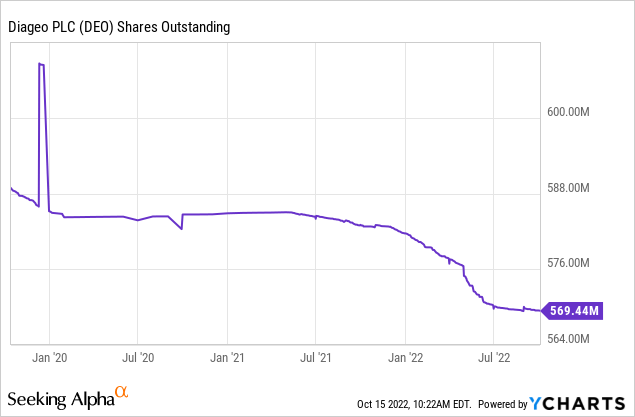

Share dilution and insider selling

I always want to look at stock dilution and whether there is insider selling. On February 21 of this year, the company announced a buyback plan for a total of £1.7 billion. So this program now seems to be completed and is also clearly visible in the graph below. I have not found any information on further buyback plans. There have been no insider sales recently.

Diageo is announcing today that it has entered into a non-discretionary agreement with UBS AG London Branch to enable the company to buy back shares with an aggregate value of up to £1.7 billion, of which the repurchase of shares with an aggregate value of up to £1.4 billion will be completed by 30 June 2022.

Risks

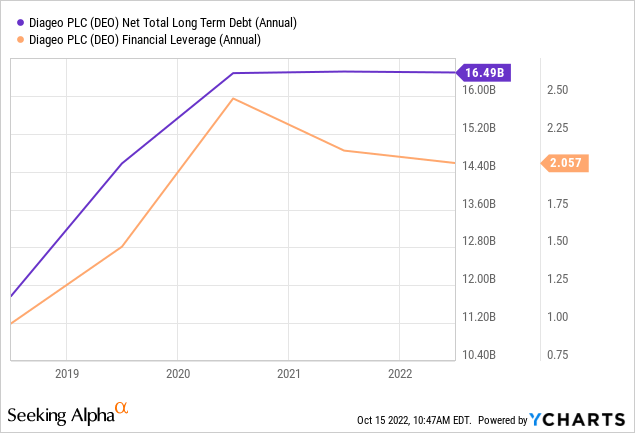

Debt should certainly be mentioned, but it has remained constant since 2020. The leverage ratio, debt/equity, is decreasing as equity is increasing. With a free cash flow of over $3B, debt is not dangerous even if interest rates rise.

Another risk is a general downgrade of the fair value on a P/E basis. This could happen if sales surprise negatively next year and the share reaches a new lower base level on a P/E basis that the market considers fair. This has been relatively high for Diageo in the past, mostly above 20.

Conclusion

The company is still very well-positioned and has a very stable business model. Revenues and shareholder returns are growing slowly (3.5% dividend growth CAGR in the last five years). It seems very likely that the company will continue to grow in the future, but one should not expect enormously high returns, which is normal for such a defensive stock. The last buyback program is also finished for the time being.

If the stock falls another 20 or 30%, I would probably give it a strong buy rating, but since it is currently trading at about its fair value, I think a buy rating is appropriate. But I would like to mention that the expected return is not high enough for my taste. I give a buy rating because I believe the stock will make money for the shareholder in the future. However, I think there are better opportunities in the market.

Be the first to comment