Marina Denisenko/iStock Editorial via Getty Images

Safe Bulkers, Inc. (NYSE:SB) remains a small but formidable figure in the dry bulk and shipping industry. It has more solid revenue and margin growth as it continues to enlarge its operations. Given the huge reduction in borrowings, it keeps its fundamentals stable. The financial statements show its consistency in profitability, liquidity, and sustainability. Moreover, the reopening of borders helps it bounce back and exceed pre-pandemic levels.

Likewise, the stock price is moving in an upward direction. It has already recovered after the steep decline from October to February. At $4.70, there is a 33% upside after its recent dip. The momentum remains strong as dividends and growth prospects make the stock cheaper. The uptrend may persist due to undervaluation.

Company Performance

Safe Bulkers, Inc. is already on a safe voyage amidst the disruptive impact of the pandemic. Its growth and continued expansion have become more evident, given its impeccable financial performance. Over the past decade, it had problems with overcapacity that pulverized the industry. Also, the shocking downturn in 2020 halted its rebound. But now, SB shows formidability, given its solid revenue and margin increase.

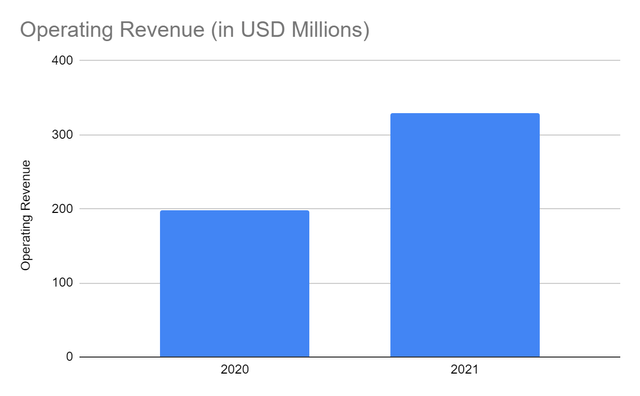

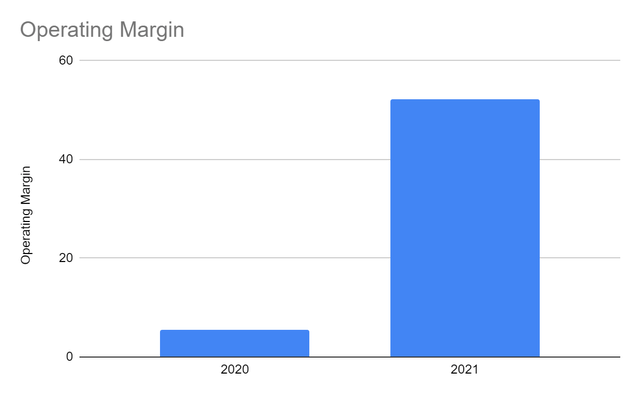

The operating revenue has already reached $329 billion in its most recent financials. It is the largest revenue growth since its crash more than a decade ago. The increased supply of vessels led to tighter competition, which affected the industry. And even Safe Bulkers was not an exception. But as the recovery continued, it capitalized on growth through secondary acquisitions, leading to a 52% operating margin.

Operating Revenue (MarketWatch)

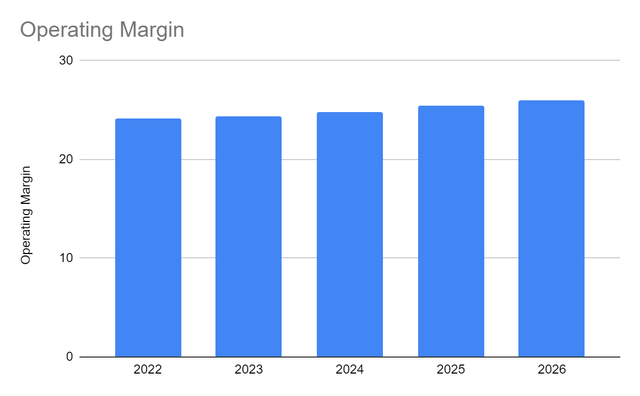

Operating Margin (MarketWatch)

Today, its efforts are starting to pay off as revenues and income keep growing. With more businesses going on the internet, long-distance transactions have become more typical. Safe Bulkers continues to reap the benefits of dry bulk commodities demand. The global economy is bouncing back, making them more significant. The reopening of borders makes the delivery of products and services more efficient.

As Safe Bulkers rebounds, it keeps up with the industry trend. Recently, its time charter equivalent was already twice as much as the value in the previous year. From $10,600, it rose to $21,700 per vessel per day (pvpd). It should no longer be a surprise as its capacity utilization kept expanding. Thanks to its continued acquisition of secondhand vessels. According to its recent guidance, Capesize and Panamax may reach $30,000-35,000 pvpd. It is a promising prospect, which may increase its time charter equivalent by 38-50%. It appears realistic, given its enlarged operating capacity and easing of restrictions. The increased spending on energy and construction will also boost its performance.

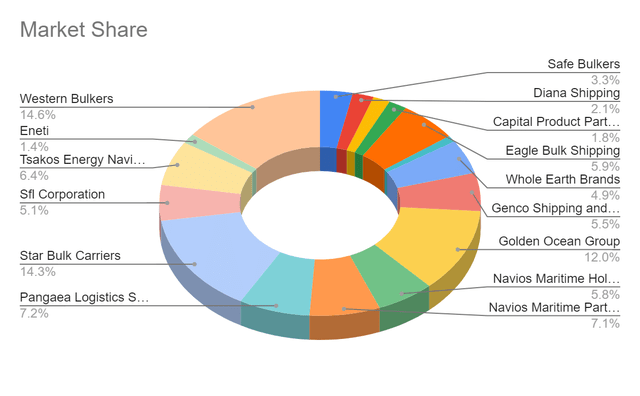

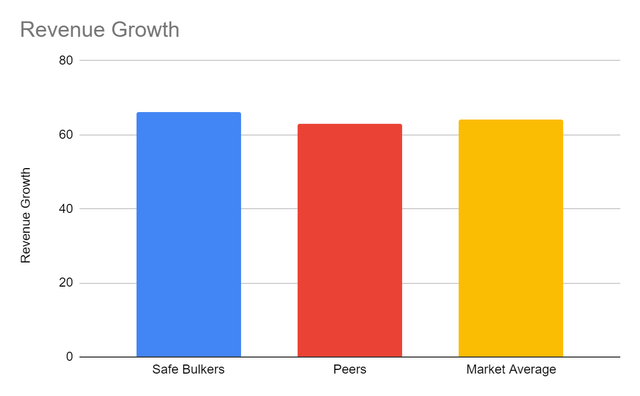

Relative to its competitors, Safe Bulkers remains a mid-sized company. It only holds 3.9% of the industry revenue. But, it is quite an increase from 3.6% in the previous year. Also, the average revenue growth of 66% is a bit higher than the industry average of 63%.

But what sets it apart from its peers is its success in keeping its costs and expenses relatively low. So as Safe Bulkers expands, it generates more revenues and realizes more earnings. It can be proven by its impressive Return on Asset (ROA) of 16%, or $16 per $100 asset. With its efficient asset management, its profitability and sustainability increase. It also shows its massive capacity to go head-to-head with the larger ones.

Moreover, it still complies with the requirements of the Energy Efficiency Design. It is timely as climate finance is becoming a more crucial aspect of the industry. So, it remains capable of balancing its growth with efficiency and environmental requirements.

How Safe Bulkers May Sustain Expansion

The reopening of borders helps the shipping industry meet the increased market demands. The governments’ increased spending on infrastructure and agriculture will become another growth driver. There may be inflationary pressures, but the fiscal stimulus is enough to offset them. Also, these macroeconomic changes are only transitory. The recovery of the manufacturing industry is fundamental to the rebound in 2022. So these will drive more demand in the sector, so the shipping industry must scale up.

Fortunately, Safe Bulkers is already prepared for the expected trends this year. Its acquisition of MV Maria, another Capesize vessel, will increase its capacity. It will help penetrate more markets, carry more items, and speed up its operations.

Moreover, efficiency and sustainability are other trends that the industry must expect. Its effort to reduce its carbon footprint may pay off in no time. Biofuels may become its alternative fuels. In fact, it did several pilot projects to test its operational performance and CO2 reduction. The results are affirmative, showing 13-20% CO2 reductions without operational problems. It will be a giant leap for the company, matching its consistent expansion. The sustainability of biofuels may lead to economies of scale. It may even enhance its efficiency and help capture more market share.

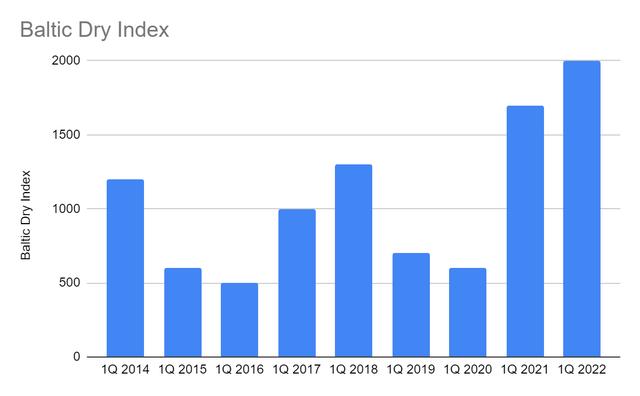

Another driving force is the rising index rate of the Baltic Dry Index. Since overcapacity pulverized the industry, the decrease has started. It was more evident in 1Q, the lowest in all quarters. But, it has changed its direction in recent years. Only, it stopped in 2020 due to the pandemic. But since 2021, the index has been rebounding. The first quarter of this year marks the highest rate since 2014. Note that there is a decrease from 4Q 2021 to 1Q 2022. Winter is often considered the primary factor that affects the 1Q index. But if we observe the annual trend, the increase becomes more evident.

Baltic Dry Index (Trading Economics)

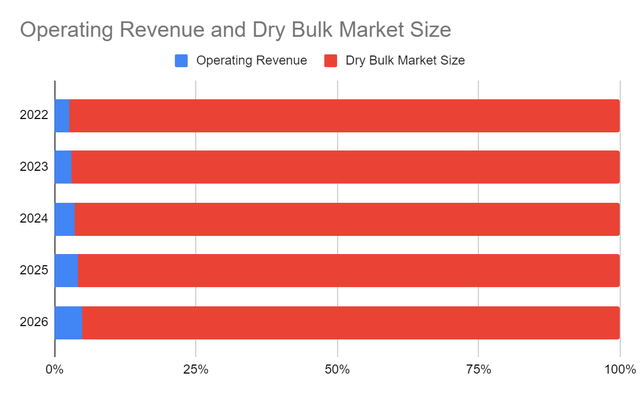

Given the fruitful results, the global dry market will reach $22 billion in 2026 with a CAGR of 4%. Safe Bulkers may expect better, given its prudent acquisitions and environmental compliance. Market expansion, matched with its increased operations, will help it keep up with the trend. Given its growth drivers and time charter equivalent, I expect a 20-24% revenue growth. Meanwhile, the operating margin may range from 24 to 26%. The projection appears to be in line with the historical trend but more conservative.

Operating Revenue and Dry Bulk Market Size (Author Estimation)

Operating Margin (Author Estimation)

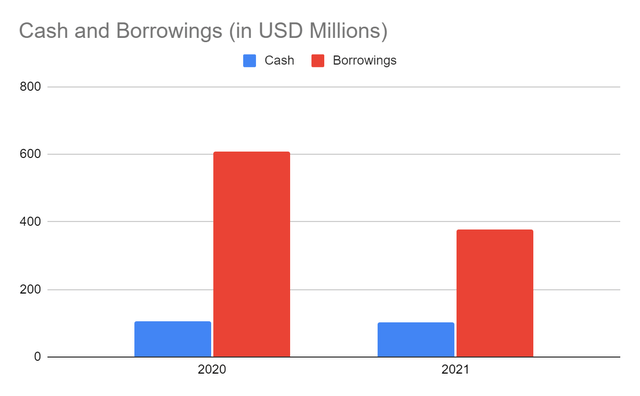

But, Safe Bulkers does not rely on revenue growth alone. It has sound fundamentals, which can be confirmed in its Balance Sheet. Its borrowings are now lower while cash and cash equivalents remain stable. Indeed, issuing an unsecured bond worth $100 million is wise. It cut its borrowings by about 40%. In terms of liquidity, its net working capital is $38 million. It can make a single payment for its short-term borrowings using cash. It shows that the company can expand without much borrowing and share issuance.

Cash and Borrowings (MarketWatch)

Indeed, Safe Bulkers benefits from its reliable and strategic management. They remain excellent in getting the right timing for their investments. They do not turn to stock splits and dilute shareholders for many years. Most of all, there is a genuine concern as management participates when money is raised. The fact that the family owns a large portion of the shares means a lot. Safe Bulkers has robust operations with a solid and intact Balance Sheet. It has more manageable financial leverage and a more stable cash flow.

Price Valuation

The bullish pattern remains evident even after its recent crash. Safe Bulkers show promising growth prospects, which may push the stock price upward. In my previous article, I was in a buy position at $1.16. It has already paid off, as the price rose by more than 400% in only a year.

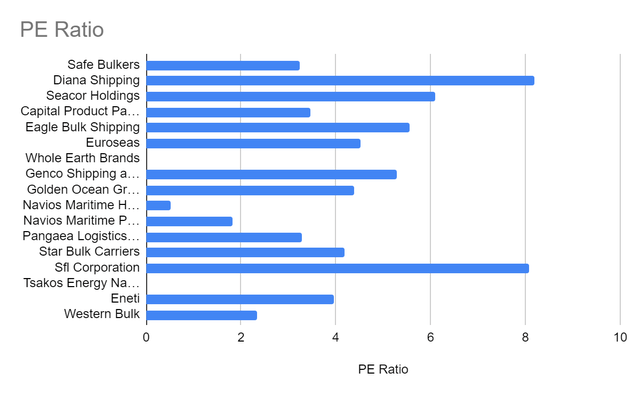

At $4.70, it appears to be very cheap, given the low PE Ratio of only 3.23. SB has the lowest PE Ratio among the popular stocks in the industry. And if we reverse the computation, we will come up with an earnings yield of 30%, which is higher than the market average.

In 2022-2023, I project the EPS to reach $1.65-1.88, leading to a lower Forward PE Ratio of 2.48. It is in line with my estimated revenue growth and the average EPS growth in recent years. There may be a 23-24% upside in the stock price for the next twelve to twenty-four months. It may be logical since SB is at the height of expansion amidst the market rebound. To better estimate it, we can use the DCF Model through FCFF.

|

FCFF |

148,880,000 |

|

Cash |

102,080,000 |

|

Borrowings |

379,000,000 |

|

Perpetuity Growth |

4-4.40% |

|

WACC |

8-8.40% |

|

Common Shares Outstanding |

112,000,000 |

|

Current Price |

$4.70 |

|

Derived Value |

$25.50-30.76 |

The derived price shows that there may be up to 500% upside for the next five years. It may be a tough challenge since the company has not reached it before its crash. But, the price may keep increasing, given the impressive fundamentals. Safe Bulkers must take advantage of the recovery through acquisitions amidst market recovery. Its secondhand vessel acquisition appears timely and relevant. With its solid prospects and market positioning, price increases are attainable. So as long as its financials remain stable, it can sustain its price movements.

Moreover, it paid its dividends again at $0.05 per share. It is even higher than the annual value in 2015. The Dividend Payout Ratio is only 4%, so it still has 96% for repayment of borrowings, expansion, and savings. Indeed, it may still enlarge its operating capacity while satisfying its stakeholders. It may still increase its capacity utilization while ensuring its adequacy.

Bottom Line

Safe Bulkers, Inc. is an attractive investment, given its solid and intact fundamentals. The market environment is more promising as the demand stimulates growth and expansion. The company has profitable prospects for the next few years. Also, the price stays undervalued, matched with the resumption of dividend payments. The recommendation is that Safe Bulkers is still a strong buy.

Be the first to comment