sankai/iStock via Getty Images

Introduction

When the calendar rolled around to 2022, it marked a new chapter for Devon Energy (NYSE:DVN) whose pivot towards dividends made them the new kid on the block with a potential high yield, as my previous article discussed. Thankfully, this was proven apt with them subsequently embarking upon what could be called a dividend spree as their variable dividends provided record cash returns, which if continued at their most recent rate would see a high yield of 9.00%. Even though this already makes for a very profitable start to their new chapter, it appears poised to improve even further following a rare win-win from their acquisition spree, which they recently embarked upon.

Executive Summary & Ratings

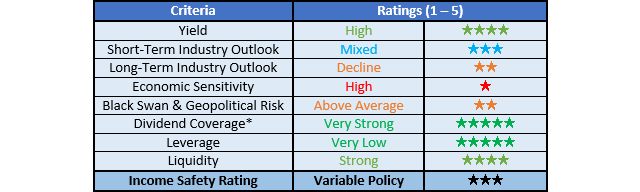

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

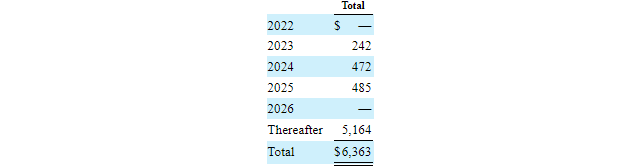

Thanks to the recovery they enjoyed during 2021 accelerating during the first half of 2022 on the back of the Russia-Ukraine war, their operating cash flow surged to $4.515b to almost match their full-year result of $4.899b during 2021, despite only being half the length of time. Unsurprisingly, this was also several magnitudes higher year-on-year versus their previous result of only $1.685b during the first half of 2021, as was widely expected given the prevailing booming operating conditions.

Very excitingly for their shareholders, they were able to capture the full benefit of this surging operating cash flow because their capital expenditure was restrained at $1.153b during the first half of 2022 and thus relatively speaking, not too much higher than its previous level of $1.003b during the first half of 2021. This resulted in their free cash flow powering to an extremely impressive $3.287b during the first half of 2022, thereby making for a world of difference versus 2019-2021 when their three-year aggregated total was only $3.322b. Even though their new shareholder returns policy provided shareholders with record dividend payments totaling $1.497b across their fixed and variable portions, their free cash flow still easily provided very strong coverage of 219.57%.

This was certainly a very profitable time for shareholders, although the bigger news is their recent acquisition spree, which stands to help their dividend spree continue into the future. The first acquisition was announced back in June 2022 for RimRock at a cost of $865m, which carries a massive free cash flow yield of 25%+, thereby translating to circa $216m per annum. Meanwhile, their second acquisition was announced more recently for Validus Energy during August at a cost of $1.8b with an insanely high circa 30% free cash flow yield, which equates to $540m per annum. If aggregated, this additional free cash flow represents an increase of $756m per annum given the prevailing one-year forward oil and gas strip prices at the times of the announcements.

Even though this will fluctuate across time given the inherent volatility in oil and gas prices, this instantly provides a sizeable boost to their free cash flow. Admittedly, if the recent lower oil prices persist and economic activity wanes, it would pull back on their free cash flow and thus dividends since the latter are linked to the former, as my previously linked article discussed. Importantly, these acquisitions will still boost their free cash flow for any prevailing operating conditions and thus provide higher dividends than otherwise would have been the case, which helps offset a degree of the downside risks posed by oil prices softening. Their cash flow outlook is clearly looking stronger but it nevertheless is always important to consider the costs that are levied upon their financial position to ensure these higher returns are not offset by higher risks.

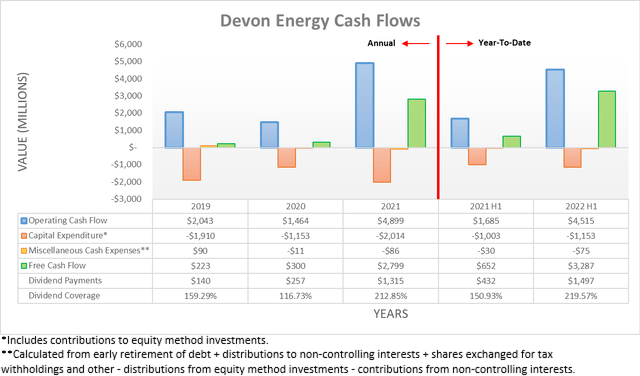

Their record dividend payments were topped off with a further $535m of share buybacks, although their net debt still plunged by a very impressive 28.66% during the first half of 2022 to land at $3.004b versus where it ended 2021 at $4.211b. Since their total debt stayed effectively unchanged at circa $6.5b, this was entirely driven by their cash balance climbing to $3.457b following the first half of 2022. This sizeable war chest provides scope to fund their $865m RimRock acquisition and further $1.8b for their Validus Energy acquisition with their cash balance dropping to circa $800m, before considering any upcoming retained free cash flow.

Funding these acquisitions will send their net debt surging to its highest level ever at $5.669b and whilst tempting to think that more debt is always bad, actually, this is not necessarily the case. It is true that less debt equals lower risks but this relationship is not linear, as after a certain point the benefit diminishes as removing more risk from an already non-risky investment does not necessarily provide a material benefit.

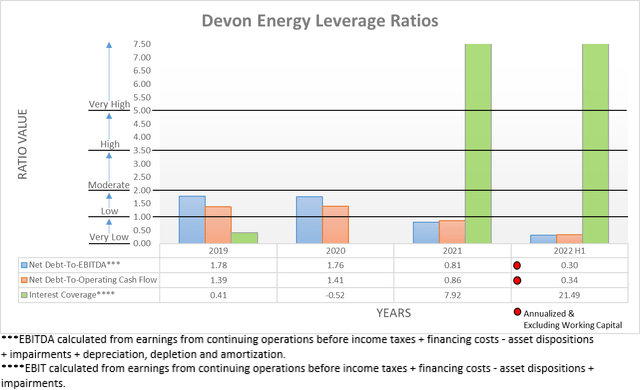

Since their leverage already ended 2021 within the very low territory, there should be no surprise that this continued following the first half of 2022. When their lower net debt is combined with their stronger financial performance, it pushed their respective net debt-to-EBITDA and net debt-to-operating cash flow down to 0.30 and 0.34, which is even further beneath the threshold of 1.00 for the very low territory than their previous respective results of 0.81 and 0.86 at the end of 2021. Even after seeing their net debt surge to $5.669b following their two acquisitions, these two ratios would stay within the very low territory with results of 0.58 and 0.64 respectively, which is simply based upon their results for the first half of 2022 and assumes no additional contributions from their new assets to ensure a margin of safety.

Whilst maintaining financial safety during booming operating conditions is not too difficult, what is far more important is whether this continues even throughout a severe downturn, such as endured during 2020 as the Covid-19 pandemic wreaked havoc. Even if this were to unexpectedly repeat before they deleverage and thus drag their financial performance back to this same suppressed level of 2022, their net debt of $5.669b would result in their net debt-to-EBITDA and net debt-to-operating cash flow hitting 4.84 and 3.87 respectively. Despite these results sitting within the high territory of between 3.51 and 5.00, this is not overly concerning because it stems from a severe downturn and equally as important, once again sees a margin of safety since it assumes no additional contributions from their new assets.

This strong outlook highlights that despite sending their net debt surging, it does not materially increase their risks since their leverage started at a sufficiently low level and thus allows management to create value for their shareholders by strategically increasing leverage. To phrase this simply, even if oil prices crashed right now, they would still have no issues remaining solvent nor returning the majority of their free cash flow to shareholders.

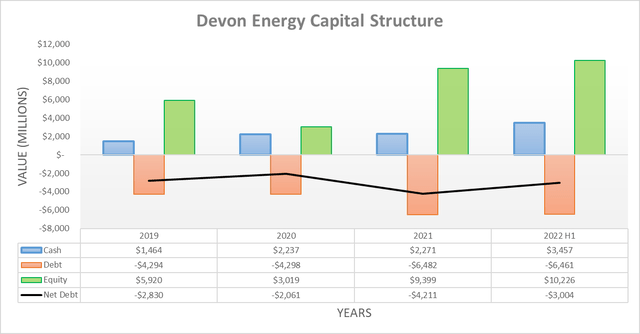

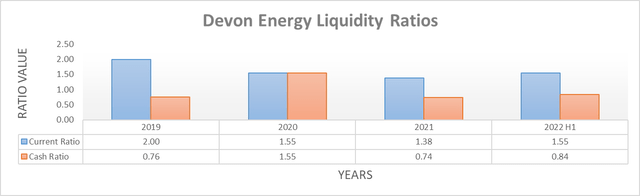

Quite unsurprisingly, their higher cash balance boosted their liquidity with their respective current and cash ratios climbing to 1.55 and 0.84, versus their previous respective results of 1.38 and 0.74 at the end of 2021. Even if they drain the entire $2.665b combined cost of their acquisitions from their cash balance without replenishing via debt issuance or upcoming retained free cash flow, it would still leave their respective current and cash ratios at 0.90 and 0.19, which for a low point are still worthy of a strong rating. Since the vast majority of their debt does not mature until after 2026, they have ample scope to issue more debt if desired without creating any material risks, as the table included below displays.

Devon Energy 2021 10-K

Conclusion

Thankfully their upcoming acquisition spree does not levy too great of a cost upon their financial position and thus it effectively creates a rare win-win whereby their shareholders can instantly enjoy a stronger cash flow outlook, whilst still sleeping easy at night. Admittedly, oil prices will continue to play a central role in their future variable dividends but at least, these acquisitions will still boost their free cash flow relatively higher regardless of the prevailing operating conditions and thus boost their dividend outlook comparably, which means that I continue to believe my buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Devon Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment