brightstars

Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) has fallen so much, the stock wasn’t expecting much heading into Q3’22 results. Investors need to focus on the potential for the tech giant to improve efficiency by up to 20% to provide a massive boost to profits for an already cheap stock. My investment thesis remains ultra Bullish on Alphabet not accurately priced for current earnings, much less the ability for substantial boosts to profits going forward.

Solid Q3’22 Considering

Alphabet entered the quarter with the stock trading at 17x official 2023 EPS targets. Our view has remained that the stock isn’t accurately priced due to the focus on GAAP earnings when the company has massive stock-based compensation included in those numbers and a large cash balance.

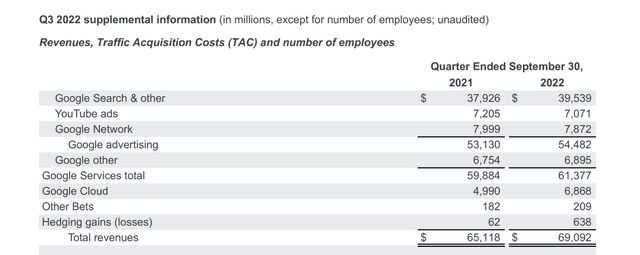

The company missed estimates as Google search revenues saw limited growth due to currency headwinds and YouTube saw ad revenues actually fall from prior years levels. In total, reported revenues were up 6% to only $69.1 billion. The big catch here is that the constant currency revenues were up 11% for a 500 basis point hit to revenue growth while the prior quarter only saw a 300 basis point hit to growth.

Source: Google Q3’22 earnings release

Alphabet was trying to leap 41% growth from last Q3 and the currency headwinds led to a big hurdle to still reach the analyst estimates at 9% growth. Without the currency impact, the tech giant would’ve just topped $70 billion in Q3’22 revenues.

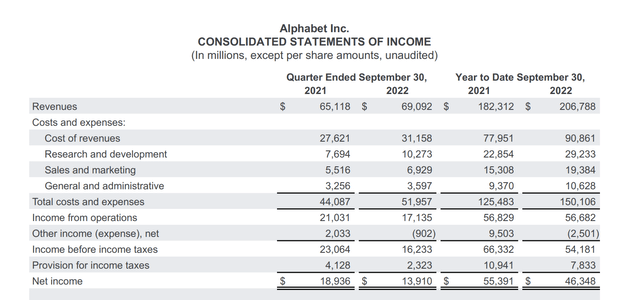

Alphabet doesn’t appear to have reported any slowdown in expense growth during the quarter. The CEO talked about a 20% efficiency boost and the company talked about a hiring freeze during the quarter, but the impact wasn’t seen during Q3.

The internet search giant again lost a massive $1.6 billion in Other Bets providing a category for trimming costs going forward. Investors still want the tech giant to invest in future growth, but the market doesn’t want an annual loss of $6.4 billion, especially in a prior environment where tech companies were aggressively competing for tech talent.

In addition, Google Cloud remains a money loser with a $699 million loss in the quarter, up from $644 million last year. The segment grew revenues 37% and investors clearly want to see a division with a nearly $30 billion run rate revenue base actually producing profits versus watching losses grow in a period of still strong growth.

The internet search giant reported total costs and expenses surged to $52.0 billion, up from only $44.1 billion last year for 18% growth. Alphabet spent just $50.2 billion in the prior quarter, so expenses actually grew an alarming $1.8 billion sequentially in a period where currency neutral revenue growth was virtually flat.

Source: Alphabet Q3’22 earnings release

These numbers should provide Alphabet with the ability to hammer home the efficiency goals of the CEO going forward.

Bargain Basement

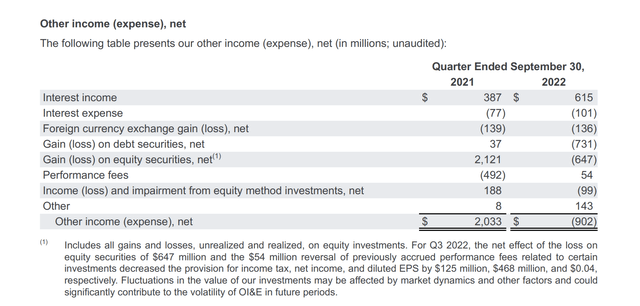

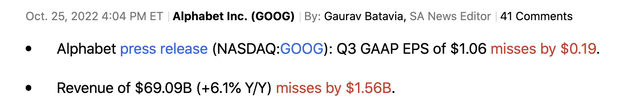

The problems with Alphabet reporting GAAP EPS numbers was again highlighted in the Q3 results. The company reported a headline EPS missing analyst targets by a wide $0.19 by reporting a Q3’22 EPS of only $1.06.

The issue here is that the EPS figure includes the now standard wild swings in Other income. This quarter the amount includes combined losses of $1.4 billion for debt and equity securities compared to a gain of $2.2 billion last Q3.

Source: Alphabet Q3’22 earnings release

The inclusion of these numbers provide no benefit to shareholders in my opinion. At an 18% effective tax rate in Q3, the combined security losses amount to $1.15 billion in hit to income, or ~$0.09 hit to profits.

Alphabet still appears to have missed targets likely due to the massive currency headwind. On top of this number, SBC was $5.0 billion in the quarter, up from an average of $4.7 billion per quarter in the 1H of the year.

The combination of the losses in Other income and SBC would add another $5.25 billion to income or the addition of $0.39 to profits before accounting for any currency impact. Otherwise, Alphabet would’ve reported an estimated $1.45 per share in non-GAAP EPS for Q3.

Our previous research had Alphabet producing a nearly $2.80 EPS boost from a 20% efficiency gain in the cost structure. The company has $20 billion in SBC expenses now that adds another $1.25 to EPS targets.

In essence, the non-GAAP targets have the tech giant on a pace for a $7+ EPS next year before any efficiency gains. Alphabet could generate a $10 annual EPS on hitting 20% efficiency goals and any number in between would provide more limited gains.

Takeaway

The key investor takeaway is that the market should’ve been very impressed with 11% growth on a constant currency basis. The stock is far too cheap for this growth rate considering the high hurdle from the prior periods and adjusted EPS targets should be around $7+.

The stock trades at about 15x adjusted EPS targets for 2023 and roughly 10x a very achievable goal of a 20% efficiency boost considering the nearly $2 billion boost to expenses in the last quarter alone.

Be the first to comment