DKosig

When the going gets tough, investors get familiar

It’s an ugly year for financial markets, and some indicators suggest the bear market of 2022 has further to fall. As a global recession looms, investors are taking steps to dig in and, as Jeff Bezos tweeted, “batten down the hatches.”

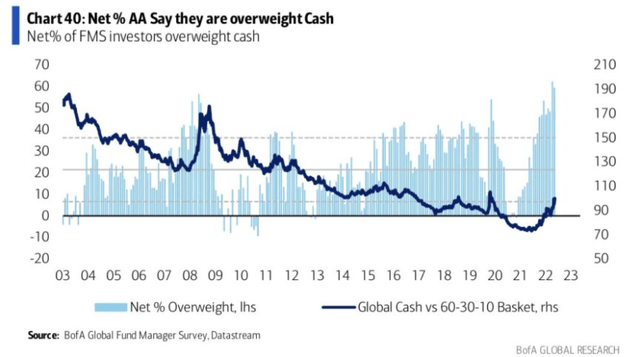

That includes reducing risk exposure and increasing liquidity. According to Bank of America’s latest Global Fund Manager Survey, managers increased cash allocations to the highest levels in over two decades.

Chart 1: Cash Allocations

BofA Global Fund Manager Survey (Bank of America as of 10/18/2022)

In addition to favoring cash, some investors also favor domestic markets over foreign. Domestic markets are more familiar and are also seen as less risky with respect to currency exchange, geopolitics, and other issues.

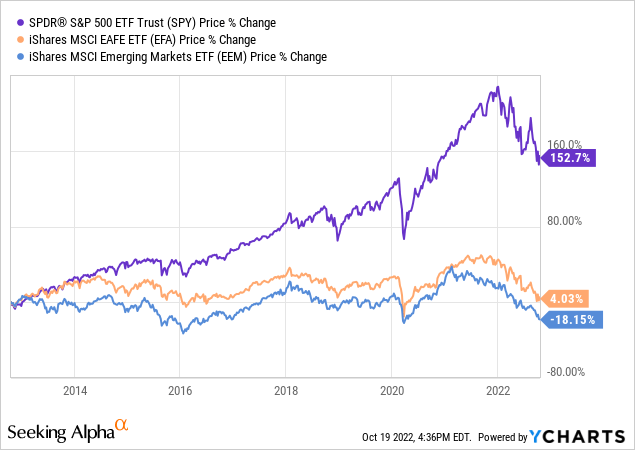

For US equity investors, a domestic bias is easy to embrace because the US stock market is the largest, most liquid, and most transparent in the world. US stocks have also substantially outperformed foreign markets over the past decade.

The chart below shows returns for the US stock market (SPY) versus foreign developed (EFA) and emerging markets (EEM) since 2013.

Chart 2: YTD Equity Returns

With uncertainty on the rise, there’s a strong case for sticking to what we know and what has worked. US markets may provide some safety (perceived or otherwise), but even after its year-to-date decline, the US stock market still looks expensive.

Valuation doesn’t matter… until it does

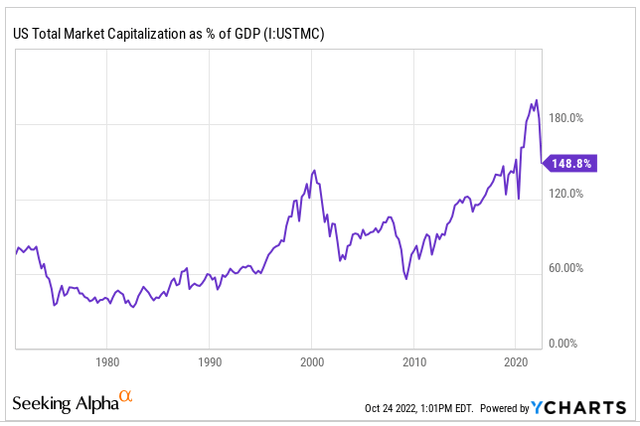

The market cap to GDP ratio for the US stock market is currently close to 1.5x, the long-term average is about 0.9x. The ratio started in 2022 close to 1.9x, the highest level in history. Despite the recent pullback, MC/GDP is still higher than it was at the peak of the housing bubble and the dot-com bubble.

Chart 3: Market Cap to GDP

Of course, the common disclaimer is valuation is not useful for timing market tops, bottoms, or short-term moves. The criticism is true and during raging bull markets valuation may seem not to matter at all. That is, until it does.

When markets eventually turn, as they inevitably do, valuation is useful for gauging the potential magnitude of long-term gains or losses. Extreme moves one way are typically met by extreme moves the other way over time.

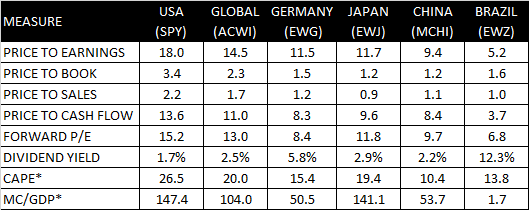

Currently, US stock market valuation is still above average and far from extreme lows. It’s not just MC/GDP, the US stock market looks overvalued across a wide range of valuation measures. A summary view of US, foreign developed (“EAFE”) and emerging markets (“EM”) valuations suggest better values are abroad.

Table 1: Global Equity Market Valuations

*CAPE and MC/GDP based on country estimates, other measures based on respective ETFs. (Morningstar, FRED, BCM as of 9/30/2022.)

A few points stand out in Table 1. First, not only does the US market (SPY) look the most expensive, it has the highest valuation readings across every measure on the table.

Second, except for Japan’s MC/GDP and China’s dividend yield, all other non-US market valuation measures are lower versus global averages (ACWI).

And third, emerging markets look absolutely or relatively cheap compared to other markets.

Seeking value in global markets

Emerging market stock valuations appear low in general, and Brazil’s equity market looks outright cheap with a P/E of 5x and a dividend yield of over 12%.

Of course, conditions have looked this way for some time. In October of last year, I laid out my case for going long the Brazilian equity market. It was an unpopular opinion because Brazil faced many problems. Inflation was in double digits and Brazil’s economy was teetering on the brink of another recession after just recovering from one in 2020.

As global stocks were making new all-time highs in 2021, the Brazillian market was down some -30% from its 52-week high. Brazil’s equity market was widely out of favor, to say the least.

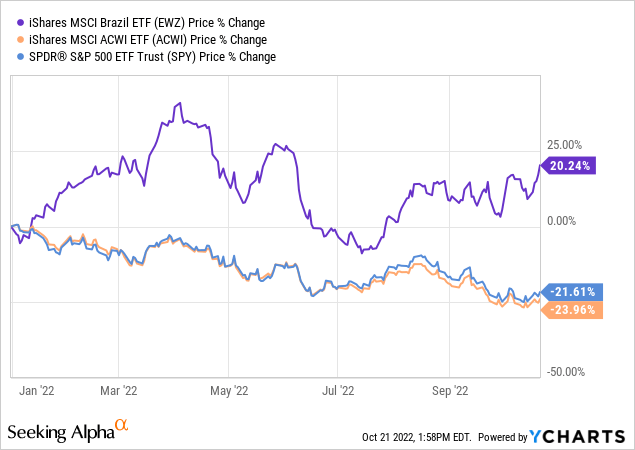

Unsurprisingly, many investors are surprised to see Brazilian stocks up more than +20% year-to-date while US and global stocks are down by roughly the same degree.

Chart 4: EWZ YTD Return

So far in 2022, Brazil appears to have avoided the risk of a double-dip recession, inflation has retreated back down into single digits, and leading economic indicators are improving from what were steep declines during 2021. Meanwhile, even after its YTD advance, Brazil’s equity market valuation remains among the lowest in the world.

I’m still optimistic about Brazil long-term and expect strong relative performance versus the US over time. However, the threat of global recession has increased substantially in 2022, and that’s obviously negative near-term.

It’s usually even worse for EMs because many EM countries like Brazil are dependent on the export of raw materials and commodities, the demand for which wanes during recessions. Meanwhile, global investors tend to repatriate capital in flight to safety trades that generally don’t benefit EMs.

Developed market equities tend to perform relatively better during downturns, so that may be a safer near-term pivot. Foreign-developed market valuations do not look as depressed as they do in EM, but they still look relatively low versus the US.

Referring back to Table 1, Japan in particular looks interesting. Most valuation measures for the Japanese market are below their own long-term averages, and all the measures on the table are favorable versus the US.

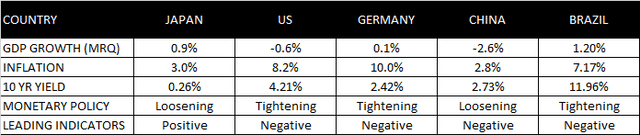

In terms of economic conditions, Japan also looks favorable versus its peers. Most developed economies are dealing with high inflation. That’s causing central banks in the US and Europe to raise interest rates and tighten monetary policy even as economic growth is falling, summarized in Table 2 below.

Table 2: Economic Statistics

TradingEconomics.com, OECD, BCM as of 10/21/2022.

But in Japan, GDP growth has increased, inflation and interest rates are still low, and the Bank of Japan has affirmed its intentions to keep monetary policy stimulative.

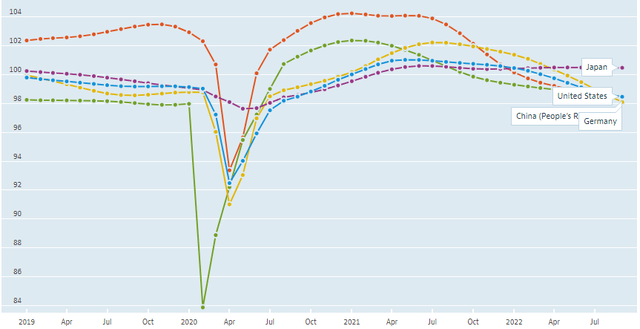

Japan is also one of the only countries where leading economic indicators are pointing toward expansion instead of contraction, shown as by the OECD’s Composite Leading Indicators below.

Chart 5: OECD CLI

OECD Composite Leading Indicators (OECD)

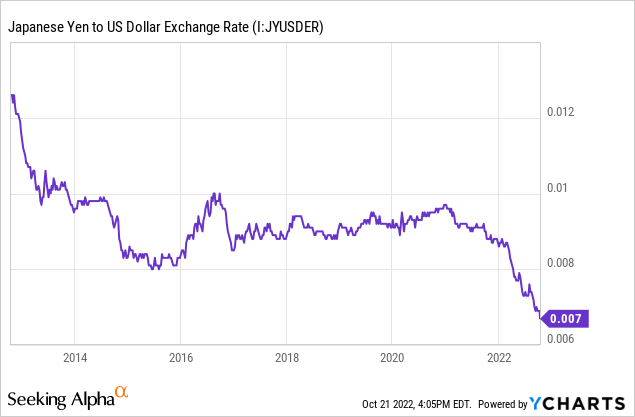

In addition, the Japanese yen is commonly seen as a safe haven during periods of global uncertainty. That could give Japanese assets a boost during a flight to safety, especially since the yen is already trading at multi-decade lows against the US dollar.

Chart 6: JPY vs USD

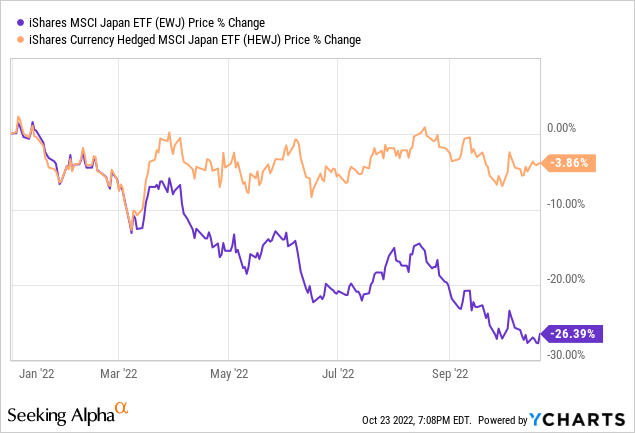

Of course, diverging monetary policies between the Federal Reserve (tightening) and the Bank of Japan (loosening) may continue to put downward pressure on the yen. A comparison of hedged versus unhedged positions in Japanese stocks shows the impact of currency risk.

An unhedged position in Japanese stocks via the iShares MSCI Japan ETF (EWJ) produced a loss of -26.39% year-to-date in US dollar terms. Meanwhile, a currency-hedged position via the iShares Currency Hedged MSCI Japan ETF (HEWJ) produced a loss of -3.86%.

Chart 7: Japanese Stocks Unhedged Versus Hedged

Most of the YTD negative returns in Japanese stocks could be attributed to yen depreciation versus the dollar. In other words, Japanese equities outperformed US equities, adjusted for currency effects. That implies markets have a favorable economic outlook for Japan versus the US.

The bottom line

As the world wrestles with deteriorating economic conditions, investors will retreat into markets that feel safe and familiar. But hiding in what’s worked before may not work ahead. Recessions and bear markets are resets that wash out past excesses and correct the misallocation of capital.

That also means market leadership typically changes from one cycle to the next, and investors have an opportunity to rotate into the next cycle’s winners. US equity investors should think globally and look abroad.

Just as markets fall in and out of favor, so will investment styles. The all-or-nothing, YOLO, FOMO, mentality that worked so well in an everything bull market is unlikely to work so well in a global downturn.

Whether you favor the US, Brazil, Japan, or something else, favor balance, diversification, and good risk management to survive the current downturn. If you take a position, build it incrementally over time on price weakness, and don’t bite off more than you can stomach.

Be the first to comment