ipopba/iStock via Getty Images

In my previous coverage of DermTech, Inc. (NASDAQ:DMTK), I highlighted the company as a unique investment opportunity based on DMTK’s proven, innovative and transformative technology. Additionally, with solutions that are more effective, accurate, cheaper and easier to administer, there seemed to be a strong case that DMTK could achieve hockey stick-like growth in the coming years and generate compounding investment returns.

Since my prior recommendation, DMTK’s stock price has dropped 55%. Given this development, as well as a vastly changed macroeconomic backdrop, it is worth re-examining the investment thesis to understand where the overall investment case stands today.

Company Overview

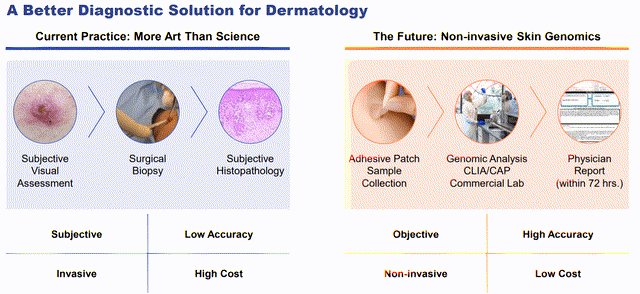

As a refresher, DermTech, Inc. is a molecular diagnostic company that develops and markets non-invasive tests to diagnose skin conditions and ailments including skin cancer, inflammatory diseases and other conditions. DMTK’s solutions provide an alternative to the surgical biopsy and minimize patient discomfort, scarring and risk of infection. Its primary product is the Pigmented Lesion Assay (PLA) test – a non-invasive, proprietary, adhesive patch (or SmartSticker) that evaluates a tissue sample for melanoma. The slide below highlights the key benefits of DermTech’s PLA approach vs. traditional biopsies.

DermTech Investor Presentation

Updated Investment Case

Since the company’s initial public offering, bulls and bears have clashed strongly over the investment outlook for DMTK. The bull argument centers on DMTK’s ability to commercialize its SmartSticker technology and capitalize on a $4 billion PLA market opportunity and also potentially grab a share of the broader $10 billion skin cancer diagnostic market. The primary bear arguments have focused on a sentiment that insurers will not seek to cover DMTK’s solutions and/or that physicians will not look to use the SmartSticker, as it would reduce biopsy revenue for individual doctors and practices. In my view, there are a number of recent developments across both the bull and bear areas that investors should consider.

DermTech is an early-stage company that is still building its corporate infrastructure. At this stage, there has rightfully been a significant focus on the company’s sales and its ability to generate growth. DermTech has largely been targeting the US market to start with, but for much of its short history, the company has not been working with a full salesforce. Instead, the company has focused on hiring and training this salesforce to help commercialize its solutions.

Throughout 2021, the company had on average 40 sales representatives during the year. As of January 2022, this number has increased to 72 sales reps, which management believes represents a fully hired salesforce. Note that a portion of the sales team remains in training, so full utilization/productivity remains a few months away. Management, however, is very optimistic regarding these recent developments. Not only is this the first time DMTK has had a fully scaled sales team, but the company has also been able to develop, release and implement a national sales strategy that aligns priorities and sales territories, and boosts future expected growth. On the recent earnings call, management noted –

This was our first national meeting with the fully scaled and resourced commercial team, an important milestone for DermTech and one that I’ve been waiting on for almost two years now. We have the necessary capacity to drive adoption of our DermTech melanoma test or DMT.

Source: Quarterly Earnings Call

On the sales front, there’s other evidence that operations are trending in the right direction. In 2021, DMTK finished the year having billed for over 44,000 samples, an 86% increase year-over-year. Additionally, Q4 2021 ASP was $252 per sample, a 34% increase compared to $188 per sample in Q4 2020. With both volumes and pricing increasing, sales momentum at the company appears to be building. Per management, sales rep productivity is also trending in the right direction. As noted on the earnings call:

Another metric to look at is sales rep productivity. We had on average about 40 fully trained sales managers during 2021. These sales managers produced on average between 1100 and 1200 samples for the year. We estimate sales manager productivity for some of our peers during a similar period after product introduction was between 507 samples per year per rep. Now we recognize that we do have a larger market opportunity for our melanoma test and some of our peers have for their respective tests, but if we look at the company with a company with an even larger market opportunity than us, for example, one in colon cancer screening, we estimate historical sales representative productivity was approximately 1000 samples per rep per year, at a similar stage of commercialization.

Source: Quarterly Earnings Call

Customer counts are also showing significant progress. DMTK had an estimated 1,800 unique ordering clinicians in Q4 2021 compared to an estimated 1,040 in Q4 2020, a 73% YOY increase and compared to approximately 1,590 in Q3 2021 or a 13% sequential increase.

Outside of the salesforce investments, DMTK is actively pursuing several other strategic initiatives designed to improve adoption and awareness of the company’s solutions. DMTK continues to expand its telehealth offering DermTech Connect, which is now available in Florida, New York, Illinois, Pennsylvania, Connecticut, Colorado, Missouri and West Virginia. There are an additional 15 to 17 states in which DermTech Connect will also be available in the coming months. DermTech connect is a telemedicine platform that is designed to match an interested patient with a participating independent dermatologist who can assess suspicious lesions using the DermTech Connect Store.

Additionally, the company recently launched DermTech Stratum to expand its presence and product offerings within the pharma and academic research communities. DermTech Stratum includes additional services such as biomarker identification, new target identification, patient segmentation and stratification, and bioinformatics support.

For an early-stage emerging company, the salesforce investments, DermTech Stratum and DermTech Connect initiatives are all positive indicators that management is actively taking steps to grow and commercialize its products and services. Additionally, the company has been working with industry partners, analysts and organizations to ensure that the benefits of its SmartSticker technology are highlighted to all players within the healthcare ecosystem. Management provided some additional insights into these developments on the Q4 call

In March, we expect the results of the Optima healthcare economic study to be published. Also, the 2022 edition of the NCCN Guidelines reaffirms the 2A [ph] recommendation for the DMT. We also believe the 2022 document strengthens the overall recommendation by delineating our test as a standalone pre-biopsy assessment, and removing some ambiguous preamble language that was present in the 2021 Guidance document. Source: Quarterly Earnings Call

Looking ahead, the company is pursuing a 3 tiered strategy to help drive growth. First, DMTK believes it can continue to improve ASPs as more tests approach the Medicare reimbursement rate of $760. Additionally, DMTK believes it can increase its appeal success, while also adding coverage from other 3rd party payers. According to management, the stage is set for a strong 2022:

“In summary, we believe the table is set for a robust 2022 as it will be the first year of commercializing the DermTech melanoma test at an appropriate commercial scale. While the vast majority of our effort will be spent securing adoption in the professional dermatology channel, which should drive nearly all the performance for the year, we will continue our expansion into primary care, professional channel, the DermTech Luminate consumer channel, the DermTech Connect telehealth channel and our DermTech Stratum research channel.” Source: Quarterly Earnings Call

Updated Investments Risks & Considerations

While the investment case above shows progress in both strategic and financial areas, the company also continues to face a number of risks. At the top of the risk list is likely DMTK’s relationships, or lack of relationships so far with national healthcare payers in the US. Although management has continued to talk about progress with national payer organizations on conference calls, the current state remains the same, which is that the company has yet to land a national payer.

If DMTK is not able to land a national payer in the next 6-12 months, the investment thesis could be severely hampered. It’s hard to envision how the longer-term monetization goals could be reached if 1-2 national payers are not on board within this timeframe. This is definitely a core risk for the company, though management sounds optimistic about future developments in this area:

So, we’re trying to address the things that the payers have sort of spoken to us about, about what they want to see. We believe we have addressed them and that’s why we believe we’re making progress with the payers. As we talked about in the past it’s hard to predict. We know that we’ve gotten some medical directors on board with the test. They’ve recommended the test to their policy panel, but the policy panel that we have no input into, that has come back with an additional question or two. So, we think we’re doing what we need to do to educate the payers. We’re providing the information they’re asking for and that’s the best we can do in terms of trying to drive a potential coverage policy. And that’s why we think it’s a question of when not if to get these payers on board. Source: Quarterly Earnings Call

Monetization per sales representative is another area to keep a close watch on given management’s repeated highlighting of the investments made in the sales organization. With an average of 40 reps in 2021 and total revenue of $11.8M, the average revenue per rep was $295k last year. This year, management is guiding toward revenue of $22M-$26M. The high end of that range would indicate revenue per rep of $361k, while the lower end would be closer to $305k per rep.

With management having repeatedly expressed confidence in the fully scaled salesforce, anything less than $305k per rep would be a disappointment and could hint at broader sales and adoption troubles. Closely tied to the revenue per rep issue are the average selling prices of DMTK’s SmartStickers. Investors should take note that management is looking to nearly triple ASPs in the long run from $252 per test today to $760 in the future state. While further Medicare coverage and national payer approval would certainly go a long way toward achieving this goal, tripling the ASPs is not going to be an easy process and will require careful execution.

According to leadership, the continuation of the COVID pandemic also slowed Q4 sales as the Omicron variant took hold. Although the pandemic is out of the company’s control, continued variants and spikes could further slow not only revenue growth but also negotiations with the national payers, potentially impacting the longer-term investment thesis.

While DMTK possesses proprietary technology, the company will need to carefully navigate the risks above to execute on the vision laid out by management and achieve its longer-term market opportunities.

Financial Update

DMTK’s financial outlook is truly a mixed bag. While the company achieved YOY revenue growth of 100%, going from $5.9M in 2020 sales to $11.8M in 2021, the quarterly revenue story was less positive. Q2, Q3 & Q4 revenues were $3.1M, $3.0M and $3.2M, respectively. Yes, there were some headwinds throughout the year, but to be flat for 3 straight quarters is definitely a bit disappointing. With the full core sales infrastructure now in place, DMTK needs to show progress in quarterly revenue growth this year.

Margins are also a mixed bag. 2021 net margins were ugly, clocking in at -823%, largely due to the salesforce investments. On the other hand, DMTK has achieved gross profitability over the last 5 quarters, so there is evidence that its business model can be viable at a larger scale.

The company remains debt-free as of 12/31/21, with $177M of cash on the balance. At current burn rates, this level of cash should cover them for 18-24 months. Failure to show progress on the growth front this year will likely significantly impact the company’s ability to raise future cash if needed.

The notes to the financial statements indicate that DMTK continues to funnel some cash to R&D, largely around “partnership” technology in the telemedicine and research/academic spaces. These investments should be a net positive in the long run but will be a short-term drag on cash flow.

For 2022, analyst consensus estimates call for revenue of $24.1M, representing another year of 100%+ growth. The consensus calls for another virtual double in 2023 with expected total revenue of $46M.

Valuation & Recommendation

With earnings still several years away the P/S ratio is my preferred valuation metric for DMTK. At a current market cap of $413M, the stock is trading at 16x-19x 2022 revenue. Even after the stock’s recent pullback, this is expensive in the current environment.

The lack of revenue progress over the last 3 quarters of 2021 is concerning and so I’m updating my view to be neutral/hold on DMTK at the moment. I do not view the growth story to be over for DMTK, but I’ll be waiting on Q1 2022 results to see if the company can resume growth before re-evaluating whether this stock should be assessed a buy rating.

For those investors that are on board with the long-term growth thesis, current prices do offer an opportunity to cost average down. DMTK’s Smartstickers are proven medical tech and have much growth potential. Now the company must move to the next phase of its corporate lifecycle and execute on its strategic priorities and market opportunities.

Be the first to comment