jax10289/iStock Editorial via Getty Images

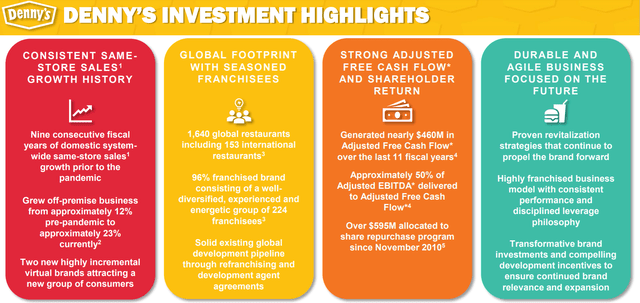

Denny’s Corp. (NASDAQ:DENN) manages one of the largest franchised full-service restaurant chains with nearly 1,500 locations in the U.S. and a growing international segment. With the entire industry facing disruptions during the pandemic, Denny’s latest challenge is dealing with inflationary cost pressures along with staffing shortages amid the tight labor market that has pressured margins. Indeed, the stock has underperformed and is down about 20% over the past year. That said, we believe shares look primed for a turnaround with DENN trading at an important area of technical support. We are bullish on Denny’s which also benefits from the ongoing post-pandemic recovery that can be positive for operating and financial momentum through the rest of 2022.

Is DENN A Good Stock to Buy?

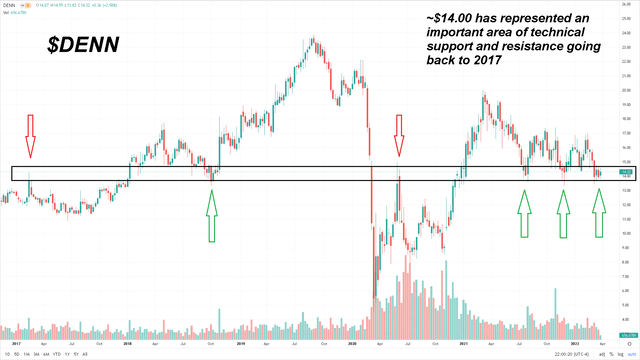

With DENN currently trading at $14.35, the first point to highlight is that the area between $13.50 and $14.50 has represented a key level of technical support and resistance going back to early 2017. Our interpretation here is that DENN bulls and bears have been in a long-running battle to decide a fair value for the stock with an implied current market cap of ~$850 million as a reference point.

From the chart, we can point out that DENN hit an all-time in 2019 near $24.00 corresponding to peak earnings that year before the pandemic. A strategic shift for the company has been to move towards a full franchise model where over 96% of system-wide locations are currently operated by franchisees. The advantage here is that it can offer higher margins to Denny’s corporate which collects on royalties and fees related to the restaurant level sales.

Seeking Alpha

In February, the company reported its full-year 2021 result highlighted by a strong recovery compared to depressed 2020 figures, although “Domestic system-wide same-store sales” for the year were still 5% below 2019 levels. This reflects the ongoing Covid challenges last year that were defined by the early stages of the reopening.

The setup here suggests that 2022 should be stronger considering the trend of easing Covid restrictions and what is likely to be a busy summer travel season. For 2022 guidance, management is expecting domestic same-store sales to climb between 26% and 28% over 2021 trends, more than surpassing the 2019 level. We believe these factors contribute to the bullish case for the stock and believe the next move in shares of DENN is higher.

Triple-Bottom Chart Pattern May Setup A Breakout Higher for DENN

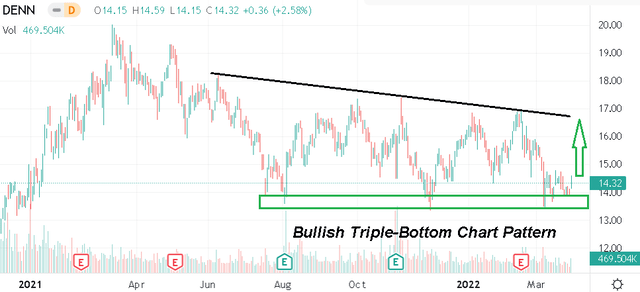

Zooming into our chart, we believe the current level for DENN under $15.00 represents a compelling buying opportunity with shares well-positioned to rally higher. We’re observing a triple-bottom chart pattern that indicates buyers are in control with the bears effectively being unable to drag shares of DENN below the critical $13.50 support level. The setup is particularly attractive because it also corresponds to three unique market moments over the past year where DENN sold off but ended up finding support.

Seeking Alpha

The first low of $13.50 last August was during the “Delta-Covid” wave which limited sales in Q3 and hit sentiment for the broader industry. Moving forward, the next pullback to just around $13.35 in December was based on the early “Omicron-variant” scare which also impacted results in the last quarter. Finally, the latest selloff in early March coincided with the softer Q4 earnings release and broader market weakness on the Russia-Ukraine conflict. Favorably, we note that shares are up about 7% from their low this month which we see as the start of a longer-term sustained rally. There is a case to be made that the weakness in the stock over the past year has already priced in the near-term challenges.

Positive DENN Fundamentals Reinforce Bullish Outlook

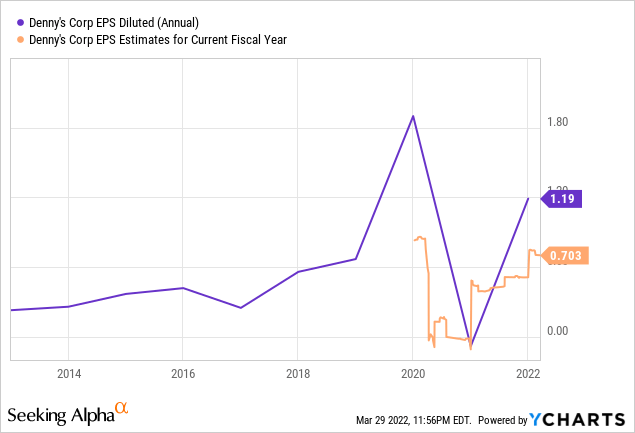

For 2022, the market consensus is for DENN to reach EPS of $0.71 on 9% y/y revenue growth. While the earnings estimate represents a 40% decrease from $1.19 in 2021, it’s important to recognize the result last year included an exceptional gain from the sale of two real estate properties. Similarly, in 2019 when the company reached an EPS of $1.90, the result that year included a gain from the sale of company-owned restaurants to a franchisee group. The point here is to say that while margins are a key monitoring point this year, the bigger story remains the company’s consistent profitability and otherwise steady long-term growth.

Denny’s benefits from its brand recognition and national footprint which we believe is well-positioned to benefit from the ongoing post-pandemic recovery including normalizing operating trends. We see room for earnings to outperform consensus with the ability of Denny’s to raise prices balancing some cost pressures. Recognizing some of the concerns over the potential slowdown in the economy, one insight we offer is that Denny’s market positioning as an “affordable” dining option can support some substitution as diners avoid higher-priced alternatives.

Source: Company IR

Is DENN a Buy, Sell, or Hold?

Putting what we see as a positive technical setup together with a favorable fundamentals outlook, we rate DENN as a buy. The triple bottom chart pattern can target a rally towards $17.50 as our initial price target. We expect the stock to gain momentum alongside the broader market which is benefiting from improved risk sentiment amid headlines of peace talks in the Russia-Ukraine conflict. Strong payrolls data should also be positive for consumer-focused stocks and the restaurant industry on the demand side.

In terms of risks, traders can use that $13.50 support level as a downside stop. A break lower could indicate a deterioration of the fundamental outlook or broader macro conditions. Weaker than expected results over the next few quarters for Denny’s could also open the door for a leg lower in the stock.

Be the first to comment