Tom Werner/DigitalVision via Getty Images

Digital Media Solutions, Inc. (NYSE:DMS) is a leading provider of diversified advertising solutions and has shown its ability to be “dynamically diversified.” We expect the Company to utilize this flexibility to expand into new verticals, grow within verticals, and expand internationally. We initiate with a BUY rating and a $6.00 price target.

Investment Thesis

Digital Media Solutions, Inc. is a digital performance marketing company offering diversified lead and software platforms. Through its Marketplace and Brand Direct campaigns, DMS increases consumer access to branded products, services, promotions, and savings opportunities. The Company creates a more efficient advertising ecosystem designed to help consumers with easier access to options, promotions, and savings while helping their advertising clients connect with high-intent consumers who are interested in the clients’ products. The Company was founded in 2012 and is headquartered in Clearwater, Florida. DMS operates and earns most of its revenues in the United States.

On July 15, 2020, Leo Holdings Corp, a special purpose acquisition company, acquired the equity in Digital Media Solutions Holdings, LLC (DMSH) along with another company (Blocker). After the transaction structured like a reverse capitalization, the Company was renamed Digital Media Solutions, Inc. Historical numbers, before the acquisition date, are for the company DMSH.

The Company is a brand-direct solutions provider that offers a diversified set of advertising and customer acquisition solutions. It is organized into three reportable segments. The Brand Direct reportable segment consists of services delivered for an advertiser’s brand, while the Marketplace reportable segment is made up of services delivered for the DMS brand. In the Other reportable segment, services offered include software services and digital media services.

DMS tries to solve problems that advertisers often face by utilizing diverse industry sources and strategies. The Company utilizes their dynamic first-party data asset, which is a database of consumer profiles which have accumulated since 2012. DMS utilizes a “pay-for-performance” model – which allows clients to see a connection between money spent and advertising results. DMS is vertical and channel-agnostic and is trying to diversify into many industries.

The Company has a wide variety of industries as clients, including insurance, consumer finance, e-commerce, home services, brand performance, health and wellness, and education and career placements.

Our thesis is that Digital Media Solutions, Inc. is an undervalued, compelling company, which will deliver value for shareholders because:

- DMS will benefit from a continuing shift in advertising from traditional to online.

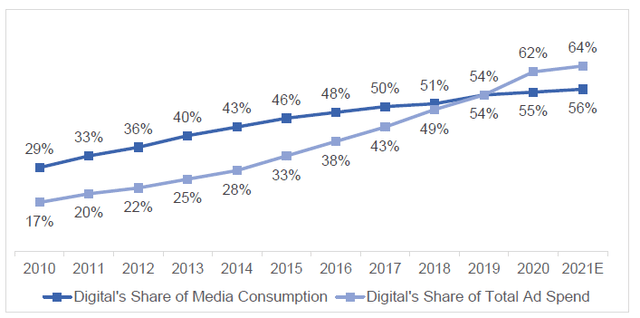

- The platform’s “Flywheel Effect” is underestimated by the market. Their data asset continues to grow and will help the Company retain clients and grow revenue.

- DMS has demonstrated the Company is “dynamically diversified” in their most recent quarter which allows them to be flexible by targeting certain verticals more than others. This flexibility is an advantage compared to most of their competitors.

- Their attempt to further diversify into new verticals and internationally will provide additional revenue opportunities.

We initiate coverage with a BUY rating and a $6.00 price target.

DMS Benefits from Significant Industry Shifts

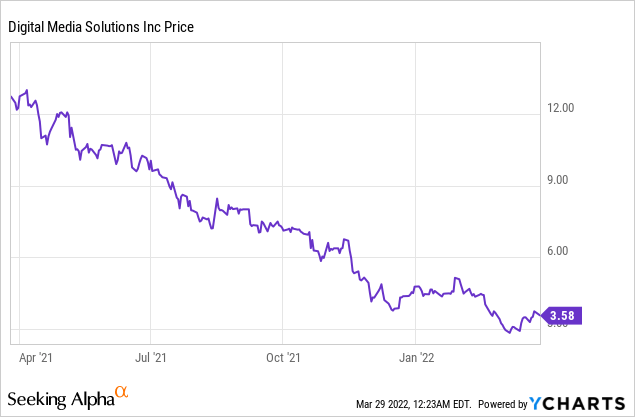

According to a November 2021 Statista report, U.S. Digital Advertising is expected to grow from $365 billion in 2020 to $460 billion by 2024. (U.S. Digital Advertising Industry – Statistics & Facts, 2021) It continues to represent a greater percentage of overall advertising mix. Digital Advertising was 40% of overall total advertising spend in 2016 and is projected to be 75% in 2024. (Digital Media Solutions Company Presentation) Digital Media will also benefit from an increase in performance advertising. Performance advertising is when the purchaser pays only when there are measurable results. Performance advertising made up 41% of digital spend in 2005 and now makes up 63%. As shown in Exhibit 1, digital’s share of total ad spend rose +4,700 bps between 2010 and 2021.

Digital Media Solutions and Singular Research

The Company’s “Flywheel Effect” Will Provide Future Growth

DMS has been accumulating useful advertising data since 2012 (slide 5). This proprietary, opt-in database has over seven billion quarterly impressions, spanning 70% of the adult population in the United States. This data helps to identify leads and understand the marketing audience. As accumulation continues, this database becomes more and more useful and provides significant advantages to the Company, creating barriers to entry for other firms.

This large and powerful data set provides customer intelligence through organizing and compiling detailed information on consumer spending habits. The more DMS engages with the consumer, the more powerful the data asset becomes. This tool allows the Company to target consumers and connect them with advertisers more precisely and efficiently.

According to the Company (slide 10), the flywheel creates growth and consistency, especially among their top 20 advertising clients who had a 100% retention rate. Revenue from these clients grew by 31% from Q4:20 to Q4:21. Management believes that their solutions deliver reliable ROI that is “trackable, scalable, and predictable” because they leverage their data asset, proprietary technology, and media reach. The Company’s flywheel effect chart is shown in Exhibit 2.

Digital Media Solutions and Singular Research

Digital Media Solutions’ Diversification by Vertical and Its Ability to be “Dynamically Diversified” Provides Opportunity

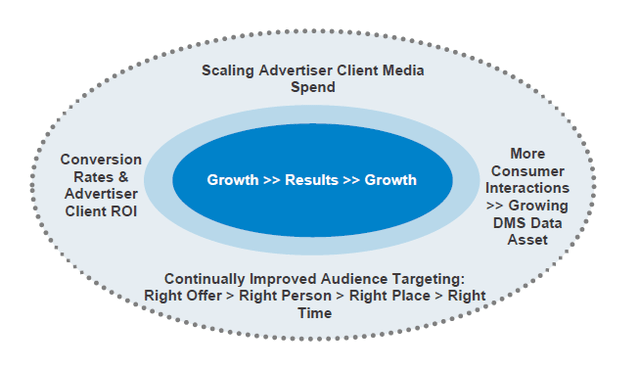

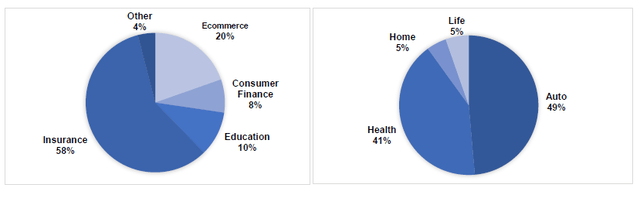

Management has commented that DMS is “dynamically diversified.” Unlike many of its competitors, they are not tied to a specific percentage of the business coming from a specific vertical which makes them more insulated from industry volatility. Despite this benefit, the Company currently still earns most of its revenue from insurance companies.

For Q4:21, insurance contributed 58% of the Company’s revenue, which grew 13% over Q4:20. Education, which was 10% of total revenues, grew 23% YOY. E-commerce made up about 20% of total revenues and was up 36% YOY. Consumer finance accounted for 8% of the total revenue and grew 56% YOY.

Although DMS had a significant amount of revenue coming from insurance, their ability to dynamically pivot benefited them during the fourth quarter when auto-insurance was impacted by macroeconomic headwinds caused by higher auto repair and replacement costs, rising used car prices, and a return to more normal driving trends. While auto-insurance made up 75% of total insurance revenues in Q4:20, it made up 49% of insurance revenues or only 28% of the Company’s total revenue in Q4:21. Clients from the health insurance vertical have become a larger part of overall insurance revenue as shown on the right chart in Exhibit 3. Also, when macro supply chain challenges restricted growth from holiday shopping, the Company was able to dynamically scale to other verticals.

This ability to adjust to the environment and to be vertical agnostic should continue to benefit DMS going forward. There are significant revenue growth opportunities as DMS expands into new verticals and internationally. While they currently receive most of their revenue from insurance, DMS has demonstrated that their product can be effective in advertising for some of the top mortgage lending companies, leading consumer brands, food and retail outlets, top-tier universities, large learning software providers, and other industries.

Digital Media Solutions and Singular Research

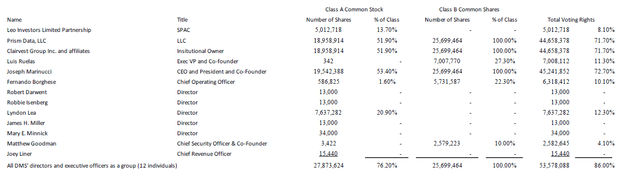

Management and Shareholders

Joe Marinucci is the co-founder and chief executive officer of DMS since the Company’s inception in 2012. Prior to DMS, Joe was President and Co-Founder of direct response marketing firm Interactive Marketing Solutions. He previously served as a board member of LeadsCouncil where he advised member companies in the online lead generation space to promote best practices across all industries.

Lion Capital created the Leo Holdings special purpose acquisition company which acquired the equity in Digital Media Solutions Holdings. Clairvest Group (OTC:CVTGF) was a shareholder in Digital Media Solutions before the SPAC occurred and remains a shareholder today.

Joe Marinucci is the manager of Prism Data, LLC and is deemed to have beneficial ownership over the interest shown. The interests shown for Clairvest and Prism Data are attributed to each other because they have a voting agreement (the Director Nomination Agreement) to support each other’s candidates for election (so the Prism ownership includes the Clairvest ownership, and vice versa).

Digital Media Solutions and Singular Research

Q4:21 Financial Results

DMS had record fourth quarter revenue of $118.9 million which compared to revenue of $102.1 million in Q4:20, an increase of 17% year-over-year. Full-year 2021 revenue was $428.2 million, up 29% versus 2020’s revenue of $332.9 million.

For the quarter, the Company had a loss of $4.1 million or $(0.11) per share versus a loss in the previous year’s fourth quarter of $10.4 million or $(0.32) per share. For FY:21, DMS showed a profit of $2.2 million or $0.06 per share versus a loss of $8.7 million or $(0.23) per share in 2020.

Adjusted EBITDA remained flat at $15 million for the quarter. For the year, adjusted EBITDA was $58 million, up 7%.

Gross profit margin increased to 30% from 27% YOY and operating expenses decreased by $6.4 million versus the same quarter of last year. Gross profit margin for the year remained flat at 30%.

Both the Brand-Direct and Marketplace Solutions showed revenue growth for the quarter. Brand-Direct Solutions generated revenue of $73 million, up 17% over the same quarter last year. For the year, Brand-Direct’s revenue was $254 million, up 28%. Gross margin for the quarter was 24%, up from 22% in the prior year, and for the year, it remained flat at 24%. Marketplace Solutions generated revenue of $59 million, up 25% over the same quarter of last year. Gross margin was 28% versus 26% in the previous year. For the year, Marketplace revenue was $224 million, up 45% from FY:20. Gross margins were 27% versus 29% in FY:20. Other Solutions revenue was $4 million, down 6% from Q4:20. Gross margin was 38%, down from 44% in the prior year. For the year, Other Solutions had revenue of $10 million, up 3%. Gross margins were 63% versus 64% in the previous year.

EPS Guidance and Estimates

The Company provided guidance and expects the following for the first quarter of 2022: revenue to be between $102-$107 million, gross margin to be between 28% and 31%, variable marketing margin to be between 32% and 36%, and adjusted EBITDA to be between $10 and $12 million.

Management expects FY:22 to be the following: revenue to be between $465 to $475 million, gross margin to be between 28% and 31%, variable marketing margin to be between 32% and 36%, and adjusted EBITDA to be between $55 and $60 million.

Based on Company forecasts, we expect sales in the first quarter to rise by 8% versus Q1:21 to $105 million and for sales in FY:22 to rise by 10% to $470.9 million. In FY:23, we conservatively forecast that sales will rise by 5.5% to $496.9 million.

For FY:22 and FY:23, we forecast net income of $2.2 million and $5.2 million, respectively. These forecasts result in diluted net earnings per share in 2022 and 2023 of $0.06 and $0.14, respectively. These forecasts do not account for the change in fair value of warrant liabilities, which move based on changes in the stock price.

Investment Risks

Macroeconomic conditions could have a significant impact on clients’ demand for DMS’ services. Economic impacts of COVID-19 or any other macroeconomic event may impact customers’ costs of services and impact their demand for DMS’ services. Beginning in Q2:21, the auto-insurance industry began to experience economic macro headwinds caused by higher auto repair and replacement costs, rising used car prices, and a return to normal driving trends. These kinds of difficulties could impact performance at DMS. While DMS was able to adjust, impacts to certain industries may impact the performance of DMS.

If the Company is unable to meet our expectation to penetrate new verticals, our forecasts may be overly optimistic. We believe that the Company is well-positioned to continue to diversify into new industries as well as grow within its current clients’ industries. If they are unable to diversify further, their growth may be limited.

Valuation

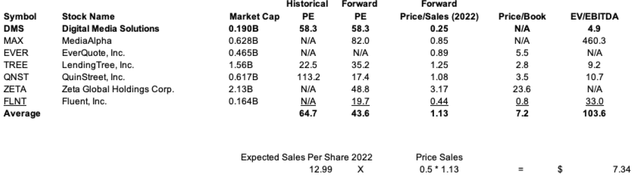

We value DMS using an average forward P/S multiple of industry peer companies blended with our Discounted Cash Flow (DCF) valuation to derive a fair value target price for the Company.

We value DMS using a forward P/S multiple instead of a forward P/E multiple since many of DMS’ peers have negative earnings caused by margin pressures in the insurance industry. In our P/S valuation, we forecast DMS’ price-to-sales ratio to expand to just 50% of its peer group average. Given DMS’ small size and opportunity for growth, ability to “diversify dynamically,” and strong top 20 customer retention rate of 100%, we believe DMS’ multiple increase (even to just 50% of the peer group average) is justified. This relative valuation gives us a price target of $7.34 which we discount back to the present value of $6.94 using the Company’s weighted average cost of capital of 8.2%.

In our DCF model, we estimate the firm would earn a return on capital of 20%, reinvesting 20% of this return into their business, growing by 5% over the next seven years. We believe these assumptions are conservative with DMS’ significant growth opportunities. These assumptions lead to a price target of $4.99.

We then equally blend the relative valuation target, $6.94, and the DCF valuation price target, $4.99, to produce a final target price of $5.97, which we round up to $6.00.

Be the first to comment